Used Cooking Oil Market Research, 2034

Market Introduction and Definition

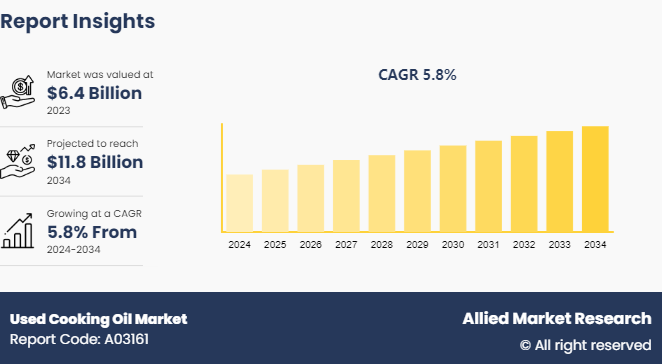

The global used cooking oil market was valued at $6.4 billion in 2023, and is projected to reach $11.8 billion by 2034, growing at a CAGR of 5.8% from 2024 to 2034. Used cooking oil, also known as waste cooking oil, is obtained owing to the repeated usage of vegetable oils for food in restaurants, hotels, and food industries as well as household sectors. The used cooking oil can be obtained from a range of vegetable oils including sunflower, palm, rape, soya, and others, and is usually available in huge volume in mixed composition. Used cooking oil is a substitute for vegetable oil in the production of biodiesel, oleo chemicals, and animal feed. It is considered a waste material and does not compete in the market. Thus, it has low cost as compared to vegetable oil and is easily available in bulk quantities. This drives the growth of the used cooking oil market.

Key Takeaways

The used cooking oil market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The used cooking oil industry has experienced robust growth due to several industry trends and growth drivers. Firstly, the increase in awareness of environmental sustainability and the need to reduce carbon emissions has fueled the demand for renewable energy sources. Biodiesel, which can be produced from used cooking oil, has emerged as an eco-friendly alternative to traditional fossil fuels, driving the used cooking oil market size. Secondly, various governments worldwide have implemented regulations and provided incentives to encourage the recycling of used cooking oil. These policy measures have not only boosted environmental conservation efforts but have also stimulated market expansion.

However, one significant challenge is the theft of used cooking oil. The rise in value of waste cooking oil, driven by its demand in biodiesel production, has attracted illegal activities where thieves steal the oil from restaurants and food establishments. This poses security and economic concerns for legitimate suppliers. Moreover, supply chain disruptions, such as transportation issues and border closures, have affected the smooth flow of used cooking oil from collection points to processing facilities. Fluctuating commodity prices, including vegetable oils, have also introduced market uncertainties for stakeholders, thus having a negative impact on the used cooking oil market growth.

Despite challenges, the used cooking oil market presents attractive business opportunities. Advancements in waste-to-energy technologies provide innovative solutions for converting used cooking oil into valuable products like biodiesel, reducing waste and carbon footprints. Expanding biodiesel production capacities offers growth prospects for players in the market, fostering sustainable energy development. In addition, there is potential for companies to develop and implement efficient collection and recycling systems, ensuring a steady supply of used cooking oil and reducing theft incidents.

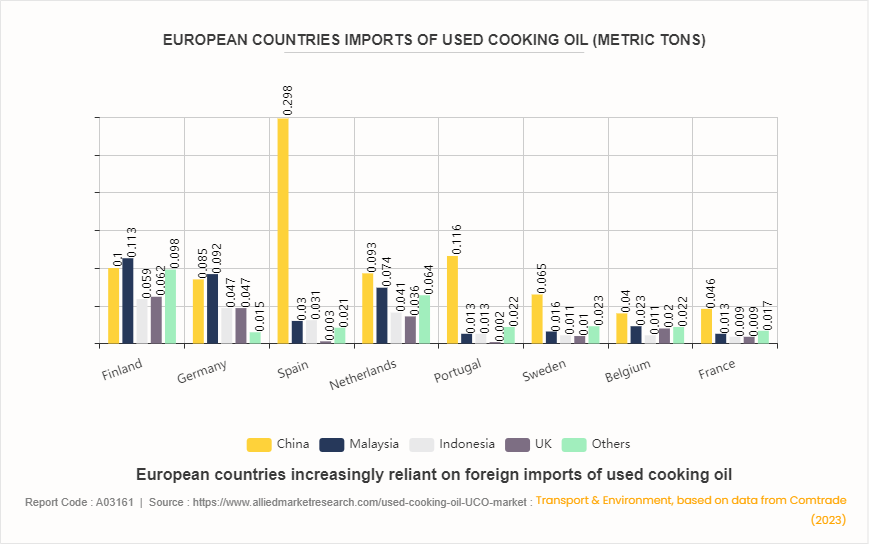

Increased Import of Used Cooking Oil in European Countries

European countries such as Finland, Germany, Spain, the Netherlands, Portugal, Sweden, Belgium, and France are increasingly importing used cooking oil from countries such as China, Malaysia, Indonesia, the UK, and others for several reasons. Used cooking oil is a key feedstock for the production of biodiesel, which is an essential component in the European Union's (EU) strategy to reduce greenhouse gas emissions and meet renewable energy targets. As the demand for biodiesel rises, so does the need for used cooking oil, which is a sustainable and cost-effective raw material.

In addition, European countries have stringent regulations regarding waste management and recycling, making the collection and processing of used cooking oil domestically challenging and expensive. By importing used cooking oil, these countries can secure a steady supply to meet their biodiesel production needs without the associated logistical and regulatory burdens.

Furthermore, exporting countries like China, Malaysia, and Indonesia have established efficient systems for collecting and processing used cooking oil, which has made it a viable export commodity. The UK and other nations also contribute to the supply, leveraging their own waste oil recycling efforts. As a result, the international trade benefits both exporters and importers by promoting sustainable practices and supporting the global circular economy.

Market Segmentation

The used cooking oil market forecast is segmented on the basis of source, application, and region. By source, it is classified into the household sector and the commercial sector. By application, it is divided into biodiesel, oleo chemicals, animal feed, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The increased use of used cooking oil in North America is driven by several key factors. There is a rise in environmental awareness and a push toward sustainable practice. Used cooking oil is being repurposed into biodiesel, a cleaner alternative to fossil fuels, which helps reduce greenhouse gas emissions in the region. Government policies and incentives have encouraged the recycling of used cooking oil, with regulations promoting renewable energy and waste reduction providing financial benefits to businesses that recycle used cooking oil. The rise in costs of traditional fuels make biodiesel an economically attractive option. In addition, the food industry is generating substantial quantities of used cooking oil, making it a readily available resource. Advancements in technology have improved the efficiency and feasibility of converting used cooking oil into biodiesel, further boosting its adoption in the North America market.

In Europe, the adoption of used cooking oil is driven by a strong network of collection and recycling infrastructure. Unlike in some other regions, Europe has well-established systems that facilitate the collection of used cooking oil from households, restaurants, and food processing facilities. The infrastructure ensures that large quantities of used cooking oil can be efficiently gathered and processed into biodiesel or other biofuels. Moreover, there is a cultural emphasis on environmental responsibility and waste reduction in many European countries, which further supports the recycling of used cooking oil. Additionally, initiatives such as certification programs for sustainable biofuels and collaborations between industry stakeholders and environmental organizations play a significant role in promoting the responsible disposal and reuse of used cooking oil across the continent. These unique factors contribute to the robust adoption of used cooking oil recycling practices in Europe.

Industry Trends:

The surge in demand for biodiesel has significantly influenced the global used cooking oil market, establishing a pivotal industry trend. Used cooking oil has become increasingly valuable for biodiesel production as a cost-effective and environment-friendly feedstock. The shift is driven by the need to reduce greenhouse gas emissions and dependence on fossil fuels, aligning with global sustainability goals. Governments worldwide are enacting supportive regulations and incentives, further boosting used cooking oil recycling initiatives. Technological advancements in collection and conversion processes have enhanced the efficiency and viability of used cooking oil as a biodiesel raw material. Consequently, there has been a significant expansion of used cooking oil collection networks and a rise in public and business awareness about the benefits of used cooking oil recycling. The growth of the biodiesel market has also attracted substantial investment, leading to increased mergers and acquisitions within the sector.

Technological advancements have significantly influenced the growth of the global used cooking oil market, setting industry trends by improving the efficiency and scalability of used cooking oil collection, purification, and conversion processes. Innovations in collection technology, such as automated systems and smart bins equipped with sensors, have streamlined the gathering of used cooking oil from various sources, reducing contamination and operational costs. Advanced purification methods, including sophisticated filtration and chemical treatment techniques, ensure that used cooking oil meets stringent quality standards for biodiesel production and other applications. Moreover, the development of more efficient conversion technologies, such as transesterification processes and advanced bio-refineries, has enhanced the yield and quality of biodiesel derived from used cooking oil, making it a more viable and convenient alternative to traditional fossil fuels. These technological improvements boost the economic feasibility of used cooking oil recycling and align with global sustainability goals by promoting the use of renewable energy sources, thereby driving the used cooking oil market share across both developed and emerging markets.

Competitive Landscape

The major players operating in the used cooking oil market include Valley Proteins, Inc., Quatra, Baker Commodities Inc., Arrow Oils Ltd, Olleco, Waste Oil Recyclers, Grand Natural Inc., GREASECYCLE, Brocklesby Limited, and Oz Oils Pty Ltd.

Other players in used cooking oil market includes Darling Ingredients Inc., Argent Energy, Greenergy, Neste, Biofuel Energy Corporation, Cargill, Saria Group, Mahoney Environmental, SeQuential, Biodiesel Amsterdam, and others.

Recent Key Strategies and Developments

In June 2023, ORLEN Unipetrol partnered with Czech Technical University in Prague and the Czech University of Life Sciences to launch a pilot project for cooking oil collection, which aims to examine the recycling options of the product and its effective conversion into biofuel and petrochemicals.

In November 2022, Neste produced from leftover raw materials, agreed to acquire the UCO collection and aggregation business and related assets in the U.S. from Crimson Renewable Energy Holdings, LLC to strengthen the presence and operations of Neste in the U.S.

In January 2020, BioD Energy, an Indian biodiesel producer, announced to start two new biodiesel processing plants to manufacture biodiesel by utilizing this waste oil.

Key Sources Referred

Food Safety and Standards Authority of India (FSSAI)

U.S. Food and Drug Administration (FDA)

Organic Trade Association (OTA)

Euromonitor International

Plant Based Foods Association

Food and Agriculture Organization of the United Nations (FAO)

National Restaurant Association (NRA)

Agricultural & Processed Food Products Export Development Authority (APEDA)

U.S. Department of Agriculture (USDA)

Bureau of Labor Statistics (BLS)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the used cooking oil market analysis from 2024 to 2034 to identify the prevailing used cooking oil market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the used cooking oil market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global used cooking oil market trends, key players, market segments, application areas, and market growth strategies.

Used Cooking Oil Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 11.8 Billion |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 298 |

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | Brocklesby Limited., ARROW OILS LTD., Valley Proteins, Inc., Grand Natural Inc., Baker Commodities Inc., Quatra, Oz Oils Pty Ltd., Olleco Limited, Waste Oil Recyclers, Inc., Greasecycle LLC |

The global used cooking oil market size was valued at USD 6.4 billion in 2023, and is projected to reach USD 11.8 billion by 2034

The global used cooking oil market is projected to grow at a compound annual growth rate of 5.8% from 2024-2034 to reach USD 11.8 billion by 2034

The key players profiled in the reports includes Valley Proteins, Inc., Quatra, Baker Commodities Inc., Arrow Oils Ltd, Olleco, Waste Oil Recyclers, Grand Natural Inc., GREASECYCLE, Brocklesby Limited, and Oz Oils Pty Ltd.

Europe dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Environmental Sustainability and Renewable Energy Demand, Government Regulations and Incentives, Rising Demand for Biodiesel, Fluctuating Commodity Prices, Advancements in Waste-to-Energy Technologies majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...