Vegan Flavor Market Research, 2034

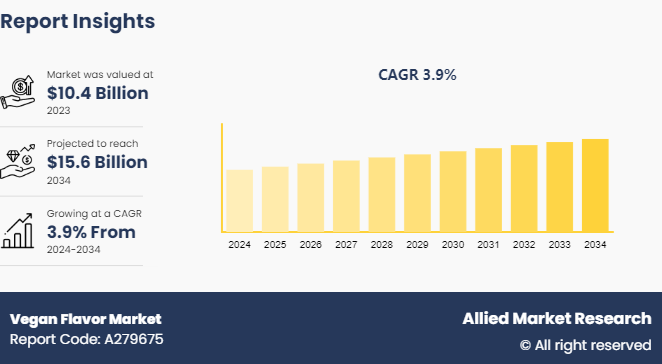

The global vegan flavor market size was valued at $10.4 billion in 2023, and is projected to reach $15.6 billion by 2034, growing at a CAGR of 3.9% from 2024 to 2034.

Market Introduction and Definition

Vegan flavors are plant-based flavoring agents designed to mimic the taste of animal-derived ingredients without using any animal products. These flavors are essential in creating tastes in vegan and vegetarian foods. Different types of vegan flavors include fruit extracts, essential oils, herbs, spices, and synthesized compounds that replicate meat, dairy, and seafood flavors. They are widely used in plant-based meats, dairy alternatives, snacks, beverages, and bakery products to enhance taste and aroma. Vegan flavors cater to the growing demand for ethical, sustainable, and health-conscious food options, providing a satisfying sensory experience for consumers who follow a vegan lifestyle or have dietary restrictions.

Key Takeaways

The vegan flavor market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

Rise in vegan population globally is anticipated to drive the demand for vegan flavor market growth. As more individuals embrace veganism for health, ethical, and environmental reasons, there is a heightened demand for plant-based alternatives across various food categories. This demand extends to flavors that enhance the taste and appeal of vegan products, driving innovation and investment in the development of a diverse range of vegan-friendly flavor profiles. Moreover, the growing vegan population is reshaping consumer preferences and purchasing habits, influencing food manufacturers to expand their offerings to cater to this expanding vegan flavors market segment.

In addition, this shift towards plant-based diets is not limited to vegans alone; an increasing number of flexitarians and individuals reducing their meat and dairy consumption are also contributing to the rising demand for vegan flavors. Consequently, food companies are incorporating vegan flavors into their product formulations to meet the evolving tastes and preferences of consumers, thereby driving the growth of the vegan flavor market share as a vital component of the broader shift towards sustainable and ethical food choices.

Developing vegan flavor formulations often requires extensive research and investment in sourcing high-quality plant-based ingredients and employing specialized processing techniques. These factors contribute to higher production costs compared to traditional flavorings derived from animal sources. As a result, manufacturers may hesitate to fully embrace vegan flavors in their product formulations, especially in price-sensitive markets where cost considerations heavily influence purchasing decisions.

Furthermore, the higher production costs associated with vegan flavors can translate into elevated retail prices for end consumers. In markets where price sensitivity is paramount, such as those with lower disposable incomes or where vegan products are perceived as premium offerings, these higher prices may deter consumers from purchasing vegan alternatives. Consequently, despite growing interest in plant-based diets and sustainability, the affordability of vegan products remains a key concern which limits the vegan flavors market demand and hinders the broader adoption of plant-based food options.

Functional and nutritional benefits integrated into vegan flavor formulations offer significant opportunities for market growth and differentiation. As consumers increasingly prioritize health and wellness in their dietary choices, there is a growing demand for plant-based foods that not only taste delicious but also provide added nutritional value. Vegan flavors fortified with vitamins, minerals, antioxidants, and other bioactive compounds can cater to this demand by offering functional benefits such as immune support, digestive health, and energy enhancement, aligning with consumers' desire for holistic wellness solutions.

In addition, the integration of functional and nutritional ingredients into vegan flavor formulations allows for the creation of products that address specific health concerns and dietary preferences. For instance, vegan flavors enriched with protein appeal to individuals seeking plant-based sources of this essential nutrient for muscle growth and repair, while flavors fortified with omega-3 fatty acids can target consumers interested in heart and brain health. Furthermore, by leveraging these functional and nutritional benefits, vegan flavor companies can differentiate their offerings in the market, attract health-conscious consumers, and capitalize on the growing demand for plant-based foods that nourish both the body and the palate.

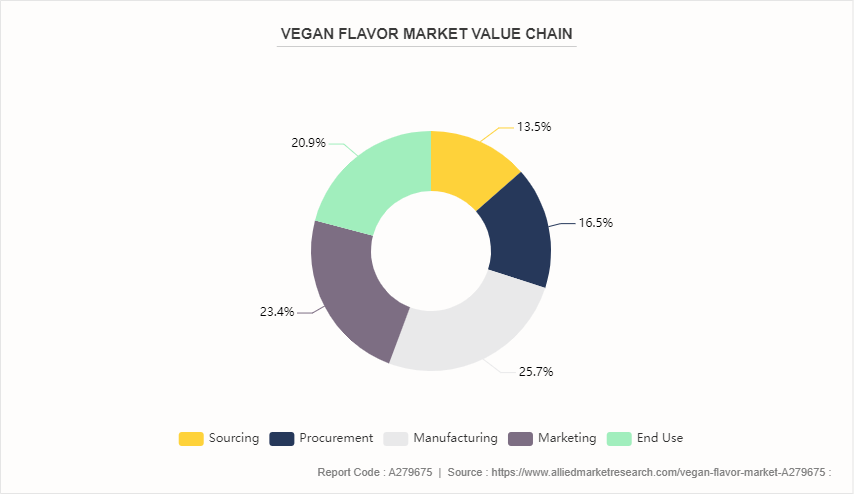

Value Chain of Vegan Flavor Market

The vegan flavor industry value chain begins with the sourcing of raw materials such as fruits, botanicals, nuts, seeds, vegetables, and other plant-based ingredients rich in flavor compounds. These natural sources are procured from growers and suppliers adhering to vegan agricultural practices. The next stage involves extraction and isolation of the desired flavor compounds from the raw plant materials. This is done using various techniques such as solvent extraction, distillation, expression (cold pressing) , or fermentation depending on the flavor type. Moreover, the extracted flavor compounds then undergo purification processes to remove any non-vegan residues and concentrate the flavor isolates. For certain synthetic or nature-identical vegan flavors, these compounds are produced via biotechnological or chemical synthesis routes as well.

Furthermore, the purified vegan flavor isolates are then formulated into different flavor products such as liquid flavors or dry flavors by combining them with vegan-compliant carriers, solvents, and processing aids based on desired specifications and applications. These formulated vegan flavor products are packaged into appropriate containers such as drums, bottles, or pouches before entering distribution channels like flavor houses, food/beverage manufacturers, nutraceutical companies or retail suppliers.

Market Segmentation

The vegan flavor market is segmented into flavor type, form, application, and region. On the basis of flavor type, the market is divided into fruit flavors, botanical flavors, nut/seed flavors and others. As per form, the market is segregated into liquid flavors and powdered flavors. On the basis of application, the market is bifurcated into food & beverages, bakery & confectionery, plant-based dairy & frozen desserts, and savory products. Region wise, the vegan flavor market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/ Country Market Outlook

North America has witnessed a significant surge in veganism and plant-based diets driven by a growing awareness of health, environmental sustainability, and animal welfare concerns. This cultural shift towards plant-based eating has created a robust demand for vegan-friendly products, including flavors, across various food and beverage categories. Moreover, North America boasts a thriving food and beverage industry with a strong focus on innovation and product development. Major players in the region are increasingly investing in research and development to create sophisticated vegan flavor profiles that closely mimic the taste and aroma of animal-derived ingredients. This commitment to innovation has positioned North American companies at the forefront of the global vegan flavor market, driving market dominance.

In addition, North America benefits from a well-established infrastructure supporting the production, distribution, and marketing of vegan products. The region's extensive network of food manufacturers, retailers, and e-commerce platforms provides ample opportunities for vegan flavor companies to reach a wide audience of consumers. Furthermore, favorable regulatory environments and consumer-friendly labeling practices in North America contribute to consumer trust and confidence in vegan products, further fueling vegan flavor market growth and dominance in the region.

Competitive Landscape

The major players operating in the vegan flavor market include Givaudan S.A., Symrise, International Flavors & Fragrances, Firmenich, Takasago International Corporation, Lallemand Bio-Ingredients, Kerry Group, Sensient Technologies Corporation, Philadelphia Cream Cheese, and Robertet Group.

Recent Key Strategies and Developments

In March 2023, Lallemand Bio-Ingredients (LBI) , which includes Lallemand Bio-Products, participated in the International Food & Drink Event (IFE) Manufacturing in London. During the event, Janusz Wielich, the Sales Director for savory products in the EMEA-APAC region, discussed the company's offerings with FoodIngredientsFirst. Wielich highlighted LBI's vegan cheese flavors and allergen-free soy flavor, emphasizing their commitment to providing food processors with wholesome and sustainable yeast components. LBI Savory Ingredients aims to support food processors by offering high-quality ingredients that meet the growing demand for plant-based and allergen-friendly options.

In July 2023, Philadelphia Cream Cheese launched three fresh plant-based cream cheese varieties: original, chive and onion, and strawberry. These flavors are free from dairy, gluten, lactose, and artificial dyes, making them suitable for a wide range of dietary preferences. In addition, they are certified kosher. The plant-based spread is crafted using a blend of faba bean protein, coconut oil, and potato starch, offering consumers a delicious and versatile alternative to traditional cream cheese options.

Key Sources Referred

Food Revolution Organization

Plant Based Food Association

Business Journalism Organization

International Food Information Council

World Bank

U.S. Department of Agriculture

Vegetarian Dietary

U.S. Food & Drug Administration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vegan flavor market analysis from 2024 to 2034 to identify the prevailing vegan flavor market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vegan flavor market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global vegan flavor market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vegan flavor market trends, key players, market segments, application areas, and market growth strategies.

Vegan Flavor Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 15.6 Billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 380 |

| By Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Symrise, Firmenich, International Flavors & Fragrances, Lallemand Bio-Ingredients, Givaudan S.A, Takasago International Corporation, Kerry Group, Philadelphia Cream Cheese, Robertet Group, Sensient Technologies Corporation |

The global vegan flavor market size was valued at USD 10.4 billion in 2023, and is projected to reach USD 15.6 billion by 2034.

The global vegan flavor market is projected to grow at a compound annual growth rate of 3.9% from 2024-2034 to reach USD 15.6 billion by 2034.

The key players profiled in the reports includes Givaudan S.A., Symrise, International Flavors & Fragrances, Firmenich, Takasago International Corporation, Lallemand Bio-Ingredients, Kerry Group, Sensient Technologies Corporation, Philadelphia Cream Cheese, and Robertet Group.

North America dominated and is projected to maintain its leading position throughout the forecast period.

Key factors contributing to this growth include the increasing adoption of plant-based diets, heightened environmental awareness, and innovative product development.

Loading Table Of Content...