Veterinary Orthopedic Implants Market Research, 2031

The global veterinary orthopedic implants market size was valued at $105,224.6 thousand in 2021 and is projected to reach $161,850.5 thousand by 2031, growing at a CAGR of 4.4% from 2022 to 2031. A veterinary orthopedic implant is a manufactured device designed to replace a joint, bone, or cartilage occur caused by a congenital defect, and a broken leg. The three most common types of orthopedic implants are screws, plates, and pins. The orthopedic implants are made of metals including stainless steel, cobalt-based alloys, and titanium. Stainless steel is often used to replace structures that have naturally degraded or have incurred trauma. Furthermore, they are available in different types such as metallic screws, metallic plates, K-wires, and staples. These implants are used in the treatment of hip dysplasia, elbow dysplasia, and bone fractures caused due to accidents, sports injuries, and bone disorders among animals.

Historical Overview

The market was analyzed qualitatively and quantitatively from 2021-2031. The veterinary orthopedic implants market size witnessed growth at a CAGR of around 4.4% from 2021 to 2031. Most of the growth was derived from the Asia-Pacific region owing to surge in health awareness, rise in disposable incomes, as well as the well-established presence of companies in the region.

Market Dynamics

The growth of the veterinary orthopedic implants market is mainly driven due to the rise in prevalence of orthopedic issues in animals such as injury and arthritis. This, highlights the demand for veterinary orthopedic implants in orthopedic management. In addition, increase in cases of cruciate ligament rupture in dogs worldwide. For instance, 85% of the all-orthopedic injuries in dogs are some form of cruciate ligament rupture injury. The veterinary orthopedic implants market growth is expected to be driven by high potential in untapped, emerging markets, due to availability of improved animal healthcare infrastructure, increase in unmet animal healthcare needs, and surge in demand for veterinary orthopedics implants. Moreover, the advent of advanced surgical techniques to treat the condition is anticipated to serve as opportunity for the market expansion during the forecast period. The demand for veterinary orthopedic implants is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market.

Factors such as increase in awareness toward veterinary orthopedic implants, further drive the growth of the market. Furthermore, rise in consumer awareness related to preventive animal healthcare and ease of accessibility boost the adoption of veterinary orthopedic implants. However, rise in technological advancements in veterinary orthopedics implants provides lucrative growth opportunities in emerging market such as China and India during the forecast period. In contrast, lack of veterinary infrastructure facilities in underdeveloped nations and high cost of veterinary orthopedic implants may restrain the market growth.

However, increase in the prevalence of animal disease such as bone injury, cancer or fracture occur due to trauma and arthritis among animals has increased the demand for orthopedic implants drive the market growth. Increase in pet insurance policies, and increase in the number of veterinary hospitals and veterinary clinics to treat the animals with rise in the number of veterinary professionals, further support the market growth. For instance, according to the U.S. spot pet insurance offers two types of policies for cats and dogs, one for accidents and another that provides coverage for both accidents and illnesses. Thus, rise in the favorable pet insurance policies supports the market growth. Furthermore, surge in ownership of companion animals acts as a key factor that contributes toward the growth of the market. For instance, according to Insurance Information Institute, stated that the total premium volume for pet insurance in the U.S. was nearly $2.6 billion in 2021. Also, according to the Pet Food Industry China, stated that in 2020, around 52 million dogs and 49 million cats were kept by 63 million pet owners in China urban cities. Moreover, rise in pet insurance policies further boost the market growth. For instance, according to the North American Pet Health Insurance Association (NAPHIA), there was a 21% increase in the pet health insurance sector in 2019. NAPHIA stated that continued growth in its sector even in 2020. Thus, rise in pet population across the globe supports the market growth. However, rise in cases of osteoarthritis condition is often associated with issues such as an injury due to trauma, hip dysplasia, elbow dysplasia, cruciate injury, or dislocations of the shoulder or knee in animals which requires the orthopedic implants this has also led to propel the market growth.

The COVID-19 pandemic had a negative impact on veterinary orthopedic implants market. A huge number of veterinary clinics & hospitals across the globe were closed due to lockdown. The lockdown led to disruption of manufacturing and transportation of essentials which are required for animals. Furthermore, other factors responsible for the impact on the market include limited availability of medical care, shortage of animals care staff, and rise in burden of COVID-19 related hospitalization. However, this situation is expected to improve as governments have started relaxing norms around the world for resuming business activities, which will further drive the market in the forecast period. For instance, American Veterinary Medical Association (AVMA) helped the veterinary community during a pandemic.

Segmental Overview

The veterinary orthopedic implants market is segmented into Product Type, Application and End User. By product type, the market is categorized into plates, screws and others. By application, the market is segregated into cruciate ligament rupture, bone fractures, elbow dysplasia, hip dysplasia and others. By end user, the market is classified into veterinary hospitals, veterinary clinics, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

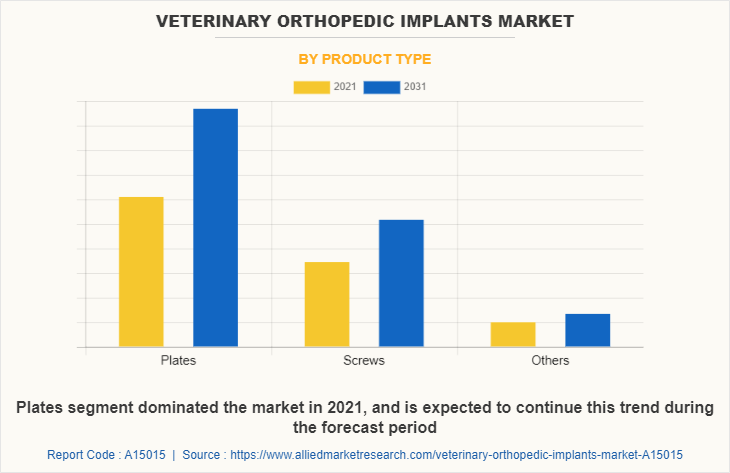

By Product Type

The market is segmented into plates, screws and others. The plates segment accounted for the largest veterinary orthopedic implants market share in 2021 owing to easy availability, affordability of product and increase in R&D activities in the medical devices industry. In addition, advancements in technology to manufacture high-quality and biologically inert metallic plates propel the growth of the market. Furthermore, increase in use of metallic plates such as Tibial Plateau Leveling Osteotomy (TPLO) plates used during orthopedic surgeries among animals also contribute toward segment growth.

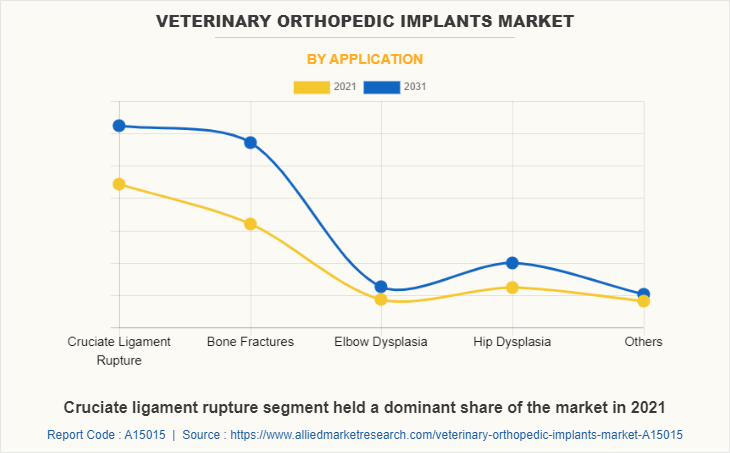

By Application

The veterinary orthopedic implants market is segregated into cruciate ligament rupture, bone fractures, elbow dysplasia, hip dysplasia and others. The cruciate ligament rupture segment dominated the global market in 2021. This is attributed to increase in trauma injuries and arthritic disease among the dogs. Furthermore, obese dogs are more susceptible to cause cruciate ruptures. Thus, increase in the number of overweight dogs is expected to propel the market growth. According to VCA Aminal Hospital, in North America obesity is the most common disease in dogs. For instance, according to the Association for Pet Obesity Prevention (APPA) in 2018-19, an estimated 50 million dogs and 56 million cats were overweight or had obesity in the U.S. However, the bone fractures segment is expected to witness highest CAGR during the forecast period. This is attributed to rise in prevalence of bone fractures among animals.

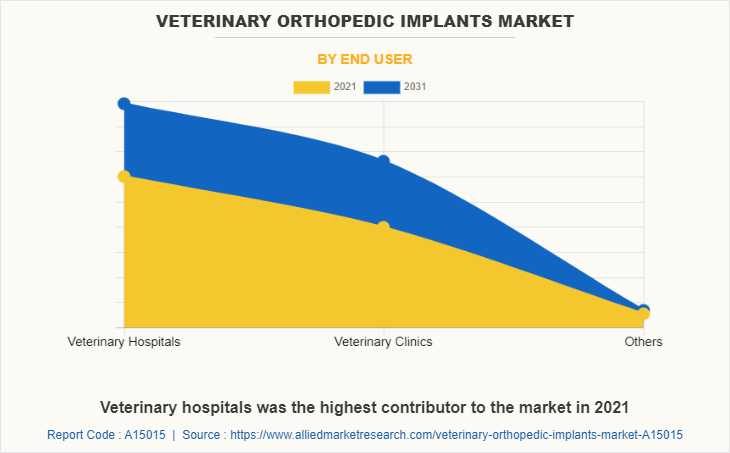

By End User

The market is classified into veterinary hospitals, veterinary clinics, and others. The veterinary hospital segment held the largest market share in 2021. This was attributed to rapid expansion of emergency and critical care units in veterinary hospitals, and availability of affordable veterinary orthopedic implants in these hospitals. However, the veterinary clinics segment is expected to witness highest CAGR during the forecast period. This is attributed to rise in number of veterinary clinics, and availability of veterinary orthopedic implant in veterinary clinics.

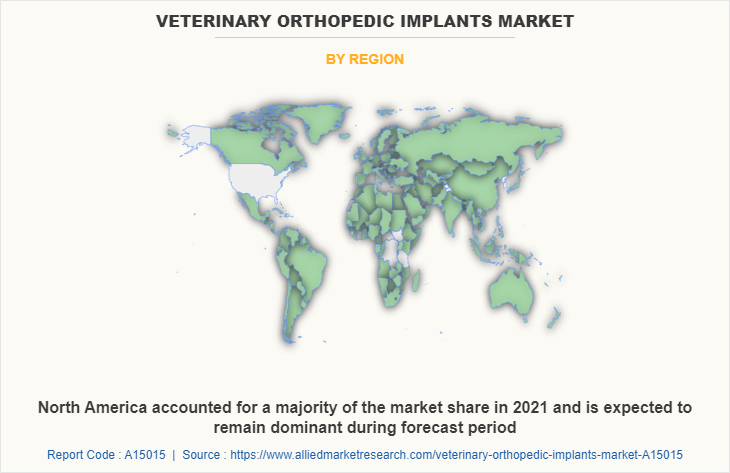

By Region

The veterinary orthopedic implants market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major veterinary orthopedic implants market share in 2021, and is expected to maintain its dominance during the forecast period.

Presence of key players, such as Johnson & Johnson (Depuy Synthes) and Integra Lifesciences and advancement in manufacturing technology of veterinary orthopedic implants in the region drive the growth of the market. In addition, surge in соnсеrn аmоng реорlе fоr mаіntаіnіng а hеаlthу lіfеѕtуlе for animal аnd соnѕіѕtеnt grоwth іn thе pet рорulаtіоn, іnсrеаѕеѕ thе dеmаnd fоr veterinary orthopedic implants in the region, which is ехресtеd tо рrореl the grоwth оf thе mаrkеt. Furthermore, presence of well-established animal healthcare infrastructure, high purchasing power, and rise in adoption rate of veterinary orthopedic implants are expected to drive the market growth.

Asia-Pacific is expected to grow at the highest rate during the veterinary orthopedic implants market forecast. The growth in this region is attributed to presence of medical device companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Furthermore, surge in demand for protein-rich animal food, and upsurge in number of veterinary clinics coupled with orthopedic implants significantly contribute toward the market growth in Asia-Pacific. Asia-Pacific offers profitable opportunities for key players operating in the veterinary orthopedic implants market, thereby registering the fastest growth rate during the forecast period, owing to the developments in infrastructure of industries, rise in disposable incomes, as well as the well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunities for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the veterinary orthopedic implants industry, such as Arthrex Vet systems, Auxein Medical, B. Braun SE (B.Braun Vet Care), BlueSAO Co., Ltd, Integra Lifesciences, Johnson & Johnson (Depuy Synthes), Narang Medical Limited (Narang Vet), Ortho Max Mfg. Co. Pvt. Ltd. Orthomed, and Vimian Group. The key players that provide advanced veterinary orthopedic implants propel the market growth.

Some examples of product upgradation in the market

In April 2021, Orthomed is leading medical technology company announced the product upgradation in SOP plates included in SOP system which is a small and low-profile system made up of titanium alloy which allows easier placement in animals. In addition, previous 2.0mm plates are now available as 16-hole and also 17 hole T-plates which can be cut to size and use exclusive screws only available from Orthomed company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the veterinary orthopedic implants market analysis from 2021 to 2031 to identify the prevailing veterinary orthopedic implants market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the veterinary orthopedic implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global veterinary orthopedic implants market trends, key players, market segments, application areas, and market growth strategies.

Veterinary Orthopedic Implants Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 161.9 million |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 223 |

| By Product Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | BlueSAO, Vimian Group, Narang Medical Limited, Arthrex Vet systems, Orthomed, Ortho Max Mfg. Co. Pvt. Ltd., B. Braun SE (B.Braun Vet Care), Johnson and Johnson, Integra Lifesciences, Auxein Medical |

Analyst Review

According to CXOs, adoption of veterinary orthopedic implants has witnessed a significant increase over the past few years. This is majorly attributed to rise in adoption of orthopedic implants and increase in technological advancements in veterinary orthopedic implants. In addition, surge in companion animal population along with rise in awareness about animal health around the globe, are expected to drive growth of the veterinary orthopedic implants market.

Furthermore, the market growth is driven by increasing cases of obesity and arthritis in animals. In addition, increase in awareness regarding emerging techniques and advancements in devices associated with veterinary orthopedic implants are expected to impel growth of the veterinary orthopedic implants market in the future. In addition, new launches and product approvals by key market players around the globe boost market growth.

Conversely, higher costs associated with the procedure of orthopedic implants hinder the growth of the market. Furthermore, CXOs added that, North America dominated the veterinary orthopedic implants market in terms of revenue, owing to well-established healthcare infrastructure, presence of key market players, government initiatives, and higher awareness among people regarding management of animal health. On the other hand, Asia-Pacific is expected to grow at a prominent CAGR during the forecast period, owing to surge in investments by key market players and availability of resources along with the cost-effectiveness of treatment in this region than in developed regions contribute to the growth of the market.

Rise in incidences of arthritis and fracture and surge in the incidence of orthopedic disorders among animals are the factors responsible for market growth.

The plates segment is the most influencing segment owing to high adoption of veterinary orthopedic plates due to their advantages such as easy to contour and cuttable.

North America is the largest regional market for Veterinary Orthopedic Implants.

The total market value of the veterinary orthopedic implants market is $105,224.6 thousand in 2021.

Top companies such as Vimian Group, B. Braun SE (B. Braun Vet Care), Integra Lifesciences, Johnson & Johnson (Depuy Synthes) held high market share in 2021.

Loading Table Of Content...