VSAT (Very Small Aperture Terminal) Market Research, 2033

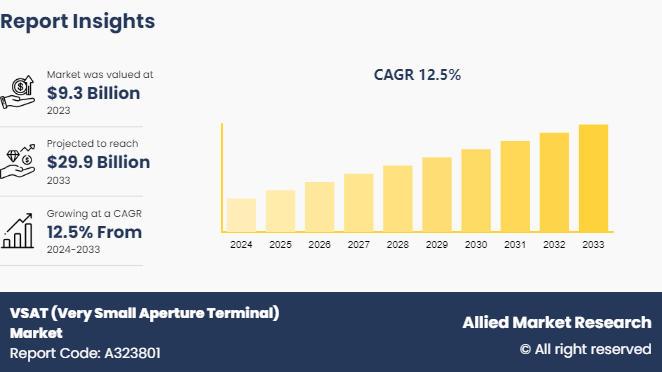

The global VSAT (Very small aperture terminal) market was valued at $9.3 billion in 2023, and is projected to reach $29.9 Billion by 2033, growing at a CAGR of 12.5% from 2024 to 2033.

Market Introduction and Definition

A VSAT (very small aperture terminal) is a compact earth station used to transmit and receive data, voice, and video signals via a satellite communication network, excluding broadcast television. A VSAT system comprises two main components, namely, an outdoor transceiver aligned with a satellite and an indoor device that connects the transceiver to the user’s communication device, such as a PC. The transceiver communicates with a satellite transponder, which, in turn, sends and receives signals from a hub ground station that manages the network.

In a VSAT network, end users connect to the hub station via the satellite, creating a star topology. Communication between users involves sending transmissions to the hub, which then relays them through the satellite to the intended recipient's VSAT. Over the years, VSAT data throughput speeds have significantly improved, now offering multimegabit services for both downstream and upstream data. The increasing use of high-throughput satellites (HTS) to provide higher bandwidth and improved service quality is one of the very small aperture terminal market trends.

VSAT systems typically use antenna dishes ranging from 1.2 to 3 meters in diameter and operate in Ku-band and C-band frequencies. However, with the launch of Ka-band satellites in regions such as North America and Asia-Pacific, and plans for Ka-band satellites in Europe, high-bandwidth, bidirectional VSAT services for enterprise, government, and other users are increasingly adopting these new frequencies.

Key Takeaways

The VSAT (very small aperture terminal) market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period .

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major very small aperture terminal industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In February 2022, Gilat Satellite Networks Ltd. unveiled SkyEdge IV, an advanced ground system for satellite communication. SkyEdge IV is designed to enhance operational efficiencies through its scalable software-centric approach. In addition, it offers VSAT backward compatibility, ensuring that customers who invested in SkyEdge II-c can seamlessly transition and protect their investments.

In May 2022, Viasat, Inc. revealed that Southwest Airlines Co. has chosen its latest Ka-band satellite in-flight connectivity (IFC) system to be pre-installed on all upcoming aircraft deliveries.

In September 2021, L3Harris Technologies introduced its latest innovation, the Hawkeye 4 (H4) Lite Very Small Aperture Terminal (VSAT) , designed to link warfighters across the globe. The H4 Lite is a portable satellite communications terminal capable of swift deployment and maneuverability in dynamic battlefield environments. It delivers high-speed data communications for Internet access, C5ISR, and video transmission.

?????Key Market Dynamics

The global very small aperture terminal market is growing due to several factors such need for reliable internet connectivity in remote areas, growing demand for broadband services, and increased demand from industries such as maritime, oil and gas, mining, and transportation. However, high initial investment costs and regulatory challenges hinder the market very small aperture terminal market growth. In addition, the development of portable and mobile VSAT terminals and rise in government initiatives are expected to provide ample opportunities for the market growth during the forecast period.

One of the primary drivers of the very small aperture terminal market is the need for reliable and high-speed internet connectivity in remote and underserved areas. In many parts of the world such as Africa and Latine America, terrestrial communication infrastructure is either non-existent or inadequate, making it challenging to provide reliable internet connectivity. VSAT technology offers a solution to this problem by enabling communication through satellite networks, bypassing the need for traditional terrestrial infrastructure. The very small aperture terminal market size is experiencing significant growth due to the increasing demand for efficient satellite communication in remote areas.

VSAT systems are particularly beneficial in areas where the cost of deploying and maintaining terrestrial infrastructure is prohibitively high, such as remote rural regions, offshore platforms, and mountainous terrains. These systems can provide high-speed internet access, voice, and data services to communities, businesses, and organizations operating in these areas, enabling them to stay connected and access critical information and resources. The very small aperture terminal market size for very small aperture terminals is projected to expand as industries like oil and gas, maritime, and defense increasingly adopt this technology.

Moreover, VSAT technology has become increasingly important in supporting various industries that rely on real-time data transmission and communication, such as the maritime, oil and gas, mining, and transportation sectors. These industries often operate in remote locations where terrestrial communication infrastructure is limited or non-existent. VSAT systems enable these industries to maintain reliable connectivity, enhancing operational efficiency, safety, and productivity. The very small aperture terminal market analysis reveals a strong growth trajectory, driven by advancements in satellite technology and the need for robust communication networks.

Furthermore, the growing demand for broadband services, driven by rise in adoption of internet-enabled devices, cloud computing, and online services, has fueled the need for VSAT technology. VSAT systems provide high-speed internet connectivity, enabling businesses and individuals in remote areas to access cloud-based applications, streaming services, and other online resources that require significant bandwidth.

Therefore, the need for reliable and high-speed internet connectivity in remote and underserved areas, where traditional terrestrial communication infrastructure is lacking or inadequate, drives the market growth. VSAT technology offers a solution by enabling communication through satellite networks, supporting various industries and facilitating access to critical information and resources for communities and businesses in these regions.

Market Segmentation

The very small aperture terminal market is segmented into solution, platform, frequency, network architecture, design, and region. On the basis of solution, the market is divided into equipment, support services, and connectivity services. By platform, the market is segregated into land VSAT, maritime VSAT, and airborne VSAT. On the basis of frequency, the market is divided into Ku-Band, C-Band, Ka-Band, X-Band, and others.

By network architecture, the market is categorized into star topology, mesh topology, hybrid topology, and point-to-point links. By design, the market is segmented into rugged VSAT and non-rugged VSAT. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The very small aperture terminal market share is dominated by North America, owing to its advanced technological infrastructure and high adoption rate of VSAT solutions.The very small aperture terminal market in North America is witnessing significant growth due to the need for reliable connectivity in remote areas and rise in adoption of satellite-based communication solutions across various industries. Innovations in high-throughput satellites (HTS) are increasing the capacity and efficiency of VSAT systems. Improved signal processing and modulation techniques are also enhancing data transmission rates and reliability. The very small aperture terminal market forecast indicate that the market will benefit from increasing government investments in satellite communication infrastructure.

Moreover, there is rise in demand for reliable connectivity, especially in remote and underserved areas. Industries such as oil and gas, mining, and forestry require dependable communication solutions, and VSAT technology meets these needs. The shift towards remote work and online education further boosts the demand for robust and consistent connectivity, which VSAT systems can provide. The expansion of internet services in rural and remote areas presents a major very small aperture terminal market opportunity.

In addition, government initiatives and support are driving the market growth. Programs designed to bring internet access to rural and remote regions are encouraging the adoption of VSAT technology. These initiatives help ensure that more areas have access to reliable communication networks, which is crucial for economic and social development.

In May 2022, the National Security Agency (NSA) issued an update to its Cybersecurity Advisory (CSA) titled "Protecting VSAT Communications, " focusing on securing very small aperture terminal (VSAT) networks. The advisory is designed to assist organizations in comprehending potential communication vulnerabilities and implementing measures to mitigate risks. The NSA advises that government VSAT networks, including those classified as National Security Systems (NSS) and those utilized by Defense Industrial Base (DIB) entities, should activate all feasible transmission security safeguards on VSAT networks.

Competitive Landscape

The major players operating in the very small aperture terminal industry include Hughes Network Systems, LLC, Viasat, Inc., Inmarsat Global Limited, Thales Group, SES S.A., Gilat Satellite Networks Ltd., L3Harris Technologies, Inc., Cobham Limited, KVH Industries, Inc., and Global Eagle Entertainment Inc. Other players in VSAT market includes Nisshinbo Holdings Inc., General Dynamics Corporation, Honeywell International Inc., and others.

Industry Trends:

In May 2023, KVH launched the One OpenNet initiative, allowing ships equipped with non-KVH antennas to utilize the communication network via any type of very small aperture terminal (VSAT) . Prior to this initiative, only vessels outfitted with KVH hardware could access the global high-throughput (HTS) network provided by the Rhode Island-based communications company.

In January 2022, Ultra Intelligence & Communications, a division under Ultra Electronics, introduced a novel portable SATCOM terminal, the ULV-950mp. This terminal has received authorization from Inmarsat for operation across the Inmarsat Global Xpress network.

In December 2021, Orbit Communication Systems Ltd. revealed its acquisition agreement to obtain full ownership of Euclid Systems Engineering Ltd. This acquisition marks Orbit's strategic move to incorporate Euclid's expertise in crafting intelligent, compact, and lightweight positioners and tracking systems tailored for defense applications.

Key Sources Referred

Global VSAT Forum (GVF)

European Satellite Operators Association (ESOA)

Satellite Industry Association (SIA)

Asia-Pacific Satellite Communications Council (APSCC)

Arab Satellite Communications Organization (Arabsat)

Network Access Associated (NAOAT)

International Telecommunication Union (ITU)

World Teleport Association (WTA)

Mobile Satellite Users Association (MSUA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the very small aperture terminal industry analysis from 2024 to 2033 to identify the prevailing VSAT market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the VSAT market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vsat (Very small aperture terminal) market trends, key players, market segments, application areas, and market growth strategies.

VSAT (Very Small Aperture Terminal) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 29.9 Billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 350 |

| By Solution |

|

| By Platform |

|

| By Frequency |

|

| By Network Architecture |

|

| By Design |

|

| By Region |

|

| Key Market Players | Thales Group , Cobham Limited , Viasat, Inc., SES S.A. , Gilat Satellite Networks Ltd. , Global Eagle Entertainment Inc. , Hughes Network Systems, LLC , L3Harris Technologies, Inc. , KVH Industries, Inc. , Inmarsat Global Limited |

Land VSAT is the leading application of VSAT (Very Small Aperture Terminal) Market

North America is the largest regional market for VSAT (Very Small Aperture Terminal)

The development of portable and mobile VSAT terminals and government initiatives are the upcoming trends of VSAT (Very Small Aperture Terminal) Market in the globe

The global vsat (Very small aperture terminal) market was valued at $9.3 billion in 2023, and is projected to reach $29.9 Billion by 2033, growing at a CAGR of 12.5% from 2024 to 2033.

The major players operating in the VSAT (very small aperture terminal) market include Hughes Network Systems, LLC, Viasat, Inc., Inmarsat Global Limited, Thales Group, SES S.A., Gilat Satellite Networks Ltd., L3Harris Technologies, Inc., Cobham Limited, KVH Industries, Inc., and Global Eagle Entertainment Inc.

Loading Table Of Content...