US Personal Finance Software Market Outlook - 2026

The US personal finance software market size was valued at $232 million in 2018, and is expected to reach $343 million by 2026, registering a CAGR of 5% from 2019 to 2026.

Personal finance software is a solution that helps to manage personal finances such as bank accounts, financial transactions, credit cards, investments, income, and expenditure of an individual through a smartphone or personal computer. It acts as a dashboard for users’ financial transactions and helps in tracking transactions and alerting the user when a problem arises. In addition, it directs monetary transactions and payrolls by helping an individual manage monthly expenses efficiently. The adoption of this software has increased among small or home business users, which helps them to easily manage their funding and business operations. Moreover, it enables effective planning and management of the inflow and outflow of monetary funds.

The growth of the US personal finance software market is driven by factors such as increase in dependency on the internet, surge in use of mobile applications, rise in adoption of personal finance software, and availability of open-source solutions. However, each factor has a definite impact on the market. Personal finance software helps in accomplishing the short-term and long-term financial goals set by individual users, reduction of unnecessary expenses, possible adjustments on financial plans, and can perform reassessment.

In addition, numerous benefits provided by personal finance software include quick & easy account reconciliation, budget planning, availability of online bill payment, and tracking & analyzing investments, which in turn boost the adoption of this software in the US market. For example, Quicken Inc. accounts for the highest share in the US personal finance software market, based on its wide product portfolio and innovative product launches, followed by Personal Capital Corporation.

Furthermore, rise in need to track and manage the income flow of individual/small business has boosted the demand for personal finance software. Moreover, this software can be linked with internet banking to provide transaction updates, thus aiding users in effective money management.

With increase in internet penetration, day-to-day financial activities such as budgeting, maintaining accounts, track on income & expenditure, retirement planning, and others are on a rise, which has boosted the utilization of personal finance software. However, several small-scale businesses and individual users are adopting open-source solutions to manage their business operations and day-to-day expenditure, owing to their minimal investment. This serves as an extremely economical solution for organizations with limited resources and expertise, which in turn hinders the adoption of the paid personal finance software. On the contrary, increase in use of personal finance software in tax planning, retirement planning, estate planning, education planning, management of cash, and to meet other financial goals is expected to offer lucrative growth opportunities for the market.

Segment Review

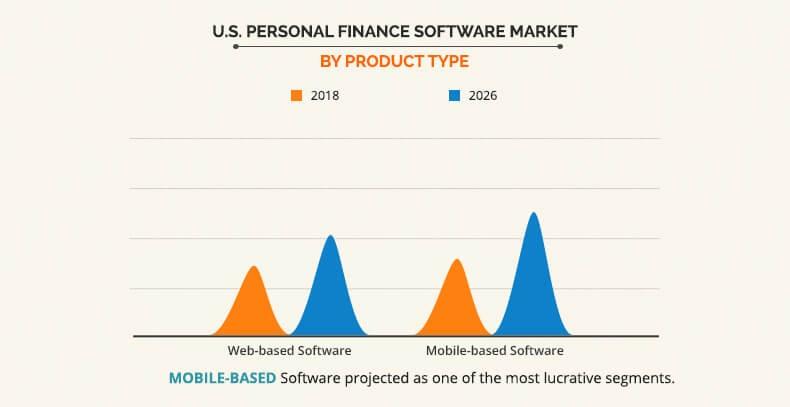

Based on product, the US personal finance software market is divided into web-based software and mobile-based software. Web-based personal finance software provides high security, as it is supported by anti-virus and anti-malware solutions that drive the growth of the market. Several web-based options are available in the market such as MyMoneyCoach, Sage Intacct, Inc., and Moneyspire Inc. Moreover, INTUIT INC. launched Mint, a free web-based service, which allows users to connect all their financial information, from bank accounts, credit cards, loans, and debts. Moreover, web-based service allows to track transactions in real time.

Increase in use of mobile-based personal finance software such as Venmo, LearnVest, PayPal, and others across different areas of operations is expected to drive the US personal finance software market growth during the forecast period.

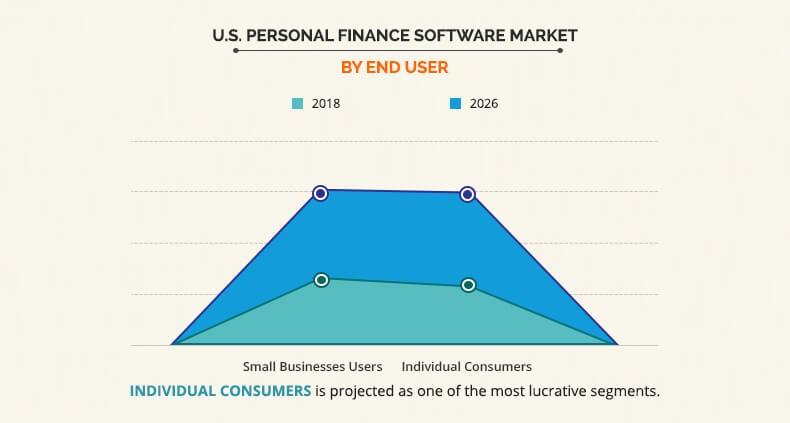

Depending on end user, the US personal finance software market is bifurcated into small business users and individual consumers. Personal finance software is primarily used by many small and home business users to integrate financial data of business and segregate the information to deliver a desired analytical output for improved financial planning. It helps business users to make smarter money decisions by highlighting spending trends, helps to manage debt repayment, and track financial goals. The individual consumers' segment adopts personal finance software to manage bank accounts, credit cards, investments, income, and individual expenditure through a smartphone or a personal computer. Moreover, the demand for this software has increased in the individual consumer's segment, due to its benefits over web-based software such as instant online & offline access, push notifications & instant updates, productivity improvement, and cost reduction. Personal finance software can manage monetary transactions by helping an individual to manage monthly expenses efficiently. Moreover, this software functions as a dashboard for users to track financial transactions and alert them when a problem arises.

The report provides a comprehensive analysis of the leading companies operating in the US personal finance software industry such as Quicken Inc., Buxfer, Inc., CountAbout Corporation, doxo Inc., IGG Software, Inc., Microsoft Corporation, Moneyspire Inc., Personal Capital Corporation, Qapital, Inc., and You Need a Budget LLC.

Key Benefits For US Personal Finance Software Market

- The study provides an in-depth analysis of the US personal finance software market trends and future estimations to elucidate the imminent investment pockets.

- Porter’s Five Forces analysis illustrates the potency of buyers and suppliers operating in the US Personal Finance Software Industry.

- A comprehensive US personal finance software market analysis along with factors that drive and restrict the growth is provided.

- A comprehensive quantitative analysis for US personal finance software market is provided from 2018 to 2025 to assist stakeholders to capitalize on the prevailing market opportunities.

- An extensive analysis of the key segments of the industry helps understand the trends in US personal finance software market.

- Comprehensive analysis of US Personal Finance Software market share, along with key player service offerings and their strategies are provided to understand the competitive outlook of the industry.

- The US Personal Finance Software Market forecast are provided till 2026 considering the market dynamics and investments from major player in the market.

U.S. Personal Finance Software Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By END USER |

|

| Key Market Players | QUICKEN INC, IGG SOFTWARE, INC, BUXFER, INC, COUNTABOUT CORPORATION, MICROSOFT CORPORATION, YOU NEED A BUDGET LLC, PERSONAL CAPITAL CORPORATION, Doxo inc, QAPITAL, INC, MONEYSPIRE INC |

Analyst Review

The U.S. personal finance software market is expected to grow at a significant rate, due to rise in need for advanced financial tools, technological advancements related to new product development, and availability of low-cost products.

Personal finance software is a tool designed to integrate the financial data of a user and segregate this information to deliver a desired analytical output for improved financial planning. This software tool utilizes a variety of financial data as input and can be implemented for varied tasks such as financial transactions, bank records management, investment tracking, budget management, portfolio management, and others.

Furthermore, the latest trends which are gaining momentum in the personal finance software market are availability of mobile applications; change in consumer behavior in terms of spending, saving, and managing their money; and cloud storage offering from major players in the market. Moreover, increase in reach of mobile network encourages organizations to adopt mobile collaboration services that help to boost the profitability of their business. In addition, the availability of advanced features such as comparison between income and expenditure, to get a better idea of budgeting personal finance, are expected to provide lucrative opportunities for mobile-based personal finance software market.

Loading Table Of Content...