UV LED Market Research, 2032

The Global UV LED market was valued at $0.8 billion in 2023 and is projected to reach $3.8 billion by 2032, growing at a CAGR of 19.4% from 2024 to 2032. Ultraviolet (UV) LED technology converts electrical energy into ultraviolet light. The UV LED industry vertical involves implementing numerous technologies such as UV-A, UV-B, and UV-C. It usually operates below 100 degrees Fahrenheit. In the past, the application of UV LED was limited to certain specific applications such as curing, counterfeit, forensic, and others. However, with the developments and advancements in technology, it has witnessed adoption into mainstream applications such as disinfection, purification, indoor gardening, sterilization, and medical phototherapy.

Key Takeaways

Based on type, the UV-A segment dominates the market in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on application, the Disinfection/Purification segment dominated the UV LED market in revenue in 2023.

Based on the industry vertical, the healthcare and medical segment dominated the UV LED market in revenue in 2023.

Region-wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

The world's population reached 7.89 billion people in 2021. Global employment figures reached 3.32 billion in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion. The use of LEDs is expected to increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals.

In 2023, there were 94 million automobiles produced worldwide. Global sales of electric vehicles exceeded 10 million in 2022, and it was predicted that sales in 2023 would rise by another 35% to a total of 14 million. The market share of electric cars rose from 4% in 2020 to 14% in 2022 as a result of this quick expansion. Since electric cars need more processors per vehicle than conventional automobiles, there has also been an increase in the need for automotive semiconductor chips as more of them are used. The rise in semiconductor demand in the automotive industry is likely to help the market for LED lighting.

Key Market Dynamics

The surge in the utilization of UV curing systems is significantly driving the UV LED market. UV curing technology, which uses UV light to quickly dry or cure coatings, inks, adhesives, and other materials, has seen a marked increase in adoption across various industries, including automotive, electronics, and healthcare. The efficiency, speed, and environmental benefits of UV curing, such as reduced energy consumption and lower emissions compared to traditional thermal curing methods, are key factors fueling this growth. UV LEDs, which offer advantages like a longer lifespan, lower operational costs, and the ability to operate at lower temperatures, are integral to these systems, making them the preferred choice over traditional mercury lamps. Consequently, the rising demand for advanced and eco-friendly manufacturing processes is propelling the UV LED market, as these LEDs are essential for the effective implementation of modern UV curing applications.

However, the high cost of UV LEDs presents a significant restraint for the widespread adoption of UV LEDs. Advanced UV LEDs are one of the emerging technologies in the market recently. Features such as compact size, low current requirement, long service life, tight tolerance of wavelengths, environmental friendliness, and others have created a competitive edge for advanced mercury-free devices over other mercury-based devices.

Furthermore, the integration of advanced functions into the UV application, such as sterilization, photo therapy, curing, purification, and disinfection, has increased the value of UV LED devices in the market. UV LED light is costly as it contains some techniques to fulfill various specific applications that comprise maintenance and energy costs. Therefore, high cost is expected to restrain their adoption, which can hamper market growth. In addition, the high investments in initial levels restrict initial acceptance of UV LEDs.

Furthermore, the growth of UV LED lights in various applications presents a substantial opportunity for the UV LED market. UV LED applications provide various benefits such as low power consumption, high switching capabilities, and safe operations, which have led to an extensive adoption of UV LED applications in nearly all industries. Moreover, earlier the use of UV LEDs was limited to some applications such as curing, coating, and adhesiveness; however, now continuous R&D and advancements in UV applications have increased their applications such as disinfection, photo therapy, water and & air purification, forensic, printing, and counterfeits. Some of these applications include UVA applications with handheld devices/smartphones for counterfeit analysis or detection, and incorporation of UVC with various medical devices and refrigerators for disinfection. Moreover, other applications, such as air and water disinfection, are also dependent on UV LED applications. Thus, all these factors are responsible for creating opportunities in the UV LED market in the upcoming years.

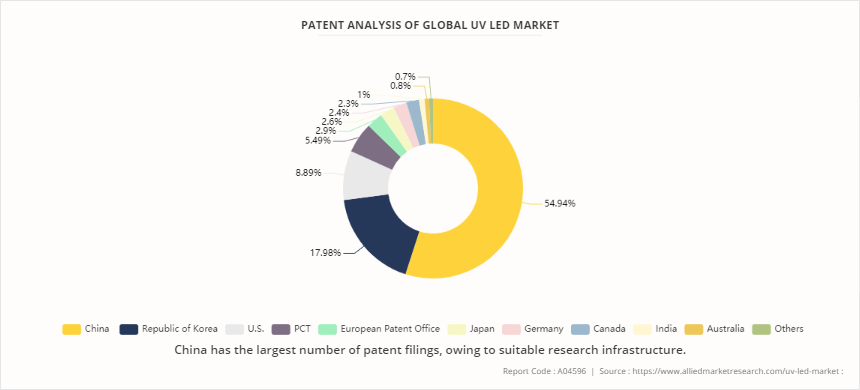

Patent Analysis of the Global UV LED Market

The overall UV LED patents are segregated based on the patents filed in the U.S., European Patent Office, China, PTC, Germany, Japan, India, and other countries. China has the largest number of patent filings, owing to a suitable research infrastructure. Approvals from these authorities are followed/accepted by LED registration authorities in many of the developing regions/countries. Therefore, China and Korea have the maximum number of patent filings. Moreover, the majority of the UV LED manufacturing companies belong to China, Korea, and the U.S., which largely contribute to the growth in the number of patent applications filed in these regions. China dominates the market, registering ~55.0% of the patents. It is followed by the Republic of Korea, which displays ~18.0% share of the total (UV LED) patents filed across the world.

Market Segmentation

The UV LED market is analyzed into type, application, industry vertical, and region. Based on type, the UV LED market forecast is categorized into UV-A, UV-B, and UV-C. Based on application, the market is divided into UV curing, purification, indoor gardening, counterfeit detection, and others. Based on industry vertical, the UV LED Industry is divided into healthcare and medical, agriculture, industrial, residential, and commercial.

Region wise, the UV LED industry trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, and rest of Europe), Asia-Pacific (Japan, China, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Market Segment Outlook

By type, the UV-A segment dominated the market in terms of revenue in 2023 and is expected to follow the same trend during the forecast period due to its broad range of applications, including UV curing in industrial processes, forensic analysis, counterfeit detection, and radiation therapy. These applications drive the demand for UV-A LEDs, making them the dominant segment in the market.

By application, the Disinfection/Purification segment held the highest market share in 2023, accounting for nearly half of the UV LED market share due to the increasing demand for clean water and the rise in adoption of UV LEDs for disinfection purposes across various industries, particularly in water treatment and purification systems. The COVID-19 pandemic has further boosted this segment, as there has been a heightened focus on hygiene and sanitation, driving the use of UV LEDs for disinfection to prevent the spread of viruses and bacteria.

By industry vertical, the healthcare and medical segment held the highest market share in 2023, accounting for nearly half of the UV LED market share this dominance is driven by the extensive use of UV LEDs in medical applications, such as sterilization, disinfection, and medical equipment sanitization, particularly due to heightened hygiene concerns following the COVID-19 pandemic. The demand for UV systems in healthcare is significant because they are used in dialysis machines, catheters, hearing aids, and other critical medical devices.

Regional/Country Market Outlook

Based on region, the UV LED Industry Report is analyzed across North America, Europe, Asia Pacific, and LAMEA. Asia-Pacific holds the highest market share in the UV LED market in 2023 due to a strong industrial base, particularly in nations like China, Japan, and South Korea, which are key centers for electronics and automotive manufacturing. Additionally, the widespread adoption of UV LED technology for applications such as sterilization, disinfection, and water purification, driven by growing awareness of hygiene and environmental sustainability, significantly boosts market growth. The region's substantial investments in technological advancements and infrastructure, along with supportive government policies promoting eco-friendly solutions, further reinforce the dominant position of Asia-Pacific in the UV LED market.

Competitive Landscape

The major UV LED manufacturers are Nordson Corporation, LG Innotek Co. Ltd., Lumileds Holding B.V, Nichia Corporation, OSRAM, Koninklijke Philips N.V., Semileds Corporation, Crystal IS, Sensor Electronic Technology, and Phoseon Technology.

Recent Key Strategies and Developments

In October 2021, LG Innotek announced the development of a new sterilization module that uses deep ultraviolet-C (UVC) LED technology. The module can reportedly eliminate up to 99.9% of germs and viruses in just five minutes, making it ideal for use in various applications such as air purifiers, water purifiers, and medical devices.

In June 2021, Crystal IS, a manufacturer of high-performance UVC LEDs, announced the launch of a new line of deep UV LED modules for air and surface disinfection applications. The modules use Crystal IS's Optan UV-C LEDs and are designed to provide high germicidal efficacy while maintaining low power consumption.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, UV LED market analysis, current trends, estimations, and dynamics of the UV LED market analysis from 2024 to 2032 to identify the prevailing UV LED market opportunities and UV LED sector analysis.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the UV led market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global UV LED market trends, UV LED Market Share by Companies, UV LED Market Insights UV LED Company List, UV LED for US Market, UV LED Market Size by Country, UV LED Market Data, key players, uv led strip market, uv light bulb, segments, application areas, and market growth strategies.

UV LED Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.8 Billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Lumileds Holding B.V, Koninklijke Philips N.V., Nordson Corporation, LG Innotek Co. Ltd, NICHIA CORPORATION, Semileds Corporation, Crystal IS, ams-OSRAM AG., Phoseon Technology., SENSOR ELECTRONIC TECHNOLOGY |

Increased Adoption in Disinfection and Sterilization, and Expansion in Water and Air Purification are the upcoming trends of UV LED Market in the globe.

Disinfection/Purification is the leading application of UV LED Market

Asia-Pacific is the largest regional market for UV LED

In 2023, $0.8 Billion was the estimated industry size for UV LED

Nordson Corporation, LG Innotek Co. Ltd., Lumileds Holding B.V, Nichia Corporation, OSRAM, Koninklijke Philips N.V., Semileds Corporation, Crystal IS, Sensor Electronic Technology, and Phoseon Technology are the top companies to hold the market share in UV LED.

Loading Table Of Content...