Unsecured Business Loans Market Research, 2031

The global unsecured business loans market was valued at $4.3 trillion in 2021, and is projected to reach $12.5 trillion by 2031, growing at a CAGR of 11.7% from 2022 to 2031.

Unsecured business loans are loans that do not require collateral. This means that the borrower does not have to pledge any assets, such as property or equipment, to secure the loan. Instead, the lender assesses the creditworthiness of the borrower and decides on the basis of borrower's credit score, income, and other financial information. Unsecured business loans are typically smaller loans and have higher interest rates than secured loans, which are backed by collateral. This is due to the fact that the lender is taking on more risk by not having any collateral to seize if the borrower defaults on the loan.

Rise in demand for unsecured business loans due to its short loan application process is a key driver for the growth of unsecured business loans market. As they do not require collateral and are mostly determined by a borrower's creditworthiness and business financials, unsecured business loans often have a quicker application procedure than conventional secured loans. Thus, this can help to reduce costs and improve profitability for lenders, while also providing a better customer experience for borrowers. In addition, surge in demand for working capital by MSMEs and growth of small & medium-sized enterprises (SMEs) are major driving factors for the market expansion.

However, compliance and regulatory issues for providers is a major factor that hampers the growth of the market as the ever-changing regulations and compliances, unsecured business loan providers face the challenge of updating their offerings to ensure compliance. Contrarily, the growth of digital lending platforms is likely to continue in the coming years, driven by advances in technology and change in consumer preferences, which are anticipated to provide an opportunity to scale up unsecured business loans market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the unsecured business loans market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the unsecured business loans market.

Segment Review

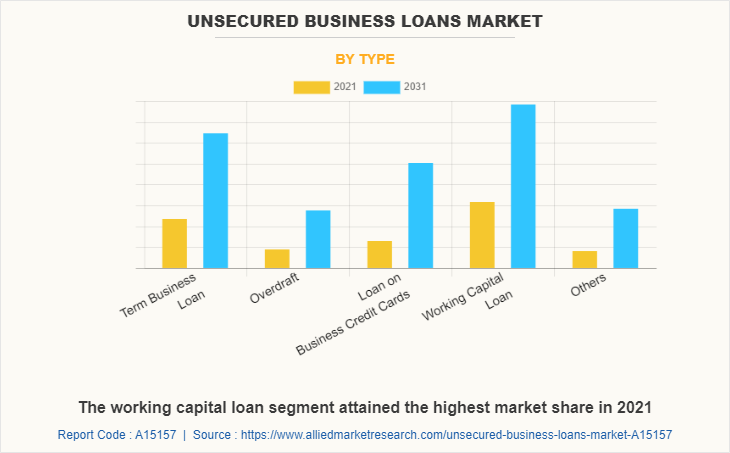

The unsecured business loans market is segmented on the basis of type, enterprise size, and provider. By type, the market is fragmented into term business loan, overdraft, loan on business credit cards, working capital loan, and others. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. On the basis of provider, it is classified into banks, NBFCs, and credit unions. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The unsecured business loans market witnessed significant growth in 2021, with the working capital loan segment being the highest growing segment based on type. This can be attributed to the fact that working capital loans provide businesses with short-term financing to cover day-to-day operations such as paying bills, salaries, and other expenses. Many businesses faced financial challenges due to the COVID-19 pandemic, making it difficult for them to maintain their cash flow. As a result, they turned to working capital loans to bridge the gap and keep their operations running smoothly. On the other hand, the loan on business credit cards segment is forecasted to be the fastest-growing segment in the unsecured business loans market.

This can be attributed to several factors, including the convenience and flexibility of credit cards for business expenses, the ease of obtaining credit cards, and the rewards and benefits offered by card issuers. In addition, many small and medium-sized businesses are increasingly relying on credit cards as a financing option, especially in the wake of the pandemic. As a result, the demand for business credit cards is expected to continue to rise in the coming years, driving growth in this segment of the unsecured business loans market.

Based on region, the Asia-Pacific region witnessed the highest growth in the unsecured business loans market in 2021. This can be attributed to several factors, including the increasing number of startups and small and medium-sized enterprises (SMEs) in the region, the growth of e-commerce and digital business models, and the availability of innovative fintech solutions that provide access to quick and easy financing. In addition, many countries in the region have implemented favorable government policies and initiatives to support entrepreneurship and business growth, further driving demand for unsecured business loans. On the other hand, the LAMEA region is forecasted to be the fastest-growing segment in the unsecured business loans market during the forecast period.

This can be attributed to several factors, including the large and growing population, the increasing adoption of digital technologies and business models, and the increasing awareness of the benefits of unsecured business loans among entrepreneurs and SMEs. In addition, many countries in the region are undergoing economic transformations, with a focus on diversification and innovation, which is driving demand for unsecured business loans to support new and growing businesses.

The report analyzes the profiles of key players operating in the unsecured business loans market such as American Express Company, Bajaj Finserv Ltd, Bank of America Corporation, clix capital, Deutsche Bank AG, Funding Circle, HDFC Bank Ltd, National Funding, OnDeck and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the unsecured business loans market.

Market Landscape and Trends

The unsecured business loans market has witnessed significant growth in recent years, driven by a number of factors including the rise of small businesses and startups, the growth of alternative lending options, and the increasing digitization of the lending industry. With the rise of small businesses and startups, there has been a growing demand for unsecured business loans. Many entrepreneurs are looking for quick and flexible funding options that don't require collateral. Online lenders have become increasingly popular in recent years due to their quick and easy application process. This has made it easier for small businesses to access unsecured loans. There is a growing trend towards alternative financing options in the unsecured business loans market, such as invoice financing and merchant cash advances are becoming more popular for businesses that may not qualify for traditional loans. These options allow businesses to use their existing assets to obtain financing without collateral. Therefore, the unsecured business loans industry is evolving to meet the needs of small businesses and startups.

Top Impacting Factors

Growth of Small and Medium-sized Enterprises (SMEs)

The growth of small and medium-sized enterprises (SMEs) has been a key driver of the unsecured business loans market. SMEs are a critical part of the global economy, accounting for a significant share of employment and GDP in many countries. However, these businesses often struggle to access the financing they need to grow and thrive. This has created a significant opportunity for lenders to provide unsecured business loans to SMEs. In addition, governments around the world are increasingly recognizing the importance of SMEs and are implementing policies to support their growth. This includes providing tax incentives, offering loan guarantees, and launching programs to improve financial literacy among SMEs. These policies are helping to increase the availability of financing for SMEs and are driving growth in the unsecured business loans market.

Furthermore, SMEs produce the majority of formal jobs in developing countries, accounting for 7 out of every 10 jobs. Thus, SMEs prefer unsecured business loans as these have a short application process and do not require any collateral as security. Therefore, these features have contributed to the growth in popularity of unsecured business loans market outlook and their increasing demand.

Rise in Demand for Unsecured Business Loans due to its Short Loan Application Process

The rise in demand for unsecured business loans can be attributed to several factors, including short loan application process. As they do not require collateral and are mostly determined by a borrower's creditworthiness and business financials, unsecured business loans often have a quicker application procedure than conventional secured loans. Moreover, the shorter application process for unsecured business loans is attractive to small business owners who need quick access to capital to grow their businesses. Many small businesses operate in fast-paced and rapidly changing industries and may not have the luxury of waiting several weeks or months for a loan decision.

Furthermore, the short application process for unsecured business loans can help to reduce the administrative burden on both borrowers and lenders. With few documents to review and less steps in the application process, lenders can process loan applications more quickly and efficiently. This can help to reduce costs and improve profitability for lenders, while also providing a better customer experience for borrowers. Therefore, the rise in demand for unsecured loans due to its short-term loan application process drives the growth of the market size.

Surge in Demand for Working Capital by MSMEs

A growth demand for working capital by MSMEs (Micro, Small and Medium Enterprises) for a variety of reasons has been witnessed. Working capital is the lifeblood of any business, providing the funds needed to cover day-to-day expenses such as payroll, rent, utilities, and inventory purchases. As MSMEs grow and expand, they often require additional working capital to support increased inventory levels, higher staffing costs, and other expenses associated with growth. In addition, many MSMEs experience seasonal fluctuations in demand, which sometimes results in temporary cash flow shortage. Working capital can help to bridge the gap between receivables and payables during slow periods.

Furthermore, the rise in demand for working capital by MSMEs reflects the importance of cash flow management for small businesses. By having access to adequate working capital, MSMEs can ensure that they have the funds they need to grow, respond to market changes, and navigate unexpected challenges. Therefore, unsecured business loans plays an important role in promoting unsecured business loans and supports the growth of MSMEs.

Compliance and Regulatory Issues for Providers

Providers of unsecured business loans may require obtaining licenses or permits from regulatory bodies in order to operate. Regulations and compliances change in each region and must be adhered to by financial organizations. Thus, the banking and financial sector is increasingly adopting technology-driven solutions to reduce the cost associated with compliance management. In addition, providers of unsecured business loans are often subject to consumer protection regulations aimed at preventing predatory lending practices. These regulations can include disclosure requirements, caps on interest rates & fees, and other requirements. Furthermore, with the ever-changing regulations and compliances, unsecured business loan providers face the challenge of updating their offerings to ensure compliance, which may hamper the unsecured business loans market growth during the forecast period.

Unsecured Loans Carry a Higher Risk of Default

Unsecured loans carry a higher risk of default, this is due to the fact that unsecured loans are not backed by collateral, which means that if the borrower defaults on the loan, the lender may have limited options for recouping their losses. The risk of default on unsecured loans can be higher as borrowers may be more likely to default if they do not have collateral to lose. In addition, the higher risk of default may make lenders more hesitant to offer unsecured loans to certain businesses, particularly those that are perceived as high-risk. This can limit the availability of financing and make it more difficult for some businesses to obtain the capital they need to grow and succeed. Therefore, this factor can hamper the growth of the unsecured business loans market share.

The Growth of Digital Lending Platforms

The growth of digital lending platforms has created new opportunities for lenders to reach customers more quickly and efficiently. By leveraging automation and data analytics, lenders can streamline the loan application process, reduce costs, and improve customer experience. Moreover, these platforms can use automated underwriting and credit scoring algorithms to evaluate loan applications quickly and provide funds to borrowers within days or even hours. In addition, fintech companies are increasingly entering the unsecured business loans market, offering innovative solutions and streamlined processes. These companies are often able to assess creditworthiness using alternative data sources and offer more flexible lending terms.

Furthermore, digital lending platforms often provide borrowers with a wider range of financing options, including both secured and unsecured loans, as well as loans for specific purposes such as equipment financing or invoice factoring. This can make it easier for borrowers to find the right financing solution for their needs. Overall, the growth of digital lending platforms is likely to continue in the coming years driven by advances in technology and change in consumer preferences, which are expected to provide an opportunity to scale up unsecured business loans market size during the forecast period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the unsecured business loans market forecast from 2021 to 2031 to identify the prevailing unsecured business loans market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the unsecured business loans market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global unsecured business loans market trends, key players, market segments, application areas, and market growth strategies.

Unsecured Business Loans Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 12.5 trillion |

| Growth Rate | CAGR of 11.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 406 |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| By Region |

|

| Key Market Players | Wells Fargo, American Express Company, Deutsche Bank AG, Funding Circle, OnDeck, HDFC Bank Ltd, clix capital, Bajaj Finserv Ltd, Bank of America Corporation, National Funding |

Analyst Review

The unsecured business loans market is expected to experience significant growth in the coming years driven by several key opportunities and growth factors. One of the main growth factors is the surge in demand for funding from small and medium-sized businesses. This demand is being driven by a number of factors, including the growth of the economy, the surge in popularity of entrepreneurship, and the need for working capital to finance business growth & expansion. Another opportunity for the unsecured business loans market is the emergence of new technologies, such as blockchain and artificial intelligence, which are expected to transform the lending process and make it more efficient and secure. For instance, blockchain technology could be used to create a secure and transparent system for verifying borrower identities and tracking loan payments, while AI could be used to automate the underwriting process and improve the accuracy of credit scoring models. In addition, the regulatory environment is expected to create new opportunities for the unsecured business loans market. For example, in the U.S., the Small Business Administration (SBA) has increased the maximum loan amount for its unsecured loan program, which is expected to encourage more lenders to participate in the program and increase access to capital for small businesses. Moreover, the expansion of the global economy is expected to create new growth opportunities for the unsecured business loans market, particularly in emerging markets where there is a growth in demand for capital from small and medium-sized businesses. Therefore, the unsecured business loans market is expected to continue to grow and evolve as new opportunities and growth factors emerge.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in December 2022, MSMEs’ principal financial institution Small Industries Development Bank of India (SIDBI) partnered with the non-deposit taking non-banking financial company (NBFC) lender Ambit Finvest to co-lend unsecured loans to MSMEs. Co-lending is among the focus areas for SIDBI in its direct credit approach to small businesses, and hence partnering with NBFCs provides it with a wider geographical reach to deepen its credit offerings to MSMEs. This strategy by the market player operating at a global and regional level is projected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include American Express Company, Bajaj Finserv Ltd, Bank of America Corporation, clix capital, Deutsche Bank AG, Funding Circle, HDFC Bank Ltd, National Funding, OnDeck, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the unsecured business loans market.

The global unsecured business loans market was valued at $4,257.93 million in 2021, and is projected to reach $12,466.81 million by 2031, growing at a CAGR of xx% from 2022 to 2031.

The global unsecured business loans market was valued at $4,257.93 million in 2021, and is projected to reach $12,466.81 million by 2031, growing at a CAGR of xx% from 2022 to 2031

Growth of small and medium-sized enterprises (SMEs) Rise in demand for unsecured business loans due to its short loan application process Surge in demand for working capital by MSMEs

American Express Company, Bajaj Finserv Ltd, Bank of America Corporation, clix capital, Deutsche Bank AG, Funding Circle, HDFC Bank Ltd, National Funding, OnDeck and Wells Fargo

The unsecured business loans market is segmented on the basis of type, enterprise size, and provider. By type, the market is fragmented into term business loan, overdraft, loan on business credit cards, working capital loan, and others. By enterprise size, it is bifurcated into large enterprises and small & medium-sized enterprises. On the basis of provider, it is classified into banks, NBFCs, and credit unions. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA

Loading Table Of Content...