Veterinary Dental Equipment Market Research, 2032

The veterinary dental equipment market size was valued at $306 million in 2022, and is projected to reach $537.5 million by 2032, growing at a CAGR of 5.8% from 2023 to 2032. Veterinary science is a branch of science that deals with the medical care and treatment of animals, including pets, livestock, wildlife, and zoo animals. The primary goal of veterinary science is to maintain the health and well-being of animals, prevent & treat illnesses and injuries, and promote their overall welfare. This involves various aspects of animal care, including nutrition, hygiene, vaccination, dentistry, and disease management. Veterinary dental equipment refers to a range of specialized tools and devices that are designed for the examination, diagnosis, and treatment of dental and oral conditions in animals. These tools and equipment are used by veterinarians and veterinary technicians to provide comprehensive dental care to animals, including pets, livestock, and zoo animals.

Market Dynamics

The veterinary dental equipment market share is driven by an increase in pet ownership. As more people are adopting pets and considering them as part of their family, they are willing to invest in their pets' health and well-being. Dental health is an essential aspect of pet health that is often overlooked by pet owners.

However, with the rise in awareness about the consequences of poor dental hygiene, pet owners have become more conscious of the need for proper dental care for their pets. This has led to an increased demand for veterinary dental equipment such as dental drills, scalers, and probes. In addition, the rise in prevalence of dental diseases in pets is another factor driving the demand for veterinary dental equipment.

Dental diseases are a common problem in pets, and if left untreated, they can lead to serious health complications. As a result, pet owners are increasingly seeking dental care services for their pets, leading to a rise in demand for veterinary dental equipment. For instance, the surge in prevalence of dental diseases in animals, such as periodontal disease and tooth decay, is a significant driver that contributes to the growth of the market. According to the American Veterinary Dental Society, periodontal disease is the most common dental condition in dogs and cats, by the time the pet is 3 years old. Furthermore, the surge in number of veterinary clinics and hospitals fosters the demand for veterinary dental equipment. With an upsurge in number of veterinarians specializing in dental care for pets, the demand for advanced dental equipment has increased. This has led to a rise in investments in veterinary dental equipment by veterinary clinics and hospitals.

In addition, expansion of the pet insurance industry is acting as a significant driver for veterinary dental equipment market. Pet insurance policies cover a range of medical expenses, including dental care, which can be costly. As a result, pet owners are increasingly opting for regular dental check-ups and preventive dental care for their pets. This has led to a surge in demand for advanced veterinary dental equipment, such as dental X-ray machines, ultrasonic scalers, and dental drills. According to 2022 report by North American Pet Health Insurance Association (NAPHIA), 4.41 million pets were insured in North America at the end of 2021 and the pet health insurance market grew by 27.7%. According to the same source, the total premium volume in the U.S. reached $2.6 billion in December 2021. The pet insurance industry has also played a vital role in increasing pet owner awareness of the importance of dental care. Insurance companies provide educational materials on pet dental care and offer coverage for preventive dental procedures such as cleanings and X-rays. This has encouraged pet owners to take better care of their pets' teeth and gums.

However, the high cost of veterinary dental equipment has emerged as a major restraint for the veterinary dental equipment market size, as it limits the adoption of these technologies by small animal clinics and pet owners. One of the main reasons for the high cost of veterinary dental equipment is the advanced technology used in these devices. Modern dental equipment for animals includes advanced imaging systems, high-speed drills, ultrasonic scalers, and other sophisticated tools that require significant investments in research and development, as well as manufacturing and marketing.

Segmental Overview

The veterinary dental equipment market share is segmented on the basis of product type, animal type, end user and region. By product type, the market is classified into hand instruments, equipment and consumables. By animal type, the market is divided into large and small animals. By end user, it is fragmented into veterinary hospitals, veterinary clinics and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

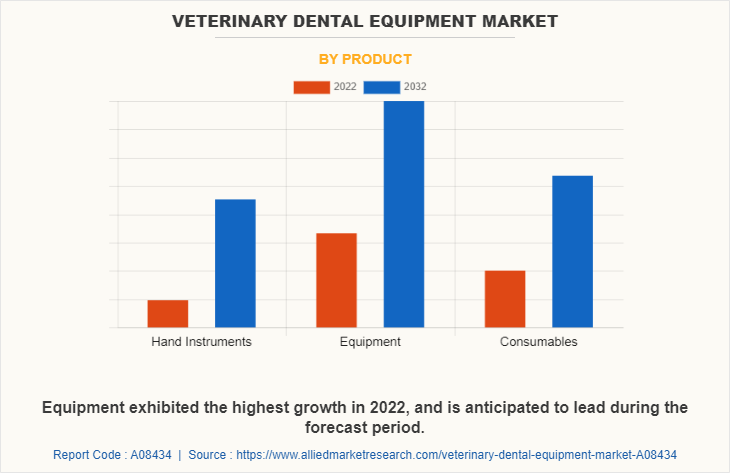

By Product Type

The market is segmented into hand instruments, equipment and consumables. The hand instruments are further divided into dental elevators, dental probes, extraction forceps, curettes and scalers, retractors, dental luxators, and others. The equipment segment is classified into dental X-ray systems, electrosurgical units, dental stations and dental lasers. Furthermore, the consumable segment is classified into dental supplies and prophy products. The equipment segment dominated the veterinary dental equipment market growth, owing to the wide range of applications in diagnosis and treatment of dental disorders in animals.

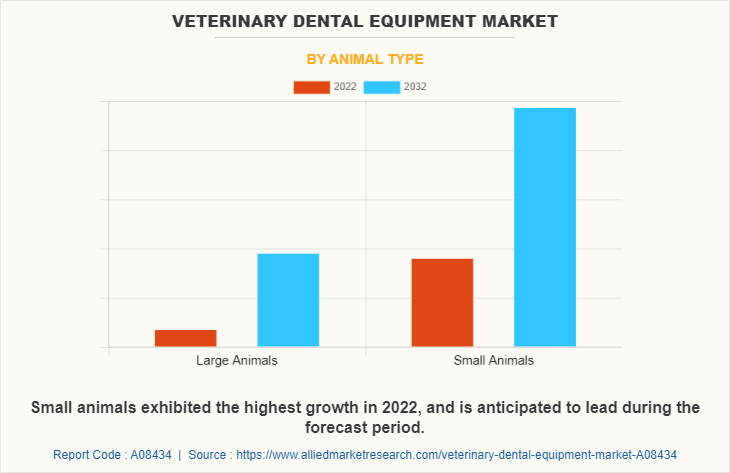

By Animal Type

The market is classified into large and small animals. The small animals segment dominated the market, owing to the rise in pet ownership, especially small animals such as dogs and cats.

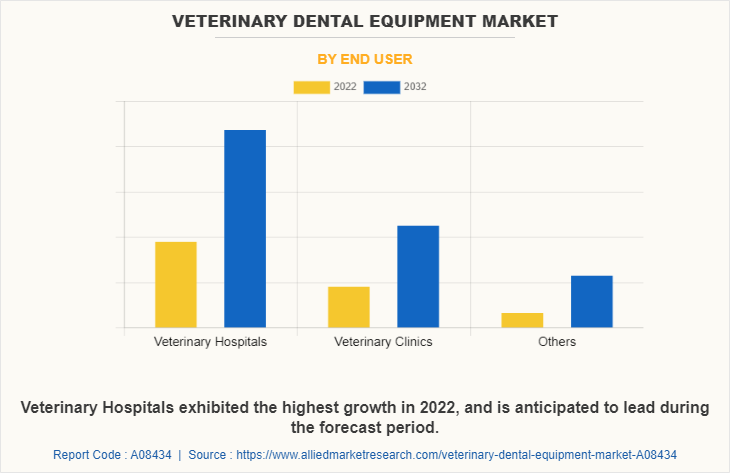

By End User

On the basis of end user, the market is fragmented into veterinary hospitals, veterinary clinics and others. The veterinary clinics segment is expected to register the fastest growth during the forecast period.

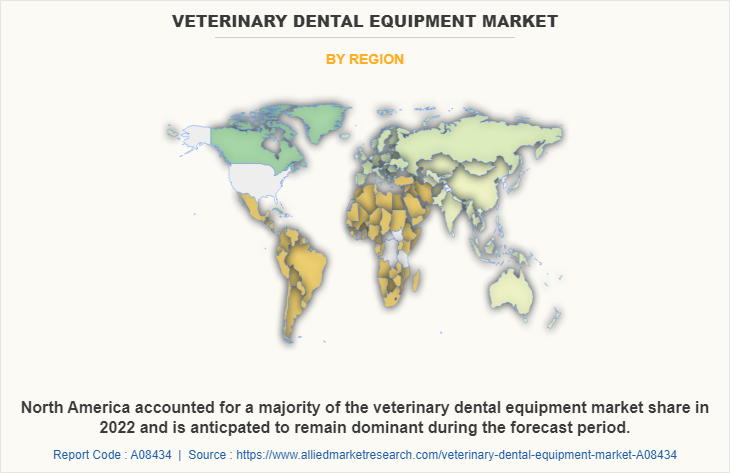

By Region

The veterinary dental equipment market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the veterinary dental equipment market in 2021, owing to increase in pet ownership and strong presence of several major players, such as, Dentalaire, International, Midmark Corporation and Integra LifeSciences, and technological advancement in diagnostic methods. In addition, Asia-Pacific is expected to witness growth at the fastest rate during the veterinary dental equipment market forecast. This is attributed to increase in ownership of domestic cattle, especially in India.

Competition Analysis

Competitive analysis and profiles of the major players in the veterinary dental equipment industry, such as Planmeca OY, Acteon group ltd., Integra LifeSciences, Johnson & Johnson, Midmark Corporation, Cislak Manufacturing, Inc., MAI, Animal Health, Eickemeyer Veterinary Equipment Inc, Dentalaire International and iM3Vet Pty Ltd. Major player have adopted partnership as key developmental strategy to improve the product portfolio of the veterinary dental equipment industry.

Recent partnership in the veterinary dental equipment market

In October 2022: Midmark Corporation announced a partnership with SignalPET, the creator of the SignalSMILE software that uses artificial intelligence and machine learning technology to help veterinarians detect common pathologies on companion animal dental X-rays.

In November 2022: MAI Animal Health announced a partnership with VetWelding SA based in Switzerland to introduce the first Ultrasonic Resorbable Implant technology known as Bone Welding to provide solutions to Oral Maxillofacial and Orthopedic Veterinary specialists.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the veterinary dental equipment market analysis from 2022 to 2032 to identify the prevailing veterinary dental equipment market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the veterinary dental equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global veterinary dental equipment market trends, key players, market segments, application areas, and market growth strategies.

Veterinary Dental Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 537.5 million |

| Growth Rate | CAGR of 5.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 230 |

| By Product |

|

| By Animal type |

|

| By End user |

|

| By Region |

|

| Key Market Players | J & J Instruments, Inc, Acteon group ltd., Cislak Manufacturing, Inc., Integra LifeSciences, MAI Animal Health, Midmark Corporation, Eickemeyer Veterinary Equipment Inc, Dentalaire, International, Planmeca OY, iM3Vet Pty Ltd. |

Analyst Review

According to the insights of CXOs, increase in demand for veterinary dental equipment and rise in investments for development of veterinary dental equipment globally are expected to offer profitable opportunities for the expansion of the market. In addition, favorable government initiatives toward animal welfare and higher spending for animal dental care have piqued the interest of several companies to develop veterinary dental equipment.

CXOs further added that the increase in pet ownership and technological advancements such as digital radiography and laser technology are expected to boost the growth of the market. In addition, the increase in awareness about dental disorders among pets across the globe has resulted in a rise in demand, thus driving the growth of the market.

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to increase in pet ownership and highly developed veterinary healthcare system. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of veterinary dental equipment and increase in number of key players manufacturing veterinary dental equipment, which is anticipated to drive the growth of the market during the forecast period.

Veterinary dental equipment refers to a range of specialized tools and devices that are used to diagnose, treat, & prevent dental and oral problems in animals such as periodontal disease, tooth decay, and oral infections.

The total market value of the veterinary dental equipment market is $306.01 million in 2022.

The forecast period for veterinary dental equipment market is 2023 to 2032.

Top companies such as iM3Vet Pty Ltd., Cislak Manufacturing, Inc, Dentalaire International held a high market position in 2021.

Equipment segment dominated the global market in 2022 and expected to continue this trend throughout the forecast period. The dominance of this segment can be attributed to rise in adoption of this devices for diagnosis and treatment of pets.

Surge in pet ownership, rise in demand for specialty veterinary care and technological advancements in veterinary dental equipment.

The overall impact of COVID-19 remains negative on the Veterinary Dental Equipment Market.

Yes, the competitive landscape is included in the veterinary dental equipment market report.

Loading Table Of Content...

Loading Research Methodology...