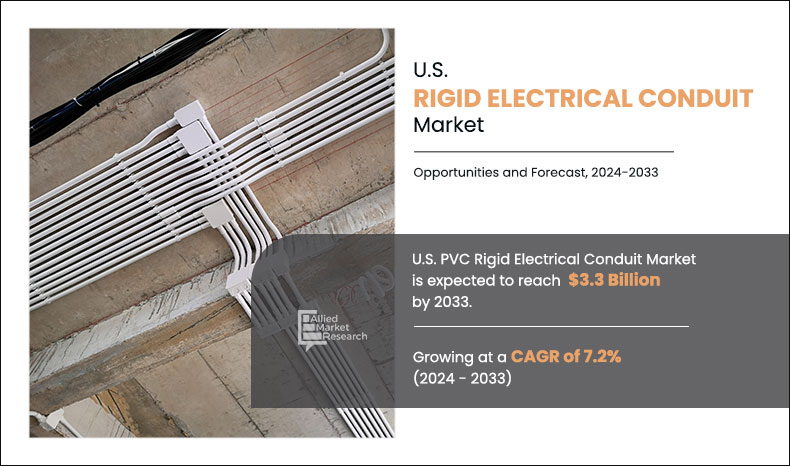

The U.S. PVC rigid electrical conduit market was valued at $1.7 billion in 2023 and is estimated to reach $3.3 billion by 2033, exhibiting a CAGR of 7.2% from 2024 to 2033. The increase in demand for renewable energy integration and the cost-effectiveness and ease of installation of PVC rigid electrical conduit are significant drivers for its rising demand in the U.S. As the country intensifies efforts to transition to renewable energy sources such as solar and wind, there is a growing need for robust electrical infrastructure capable of supporting these systems. PVC conduits offer an ideal solution due to their durability, resistance to environmental stressors, and ability to protect electrical wiring in diverse conditions.

Introduction

PVC rigid electrical conduit is a type of piping made from polyvinyl chloride (PVC) used to protect and route electrical wiring in various applications. It provides a safe and secure pathway for electrical cables, shielding them from physical damage and environmental factors. PVC rigid electrical conduit is used for its cost-effectiveness, lightweight nature, and compliance with electrical safety standards, making it a reliable choice for electricians and contractors.

Key Takeaways

- The U.S. PVC rigid electrical conduit market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of end use.

- The U.S. PVC rigid electrical conduit market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The key players in the U.S. PVC rigid electrical conduit market are ABB Ltd., Atkore, CANTEX INC., United Pipe & Steel, Prime Conduit, Inc., National Pipe and Plastics, Inc, Robroy Industries, Anamet Electrical, Inc., IPEX USA LLC., and JM EAGLE, INC.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the perovskite solar cells industry.

Market Dynamics

The growing demand for renewable energy integration is significantly driving the need for PVC rigid electrical conduits in the U.S. The International Energy Agency (IEA) estimates that the majority of global electricity need to be generated using renewables to reach net-zero emissions by 2050. The U.S. has set a goal of generating 100% clean electricity by 2035. As the country shifts towards cleaner energy sources such as solar and wind power, the infrastructure to support these technologies becomes increasingly critical. PVC rigid electrical conduits play a vital role in protecting and routing the electrical wiring required for renewable energy systems. Their durability, corrosion resistance, and cost-effectiveness make them an ideal choice for these applications. All these factors are expected to drive the growth of the U.S. PVC rigid electrical conduit market during the forecast period.

However, sustainability initiatives and regulations aimed at reducing carbon footprints and promoting eco-friendly construction practices are increasingly pushing industries towards alternatives to PVC. Materials such as high-density polyethylene (HDPE) and non-plastic conduits made from metals or sustainable composites are gaining traction due to their lower environmental impact and recyclability. The PVC rigid electrical conduit market in the U.S. faces challenges in adapting to these evolving regulatory and consumer demands as stakeholders prioritize environmental responsibility and seek to adhere to stringent sustainability standards. All these factors hamper the U.S. PVC rigid electrical conduit market growth.

The adoption of advanced building technologies in the U.S. presents significant opportunities for PVC rigid electrical conduit. The demand for durable, reliable conduit materials increases as modern buildings increasingly integrate smart technologies, renewable energy solutions such as solar panels, and sophisticated electrical systems. PVC rigid electrical conduit stands out due to its versatility, cost-effectiveness, and ability to withstand various environmental conditions. These conduits provide essential protection for electrical wiring, ensuring safety and longevity in residential, commercial, and industrial applications. All these factors are anticipated to offer new growth opportunities for the U.S. PVC rigid electrical conduit market during the forecast period.

Segments Overview

The U.S. PVC rigid electrical conduit market is segmented into end use. By end use, the market is divided into telecommunications, electrical wiring, utility, renewables, and others.

The electrical wiring segment accounted for more than two-fifths of the U.S. PVC rigid electrical conduit market share in 2023 and is expected to maintain its dominance during the forecast period. PVC rigid electrical conduits are lightweight and easily cut, shaped, and joined that reduce the labor and time required for installation. This ease of handling speeds up the construction process and reduces labor costs that makes PVC conduits an economically efficient solution. Furthermore, PVC conduits offer excellent electrical insulation properties, which enhances safety by reducing the risk of electrical shocks and short circuits. Their non-conductive nature ensures that they do not contribute to any form of electrical interference, making them suitable for a wide range of electrical applications. These factors are expected to drive the demand for the PVC rigid electrical conduit during the forecast period.

By End Use

Electrical wiring is projected as the most lucrative segment.

National Electrical Code (NEC) Standards:

The National Electrical Code (NEC), published by the National Fire Protection Association (NFPA) is the foremost standard governing electrical installations in the U.S.

- Material Requirements: The NEC specifies acceptable materials for electrical conduits, including PVC. PVC conduit must meet certain material composition standards to ensure it safely houses electrical wiring and withstand environmental conditions such as temperature changes, moisture, and physical impact.

- Installation Guidelines: The NEC provides detailed guidelines on the installation of PVC rigid electrical conduit to ensure safety and performance. This includes rules for bending, securing, and supporting conduits to prevent damage and maintain electrical integrity over time.

- Safety Standards: Safety is important in the NEC, and it outlines requirements for PVC conduit to protect against risks such as fire, electric shock, and mechanical damage. These standards help ensure that PVC conduits are robust and reliable in various building environments, from residential homes to industrial facilities.

- Conduit Sizing and Fill: The NEC specifies the sizing and fill capacities of PVC conduits based on the number and size of conductors they contain. This ensures that conduits are not overcrowded, which leads to overheating and potential safety hazards.

Competitive Analysis

Key players in the U.S. PVC rigid electrical conduit market include ABB Ltd., Atkore, CANTEX INC., United Pipe & Steel, Prime Conduit, Inc., National Pipe and Plastics, Inc, Robroy Industries, Anamet Electrical, Inc., IPEX USA LLC., and JM EAGLE, INC.

In the U.S. PVC rigid electrical conduit market, companies have adopted acquisition and collaboration to expand the market or develop new products. For instance, in May 2024, ABB acquired Siemens Wiring Accessories business in China, expanding its market reach and offering in smart buildings. This acquisition is expected to provide access to a wide distribution network across 230 cities and additional expertise from regional sales, manufacturing operations, and management teams. Moreover, in December 2023, Atkore committed to the National Electrical Contractors Association's Premier Partner sponsorship program for three years. The top-level sponsorship program connects NECA members to the leading companies in the electrical construction industry.

Key Benefits of Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the U.S. PVC rigid electrical conduit market analysis from 2023 to 2033 to identify the prevailing U.S. PVC rigid electrical conduit market opportunities.

- The market research is offered along with information related to key drivers, restraint, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the U.S. PVC rigid electrical conduit market statistics and segmentation assists to determine the prevailing market opportunities.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the U.S. PVC rigid electrical conduit market trends, key players, market segments, application areas, and market growth strategies.

U.S. PVC Rigid Electrical Conduit Market Report Highlights

| Aspects | Details |

| By End Use |

|

| By Key Market Players |

|

Analyst Review

According to the opinions of various CXOs of leading companies, the U.S. PVC rigid electrical conduit market is expected to witness an increase in demand during the forecast period. Increase in demand for renewable energy integration and cost-effectiveness and ease of installation increased the demand for the U.S. PVC rigid electrical conduit market during the forecast period. Renewable energy integration, particularly from sources such as solar and wind, has surged in recent years as the U.S. seeks to diversify its energy portfolio and reduce dependence on fossil fuels. PVC rigid electrical conduit plays a critical role in these installations by safely housing wiring and cables that connect renewable energy systems to the electrical grid. Its ability to withstand various environmental conditions, such as exposure to sunlight and moisture, makes it a preferred choice for outdoor and rooftop installations associated with solar panels and wind turbines.

Moreover, cost-effectiveness also drives the demand for PVC rigid electrical conduit. PVC conduits are generally affordable to purchase and install when compared to alternatives such as metal conduits. This cost advantage is particularly appealing to builders and contractors looking to manage project budgets without compromising on quality or safety standards. In addition, PVC conduit's lightweight nature simplifies handling and reduces labor costs during installation, further enhancing its economic appeal.

Increase in demand for renewable energy integration and cost-effectiveness and ease of installation are the key factors boosting the U.S. PVC rigid electrical conduit market growth.

The U.S. PVC rigid electrical conduit market was valued at $1,681.00 million in 2023 and is estimated to reach $3,282.52 million by 2033, exhibiting a CAGR of 7.2% from 2024 to 2033.

Key players in the U.S. PVC rigid electrical conduit market include ABB Ltd., Atkore, CANTEX INC., United Pipe & Steel, Prime Conduit, Inc., National Pipe and Plastics, Inc, Robroy Industries, Anamet Electrical, Inc., IPEX USA LLC., and JM EAGLE, INC.

Adoption of advanced building technologies is the opportunity to the U.S. PVC rigid electrical conduit market growth.

The U.S. PVC rigid electrical conduit market is segmented into end use. By end use, the market is segmented into telecommunications, electrical wiring, utility, renewables, and others.

Environmental concerns and sustainability issues hamper the growth of U.S. PVC rigid electrical conduit market growth.

Electrical wiring is the fasting growing segment on the basis of end use in U.S. PVC rigid electrical conduit market.

Loading Table Of Content...