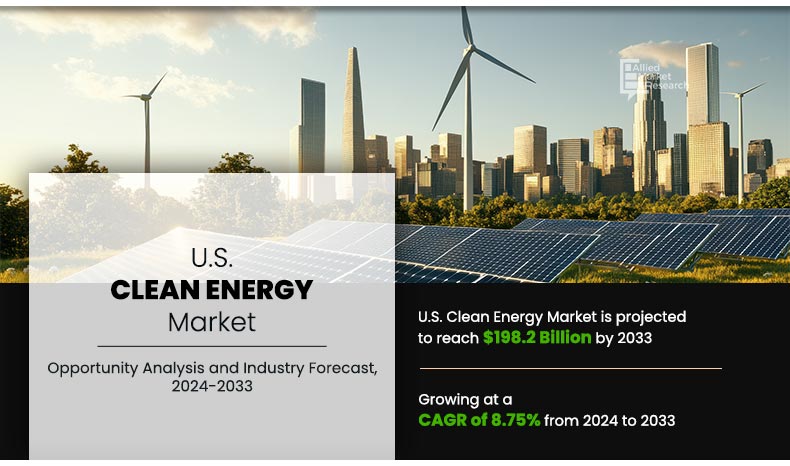

U.S. Clean Energy Market Research, 2033

The U.S. clean energy market was valued at $85.7 billion in 2023, and is projected to reach $198.2 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. Technological advancements, the surge in demand for energy storage solutions, and regulatory support, further boost its demand.

Introduction

The U.S. clean energy market has grown due to several factors, including technological advancements in renewable energy, government policies & regulations, and concerns regarding energy security. However, high initial costs, intermittent & storage challenges, and competition with fossil fuels limit market growth. Furthermore, investments in energy storage solutions and green energy buildings create attractive opportunities for the expansion of the U.S. clean energy market.

Clean energy is derived from renewable sources such as sunlight, wind, water (hydropower), geothermal heat, and biomass. These sources are replenishable and have minimal environmental impact compared to fossil fuels.

Renewable energy sources, including geothermal and biomass, experienced notable growth with consumption increasing from 2,434.53 TWh in 2022 to 2,469.42 TWh in 2023. This represents an absolute increase of 34.87 TWh, corresponding to a remarkable relative change of 1.4% according to the U.S. primary energy production. This surge in renewable energy consumption boosts the prominence and adoption of sustainable energy solutions worldwide.

Among the specific renewable energy categories, biofuels, solar, and wind energy contribute to this upward trend. The increase in consumption of biofuels, solar and wind energy reflects advancements in technology and growing investments in clean energy sectors.

Key Takeaways:

- Quantitative information mentioned in the U.S. Clean Energy Market includes the market numbers in terms of value ($Billion) concerning different segments, annual growth rate, CAGR (2024-33), and growth analysis.

- The analysis in the report is provided based on end-use. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Vestas Wind Systems A/S, Siemens A.G., GE Vernova, NextEra Energy, First Solar, Inc., JA Solar, First Gen Corporation, Terra Gen LLC, Calpine, and DTE Energy hold a large proportion of the U.S. Clean Energy Market.

- This report makes it easier for existing market players and new entrants to the clean energy industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics

Rapid technological advancements propel the U.S. clean energy market forward, revolutionizing the new path to generate, distribute, and consume energy. Innovations in solar panel efficiency, wind turbine design, battery storage capacity, and smart grid technology reduce costs and improve the reliability of renewable energy sources. Breakthroughs in materials science, AI, and data analytics have optimized energy production and consumption, leading to more resilient and sustainable energy systems. These advancements boost the expansion of the scope and scale of the U.S. clean energy market, making renewable energy solutions increasingly competitive with conventional fossil fuels.

While technological advancements have significantly reduced the costs of clean energy technologies, high initial capital expenditures remain a significant barrier to the adoption of renewable energy for many individuals, businesses, and governments. The upfront costs associated with installing solar panels, wind turbines, energy storage systems, and other clean energy infrastructure are prohibitive, particularly for those operating on tight budgets or in regions with limited access to financing. Addressing this challenge requires innovative financing mechanisms, such as solar leasing programs, energy efficiency financing initiatives, and public-private partnerships. In addition, continued R&D efforts aimed at driving down the costs of clean energy technologies are expected to unlock the full potential of the U.S. clean energy market.

Energy storage solutions represent a significant opportunity for the growth of the U.S. clean energy market, offering the ability to store surplus energy generated from renewable sources for use during times of high demand or when renewable energy generation is low. Advancements in battery technology, including lithium-ion batteries, flow batteries, and solid-state batteries, have made energy storage systems more efficient, reliable, and cost-effective. These technologies enable grid operators to better manage fluctuations in renewable energy production and improve the integration of intermittent energy sources into the grid.

Furthermore, energy storage solutions play a critical role in enabling the widespread adoption of electric vehicles, by providing necessary infrastructure for charging and managing vehicle-to-grid interactions. As the demand for reliable energy storage continues to grow, the market for energy storage solutions is expected to witness significant expansion, presenting lucrative opportunities for investors, developers, and manufacturers for the development of clean energy.

Between 2022 and 2023, there was a notable surge in U.S. renewable energy production.

Renewable energy accounted for about 9% of total U.S. primary energy production and 9% of total energy consumption in 2023. Significant increase in solar and wind energy production drives the recent growth of clean energy industry. Hydropower generation in 2023 was roughly 6% higher than in 2022. While biomass energy production and consumption increased compared to 2022, they remained below the record levels witnessed in 2018. Biofuels contributed approximately 53% of total biomass consumption in 2023. Geothermal energy consumption also reached an all-time high in 2023. These fluctuations highlight both progress and challenges in the global transition to renewable energy sources, influenced by regional dynamics and policy initiatives.

Segment Overview

The U.S. clean energy market is segmented into type and application. By type, the market is divided into solar energy, wind energy, geothermal energy, biomass, and others. By application, the market is segregated into residential, commercial, and industrial.

U.S. Clean Energy Market, By Type

In 2023, the wind energy segment held the highest market share, accounting for nearly one-third of clean energy revenue. This is due to its scalability, reliability, and abundant resource availability. Wind turbines generate electricity on a large scale, offering a cost-effective solution. Geothermal energy, with a projected 9.8% CAGR from 2024 to 2033, is growing rapidly due to its continuous, reliable power generation, minimal environmental impact, and scalability. It offers a sustainable and accessible source of electricity and heat globally.

By Type

Wind Energy segment is the most lucrative segment

U.S. Clean Energy Market, By Application

In 2023, the industrial segment held the largest market share in the U.S. clean energy market, accounting for over half of revenue. This growth is attributed to increased demand for emergency backup power in industrial buildings, which has led to the use of renewable energy sources like wind, solar, geothermal, and biomass. The commercial segment is projected to experience the highest CAGR of 9.1% from 2024 to 2033, driven by infrastructure development in developing countries and a shift towards sustainable power generation.

By Application

Industrial segment is the most lucrative segment

Competitive Analysis

The major players operating in the U.S. clean energy market include Vestas Wind Systems A/S, Siemens A.G., GE Vernova, NextEra Energy, First Solar, Inc., JA Solar, First Gen Corporation, Terra Gen LLC, Calpine, and DTE Energy. Rapid urbanization and industrialization across the globe have led to an increase in environmental contamination with various applications.

Additional growth strategies such as expansion of production capacities, acquisition, and partnership in the development of the innovative products from manufacturers have helped to attain key developments in the U.S. clean energy market trends.

Renewable Energy consumption trends:

- Solar energy consumption exhibited remarkable growth during this period, soaring from 207.15 TWh in 2022 to 240.53 TWh in 2023, marking a substantial absolute change of +33.37 TWh, equivalent to an impressive 16% increase.

- Wind energy consumption similarly experienced significant expansion, surging from 438.68 TWh in 2022 to 429.53 TWh in 2023, indicating a noteworthy absolute change of -9.15 TWh, representing a relative change of approximately -2%.

- Other renewables, encompassing geothermal and biomass energy, experienced a substantial increase from 71.51 TWh in 2022 to 67.29 TWh in 2023, marking a significant absolute change of -4.22 TWh or a relative change of -6%.

Key Benefits For Stakeholders

- The report includes in-depth analysis of different segments and provides market estimations between 2023 and 2033.

- A comprehensive analysis of the factors that drive and restrict the growth of the U.S. Clean Energy Market is provided.

- Porter’s five forces model illustrates the potency of buyers & sellers, which is estimated to assist the market players to adopt effective strategies.

- Estimations and forecast are based on factors impacting the U.S. Clean Energy Market growth, in terms of value.

- Key market players are profiled to gain an understanding of the strategies adopted by them.

- This report provides a detailed analysis of the current U.S. Clean Energy Market trends and future estimations from 2024 to 2033, which help identify the prevailing market opportunities.

U.S. Clean Energy Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By KEY MARKET PLAYERS PROFILED IN THE REPORT |

|

Analyst Review

CXOs in the U.S. clean energy sector are at the forefront of a transformative era, driven by rising global demand for sustainable solutions and ambitious governmental policies. They play a pivotal role in advancing environmentally friendly power systems to combat climate change and meet renewable energy targets. The industry is diversifying, leveraging technologies like solar, wind, and bioenergy across various applications, from power generation to transportation.

Key strategic priorities for CXOs include improving energy storage solutions, modernizing grids, and increasing efficiency in renewable technologies. These advancements enhance system reliability which aligns with broader corporate sustainability goals. As regulatory frameworks evolve, industry leaders must navigate complexities while leveraging incentives to attract investments and foster innovation. For instance, initiatives to decarbonize energy sources and expand renewable infrastructure are critical to meeting long-term climate commitments.

Moreover, the clean energy sector presents significant opportunities in emerging areas, such as electric vehicles, offshore wind development, and hydrogen technologies. CXOs are tasked with scaling operations to meet demand while ensuring affordability and energy security. By fostering collaboration between public and private sectors, they are steering the U.S. toward a sustainable and resilient energy future, positioning the country as a leader in the global transition to clean energy.

An increase in demand in energy storage solutions is the key factor boosting the U.S clean energy market growth

The U.S Clean Energy Market was valued at $85.7 billion in 2023 and is projected to reach $198.2 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Key players in the U.S. clean energy market include Vestas Wind Systems A/S, Siemens A.G., GE Vernova, NextEra Energy, First Solar, Inc., JA Solar, First Gen Corporation, Terra Gen LLC, Calpine, and DTE Energy.

Regulatory support is the main driver of U.S. clean energy market.

The U.S Clean Energy Market is segmented into type, application. On the basis of type, the market is classified into wind energy, solar energy, geothermal energy, biomass and others. On the basis of application, the market is divided into residential, commercial, and industrial.

High initial capital cost, and grid integration are the restraint factors fo U.S clean energy market.

Industrial is the dominating segment based on application

Loading Table Of Content...