Valine Market Research, 2033

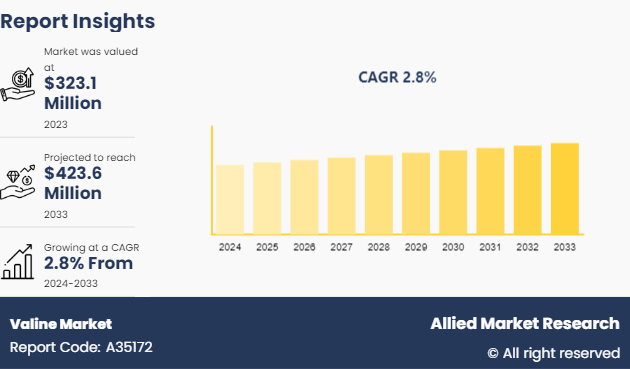

The global valine market was valued at $323.1 million in 2023, and is projected to reach $423.6 million by 2033, growing at a CAGR of 2.8% from 2024 to 2033.

Introduction

Valine, an essential amino acid present in two primary forms - L-valine and D-valine, holds significant importance in various industries due to its diverse applications and physiological benefits. L-valine, the natural form, is widely utilized in protein synthesis, dietary supplements, and muscle metabolism, playing a crucial role in energy production and tissue repair. On the other hand, D-valine, less common but essential in pharmaceutical research and drug development, contributes to the synthesis of specific drugs and peptides. The distinct properties and functions of both forms underscore their relevance in nutrition, pharmaceuticals, and beyond, highlighting their versatility and impact across different sectors.

In the pharmaceutical industry, valine is a key ingredient in parenteral nutrition solutions, amino acid injections, and dietary supplements, supporting muscle growth, tissue repair, and overall health. Furthermore, in the food and beverage sector, valine plays a significant role in sports nutrition products, protein powders, and energy bars, aiding in muscle recovery and enhancing athletic performance. In addition, valine finds applications in animal feed formulations, promoting growth and muscle development in livestock and poultry. The widespread use and importance of valine across these industries emphasize its crucial role in supporting health, muscle function, and nutritional requirements in diverse sectors.

Key Takeaways

- The valine market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major valine industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

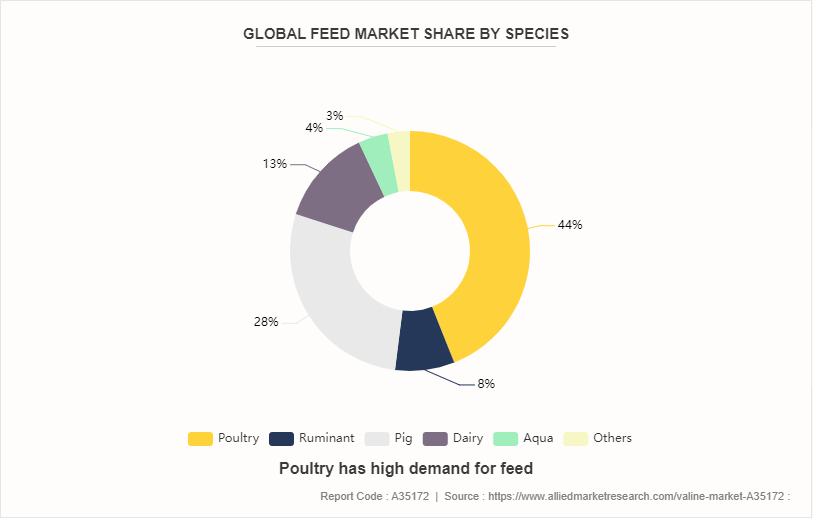

The valine market exhibits complex drivers, restraints, and opportunities that shape its growth trajectory and industry landscape. A critical driver propelling market expansion is the escalating demand for animal nutrition, spurred by the burgeoning livestock and poultry industry. Valine's indispensable role as an essential amino acid supplement in animal feed, facilitating animal growth, feed efficiency, and overall health, underscores its pivotal significance within the feed industry. This demand surge is poised to persist as the global need for premium-quality animal nutrition products continues to rise.

Furthermore, the market is significantly influenced by the upward trend in health and wellness consciousness. Consumers' increasing emphasis on personal health and fitness goals has resulted in a heightened demand for valine in dietary supplements and functional foods. The market response to this trend is evident in the growing availability of products enriched with valine, catering to the consumer focus on muscle growth, recovery, and overall fitness. This consumer shift towards health-conscious consumption habits is anticipated to sustain the growth momentum of the valine market, particularly within the dietary supplement and functional food segments. For instance, The Nutraceuticals World publication reports “a rising consumer interest in health-focused products, including dietary supplements enriched with amino acids such as valine, attributing the trend to the growing emphasis on holistic well-being and fitness goals”. Market data from Euromonitor International highlights “an increasing consumer preference for functional foods and beverages designed to support muscle recovery, energy levels, and overall fitness, aligning with the demand for valine-enriched products in the health and wellness market”.

Nevertheless, the valine market encounters notable restraints that have the potential to impede its growth trajectory. High production costs, particularly prevalent in fermentation processes, pose a significant obstacle for valine manufacturers, potentially constraining profitability and affordability. Moreover, stringent regulatory frameworks governing valine production and utilization across food, feed, and pharmaceutical applications present intricate compliance challenges for industry stakeholders. In addition, the competitive landscape poses a threat, with the availability of alternative supplements vying for consumer preference, potentially diverting demand away from valine-based products. Regulatory insights from the Food and Drug Administration (FDA) underscore the stringent guidelines governing amino acid production and usage in various industries, emphasizing the complexity and compliance challenges faced by valine market stakeholders.

A research study published in the Journal of Biotechnology explores the potential of biotechnological innovations in amino acid production, indicating opportunities for manufacturers to enhance operational efficiency and reduce costs in valine production processes. The valine market harbors promising opportunities for growth and expansion. Emerging markets in Asia-Pacific, Latin America, and Africa present substantial avenues for market development, bolstered by rising disposable incomes and evolving dietary preferences. Technological advancements in production processes hold the promise of enhancing operational efficiency and cost-effectiveness, thereby creating growth prospects for manufacturers. Furthermore, with the growing traction towards plant-based diets and veganism, the market can leverage the escalating demand for plant-based products by developing and promoting plant-based valine supplements tailored to the preferences of health-conscious and environmentally-conscious consumers.

Segment Overview

The valine market is segmented into type, end-use industry, and region. By type, the market is classified into D-valine, and L-valine. As per the end-use industry, the market is categorized into feed industry, food industry, pharmaceutical industry, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key market players in the valine market include AJINOMOTO Co., Inc., Foodchem International Corporation, Kyowa Hakko Bio Co., Ltd., Fuerst Day Lawson Ltd., Meihua Holdings Group Co., Ltd., Penta Manufacturing Company, Fufeng Group Company Limited, Wuxi Jinghai Amino Acid Co., Ltd., Evonik Industries AG, Avanscure Lifesciences Private Limited, and others.

Recent Key Developments in Valine Market

- On February 13, 2024, Ajinomoto Co., Inc. expands its corporate venture capital arm in Silicon Valley focusing on valine-related innovations, strengthening investments in food, health, and green technology sectors.

- On March 22, 2024, ADM acquired Fuerst Day Lawson Limited, enhancing its natural taste and nutrition solutions offerings in the valine industry, expanding its global presence and product portfolio.

- On March 25, 2024, FIC 2024 Shanghai showcased innovative applications in the valine industry, emphasizing sustainable practices, health trends, and international cooperation, setting a direction for future development.

Industry Trends

- Increased focus on sustainable and environmentally-friendly production methods to meet rising consumer demand for ethically sourced ingredients. For instance, The Sustainability in Food and Agriculture report by the Food and Agriculture Organization (FAO) of the United Nations discusses the significance of sustainable production practices in the food industry, including amino acid production, to reduce environmental impact and promote long-term sustainability. Research conducted by the World Wildlife Fund (WWF) on sustainable sourcing in the food sector underscores the growing trend towards sustainable production methods in response to increasing consumer awareness and demand for products that are environmentally responsible.

- Integration of advanced technology, such as biotechnology and fermentation techniques, to enhance valine production efficiency and reduce costs. A study published in the Journal of Amino Acids highlights the use of biotechnological approaches and fermentation techniques in amino acid production, indicating the potential for the integration of advanced technology to enhance valine production efficiency and reduce manufacturing costs.

- Growing popularity of personalized nutrition solutions leading to tailored valine formulations catering to individual health and fitness needs. The Nutrigenomics Journal suggests a rising interest in personalized nutrition tailored to individual genetic profiles and health goals, indicating a shift towards customized valine formulations to meet specific consumer needs in the health and fitness sector.

- Expansion of product offerings to include innovative valine-enriched functional foods and beverages targeting specific health benefits. The Food Technology & Innovation Forum report discusses the trend of food and beverage companies diversifying their product portfolios to include functional foods enriched with amino acids like valine, aligning with consumer preferences for health-enhancing products with specific nutritional benefits.

- The growing trends toward plant-based diets and vegan lifestyles has led to rise in demand for plant-based valine supplements. An article in the Journal of Plant-Based Nutrition and Health explores the surge in demand for plant-based supplements, including amino acids, driven by the shift towards plant-based diets and the perceived health benefits associated with plant-derived ingredients. A market research study by Mintel on plant-based trends in the health and wellness sector highlights the growing consumer preference for plant-based supplements, indicating a market shift towards plant-derived amino acids like valine. The plant-based supplements market analysis projects significant growth in the plant-based supplements sector, driven by increasing consumer interest in vegan and vegetarian lifestyles, contributing to the rising demand for plant-based valine supplements.

Global Feed Industry Impact on Valine Market

The escalating demand for animal protein worldwide, particularly in livestock, dairy, and fish sectors, has significant implications for the valine market. With global compound feed production surpassing one billion tons annually and commercial feed manufacturing generating over US $400 billion in turnover, the need for essential amino acids like valine in feed formulations is poised to increase. The United Nations Food and Agriculture Organization (FAO) projects a 1.7% yearly growth in animal protein production until 2050, with meat production expected to surge by nearly 70%, aquaculture by 90%, and dairy by 55%. This surge in protein demand underlines the crucial role of valine in animal nutrition. The extrapolation of growth rates suggests a quadrupling of needs by 2050, reinforcing the importance of valine as a key component in meeting the nutritional requirements of livestock and aquaculture industries on a global scale.

Valine Market Trends in Food Industry 2024

- The fastest rising consumer need for valine is protein, indicating a growing interest in protein-rich foods.

- The dominating diet for valine is vegan, highlighting a preference for plant-based sources of valine.

- Top ingredients and flavors associated with valine that have shown significant growth in the past year include energy drink, fruit punch, pita, rye bread, and fish, with fish showing a notable increase of 138.89%.

- The most popular prepared food pairings for valine include pita, rye bread, scrambled eggs, boiled egg, and toast, showcasing the versatility of valine in various food combinations and recipes.

These specific insights focus on valine-related trends, consumer preferences, and food pairings, providing a targeted view of how valine is perceived and consumed within the food industry.

Key Sources Referred

- United Nations Food and Agriculture Organization (FAO)

- Food and Drug Administration (FDA)

- Nutraceuticals World

- Mintel

- Food Technology & Innovation Forum

- Nutrigenomics Institute

- World Wildlife Fund (WWF)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the valine market analysis from 2024 to 2033 to identify the prevailing valine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the valine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global valine market trends, key players, market segments, application areas, and market growth strategies.

Valine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 423.6 Million |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Ajinomoto Co., Inc., Fuerst Day Lawson Ltd., Foodchem International Corporation, Evonik Industries AG, Penta Manufacturing Company, Wuxi Jinghai Amino Acid Co., Ltd., Meihua Holdings Group Co., Ltd., Avanscure Lifesciences Private Limited, Kyowa Hakko Bio Co., Ltd., Fufeng Group Company Limited |

$323.1 Million is the industry size of Valine market in 2023.

Growing economies in the emerging markets, Technological advancements in production, Growing demand for plant-based products are the upcoming trends of Valine Market in the globe

L-Valine is the leading application of valine market in 2023.

Asia-Pacific is the largest regional market for valine in 2023.

AJINOMOTO Co., Inc., Foodchem International Corporation, Kyowa Hakko Bio Co., Ltd., Fuerst Day Lawson Ltd., Meihua Holdings Group Co., Ltd., Penta Manufacturing Company, Fufeng Group Company Limited, Wuxi Jinghai Amino Acid Co., Ltd., Evonik Industries AG, Avanscure Lifesciences Private Limited are the top companies to hold the market share in Valine.

Loading Table Of Content...