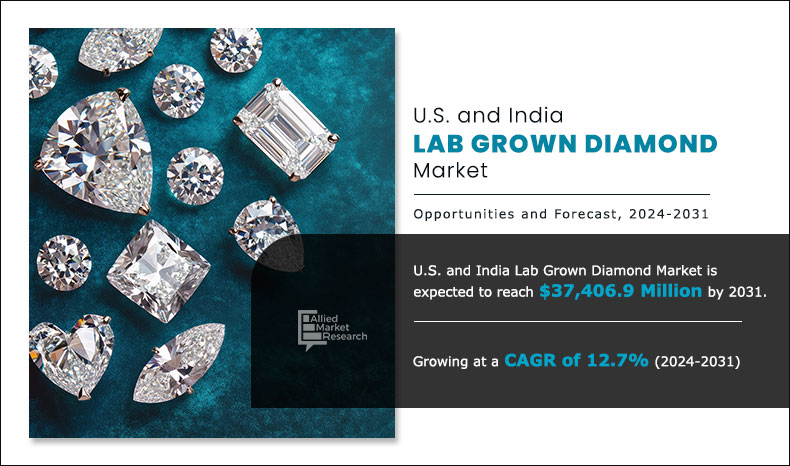

The U.S. and India lab grown diamond market size was valued at $14,725.3 million in 2023 and is projected to reach $37,406.9 million by 2031, registering a CAGR of 12.7% from 2024 to 2031.

A lab-grown diamond, also known as a man-made or cultured diamond, is created in a laboratory rather than mined from the earth's crust. It has the same chemical structure (pure carbon in crystalline form), physical attributes (hardness, elegance, and durability), and optical characteristics comparable to natural diamonds. These diamonds are manufactured utilizing cutting-edge technologies including High-Pressure High-Temperature (HPHT) and Chemical Vapor Deposition (CVD). The HPHT procedure recreates the severe heat and pressure conditions in the Earth's mantle, whereas the CVD process creates diamonds by depositing carbon atoms from a gas onto a substrate. Lab-grown diamonds are becoming popular in jewelry, technology, and industrial uses due to their ethical source, low environmental impact, and low cost.

Key Takeaways

- On the basis of manufacturing method, the CVD segment dominated the U.S. and India lab grown diamond market in 2023 and is expected to retain its dominance throughout the forecast period.

- On the basis of size, the below 2 carat segment dominated the market in 2023 and is expected to retain its dominance throughout the forecast period.

- On the basis of application, the fashion segment dominated the U.S. and India lab grown diamond industry in 2023 and is expected to retain its dominance throughout the forecast period.

Market Dynamics

The reduction in certification costs for lab-grown diamonds is positively contributing to lowering the overall cost of these diamonds, acting as a key driver for the growth of the lab-grown diamond market in India. Certification is a crucial aspect of the diamond industry, as it ensures quality assurance, authenticity, and consumer trust. Traditionally, high certification fees are added to the final retail price, making lab-grown diamonds relatively expensive despite their cost advantage over natural diamonds. However, with the decreasing costs of certification, manufacturers and retailers can pass on these savings to consumers, making lab-grown diamonds more affordable and accessible. This cost reduction is particularly beneficial in the price-sensitive Indian market, where affordability plays a crucial role in consumer purchasing decisions.

According to a market stakeholder, in the past two years, the certification cost for lab grown diamonds in India dropped by 40%-50% and the average cost for certification in 2024 was around $17-$18. Further, the stakeholder stated the manufacturers are not going for certifications for G-colored diamonds as they are increasing the overall price at a high rate above the desired market value. In addition, the lower certification expenses enable small and medium-sized businesses to enter the market more competitively, expanding the overall reach of lab-grown diamonds. As a result, the declining certification costs are driving higher adoption rates, increased demand, and overall U.S. and India lab grown diamond market demand.

The increased transparency of information about lab-grown diamonds has been recognized as a primary driver of industry expansion in both the U.S. and India. Historically, a lack of understanding and propaganda regarding lab-grown diamonds, particularly concerns about their authenticity, excellence, and resale value, has hampered consumer adoption. Consumers are growing more knowledgeable about the benefits of lab-grown diamonds, such as their ethical sourcing, less environmental impact, and cost-effectiveness when compared to natural diamonds, owing to increased access to detailed information via digital platforms, industry reports, and third-party certifications. Greater openness is creating confidence and growing demand among environmentally concerned shoppers in the U.S.

Meanwhile, in India, where diamonds are culturally and socially significant, clearer differences between natural and lab-grown diamonds, as well as their various price and value propositions, are helping to boost customer trust and increase the market. Furthermore, the availability of standardized grading reports from respected organizations promotes openness, allowing customers to make more informed purchase decisions. As a result, the increased availability of credible information is not only resolving consumer skepticism but also hastening market penetration and demand for lab-grown diamonds across the U.S. and India.

Retail industry participants' initiatives to offer customization and build customer-friendly user interfaces (UI) for ease of understanding are increasing the shift of consumers to lab grown diamonds in both the U.S. and India. As consumer preferences change towards personalized jewelry, shops are employing powerful digital tools to offer customization possibilities, allowing consumers to create their own rings, necklaces, and other diamond jewelry with their desired cuts, settings, and metals. This high level of personalization boosts client involvement and happiness, making lab-grown diamonds an appealing alternative.

Furthermore, merchants are investing in sophisticated and user-friendly online platforms that streamline the buying experience by providing interactive 3D visualization, augmented reality (AR) try-ons, and AI-driven suggestions. These qualities help buyers understand the quality, price, and positive aspects of lab-grown diamonds, decreasing skepticism and increasing confidence in their purchasing decisions. In the U.S., where e-commerce is important in jewelry sales, these digital developments appeal to tech-savvy buyers seeking simplicity and transparency.

Similarly, in India, where traditional jewelry buying is dominated by in-store experiences, the development of smooth web interfaces is bridging the gap between physical and digital retail, allowing lab-grown diamonds to reach a larger audience. Retailers in both countries are increasing customer interest and boosting market growth by improving the shopping experience through customization and user-friendly digital platforms.

Segmental Overview

The U.S. and India lab grown diamond market is segmented into manufacturing method, size, and application. By manufacturing method, the market is classified HPHT and CVD. By size, the market is classified into below 2 carat, 2-4 carat, and above 4 carat. By application, the market is classified into fashion and industrial.

By Manufacturing Method

According to manufacturing method, the CVD segment dominated the market in 2023 and is expected to sustain its market share during the forecast period, due to its ability to produce high-quality diamonds with superior purity and fewer inclusions compared to the High-Pressure High-Temperature (HPHT) method. CVD technology allows for precise control over diamond growth, making it the preferred choice for jewelry, electronics, and industrial applications. In addition, advancements in CVD processes, lower production costs, and increase in consumer preference for sustainable and ethically sourced diamonds have further strengthened its market leadership in the U.S. and India.

By Manufacturing Method

U.S. and India Lab Grown Diamond Market, By Manufacturing Method

By Size

According to size, the below 2 carat segment dominated the market in 2023 and is expected to sustain its market share during the forecast period. Below 2 carat diamonds are driven by strong consumer demand for affordable, high-quality diamonds in engagement rings, fashion jewelry, and everyday wear. This segment benefits from the cost-effectiveness of lab-grown diamonds, making them an attractive alternative to natural diamonds, particularly for younger consumers seeking sustainable and ethically sourced options.

By Size

U.S. and India Lab Grown Diamond Market, By Size

By Application

According to application, the fashion segment dominated the market in 2023 and is expected to sustain its market share during the forecast period. The fashion segment is driven by increasing consumer preference for affordable, stylish, and sustainable jewelry. Lab-grown diamonds offer a cost-effective alternative to natural diamonds, making them highly popular for everyday accessories, statement pieces, and personalized designs. In addition, the expanding presence of online and retail jewelry brands promoting lab-grown diamonds has strengthened their dominance in the fashion market.

By Application

U.S. and India Lab Grown Diamond Market, By Application

Competition Analysis

Players operating in the U.S. and India lab grown diamond market have adopted various developmental strategies to expand their U.S. and India lab grown diamond market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Rapnet, Virtual Diamond Boutique (VDB), International Diamond Exchange (IDEX), Polygon, Diamond Foundry, LGD Trade, LGDeal, Diamond Trade Centre, Stone Search, and Fuego Trade.

By Country

U.S. and India Lab Grown Diamond Market, By Country

Some Examples of Service Launch in The Market

- In January 2025, RapNet, the world’s largest online diamond trading network launched its Gemstone Trading Network for expanding its platform to include loose colored gems. This dedicated colored gem trading platform highlights the growing significance of colored stones within the global jewelry market and demonstrates RapNet’s commitment to serving the evolving needs of the industry.

- In May 2022, Virtual Diamond Boutique launched a new digital tool that allows salespeople to engage customers longer and personalize their in-store experience. The VDB Sales Genie app is customizable by retailers and can be accessed on both tablets and smartphones.

Example of Partnership in The Market

- In September 2021, International Diamond Exchange Online (IDEX) and One Creation Corporation announced a strategic partnership for jointly developing a unique database for the participants in the diamond industry.

Key benefits for stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the U.S. and India Lab Grown Diamond Market analysis from 2024 to 2031 to identify the prevailing U.S. and India Lab Grown Diamond Market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities during the U.S. and India Lab Grown Diamond Market forecast period.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as U.S. and India Lab Grown Diamond Market trends, key players, market segments, application areas, and U.S. and India Lab Grown Diamond Market growth strategies.

U.S. and India Lab Grown Diamond Market Report Highlights

| Aspects | Details |

| By Manufacturing Method |

|

| By Size |

|

| By Application |

|

| By Country |

|

Analyst Review

The CXOs believe that technical breakthroughs, shift in customer tastes, and increased regulatory monitoring are expected to drive the lab-grown diamond (LGD) sector. As production processes improve, the quality and customization of LGDs are projected to increase, thus strengthening their place in both fine jewelry and industrial markets. Certification will be critical in determining price since recognized grading standards from organizations such as IGI, GIA, and SGL will boost customer trust and offer obvious value distinction. However, the operations manager of one of the largest LGD manufacturer companies in India, stated that the certification cost has been reduced by 40-50% in India, and they are not opting for certification of the diamond below 0.5 carats as they increase the overall prices and buyers are losing interest. High-quality, certified diamonds with exceptional cut, color, and clarity are expected to attract a premium price, but uncertified or lower-grade LGDs may see price reductions owing to perceived quality discrepancies.

Meanwhile, increased raw material costs, such as high-purity carbon sources and energy-intensive manufacturing procedures, provide hurdles for manufacturers, particularly in India, a significant production hub. These cost constraints may drive industry consolidation, with bigger, vertically integrated enterprises gaining an advantage over smaller players battling to stay profitable.

Furthermore, openness in price and product understanding is becoming more vital for market success. B2B customers and consumers both want clarification on production processes (HPHT vs. CVD), sourcing, and sustainability promises. Platforms that offer real-time price information, authentication services, and instructional materials are more likely to win market trust and increase transaction volumes. Overall, the LGD business is poised for long-term growth, but firms who prioritize quality certification, cost-effective production, and transparency are expected to emerge as market leaders.

The U.S. and India lab grown diamond market was valued at $14,725.3 million in 2023 and is projected to reach $37,406.9 million by 2031, registering a CAGR of 12.7% from 2024 to 2031.

The U.S. and India lab grown diamond market registered a CAGR of 12.7% from 2024 to 2031.

Raise the query and paste the link to the specific report and our sales executive will revert with the sample.

The forecast period in the U.S. and India lab grown diamond market report is from 2024 to 2031.

The top companies that hold the market share in the U.S. and India lab grown diamond market include Rapnet, Virtual Diamond Boutique (VDB), International Diamond Exchange (IDEX), Diamond Foundry, and others.

The U.S. and India lab grown diamond market report has 3 segments. The segments are into manufacturing method, size, and application.

Loading Table Of Content...