Valuables Insurance Market Research, 2034

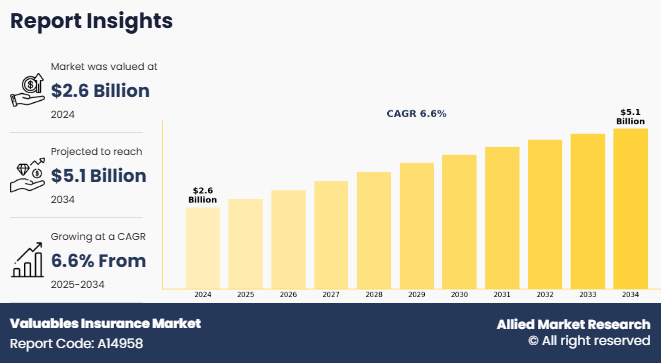

The valuables insurance market was valued at $2.6 billion in 2024 and is estimated to reach $5.1 billion by 2034, exhibiting a CAGR of 6.6% from 2025 to 2034. Valuables insurance is a type of insurance that protects high-value items like jewelry, artwork, antiques, or collectibles. These items are often expensive or hold great personal or historical importance. This insurance helps cover the cost if these valuables are lost, stolen, or damaged. Regular home insurance may not give full coverage for such items, so valuables insurance gives extra protection. People and businesses use it to make sure their prized belongings are safe. If something happens to the item, the insurance can help pay for repair, replacement, or the items full value.

Key Takeaways:

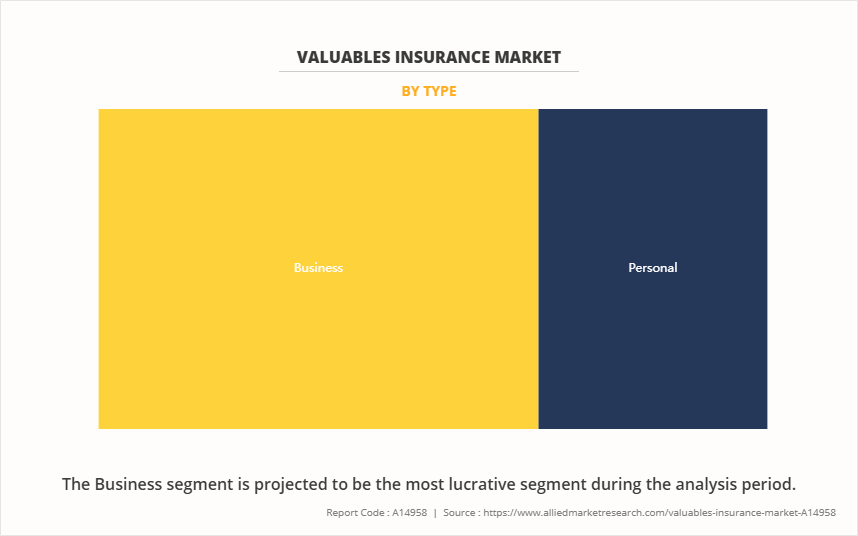

- By type, the business segment held the largest share in the valuables insurance market for 2024.

- By application, the artworks segment held the largest share in the valuables insurance market for 2024.

- By distribution channel, the direct sales segment held the largest share in the valuables insurance market for 2024.

- Region-wise, North America held the largest valuables insurance market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period in valuables insurance market .

This valuables insurance market is driven by growing awareness of the importance of protecting high-value personal and business assets against loss, theft, and damage. The increase in the standard of living, particularly in emerging economies, and a cultural shift towards collecting valuables items as investment opportunities have significantly contributed to the market's expansion. In addition, the integration of advanced technologies in insurance processes, making it easier and more efficient for clients to insure their valuables, is also driving the valuables insurance industry. The growing disposable income among middle- and high-income individuals has led to increased ownership of luxury items such as fine art, antiques, and jewelry, thereby expanding the target market for valuables insurance. Urbanization and lifestyle changes have further fueled this trend, where individuals are investing more in personal valuables not just for personal enjoyment, but also as security against economic uncertainty. As a result, insurance companies are innovating to offer more tailored products that cater to the specific needs of these clients, including flexible coverage options and value-added services such as appraisal and restoration. This diversification of product offerings is a key growth factor in fueling the valuables insurance market growth. However, the high premiums and complex policy terms discourage some individuals and small businesses from purchasing coverage, hampering valuables insurance market growth.

Moreover, the growing risks associated with climate change and geopolitical instability have heightened the awareness and importance of insuring valuables. Events such as natural disasters, political unrest, and economic fluctuations represent significant threats to high-value items. Consequently, individuals and businesses are increasingly viewing insurance as a necessary investment to safeguard their possessions against such risks. This shift in perception is further enhanced by regulatory changes that favor consumer protection, ensuring that insurance policies are transparent and claim settlements are fair and prompt. These regulatory frameworks are designed to build consumer trust, leading to higher adoption rates of valuables insurance market policies.

Segment Review

The valuables insurance market is segmented on the basis of type, application, distribution channel and region. By type, it is bifurcated into business and personal. By application, it is classified into artworks, jwellery, antiques and others, By distribution channel, it is segmented into direct sales, brokers, online platforms and others. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, it is segmented into business and personal. the global valuables insurance market share was dominated by the business segment in 2024, owing to the growing need among businesses such as jewelry stores, art dealers, museums, and auction houses to protect high-value assets. These businesses handle expensive items that are vulnerable to theft, damage, or loss, making insurance coverage essential. In addition, a rise in global trade in luxury goods and increased participation in art and antique auctions are further driving demand for valuables insurance market.

However, the personal segment is expected to register the highest CAGR during the forecast period. This is attributed to the growing ownership of luxury items such as watches, jewelry, and collectibles among high-net-worth individuals, especially in emerging markets. Moreover, increase in the awareness about the risks of loss or theft, among individual, is further encouraging individuals to seek valuables insurance coverage.

Region-wise, North America dominated the Valuables insurance market share in 2024. This was attributed to its well-developed insurance industry and the high number of individuals owning luxury items. The rise of digital platforms and e-commerce for buying and selling high-value items has pushed the demand for specialized insurance.

However, Asia-Pacific is expected to exhibit the highest CAGR during the forecast period owing to the rise in online purchases of expensive items. In addition, the rise in long-term investments in luxury goods and increase in the awareness towards insurance are driving the growth of the valuables insurance industry.

Competition Analysis

The report analyzes the profiles of key players operating in the valuables insurance market such as AXA XL, Arthur J. Gallagher & Co., AIG, Chubb Limited, Jewelers Mutual Group, BriteCo Inc., The Hagerty Group, LLC, Eeckman Art & Insurance, Zurich Insurance Company Ltd., Assurant Inc., Liberty Mutual Insurance Company, The Hartford Insurance Group, Inc., Allianz SE, Hiscox Ltd, Tokio Marine Kiln, The Travelers Indemnity Company, Arch Capital Group Ltd., W.R. Berkley Corporation, Munich Re, Markel Group Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the valuables insurance market.

Recent Key Developments in the Valuables insurance market

- In April 2025, Jewelers Mutual Group acquired Q Report, a company in Australia. This strategic move allows Jewelers Mutual to leverage its jewelry insurance products and establish its presence in Australia, thus enhancing its global footprint and customer base.

- In May 2024, Chubb partnered with Arta, a logistics and technology company specializing in high-value goods, to introduce a new embedded valuables insurance product. The offering allows businesses to provide end-to-end insurance coverage at the point of sale for collectibles such as fine art, antiques, luxury goods, trading cards, and jewelry.

Top Impacting Factors

Driver

Rise in the Need for Safety

The rise in the need for safety and protection is a major factor driving the growth of the valuables item insurance market. As people invest more in expensive and rare items like jewelry, fine art, luxury watches, and collectibles, they are becoming more aware of the risks involved such as theft, loss, accidental damage, or natural disasters. These items often hold both financial and emotional value, making it essential for owners to keep them safe and properly insured. Standard home insurance policies usually have limits that may not fully cover the value of these high-end items. This is why many individuals are now looking for specialized insurance that offers better protection, clear terms, and full coverage based on the actual value of the item. Valuables item insurance meets this need by offering tailored policies and easy claims processes. In today's world, where security concerns are rising and unexpected events can happen anytime, people want to feel confident that their valuables belongings are safe. This growing sense of responsibility and need for peace of mind is pushing more customers to explore and invest in valuables item insurance. As a result, insurers are also improving their services and using technology to offer better safety and convenience to their clients. These factors boosting thw growth of valuables insurance market.

Restraints

High Premiums and Appraisal Cost

High premiums and appraisal costs are major factors slowing down the growth of the valuables item insurance market. Many people are interested in protecting their expensive belongings like jewelry, artwork, or collectibles, but the overall cost of getting insurance can be too high. Premiums for valuables item insurance are usually more expensive than regular home or renter insurance because they cover items of greater worth and come with more detailed protection. For many potential customers, especially those with smaller budgets, these higher premiums can make the insurance feel out of reach.

In addition to premiums, appraisal costs can also be a burden. Most insurance companies require a professional appraisal to determine the exact value of an item before offering coverage. These appraisals are important to make sure the item is properly insured, but they can be costly and time-consuming. For people with multiple valuables items, the total appraisal expense can add up quickly. Because of these costs, some individuals may avoid getting insurance altogether or may settle for basic coverage that doesn‐™t fully protect their belongings. This holds back the market from reaching a wider customer base. Unless insurers find ways to reduce these costs or offer more flexible pricing models, high premiums and appraisal fees will continue to be a challenge for market growth.

Opportunity

Expansion into Emerging Markets where Wealth is Increasing

Expansion into emerging markets where wealth is increasing is creating new valuables insurance market opportunity. As incomes rise in countries across Asia, Latin America, and parts of Africa, more people are purchasing high-value items such as luxury watches, fine jewelry, collectibles, and artworks. With this rise in ownership of expensive possessions comes the need for protection against loss, theft, or damage. This increase in demand creates opportunity for insurers to introduce valuables insurance products tailored to the needs of these new customers. In addition, digital platforms and mobile apps make it easier to reach and serve clients in these regions. Insurers can also collaborate with local jewelers, galleries, and financial advisors to build trust and increase awareness about the importance of insuring valuable items. Overall, the wealth growth in emerging markets presents a promising opportunity for insurers to expand their customer base and strengthen their global presence. According to the Valuables Insurance Market Forecast, this trend is expected to significantly contribute to global market expansion over the next decade. The Valuables Insurance Market Outlook also suggests a steady rise in demand, supported by the shift toward digital access and customer-centric offerings. Moreover, current Valuables Insurance Market Trends highlight increasing personalization, mobile-first engagement, and embedded insurance partnerships as key growth drivers.

Key Benefits for Stakeholders

- The study provides an in-depth valuables insurance market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, & opportunities, and their impact analysis on the valuables insurance market size is provided in the report.

- The Porter‐™s five forces analysis illustrates the potency of buyers and suppliers operating in the cybersecurity industry.

- The quantitative analysis of the global valuables insurance market for the period 2024‐“2034 is provided to determine the valuables insurance market potential.

Valuables Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 5.1 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 227 |

| By Application |

|

| By Distribution Channel |

|

| By Type |

|

| By Region |

|

| Key Market Players | W.R. Berkley Corporation, The Hagerty Group, LLC, Markel Group Inc., Arthur J. Gallagher & Co., The Hartford Insurance Group, Inc., Jewelers Mutual Group, Liberty Mutual Insurance Company, Assurant Inc., Munich Re, Zurich Insurance Company Ltd., Chubb Limited, Eeckman Art & Insurance, Arch Capital Group Ltd., The Travelers Indemnity Company, Hiscox Ltd., Allianz SE, AIG, BriteCo Inc., Tokio Marine Kiln, AXA XL |

Analyst Review

As the valuable insurance market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. The valuable insurance market is experiencing significant growth, driven by growing awareness about asset protection. More people are becoming aware of the need to protect their expensive items. High-value belongings like jewelry, artwork, and luxury watches are often at risk of being lost, stolen, or damaged. As people understand these risks, they are looking for ways to keep their valuables safe. Valuable insurance helps by offering financial protection and peace of mind. It covers the cost of repair or replacement in case something happens. This growing awareness, especially among high-net-worth individuals, is leading to more demand for such insurance and helping the market grow steadily.

Furthermore, supportive regulations from the government and the rise in the availability of financial advice are driving the valuable insurance market growth. These rules make it easier for people and businesses to understand how to protect their expensive items and choose the right insurance. Financial advisors also assist by giving clear advice on which plans to pick and how to manage risks. Due to these changes, more people feel confident about getting insurance. This is making valuable insurance easier to use, more reliable, and more popular, which is fueling the market growth.

Moreover, partnerships with jewelers and art dealers are fueling valuable insurance market growth. These partnerships make it easier for people to get insurance when they buy expensive items like jewelry, watches, or artwork. Jewelers and art dealers can guide buyers on the importance of insurance and even connect them with trusted insurance providers. This builds trust and helps customers protect their valuable items right from the time of purchase. It also saves time for the customer and makes the whole process smoother. For insurance companies, working with these partners helps them reach more people who need coverage. As a result, such partnerships are making valuable item insurance more popular and more available to a wider group of buyers.

The rise in adoption of digital platforms for policy management, claims processing and, rising demand for customizable coverage plans are the upcoming trends of the Valuables Insurance Market in the globe.

Business segment is the leading type of Valuables Insurance Market.

North America is the largest regional market for Valuables Insurance.

$5.1 billion is the estimated industry size of Valuables Insurance.

AXA XL, Arthur J. Gallagher & Co., AIG, Chubb Limited, Jewelers Mutual Group, BriteCo Inc., The Hagerty Group, LLC, Eeckman Art & Insurance, Zurich Insurance Company Ltd., Assurant Inc., Liberty Mutual Insurance Company, The Hartford Insurance Group, Inc., Allianz SE, Hiscox Ltd, Tokio Marine Kiln, The Travelers Indemnity Company, Arch Capital Group Ltd., W.R. Berkley Corporation, Munich Re, Markel Group Inc. are the top companies to hold the market share in Valuables Insurance

Loading Table Of Content...

Loading Research Methodology...