Vaccines Market Research, 2035

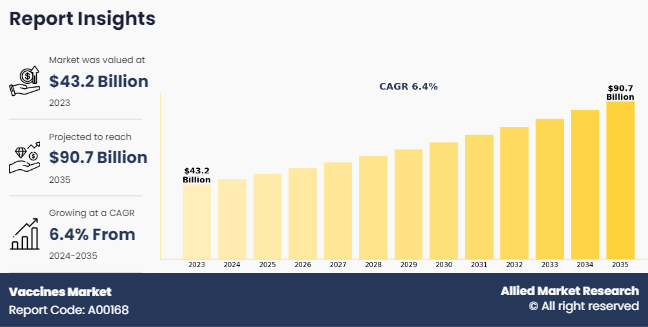

The global vaccines market was valued at $43.2 billion in 2023, and is projected to reach $90.7 billion by 2035, growing at a CAGR of 6.4% from 2024 to 2035. Vaccines are essential tools for preventing infectious diseases and reducing their burden on public health. Government-led immunization programs, public health campaigns, and vaccination initiatives prioritize disease prevention, driving demand for vaccines and sustaining market growth. For instance, according to the World Health Organization (WHO), in January 2023, a total of 64 infectious diseases were reported globally, affecting 235 countries and regions. In addition, WHO estimated that more than 25 million outpatient visits and more than 2 million hospitalizations were attributable to rotavirus infections each year.

A vaccine is a biological preparation that stimulates the immune system to recognize and protect against specific infectious diseases. It typically contains weakened or inactivated forms of pathogens (such as viruses or bacteria) or their components, which trigger an immune response without causing the disease itself. Vaccines help the body develop immunity to a particular disease by priming the immune system to recognize and fight off the pathogen if encountered in the future, thereby preventing, or reducing the severity of illness.

Key Takeaways

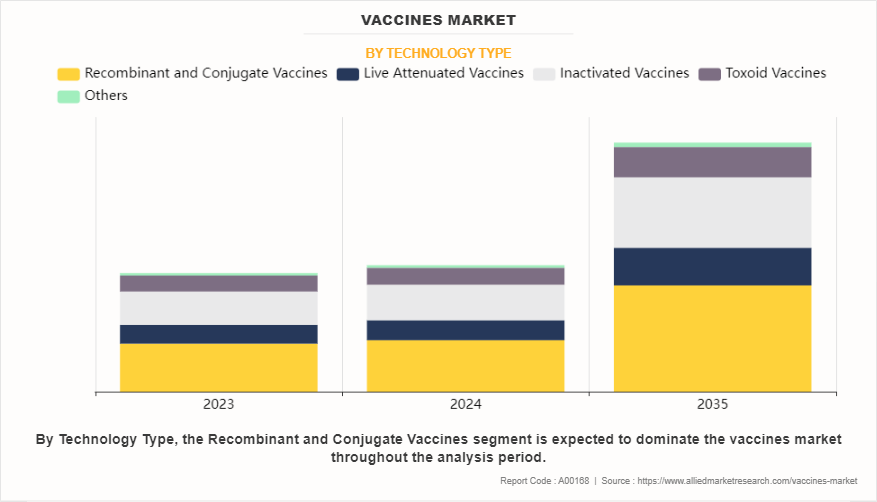

By technology, the recombinant and conjugate vaccines segment dominated the global vaccines market share in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

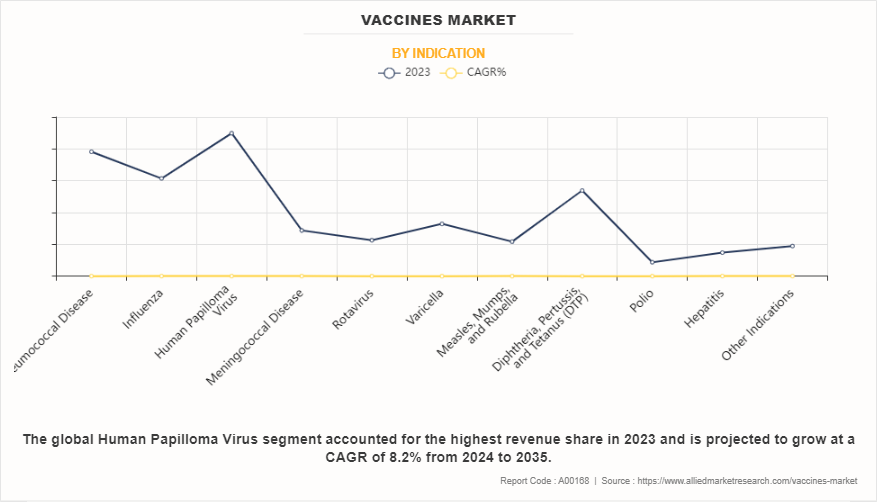

By indication, the human papilloma virus segment dominated the global market in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

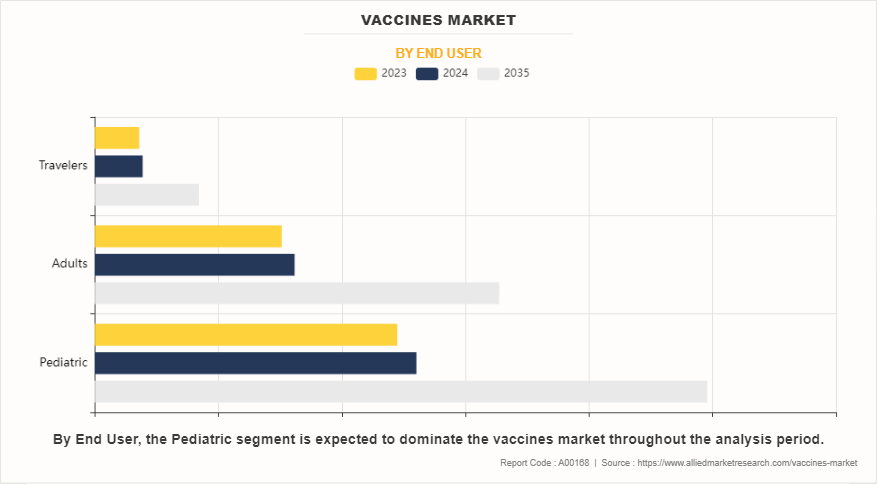

By end user, the pediatric segment dominated the global vaccines market in terms of revenue in 2023.

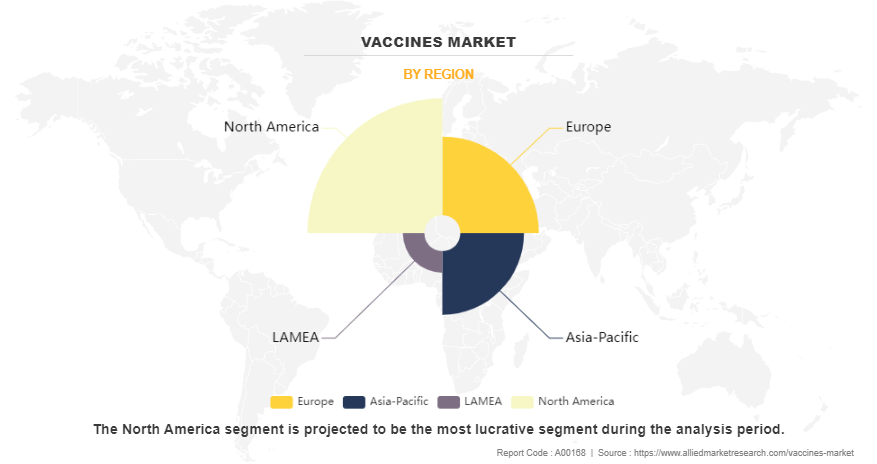

By region, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The vaccines market trends includes rise in prevalence of infectious diseases worldwide, and growing emphasis on preventive healthcare measures, including vaccination. Governments and healthcare organizations are investing in vaccination programs to reduce the incidence of diseases and minimize their impact on public health. This emphasis on prevention is driving the demand for vaccines across different demographics and geographies. The Advisory Committee on Immunization Practices (ACIP) is a group of medical and public health experts that develops recommendations on use of vaccines in the civilian population in the U.S. The committee members of ACIP meet Centers for Disease Control and Prevention (CDC) three times each year and discuss vaccine research, as well as various developments in vaccine technology. Such initiatives aid in increasing the demand for vaccines by acknowledging different vaccinations which is expected to drive the vaccines market growth.

In addition, advancements in biotechnology and vaccine development technologies have significantly contributed to the growth of the vaccines industry. New techniques, such as recombinant DNA technology and adjuvant formulations, have enabled the development of more efficacious and safer vaccines. Furthermore, innovations in vaccine delivery systems, such as needle-free injections and microneedle patches, are improving vaccine administration and patient compliance. Recent advances in vaccine technology are now providing an vaccines market opportunity to target new diseases. There has been a development of a wide array of new vaccination technologies ranging from targeted attenuation techniques of live pathogens to the delivery of biologically engineered protein and peptide antigens as well as viral vector and nucleic-acid based antigens. Many of these technologies have yielded highly promising results. Moreover, there has been a significant increase in spending for the development of vaccine technology. This further drives the growth of the vaccines market.

Furthermore, government-led immunization programs, aimed at increasing vaccine coverage among populations, are driving the demand for vaccines. Initiatives such as the Expanded Program on Immunization (EPI) by the World Health Organization (WHO) and national vaccination campaigns in various countries are expanding access to vaccines, especially in low- and middle-income countries. Despite the benefits of vaccination, vaccine hesitancy remains a significant challenge globally. Misinformation, distrust in vaccines, and concerns about safety and efficacy can undermine immunization efforts and contribute to disease outbreaks. Addressing vaccine hesitancy requires comprehensive communication strategies, community engagement, and efforts to build trust in vaccination. In contrast, advances in vaccine technology, such as mRNA vaccines and viral vector platforms, are paving the way for the development of novel vaccines against a wide range of infectious diseases and other health conditions which provides opportunity to market growth.

Segments Overview

The global vaccine market report is segmented into technology type, indication, end user, and region. On the basis of the technology type, the market is segregated into recombinant and conjugate vaccines, live attenuated vaccines, inactivated vaccines, toxoid vaccines, and others. By indication, the market is divided into pneumococcal disease, influenza, human papilloma virus, meningococcal disease, rotavirus, varicella, measles, mumps, and rubella, diphtheria, pertussis, and tetanus (DTP), polio, hepatitis, and other indications. As per end user, the market is categorized into pediatric, adults, and travelers. Region wise, it is analyzed across North America, Europe, Asia-Pacific, LAMEA.

By Technology Type

The recombinant and conjugate vaccines segment dominated the global vaccines market size in 2023, owing to their efficacy, safety, broad application, and support from public health initiatives and international organizations. In addition, recombinant and conjugate vaccines are utilized for preventing a wide range of infectious diseases, including bacterial infections such as pneumococcal disease and meningococcal disease, as well as viral infections like hepatitis B and human papillomavirus (HPV). Their versatility in targeting various pathogens contributes to their dominance in the global vaccine market.

By Indication

The human papilloma virus segment dominated the global vaccines market share in 2023 and is expected to register the highest CAGR during the forecast period, owing to the effectiveness of HPV vaccines in preventing HPV-related diseases, the implementation of vaccination programs, awareness campaigns, and support from global health initiatives. In addition, inclusion of HPV vaccination in national immunization schedules and reimbursement policies further boosts the market share of the human papilloma virus segment.

By End User

The pediatrics segment dominated the global vaccines market size in 2023, owing to universal immunization programs, routine vaccination schedules, vaccine mandates, disease prevention efforts, investments in vaccine development, global health initiatives, and pediatric vaccine innovation. However, travelers segment is expected to register the highest CAGR during the forecast period. This is attributed to the increasing international travel, emerging infectious diseases, travel medicine services, mandatory vaccination requirements, health and safety concerns among travelers, and the expansion of the travel vaccine portfolio.

By Region

The global vaccine market report 2024 is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the vaccine market in 2023 and is expected to maintain its dominance during the forecast period. North America hosts several major vaccine manufacturers and distributors, supplying vaccines to domestic and international markets. The region's vaccine production capacity, supply chain infrastructure, and distribution networks support global vaccine supply and distribution. North American vaccine manufacturers play a pivotal role in meeting global vaccine demand, further consolidating the region's dominance in the vaccine market.

However, Asia-Pacific offers profitable opportunities for key players operating in the vaccine market and is expected to register the fastest growth rate during the vaccines market forecast period, owing to rising prevalence of infectious diseases, government initiatives, emerging markets, technological advancements, and health security priorities. Asia-Pacific presents attractive market entry opportunities for vaccine manufacturers seeking to expand their global footprint. Emerging markets in the region, including China, India, and the Pacific Islands, offer untapped potential for vaccine sales and market penetration. Strategic partnerships, collaborations, and investments in local manufacturing and distribution networks enable vaccine companies to capitalize on growth opportunities in Asia-Pacific.

Competitive Analysis

The global vaccine market report 2024 includes key players such as Pfizer and Merck & Co., Inc. have adopted product approval and clinical trials as key developmental strategies to improve the product portfolio of the vaccine market. For instance, in August 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has approved ABRYSVO (Respiratory Syncytial Virus Vaccine), the company’s bivalent RSV prefusion F (RSVpreF) vaccine, for the prevention of lower respiratory tract disease (LRTD) and severe LRTD caused by RSV in infants from birth up to six months of age by active immunization of pregnant individuals at 32 through 36 weeks gestational age.

Recent Developments in the Vaccines Industry

In April 2024, Bavarian Nordic A/S announced that JYNNEOS, the only FDA-approved mpox vaccine, is now commercially available in the U.S., marking a significant expansion for access to JYNNEOS by establishing additional pathways for vaccine procurement, distribution, and reimbursement by both public and private payers.

In April 2024, Pfizer Inc. announced positive top-line immunogenicity and safety data from the ongoing pivotal Phase 3 clinical trial (NCT05842967) MONeT (RSV IMmunizatiON Study for AdulTs at Higher Risk of Severe Illness),evaluating a single dose of ABRYSVO versus placebo in adults 18 to 59 years of age at risk of developing severe respiratory syncytial virus (RSV)-associated lower respiratory tract disease (LRTD).

In October 2024, GSK plc announced that it has reached an exclusive agreement with Chongqing Zhifei Biological Products, Ltd. (Zhifei) to co-promote GSK’s shingles vaccine, Shingrix, in China for an initial three-year period, with the potential to extend the partnership should all parties agreement.

In March 2024, Pfizer Inc. announced that the European Commission (EC) has granted marketing authorization for the company’s 20-valent pneumococcal conjugate vaccine, marketed in the European Union under the brand name PREVENAR 20, for active immunization for the prevention of invasive disease, pneumonia, and acute otitis media caused by Streptococcus pneumonia in infants, children, and adolescents from 6 weeks to less than 18 years of age.

In August 2023, Pfizer Inc. announced that the European Commission (EC) has granted marketing authorization for ABRYSVO, the company’s bivalent respiratory syncytial virus (RSV) prefusion F (RSVpreF) vaccine, to help protect both infants through maternal immunization and older adults.

In March 2024, Merck, known as MSD outside of the United States and Canada, announced plans to initiate clinical development of a new investigational multi-valent HPV vaccine designed to provide broader protection against multiple HPV types.

In December 2021, Merck announced the European Commission (EC) has approved VAXNEUVANCE (Pneumococcal 15-valent Conjugate Vaccine) for active immunization for the prevention of invasive disease and pneumonia caused by Streptococcus pneumoniae in individuals 18 years of age and older.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vaccines market analysis from 2023 to 2035 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the vaccines market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global vaccines market trends, key players, market segments, application areas, and market growth strategies.

Vaccines Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 350 |

| By Technology Type |

|

| By Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | Emergent Bio Solutions Inc., CSL Limited, GlaxoSmithKline Plc., Sanofi, Bavarian Nordic, Pfizer, Serum Institute of India Pvt. Ltd., Zhi Fei Biological, Merck & Co., Inc., Bharat Biotech |

Analyst Review

Rise in prevalence of infectious diseases and increase in awareness about the benefits of vaccination leading to higher vaccination rates are the major factors which drive the market growth. As per the CXOs, vaccines are anticipated to witness high adoption in the near future, owing to growth in number of immunization programs across the globe. In addition, the market exhibits high growth rate, owing to surge in advances in biotechnology, genomics, and vaccine platforms, which enable the development of novel vaccines with improved safety, efficacy, and scalability.

Furthermore, North America is expected to remain dominant during the forecast period, due to local presence of large in-house vaccine manufacturers such as GSK, Merck & Co., Inc., and Pfizer. In addition, advanced healthcare infrastructure, government funding, and regulatory support further support the market growth in this region. Moreover, Asia-Pacific registered highest CAGR and is expected to continue this trend throughout the forecast period, owing to improvement in healthcare facilities, surge in adoption of vaccination awareness programs, and rapid improvement in economic conditions.

The total market value of vaccines market is $43.2 billion in 2023.

The market value of vaccines market in 2035 is $90.7 billion.

The forecast period for vaccines market is 2024 to 2035.

The base year is 2023 in vaccines market.

North America is accounted for the largest market share in 2023 owing to well established healthcare infrastructure, rise in investments in research and development, and the easy availability of vaccines.

GSK, Merck, Sanofi, Pfizer, and CSL Limited, held a high market position owing to the strong geographical foothold in different regions.

Pediatric vaccines segment dominated the global market, owing to increase in the prevalence of numerous diseases, such as pertussis, influenza, diphtheria, and tetanus, pertussis, rise in government and non-government funding for the development of novel vaccines and surge in initiatives for raising awareness.

The growth of the vaccines market is primarily driven by increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in radiopharmaceutical research and development, rising demand for personalized medicine, and supportive regulatory frameworks and reimbursement policies

Vaccinations play a key role in sustaining people's health across different countries; hence, they are used in various national disease-prevention strategies

Vaccines are biological substances designed to stimulate the body's immune system to recognize and fight against specific pathogens, such as viruses or bacteria, without causing the disease itself.

Loading Table Of Content...

Loading Research Methodology...