Vanilla Extract Market Research, 2032

The global vanilla extract market size was valued at $4.8 billion in 2022, and is projected to reach $7.8 billion by 2032, growing at a CAGR of 5% from 2023 to 2032.

Vanilla extract is a type of flavored product that is extracted from vanilla beans. The production of vanilla extract takes place by soaking and filtering vanilla pods in a mixture of ethanol and water. The production process involves harvesting and processing vanilla beans, extracting the flavorful compounds, and preparing the final vanilla extract such as pure vanilla extract, vanilla powder, vanilla syrup, among others. Vanilla extracts are frequently utilized as a flavor enhancer in a variety of food, beverages, and other products.

Market Dynamics

The rise in demand for processed bakery products has significantly helped to boost the vanilla extract market growth. Vanilla is a classic flavor that is used in a wide range of packed baked products, which includes cakes, cookies, pastries, muffins, and bread items, increases the demand for vanilla extracts in baking industry. The sweet and aromatic quality of vanilla extract strengthens the overall flavor profile of these products, which makes them more appealing to consumers. There are many consumers those associate vanilla with ease and tradition in baked goods. As the bakery industry caters to consumers' growing preferences for familiar and classic flavors, the vanilla extract market demand is expected to increase during the market forecast.

Moreover, the trend toward premium and high-quality baked goods has led to an increased use of natural and premium ingredients, including vanilla extract. Consumers are willing to pay more for bakery products that offer superior taste and quality, and vanilla plays a crucial role in delivering a premium sensory experience. In addition, baked food items are often associated with celebrations, special occasions, and holidays. Vanilla-flavored treats, such as birthday cakes, wedding cakes, and holiday cookies, are staples in these baked items, which thus helps to drive seasonal and event-based demand for vanilla extract, which is anticipated to boost the vanilla extract market size.

Although the vanilla extract market share has increased, it still faces certain challenges due to the presence of alternative products in the market. Natural vanilla extract can be expensive, especially if there are fluctuations in vanilla bean prices or supply shortages. Manufacturers, particularly those operating on tight budgets, may explore alternative flavors and extracts that provide cost savings without compromising on taste. This consideration can impact the market growth of vanilla extract, especially in price-sensitive industries. Moreover, the constant drive for innovation in the food and beverage industry may lead to the development of novel and exciting flavor combinations. For instance, spice and herb extracts can be used to create distinctive tastes that compete with or replace the traditional appeal of vanilla extract, thus hampering the vanilla extract market growth. This increased focus on innovation of different flavors in the food industry can influence consumer preferences and have a negative impact on the market shares.

The use of synthetic vanilla extract is expected to create opportunities in the vanilla extract market. Synthetic vanilla extracts are often more cost-effective to produce than natural vanilla extracts. The cost savings can be significant for manufacturers, allowing them to offer products with vanilla flavoring at a more competitive price point. This affordability is anticipated to stimulate demand and create growth opportunities for vanilla extracts in price-sensitive markets. The production of synthetic vanilla extracts is not constrained by the limited availability of vanilla beans and is not subject to the slow maturation process of vanilla plants. This allows for large-scale and efficient production to meet growing demand, especially in industries where high volumes are required. Furthermore, the production of synthetic vanillin is considered more resource-efficient and may have a lower environmental impact compared to traditional vanilla farming. As environmental sustainability becomes a more significant consideration, synthetic alternatives may be perceived as environmentally friendly, presenting a growth opportunity for various manufacturers aligning with such consumer preferences.

Segmental Overview

The vanilla extract market is analyzed on the basis of product type, source, application, distribution channel, and region. By product type, the market is bifurcated into powder and liquid. By source, the market is segmented into natural and synthetic. By application, the market is divided into food and beverages, personal care, and others. Depending on distribution channel, it is classified into B2B, supermarkets/hypermarkets, convenience stores, departmental stores, and online sales channel. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, France, Italy, Spain, Denmark, and the rest of Europe), Asia-Pacific (China, India, Japan, Thailand, Singapore, and the rest of Asia-Pacific), Latin America (Brazil, Colombia, Argentina, and the rest of Latin America), and Middle East and Africa (GCC, South Africa, North Africa, and the rest of MEA).

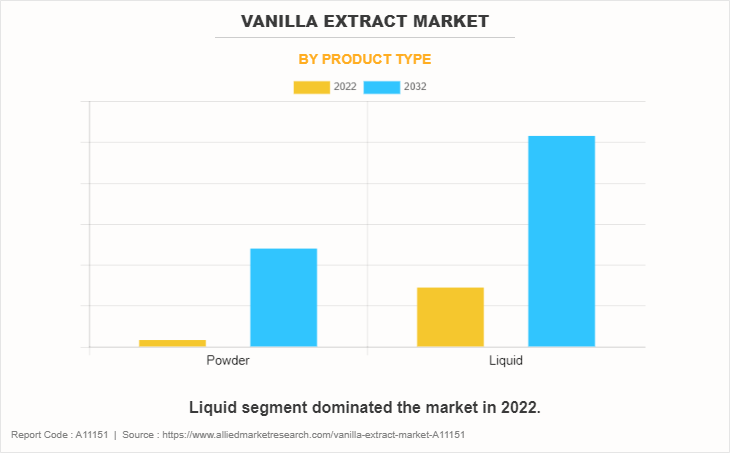

By Product Type

By product type, the liquid segment dominated the global vanilla extract market in 2022 and is anticipated to maintain its dominance during the forecast period. Liquid vanilla extract is versatile and can be easily incorporated into a wide range of recipes. The liquid form allows for even distribution in batters, doughs, and liquids, making it suitable for various culinary applications. This versatility contributes to its popularity in both home and commercial kitchens. The expanding bakery and confectionery industry are a significant driver of the demand for liquid vanilla extract. Vanilla extract is a staple ingredient in cakes, cookies, pastries, and candies, and the growth in demand for these products contributes to the overall demand for liquid vanilla extract segment.

Moreover, liquid vanilla extract is easy to incorporate into manufacturing processes due to its fluid form. This facilitates consistent and even distribution of flavor throughout products during the production of large batches, making it a preferred choice for industrial applications. Thus, the liquid segment is expected to grow in coming years owing to easy application in different sectors.

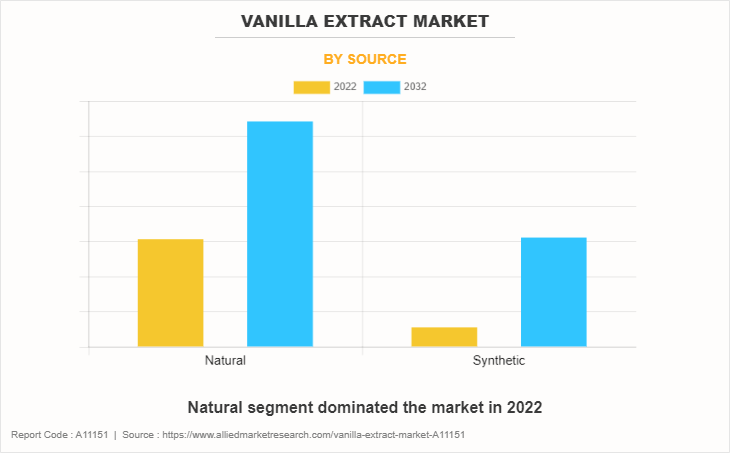

By Source

By source, the natural segment dominated the global vanilla extract market in 2022 and is anticipated to maintain its dominance during the forecast period. There is a growing trend among consumers to choose products made with natural ingredients over synthetic or artificial ones. Natural vanilla extract aligns with this preference for clean label products without artificial additives, making it a popular choice among those seeking more natural and wholesome options. Moreover, Natural vanilla extract is often associated with higher quality and purity compared to synthetic alternatives. Consumers may view natural extracts as a premium ingredient, and this perception can influence their purchasing decisions. This has contributed to the acceptance and adoption of natural vanilla extract options in various products, thus driving the vanilla extract share of this segment.

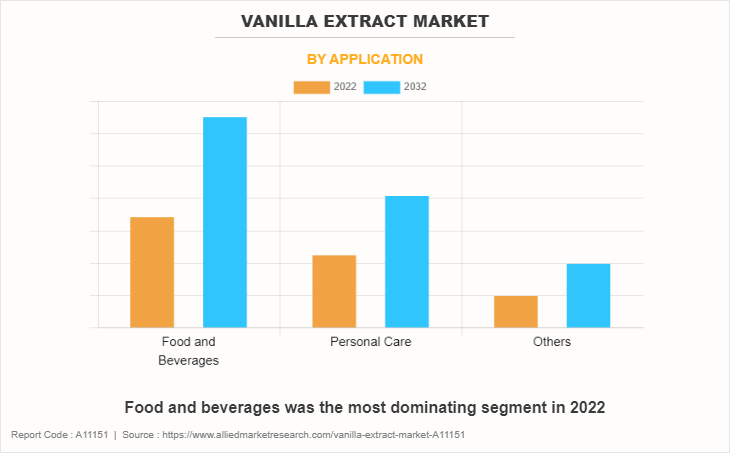

By Application

By application, the food and beverages segment dominated the global vanilla extract market in 2022 and is anticipated to maintain its dominance during the forecast period. Vanilla extracts are particularly prevalent in the bakery and confectionery sector, enriching the taste of cakes, cookies, and chocolates. With the surge in consumer interest in premium and artisanal offerings, vanilla extracts contribute to the production of high-quality, indulgent products. The beverage industry, too, witnesses a continuous integration of vanilla extracts to elevate the flavor of a diverse range of drinks, including coffees, teas, and cocktails.

Moreover, in response to the growing consumer preference for natural and clean-label ingredients, vanilla extracts derived from vanilla beans align well with health and wellness trends. Furthermore, the globalization of culinary preferences and the associated demand for international flavors further drives the usage of vanilla extracts in a variety of cuisines. As a result, vanilla extracts help to enhance product taste along with contributing to the innovation and customization of food and beverage formulations.

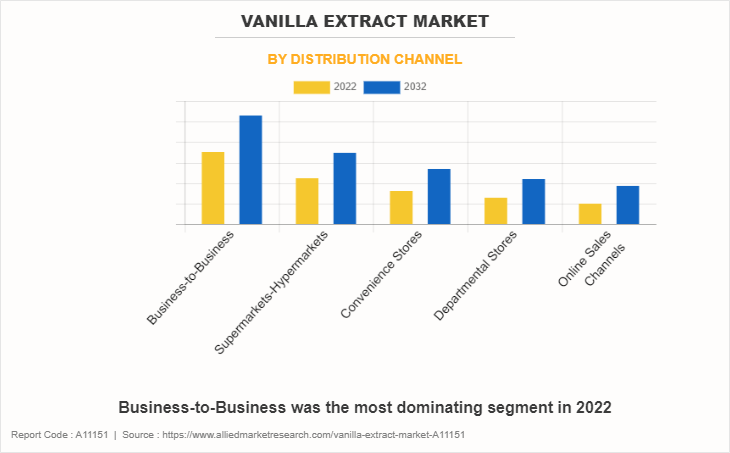

By Distibution Channel

By distribution channel, the B2B segment dominated the global vanilla extract market in 2022. The B2B vanilla extract ecosystem is comprised of multiple players, including manufacturers/suppliers, wholesalers/distributors, retailers, food service providers, food manufacturers, importers, and exporters. It consists of marketplaces where the vendor and the buyer of vanilla extract make deals and transactions. The suppliers provide vanilla extract direct from other businesses and go through a process where one business makes a transaction with another. Moreover, the B2B distribution channel does not involve any intermediaries and has smooth monetary transactions without any fraud. The B2B e-commerce evolution has introduced the path to digital procurement in the vanilla extract industry. The adoption of digitalization in sales channels has made the work of manufacturers and vendors easy and smooth. In addition, the manufacturers display their products directly through digital marketing platforms Facebook, Instagram, Twitter, and Google. Therefore, manufacturers are able to expand their consumer base along with the improved perception of their brand.

By Region

Region-wise, North America is anticipated to dominate the vanilla extract market with the largest share during the forecast period. The North American consumer base exhibits a growing interest in health and wellness. As vanilla extract is a natural flavoring derived from vanilla beans, it aligns with the preference for clean-label and natural ingredients, driving its demand in health-conscious markets.

Moreover, the demand for premium and gourmet food products is on the rise in North America. Vanilla extract, associated with premium and high-quality offerings, is sought after by consumers willing to pay a premium for products with an authentic and superior flavor profile. Furthermore, the North American region has a robust and growing bakery and confectionery industry. Vanilla extract is a key ingredient in these sectors, driving its demand as consumers continue to indulge in a variety of sweet treats.

Competitive Landscape:

The major key players vanilla extract market forecast include McCormick & Company, Inc., Firmenich SA, Adams Flavors, Foods & Ingredients, LLC, OliveNation LLC, Nielsen-Massey Vanillas, Inc., Naturalight Foods Inc., Frontier Co-op., Kerry Group plc., and Saucer Brands, Inc.

Several well-known and up-and-coming brands are vying for market dominance in the expanding vanilla extract industry. Smaller, niche firms have become more well-known for catering to particular consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative startups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Brands that are able to change the tastes of their target market and align with their ethical and environmental values have an advantage over rivals.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vanilla extract market forecast from 2022 to 2032 to identify the prevailing vanilla extract market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vanilla extract market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vanilla extract market trends, key players, market segments, application areas, and market growth strategies.

Vanilla Extract Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 185 |

| By Product Type |

|

| By Source |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | McCormick & Company, Inc., Nielsen-Massey Vanillas, Inc., Foods & Ingredients, LLC, Firmenich SA, OliveNation LLC, Saucer Brands, Inc., Adams Flavors, Kerry Group plc., Frontier Co-op., Naturalight Foods Inc. |

| | Cook’s Vanilla, Synergy |

Analyst Review

The perspectives of the leading CXOs in the vanilla extract industry are presented in this section. Vanilla extract has experienced a surge in demand owing to rising consumer interest in natural and authentic flavors, baking trends, and premium food and beverage consumption. According to many key executives the growth in demand for processed and baked products is expected to create opportunities for expansion into new markets and product categories. However, the scarcity of vanilla beans and volatility pricing remain major concerns for the vanilla extract market growth. Thus, manufacturers must prioritize diversifying product sourcing, building strong relationships with suppliers, and exploring alternative vanilla sources such as Tahitian vanilla and synthetic vanilla. Moreover, consumers are increasingly conscious of ethical and sustainable sourcing practices, thus, market players are expected to ensure fair trade practices, environmental responsibility, and traceability throughout the supply chain.

The vanilla extract industry has also seen a digital transition, with e-commerce being a key factor. Online platforms provide wider reach and access to a global consumer base, bypassing traditional distribution channels. Consumers can now acquire a variety of vanilla extract from different brands more easily due to online sales channels, and other e-commerce sites. Social media sites are developed into effective marketing tools that enable firms to interact directly with their target audience. Thus, all such factors are expected to boost the vanilla extract market growth.

The global vanilla extract market was valued at $4.8 billion in 2022, and is projected to reach $7.8 billion by 2032

The global Vanilla Extract market is projected to grow at a compound annual growth rate of 5% from 2023 to 2032 $7.8 billion by 2032

The major key players include McCormick & Company, Inc., Firmenich SA, Adams Flavors, Foods & Ingredients, LLC, OliveNation LLC, Nielsen-Massey Vanillas, Inc., Naturalight Foods Inc., Frontier Co-op., Kerry Group plc., and Saucer Brands, Inc.

Region-wise, North America is anticipated to dominate the market with the largest share during the forecast period.

Increase In Popularity of Home Baking and Cooking, Expanding Food and Beverage Industry Globally, Growth In the Premium and Gourmet Food Sector

Loading Table Of Content...

Loading Research Methodology...