The global unmanned traffic management market was valued at $0.78 billion in 2021, and is projected to reach $3.1 billion by 2031, growing at a CAGR of 15.7% from 2022 to 2031.

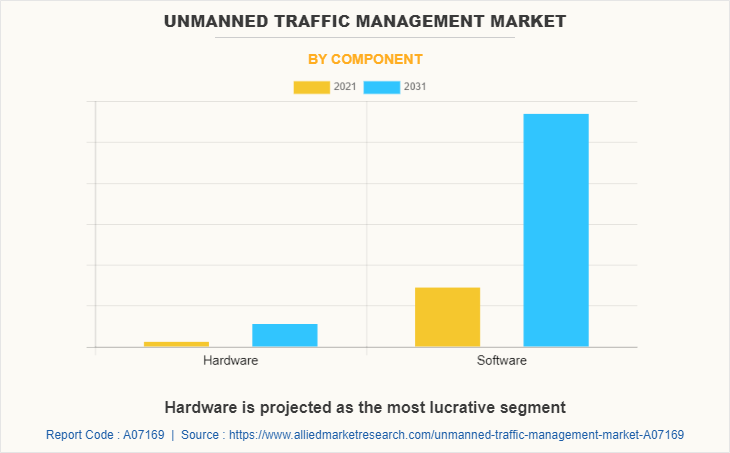

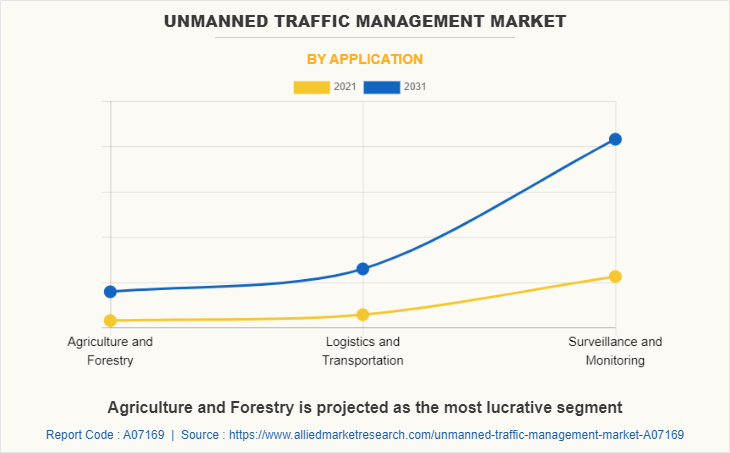

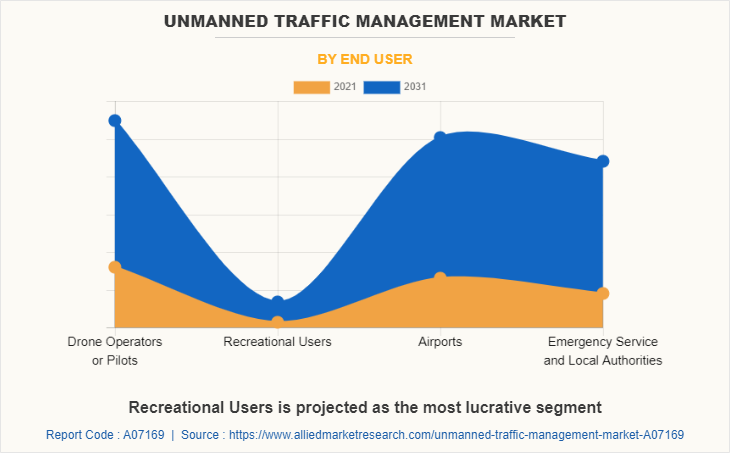

The unmanned traffic management market is segmented into Component, Application and End User.

Unmanned traffic management or unmanned aircraft system traffic management (UTM) is an air traffic management ecosystem being developed by the National Aeronautics and Space Administration (NASA), Federal Aviation Administration (FAA), other federal partner agencies, and industry players for autonomously managing the operations of unmanned aerial systems (UAS). Unmanned traffic management provides services, information architecture, software functionalities, data exchange protocols, performance requirements, and infrastructure for managing low-altitude uncontrolled unmanned aerial vehicle operations. In addition, unmanned traffic management (UTM) is a digital air traffic management technology that allows new aerial vehicles, such as delivery drones and air taxis, to enter and share future airspace securely. This adaptable and modern solution to air traffic management is expected to facilitate the rapid adoption of unmanned aerial vehicles for recreational and commercial applications in a safe manner.

The unmanned traffic management market is experiencing significant traction, which is driven by the promising growth rate of the drone market, increase in demand for improved surveillance, and rise in recent partnerships, product launches and other developments in unmanned traffic management (UTM) space. However, strict drone regulations, privacy and security concerns, and technological challenges in implementation of UTM are factors that are anticipated to hamper the growth of the unmanned traffic management market during the forecast period. On the contrary, growing demand for drones in commercial applications, and improved government support are the major factors that are expected to supplement the unmanned traffic management market, thereby providing a better opportunity for the market growth during the forecast period.

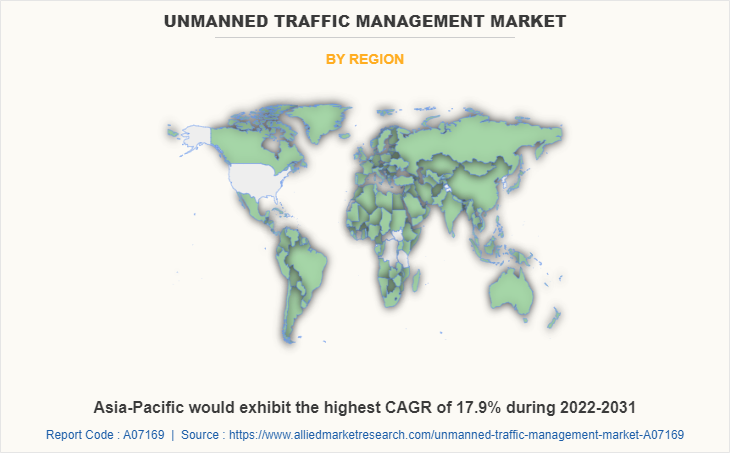

The unmanned traffic management market is segmented on the basis of component, application, end user, and region. By component, it is classified into hardware and software. By application, the market is segmented into agriculture and forestry, logistics and transportation, and surveillance and monitoring. By end user, the market is divided into drone operators or pilots, recreational users, airports, and emergency service and local authorities. The market is analyzed based on four regions, namely North America, Europe, Asia-Pacific, and LAMEA.

Key players profiled in this unmanned traffic management market report include Airbus, Altitude Angle, Droniq GmbH., Intelligent Automation (IAI), Leonardo S.p.A., One sky, PrecisionHawk Inc., Thales Group, Terra Drone, and Unifly NV.

Promising growth rate of the drone market

Drones, or unmanned aircraft vehicles, are increasingly becoming a part of everyday life and are expanding tremendously and in a variety of ways. In addition, drones are used for a variety of purposes, including recreational, business, and other applications. For instance, in agriculture, drones are used to optimize fertilizer, seed, and water use, reduce time on crop scouting, respond more quickly to pests, weeds, and fungi, validate treatment performed, improve varying treatments in real-time, and predict yield from a field. Such growing use of drones in various industries and developments of advanced drones are anticipated to boost the growth of the unmanned traffic management market during the forecast period.

For instance, in November 2020, DJI Technologies launched AGRAS T20 smart spraying drone. It features autonomous flight planning and terrain-sensing radar, extended flight time, high payload capacity, and off-the-grid power options. DJI technologies the AGRAS T20 equipped with 8 nozzles and high-volume pumps that can spray at a rate of up to 6 L/min. These growing applications of the drone market create the need for adoption of unmanned traffic management systems. For instance, in November 2021, air traffic controllers at Lille and Rennes airports signed an agreement with the Thales Group. Under this agreement, Thales’s TopSky UAS solution was adopted by air traffic controllers at Rennes airport in Brittany to manage unmanned air traffic. The solution makes the flight request process more efficient, helping drone operators to gain easier access to airspace. Such deployments of systems are expected to propel the growth of the unmanned traffic management market during the forecast period.

Public and private developments and investments in UTM

Increasing public and private companies’ investments in the development of unmanned traffic management systems are anticipated to drive the growth of the market during the forecast period. For instance, in March 2022, Terra Drone Corporation raised a B-series fund of $70 million (8 billion Japanese yen) to accelerate the development of an air traffic control system for unmanned aircraft known as Unmanned Traffic Management or UTM.

Moreover, the developments of unmanned traffic systems and collaborations of private and public market players to enhance the performance and efficiency of UTM are expected to fuel the growth of the unmanned traffic management market. For instance, in August 2020, PrecisionHawk, Inc. developed Automated Unmanned Air Traffic Control System, which is designed to enable collision avoidance between drones and manned aircraft. In addition, in December 2020, Altitude Angle entered into collaboration with Inmarsat, the leader in global mobile satellite communications, and A-techSYN, a foremost manufacturer of next-generation Unmanned Aerial Vehicles (UAVs) to jointly develop Pop-Up UTM platform. Also, in June 2019, Terra Drone Corporation entered into collaboration with Unifly, a leading drone traffic management provider. Under this collaboration, Terra Drone Corporation successfully demonstrated an unmanned traffic management (UTM) system developed jointly with Unifly to the Taiwanese government officials.

Thus, increasing developments and investments in UTM by private and public industry players are expected to propel the growth of the unmanned traffic management industry over the forecast period.

Privacy and security concerns related to data

According to the National Aeronautical and Space Administration (NASA), unmanned traffic management (UTM) is a bit different than the air traffic control system used by the Federal Aviation Administration (FAA) for commercial airplanes. UTM is based on the digital sharing of each user's planned flight details. Each user will have the same situational awareness of the airspace, unlike what happens in air traffic control. In addition, UTM systems share real-time information with unmanned aerial vehicles or drone pilots for operating safely and managing operations according to information. Such information is transferred through a distributed network of highly automated systems via application programming interfaces (API), excluding voice communication. Due to this, there is a chance of cyber threats or data hacking for misleading drone operators through UTM systems. This factor is anticipated to hamper the growth of the market.

Moreover, hackers may be able to exploit drones if they acquire access to the drones' unencrypted Wi-Fi and GPS systems. This also negatively impacts the unmanned aerial vehicles market and simultaneously hinders the growth of the unmanned traffic management system market.

Increase demand for improved surveillance

The growth in threat from terrorism and increase in security concerns worldwide have led to increasing expenditure on drones or unmanned aerial vehicles, which in turn is boosting the use of drones in industrial surveillance and is expected to create demand for unmanned traffic management systems to perform drone operations in a safer manner. Drones can carry out stealth operations, function at night, operate at any location, and are easy to deploy. Such benefits have led to an increasing number of drones in the law of enforcement and industrial surveillance operations. For instance, in March 2021, Elbit Systems Ltd. signed a $300 million contract to supply Hermes 900 unmanned aircraft systems to 12 countries in Asia. Such drone operations to improve surveillance creates the need for the deployment of unmanned traffic management systems to help drone pilots identify and allocate specific operations to drones. For instance, in February 2020, Unifly NV signed an agreement with NAV CANADA for the deployment of a national system that provides digital services for safely operating and managing drones in Canadian airspace. The system has an intuitive user interface and will enable Canadian drone pilots to access the web and mobile applications to identify safe and legal airspace, plan flights, and manage operations, pilots, and a fleet of drones. Thus, an increase in demand for improved surveillance is expected to create demand for drones and consequently propel the growth of the unmanned traffic management market.

Moreover, the security of key institutions has been greatly enhanced with advanced video surveillance and access control systems. Drones are used for surveillance of major events or gatherings in large cities. Also, several government agencies impose strict policies and guidelines for the installation of drones at high-risk locations. For instance, in April 2022, OneSky entered into a partnership with Garuda Robotics (GR) to provide Uncrewed Aircraft Traffic Management (UTM) services to aviation authorities, city governments, enterprises, and security agencies in Malaysia. Such factors are expected to create the need for unmanned traffic management systems in security agencies or surveillance systems in urban areas, which are expected to fuel the growth of the market during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the unmanned traffic management market analysis from 2021 to 2031 to identify the prevailing unmanned traffic management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the unmanned traffic management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global unmanned traffic management market trends, key players, market segments, application areas, and market growth strategies.

Unmanned Traffic Management Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Unifly NV, Droniq GmbH, PrecisionHawk Inc, Leonardo SpA, Terra Drone Corporation, Intelligent Automation, Airbus, OneSky, Thales Group, Altitude Angle |

Analyst Review

With the rapid technological advancement of unmanned vehicles, policy initiatives, and the emergence of new user applications, the number of unmanned vehicles flying in the global airspace is expected to skyrocket, fueling the rise in demand for unmanned traffic management. In addition, many countries have begun to take steps toward enabling advanced use cases such as cargo delivery by unmanned aircraft. Such use-case applications allows unmanned aircraft fly with airplanes. The safety of manned and unmanned aircraft in global airspace is vital, and safety must be supported by a combination of procedures, rules, technology, and real-time data transmission. The present Air traffic management (ATM) systems were not built to handle unmanned vehicles or drone traffic. This factor creates a need for development of unmanned traffic management solutions.

Moreover, the unmanned traffic management market is expected to witness significant growth due to rise in collaboration of the market players with national agencies or organizations. For instance, in February 2020, Airbus entered into collaboration with the Civil Aviation Authority of Singapore (CAAS) to enable urban air mobility (UAM) in Singapore. Under this collaboration, Airbus selected to recognize the Unmanned Traffic Management (UTM) system and services to support the initial use-case in Singapore.

Furthermore, numerous developments have been carried out by key players that operate in the industry, which are anticipated to create remunerative opportunities for expansion of the market during the forecast period. For instance, in March 2021, Altitude Angle launched a GuardianUTM Enterprise, an intuitive, cost-effective platform that will initially be deployed to support regional and local airports and airfields.

The unmanned traffic management market is segmented on the basis of component, application, end user, and region. Based on component, it is classified into hardware, software, and service. By application, the market is segmented into agriculture & forestry, logistics & transportation, and surveillance & monitoring. By end user, the market is divided into drone operators/pilots, recreational users, airports, and emergency service public and local authorities. The market is analyzed based on four regions, namely North America, Europe, Asia-Pacific, and LAMEA

Unmanned traffic management market valued $784.6 million in 2021 and is expected to be valued at $3,120.7 million by 2031, registering a CAGR of 15.7% between 2022 and 2031.

Surveillance and Monitoring is the leading application of Unmanned Traffic Management Market

Large-scale deployment for unmanned traffic management services throughout the world.

North America is the largest regional market for Unmanned Traffic Management

Leading companies operating in the market are Thales Group, Airbus, Altitude Angle, Unifly NV, and Terra Drone.

Loading Table Of Content...