Urinary Tract Infection Testing Market Research, 2031

The global urinary tract infection testing market was valued at $574 million in 2021, and is projected to reach $1 billion by 2031, growing at a CAGR of 6.2% from 2022 to 2031. A urinary tract infection (UTI) is a type of bacterial infection that occurs between the perirenal fascia and urethral orifice. It is one of the most prevalent bacterial infections worldwide. UTIs have a significant number of financial implications on society. They affect work performance, sexual health, family responsibilities, and quality of life. In addition, recurrence of UTIs is very high in women, which can result in glandular cystitis, pyelonephritis, urinary sepsis, and even acute renal failure leading to death.

The market for urinary tract infection testing industry is predicted to expand significantly due to the increase in incidence of urinary tract infections around the world. In 2019, there were an estimated 404.61 million cases of UTIs across the world. UTIs are the most commonly occurring infections in aging people. This age group contributes to around 15 to 30% of overall UTIs. The burden of UTIs varies per region, nation, socio-demographic status, age, and sex. In both, hospital as well as community settings, UTIs pose a serious threat to public health. In addition, they are the most prevalent outpatient infections, and most adult women will have more than one UTI at least once in their lifetime. In healthcare settings, around 9.4% of patients are diagnosed with healthcare-related UTIs. The overall increasing economic and emotional burden of UTIs shows that timely testing, appropriate prevention, and medication must be bolstered, especially in aging societies and high-income regions. UTIs. The overall increasing economic and emotional burden of UTIs shows that timely testing, appropriate prevention, and medication must be bolstered, especially in aging societies and high-income regions.

However, errors such as false negative or false positive results in UTI testing may restrain the urinary tract infection testing market growth. Dipstick tests may give false findings in one out of every five patients. Patients may get negative results for a urine test but can still show signs of UTIs. Doctors usually act on such test results, which can result in unnecessary treatment as well as evaluation. Such testing errors create confusion and uncertainty in patients.

The increasing prevalence of diabetes in low and middle-income nations is anticipated to offer ample urinary tract infection testing market opportunity. UTIs are most prevalent in patients with type 2 diabetes. In such patients, UTIs are more acute, driven by more invulnerable pathogens. Diabetic patients exhibit more acute symptoms than patients without diabetes. Treatment of such patients should be according to the harshness of the infection and urine test results. People with diabetes are more susceptible to get urinary tract infections like acute cystitis. Rise in incidence of diabetes worldwide is fueling the high prevalence of cystitis. Moreover, there is an increase in interest in creating innovative and effective technologies that can swiftly and accurately identify UTIs and provide the doctor with recommendations for the best antibiotic to use for a certain patient. This and all other factors are expected to offer lucrative growth opportunities to major market players.

Product launches, mergers, and acquisitions are some of the common strategies implemented by the major market players to maintain competitive edge in the market. For example, in 2019, Scanwell Health, a Los Angeles-based startup, launched an at-home test for urinary tract infections testing. Similar to conventional test methods, a chemically treated strip reacts with a urine sample, and then the company’s computer vision technology is used to evaluate the test results.

The key players profiled in the urinary tract infection testing market forecast report include F. Hoffmann-La Roche Ltd, Stryker, Abbott, Siemens, Sysmex Corporation, Cardinal Health, Danaher, Quidel, Bio-Rad Laboratories, Inc., and ACON Labs.

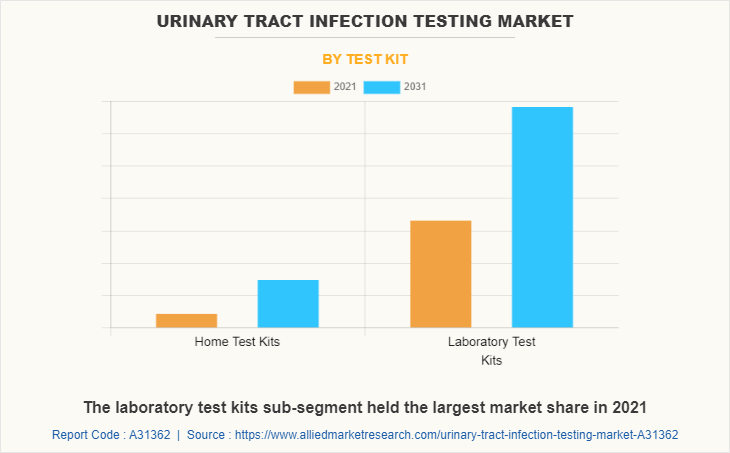

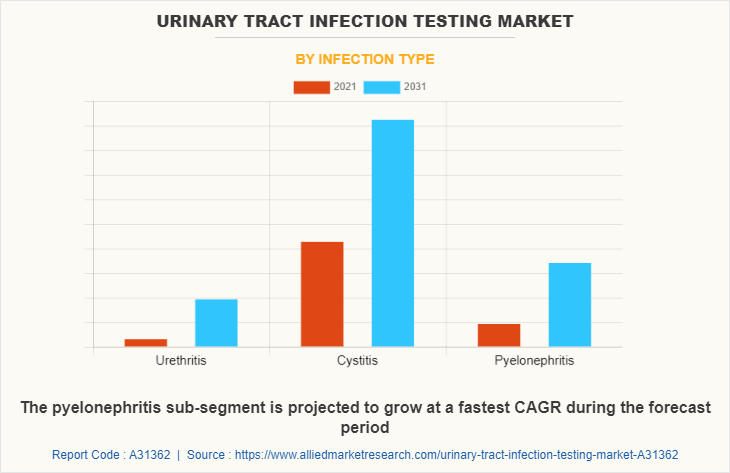

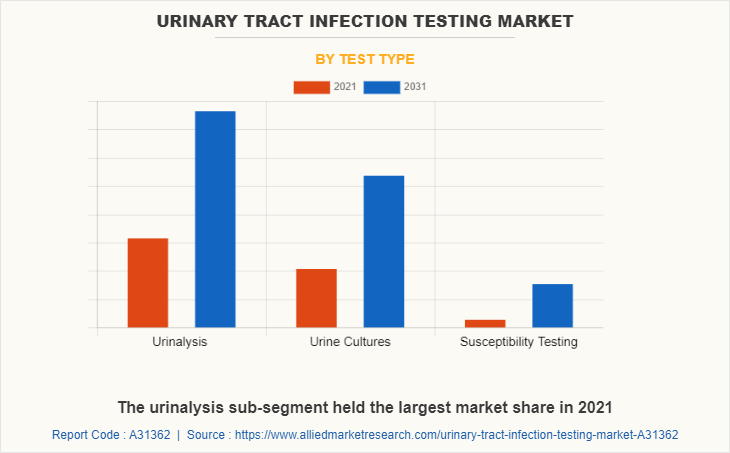

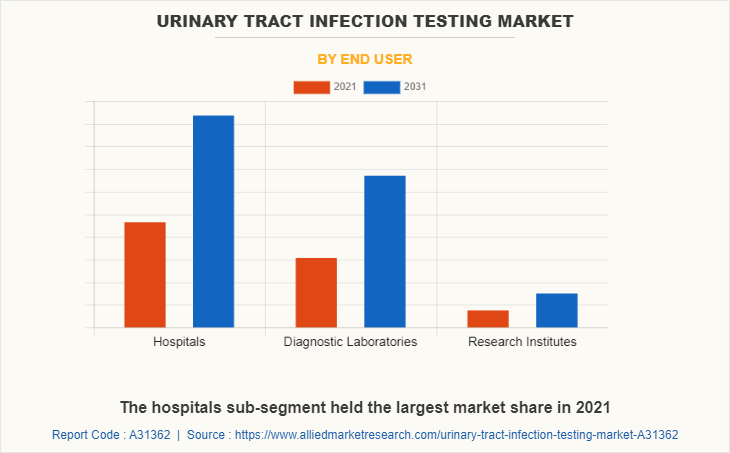

The urinary tract infection testing market is segmented on the basis of infection type, test type, end user, test kit, and region. On the basis of infection type, the market is divided into urethritis, cystitis, and pyelonephritis. On the basis of test type, the market is classified into urinalysis, urine cultures, and susceptibility testing. On the basis of end-user, the market is divided into hospitals, diagnostic laboratories, and research institutes. On the basis of test kit, the market is classified into home test kits and laboratory test kits. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The urinary tract infection testing market is segmented into Test Kit, Infection Type, Test Type and End User.

On the basis of test kit, the laboratory test kits segment dominated the market in 2021. The urinary tract infection laboratory test kit can monitor blood, pH, nitrites, leukocytes, and other parameters in urine to determine UTIs. Laboratory test kits can deliver meticulous test results on a smartphone in under a minute. Moreover, patients can re-check if they are infection-free or not simply by utilizing these UTI test kits. These are predicted to be the major factors that will affect the urinary tract infection testing market size during the forecast period.

On the basis of infection type, the cystitis segment dominated the market in 2021. Recurrent cystitis appears in around 25 percent of women within six months after their first UTI, and the possibility of cystitis increases in women with one or more than one previous UTIs. Cystitis is a bladder-specific urinary tract infection (UTI). It occurs most frequently in women. Uncomplicated cystitis gets cured on its own. However, antibiotics may be required if the severity increases. Patients with uncomplicated cystitis normally show signs of progress in symptoms within three days after the use of antibiotics. Some people experience cystitis frequently and may require ongoing or prolonged medical care. Globally, 10 out of every 100 women get acute cystitis each year, according to NCBI's epidemiology report. In addition, women are more vulnerable to cystitis recurrence than males. Due to all these factors, the growth of the cystitis sub-segment is expected to hold a major market share during the forecast period.

On the basis of test type, the urinalysis segment dominated the global urinary tract infection testing market share in 2021. The demand for urinalysis is projected to increase during the forecast period due to aging societies worldwide. The geriatric population is more vulnerable to urinary tract infections. Urinalysis checks various aspects of the urine sample, including chemical, visual, and microscopic. Urinalysis is increasingly used by healthcare providers to diagnose urinary tract infections (UTIs) along with liver and kidney problems and diabetes. This test can be performed during a routine check-up to evaluate UTI symptoms. A urinalysis involves several examinations of a urine sample. A complete urinalysis will typically include a visual (also called physical) examination, a microscopic examination, and a chemical dipstick test, each of which involves different measurements and evaluations.

By end user, the hospitals segment dominated the market in 2021. Patients' catheters or invasive urogenital manipulation, which allows germs to enter the bladder and encourages multiplication by creating a sustainable habitat, are the main causes of hospital acquired urinary tract infection. Over 50% of infections are caused by UTIs obtained in hospitals. Numerous tests can identify the infection's pathogen and type in order to effectively treat the UTI. These are predicted to be the major factors that will affect the urinary tract infection testing market size during the forecast period.

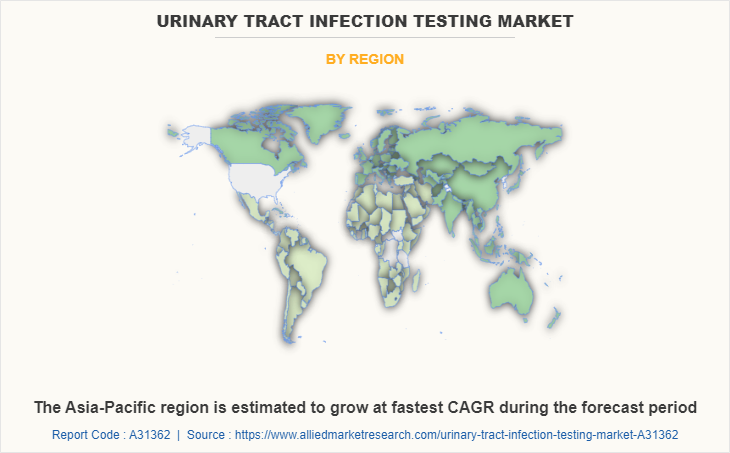

On the basis of region, North America dominated the global market in 2021. In the U.S. alone, UTIs account for over seven million physician visits every year and need over 100,000 hospitalizations. The economic implications of this are over $2 billion annually. 3% of overall hospitalized patients acquire an infection of the urinary tract in a hospital setting due to an indwelling urethral catheter. In Canada, approximately 50% of the geriatric population in long-term care facilities has the presence of bacteria in their urine without showing any symptoms of a urinary tract infection. Furthermore, the overall number of UTIs in Mexico continues to rise. It is a serious public health concern that has put a tremendous burden on the national healthcare system. UTIs are one of the major causes of doctor visits by adults, especially among sexually active women in Mexico. All these factors are expected to increase the demand for urinary tract infection testing in North America.

Impact of COVID-19 on the Global Urinary Tract Infection Testing Market Industry

- Frequency, urgency, and nocturia are the three most prevalent symptoms of the lower urinary tract. The intensity of these lower urinary tract symptoms may rise along with the COVID-19 infection. The increase in symptoms of the lower urinary tract is significantly influenced by the severity of COVID-19.

- The COVID-19 pandemic has had a negative impact on the market for UTI testing worldwide. The majority of countries had imposed strict lockdowns, which had a substantial impact on the volume of tests conducted.

- The urinary testing market was moderately impacted during the first few months the COVID-19 pandemic due to the low hospitalization rate and declining sales of urine analysis tests.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the urinary tract infection testing market analysis from 2021 to 2031 to identify the prevailing urinary tract infection testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the urinary tract infection testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global urinary tract infection testing market trends, key players, market segments, application areas, and market growth strategies.

Urinary Tract Infection Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 280 |

| By Test Kit |

|

| By Infection Type |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bio-Rad Laboratories, Danaher Corporation, Cardinal Health Inc., ACON Laboratories Inc., LabCorp(Laboratory Corporation of America Holdings)., Roche AG, Thermo Fisher Scientific, Inc., Abbott Laboratories, Stryker Corporation, SYSMEX CORPORATION |

Analyst Review

The urinary tract infection testing market is growing significantly as urinary tract infections (UTIs) cause more than 8.1 million visits to healthcare providers annually. It is estimated that approximately 60% of women and 12% of men suffer from urinary tract infections at least once in their life. Hence, urinary tract infections are the most common outpatient infections. The elderly population is more susceptible to urinary tract infections, and women are more prone to UTIs than men. Factors such as the length of the urethra, placement of urethra, sensitive skin, specific types of contraception, pregnancy, and menopause lead to urinary tract infections. However, the faulty results associated with the use of some dipstick tests or rapid test kits is estimated to hamper the market growth. Emerging technologies such as real-time microscopy, biosensors, microfluidics, and sequence-based diagnostics are estimated to boost the market growth. In June 2020, CARB-X funded Module Innovations for the development of rapid diagnostics for drug-resistant urinary tract infections (UTIs). The significant rise in the use of at-home sample collection kits & self-testing kits for UTI testing as well as portable handheld equipment is driving the market popularity.

Among the analyzed regions, North America is expected to account for the highest revenue in the market by 2031, followed by Europe, Asia-Pacific, and LAMEA. North America is predicted to generate significant revenue in the urinary tract infection testing market owing to an increase in awareness regarding the disease, rise in R&D expenses, and technological advancements for the development of new urinary tract infection testing solutions.

The increase in the prevalence of urinary tract infections (UTIs) in developing countries is one of the key factors driving the market. UTIs are the most commonly occurring infections in aging people. The burden of UTIs varies per region, nation, socio-demographic status, age, and sex. In both, hospital as well as community settings, UTIs pose a serious threat to public health. In addition, they are the most

The major growth strategies adopted by the urinary tract infection testing market players are investment and agreement.

Asia-Pacific will provide more business opportunities for the global urinary tract infection testing market in the future.

Hoffmann-La Roche Ltd, Stryker, Abbott, Siemens, Sysmex Corporation, Cardinal Health, Danaher, Quidel, Bio-Rad Laboratories, Inc., and ACON Labs are the major players in the urinary tract infection testing market.

Elderly people are the major customers in the global urinary tract infection testing market.

Loading Table Of Content...