Vehicle Wrap Film Market Research, 2033

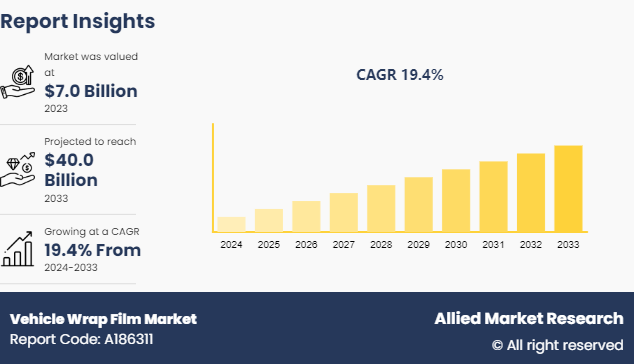

The global vehicle wrap film market was valued at $7.0 billion in 2023, and is projected to reach $40.0 billion by 2033, growing at a CAGR of 19.4% from 2024 to 2033.

Market Introduction and Definition

Vehicle wrap films, also known as vehicle wrap films or car wraps, are specialized materials used to cover and protect the exterior surfaces of automobiles. These films are typically made from durable materials such as vinyl or polyurethane and come in a variety of colors, finishes, and textures. Automotive wrap films are applied to the body panels of vehicles using a combination of heat and pressure, allowing them to conform to the contours of the vehicle's surface.

Vehicle wrap film industry wrapping film types are the different sorts of vinyl that can be applied to the bodywork of a vehicle to promote a business, protect the paintwork, or simply transform its look. Vinyl films can be used to fully wrap entire vehicles, or partially wrap the most visible surfaces of a vehicle, such as the doors, hood, or trunk.

Key Takeaways

The automotive wrap films market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major automotive wrap films industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In February 2023, Fedrigoni S.P.A. acquired a new R&D center in Grenoble, France to enhance its production innovation path and meet the growing consumer demand for innovative automotive films and wraps.

In April 2021, the Grafityp launched new colored wrapping that is chalk gray, which allows vehicle owners a sophisticated and contemporary option for vehicle customization. Chalk gray is a versatile color choice that provides a modern aesthetic while maintaining a timeless appeal.

Key Market Dynamics

The rise in demand for vehicle customization is a significant driver of the vehicle wrap film market share. The rise in trend of vehicle personalization and customization among consumers is driving the demand for automotive wrap films. Consumers seek unique and eye-catching designs for their vehicles, which can be achieved cost-effectively with wrap films compared to traditional paint jobs. Furthermore, rise in adoption in commercial fleet branding, and advancement in wrap film technology have driven the demand for the vehicle wrap film market size. However, limited durability compared to paint has hampered the growth of the vehicle wrap film market growth, while automotive wrap films offer protection against minor scratches and chips, they may not provide the same level of durability and longevity as traditional paint finishes. Harsh environmental conditions, such as extreme temperatures and prolonged exposure to sunlight, can cause wrap films to degrade over time. Moreover, high initial cost, and installation challenges are major factors that hamper the growth of the vehicle wrap film market size. On the contrary, the rise in awareness of paint protection films (PPF) among vehicle owners presents an opportunity for vehicle wrap film market trends. By offering clear PPF products that protect against stone chips, scratches, and UV damage, manufacturers can cater to the growing demand for vehicle protection solutions.

Consumer Trends and Dynamics of Global Automotive Wrap Films Market

Consumers increasingly seek ways to personalize their vehicles to reflect their individual style and preferences. vehicle wrap film industry offer a cost-effective and customizable solution for changing the color, finish, or appearance of vehicles, driving demand among consumers that value uniqueness and customization. With the proliferation of online tutorials, forums, and social media platforms, consumers are increasingly inclined to undertake do-it-yourself (DIY) projects, including vehicle customization with wrap films. DIY enthusiasts appreciate the opportunity to customize their vehicles at home, saving on installation costs and expressing their creativity.

Social media platforms play a significant role in shaping consumer trends and influencing purchasing decisions in the automotive wrap films market. Influencers and enthusiasts showcase their wrapped vehicles on platforms like Instagram, YouTube, and TikTok, inspiring followers and generating buzz around specific wrap designs and brands.

Market Segmentation

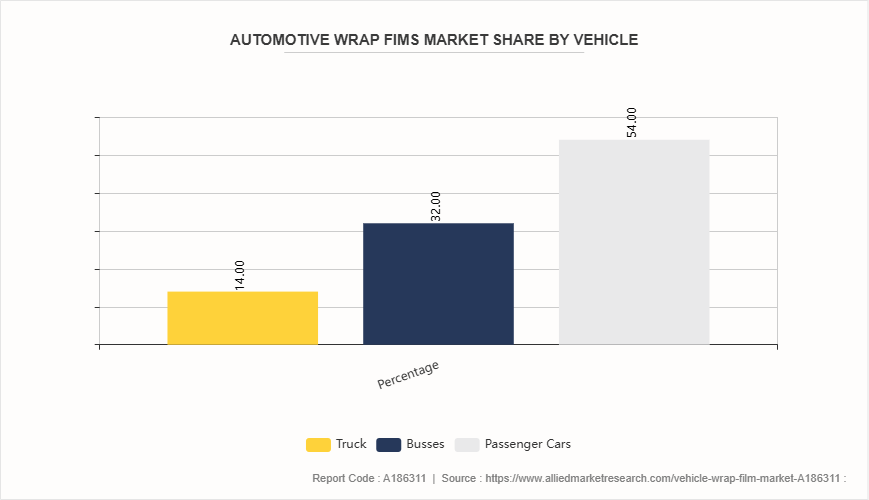

The automotive wrap films market is segmented into film type, vehicle type, application and region. On the basis of film type, the market is divided into windows films, wrap films, paint protection films. As per vehicle type, the market is segregated into passenger cars, commercial cars, and heavy commercial vehicles. On the basis of application, the market is bifurcated into advertisement purpose and safety purpose. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and middle East Africa.

Regional/Country Market Outlook

North America, particularly the U.S., has been an early adopter of automotive wrap films for both personal and commercial applications. This region has a well-established automotive aftermarket industry with a strong awareness of wrap film products among consumers, driving higher adoption rates. North America has a vibrant car culture with a strong emphasis on vehicle customization and personalization. Consumers in this region often seek ways to make their vehicles stand out and express their individual style, leading to a high demand for automotive wrap films as a cost-effective and versatile customization option.

The U.S. and Canada have large commercial fleets used for various purposes such as delivery services, logistics, and transportation. Many businesses in North America use vehicle wraps for branding and advertising purposes, contributing to the overall demand for automotive wrap films in the region. North America has witnessed a growing popularity of paint protection films (PPF) among vehicle owners seeking to preserve the appearance and resale value of their vehicles. This trend has spurred the adoption of automotive wrap films, particularly clear protective films, as consumers recognize the benefits of vehicle protection solutions.

In February 2023, Fedrigoni S.P.A. acquired a new R&D center in Grenoble, France to enhance its production innovation path and meet the growing consumer demand for innovative automotive films and wraps.

In March 2021, Avery Dennison Corporation announced the launch of new upgraded supreme wrapping film for vehicles with twelve new colors in its Rugged Range and Sleek Satin collections.

June 2021:?Arlon Graphics announced that it has developed a new cast wrap film named premium color change for fleet and vehicle applications.

In August 2021, KPMF introduced a premium visualizer tool to aid wrap shops and installers worldwide in promoting KPMF products, allowing customers to select the ideal KPMF color for their vehicles. Developed in partnership with AAV, the visualizer meticulously recreates the entire KPMF range of wrap colors and finishes, offering features such as multiple vehicles, varied environments, and the flexibility to adjust the time of day. This tool, available at no cost, enhances the customer experience and facilitates informed decision-making when choosing KPMF wraps.

Competitive Landscape

The report analyzes the profiles of key players operating in the automotive wrap films market such as 3M, Arlon Graphics LLC, Avery Dennison Corporation, Fedrigoni S.P.A, Guangzhou Carbins Film Co., LTD, Hexis S.A.S., JMR Graphics, KPMF, ORAFOL Europe GmbH, and Vvivid Vinyl. These players have adopted various strategies to increase their market penetration and strengthen their position in the automotive wrap films market.

Industry Trends

In July 2022, Avery Dennison has launched its newest paint protection film, SupremeTM PPF Xtreme, targeting vehicle owners in Australia and New Zealand, offering enhanced protection against extreme environmental conditions to safeguard their vehicle investments.

In April 2021, the Grafityp launched new color wrapping that is chalk gray, which allows vehicle owners a sophisticated and contemporary option for vehicle customization. Chalk gray is a versatile color choice that provides a modern aesthetic while maintaining a timeless appeal.

In June 2024, HEXIS has partnered with Protect Monte Carlo, a renowned manufacturer of premium automotive paint protection films (PPF) . This partnership signifies a strategic collaboration between two industry leaders to offer enhanced solutions for vehicle protection and customization.

In March 2024, ORAFOL, a prominent manufacturer of self-adhesive special films for the graphic industry, will unveil a range of new products for full car wrapping and digital printing materials at the prestigious FESPA international trade exhibition. Visitors can experience live car wrapping demonstrations at ORAFOL's booth G60 in hall 5 throughout the event, showcasing the versatility and quality of their products. Additionally, expert consultation will be available for the application of multi-layer cast and digitally printable films, catering to various car wrapping and other application needs.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits For Stakeholders

This report provides a quantitative analysis of the segments, current trends, estimations, and dynamics of the automotive wrap films market from 2023 to 2033 to identify the prevailing Vehicle wrap film market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the automotive wrap films market segmentation assists to determine the prevailing vehicle wrap film market forecast.

Major countries in each region are mapped according to their revenue contribution to the global automotive wrap films market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global automotive wrap films market trends, key players, market segments, application areas, and market growth strategies.

Vehicle Wrap Film Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 40.0 Billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 488 |

| By Film Type |

|

| By Vehicle Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vvivid Vinyl, Arlon Graphics LLC., KPMF, ORAFOL Europe GmbH., Avery Dennison Corporation, JMR Graphics, Hexis S.A.S., Guangzhou Carbins Film Co., LTD,, 3M, Fedrigoni S.P.A |

Upcoming trends in the global vehicle wrap film market include the rise in demand for customized and eye-catching vehicle graphics, the rise in popularity of matte and textured finishes, advancements in wrap film technology for easier application and durability, growing use of wraps for commercial advertising, and expanding adoption in the personal vehicle customization market.

The leading application of the Vehicle Wrap Film Market is commercial advertising, where businesses utilize vehicle wraps to transform their fleet into mobile billboards, providing high-visibility and cost-effective brand promotion and marketing.

North America is the largest regional market for vehicle wrap film, driven by extensive adoption in commercial advertising and a robust automotive aftermarket industry.

40.0 is the estimated industry size of Vehicle Wrap Film

3M, Arlon Graphics LLC, Avery Dennison Corporation, Fedrigoni S.P.A, Guangzhou Carbins Film Co., LTD, Hexis S.A.S., JMR Graphics, KPMF, ORAFOL Europe GmbH, and Vvivid Vinyl. are the top companies to hold the market share in Vehicle Wrap Film

Loading Table Of Content...