Veterinary PoC Hematology Diagnostics Market Research, 2030

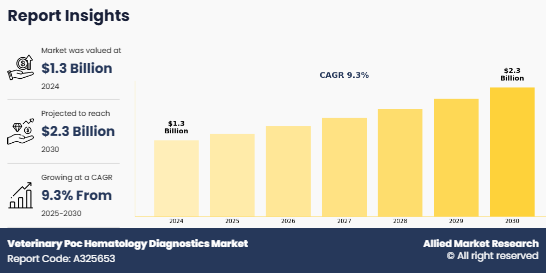

The global veterinary Poc hematology diagnostics market size was valued at $1.3 billion in 2024, and is projected to reach $2.3 billion by 2030, growing at a CAGR of 9.3% from 2025 to 2030.The growth of the veterinary PoC hematology diagnostics market is driven by rise in prevalence of animal diseases, rise in pet adoption, and increase in demand for rapid diagnostic solutions. According to National Pet Owners Survey 2024, around 65.1 million U.S. households own a dog. In addition, advancements in PoC testing technology, including portable and automated analyzers, enhance diagnostic efficiency.

Veterinary PoC hematology diagnostics refers to on-site diagnostic solutions that allow veterinarians to rapidly analyze blood samples and assess hematological parameters in animals. These diagnostics play a crucial role in the early detection and management of conditions such as anemia, infections, clotting disorders, and immune system abnormalities. Utilizing advanced technologies like automated hematology analyzers, microfluidics, and AI-driven interpretation, these systems provide rapid, reliable results, reducing the need for external laboratory testing. The growing adoption of PoC hematology diagnostics is driven by rise in demand for immediate veterinary care, rise in pet ownership, and expansion of livestock and companion animal health management.

Key Takeaways

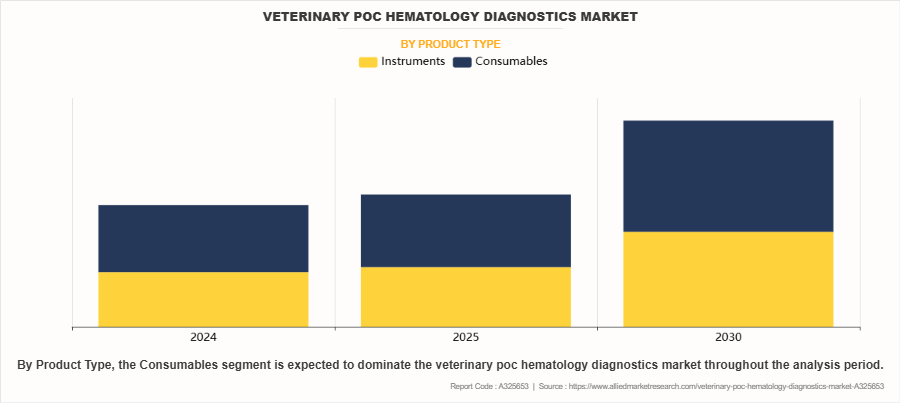

- By product type, the consumables segment was the highest contributor to the veterinary Poc hematology diagnostics industry in 2024. However, the instruments segment is expected to register the highest CAGR during the forecast period.

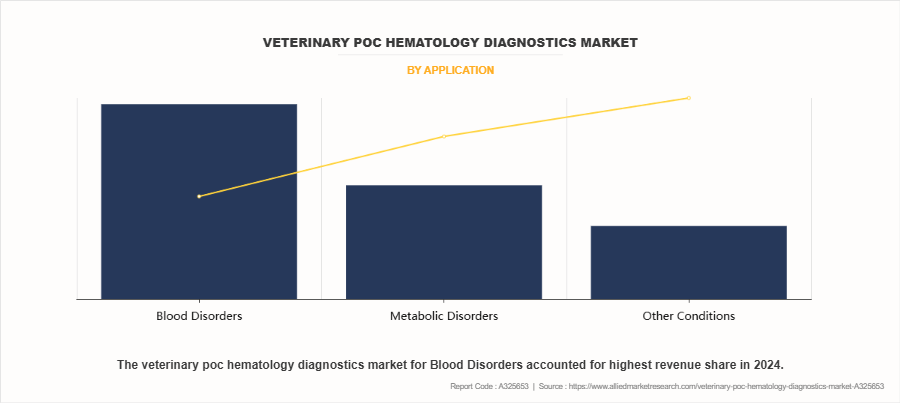

- By application, the blood disorders segment was the highest contributor to the market in 2024. However, the metabolic disorders segment is expected to register the highest CAGR during the forecast period.

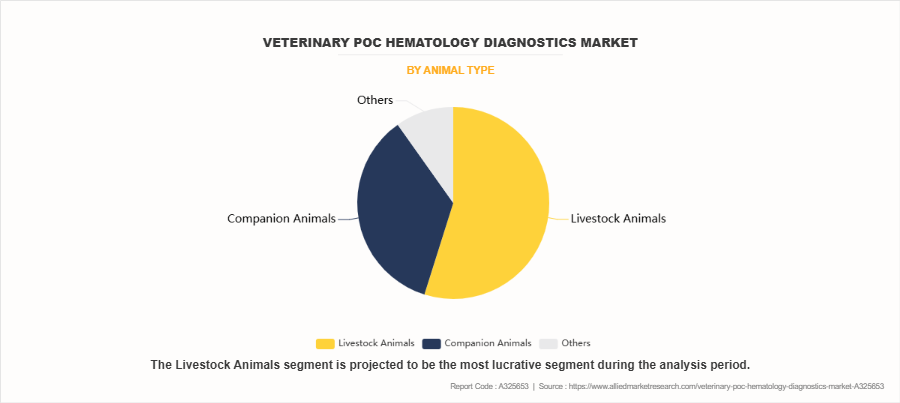

- By animal type, the livestock animals segment was the highest contributor to the market in 2024. However, the companion animals segment is expected to register the highest CAGR during the forecast period.

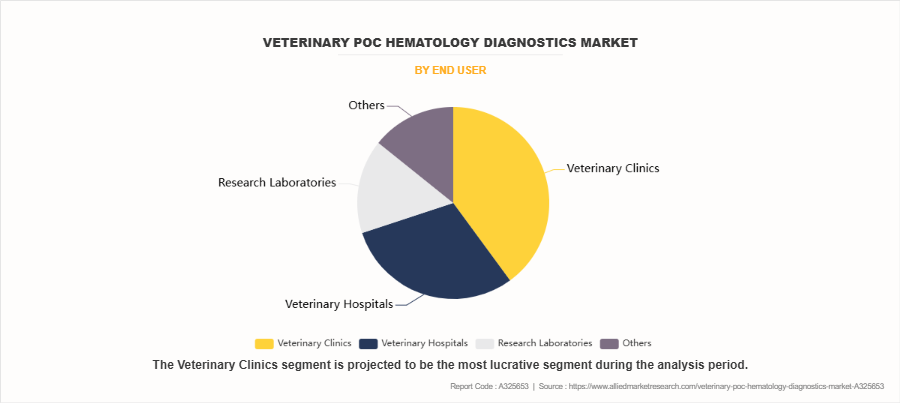

- By end user, the veterinary clinics segment dominated the market in 2024, However, the veterinary hospitals segment is expected to register highest CAGR during the forecast period.

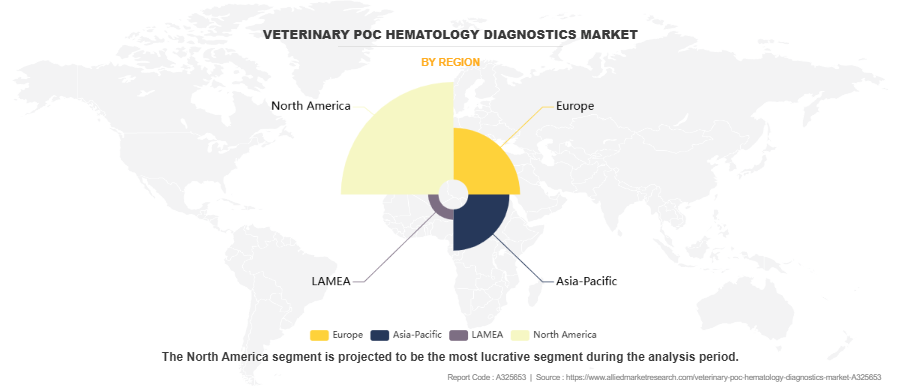

- By region, North America garnered the largest revenue share in 2024. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Market Dynamics

According to veterinary Poc hematology diagnostics market analysis the market is experiencing significant growth driven by rise in adoption of companion animals, rise in adoption of per insurance, and surge in prevalence of animal diseases. According to a 2024 article by American Veterinary Medical Association, from 1996-2024, the dog population has steadily increased, from 52.9 million to a new peak of 89.7 million. With increasing pet ownership globally, particularly in urban areas, there is rise in emphasis on pet health and wellness. Pet owners are increasingly seeking advanced diagnostic solutions for early disease detection and effective treatment, leading to a higher demand for point-of-care hematology diagnostics that provide rapid and accurate results.

In addition, humanization of pets has resulted in increased veterinary visits and preventive healthcare measures, further fueling the market growth. Veterinary clinics and pet hospitals are integrating PoC hematology analyzers to improve diagnostic efficiency and deliver real-time results, enabling timely interventions.

According to veterinary Poc hematology diagnostics market opportunity analysis rise in adoption of pet insurance is a significant driver for the growth of the veterinary PoC hematology diagnostics market. According to a 2024 article by North American Pet Health Insurance Association, the total number of pets insured in the U.S. at year-end 2023 was nearly 5.7 million. As pet ownership rises globally, more pet owners are investing in insurance policies to manage the high costs of veterinary care, including diagnostic tests and treatments.

Pet insurance coverage often includes routine blood tests, early disease detection, and emergency diagnostics, leading to higher demand for PoC hematology devices in veterinary clinics. In addition, the expansion of pet insurance policies that cover chronic disease management and preventive care encourages veterinarians to conduct frequent hematological assessments, further fueling the veterinary Poc hematology diagnostics market growth.

According to veterinary Poc hematology diagnostics market forecast analysis Rise in prevalence of animal diseases is a significant driver for the growth of the veterinary point-of-care (PoC) hematology diagnostics market. Increased incidences of infectious diseases, metabolic disorders, and zoonotic infections in companion and livestock animals have increased the demand for rapid and accurate diagnostic solutions. Emerging and re-emerging pathogens, such as avian influenza, foot-and-mouth disease, and feline leukemia, necessitate efficient hematological testing for early detection and management. In addition, rise in livestock production and globalization of animal trade contribute to the spread of diseases, further emphasizing the need for PoC diagnostics driving the veterinary Poc hematology diagnostics market growth.

With pet ownership on the rise, veterinary practitioners require quick and reliable testing methods to diagnose anemia, infections, and blood-related disorders, enhancing treatment outcomes. The ability of PoC hematology analyzers to deliver immediate results at the site of care reduces turnaround times, enabling faster clinical decisions. Rise in awareness among veterinarians and pet owners about the benefits of early disease detection and preventive healthcare also drives the growth of veterinary Poc hematology diagnostics market size.

Segmental Overview

The Veterinary PoC hematology diagnostics industry is segmented on the basis of product type, application, animal type, end user, and region. On the basis of product type, the market is divided into instruments and consumables. The instruments segment is further divided into hematology analyzers, blood gas and electrolyte analyzers, coagulation analyzers, and others. On the basis of application, the market is divided into blood disorders, metabolic disorders, and other conditions. On the basis of animal type, the market is divided into livestock animals, companion animals, and others. The livestock animals segment is further classified into cattle, swine, poultry, and others. The companion animals segment is further divided into dogs, horse, cats, and others.

On the basis of end user, the market is segregated into veterinary clinics, veterinary hospitals, research laboratories, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

By Product Type

The consumables segment dominated the veterinary PoC hematology diagnostics market share in 2024, owing to rise in demand for reagents, test kits, and cartridges required for conducting diagnostic tests. Unlike diagnostic instruments, which represent a one-time capital investment, consumables need to be replenished regularly, ensuring continuous revenue generation. The growing pet population and increasing awareness about preventive veterinary care have led to higher testing volumes, further driving the demand for consumables.

By Application

The blood disorders segment dominated the veterinary PoC hematology diagnostics market share in 2024, attributed to high prevalence of anemia, thrombocytopenia, and coagulation disorders in companion and livestock animals. Increased pet ownership and rise in awareness about animal health have driven the demand for rapid and accurate point-of-care (PoC) diagnostic solutions for early detection and management of hematological conditions. In addition, advancements in hematology analyzers and biomarker-based tests have improved the efficiency of diagnosing blood-related ailments, enabling veterinarians to initiate timely treatment.

By Animal Type

The livestock animals segment dominated the market in terms of revenue in 2024, attributed to attributed to increase in demand for rapid and accurate disease detection in cattle, sheep, pigs, and other farm animals. Rise in prevalence of infectious diseases, such as bovine leukemia and swine fever, has driven the need for PoC diagnostic solutions that enable early detection and timely intervention. In addition, the growing emphasis on livestock health management to enhance productivity and ensure food safety has led to higher adoption of hematology diagnostic tests.

By End User

The veterinary clinics segment dominated the market in terms of revenue in 2024, attributed to increase in demand for rapid and accurate diagnostic testing in clinical settings. Veterinary clinics serve as the primary point of care for a large number of pet owners, driving the need for on-site hematology diagnostics that facilitate timely disease detection and treatment. The growing pet population, coupled with rise in awareness about animal health, has led to higher diagnostic testing rates in clinics. Also, advancements in PoC hematology analyzers, offering quick and reliable results with minimal sample requirements, have further boosted adoption in veterinary clinics.

By Region

The veterinary PoC hematology diagnostics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America dominated the market in terms of revenue in 2024, owing to high adoption of advanced diagnostic technologies, a well-established veterinary healthcare infrastructure, and increased spending on pet healthcare. The region has a strong presence of key market players offering innovative diagnostic solutions, along with a growing awareness of the importance of early disease detection in companion and livestock animals. Additionally, rise in pet ownership, coupled with the willingness of pet owners to spend on diagnostic tests, has significantly contributed to the market growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period owing to rise in awareness about animal health, rapid urbanization, and the expanding livestock industry in countries such as China, India, and Japan. The region is witnessing surge in pet adoption, driven by rise in disposable incomes and changing lifestyles, leading to a greater demand for veterinary diagnostic services. Also, rise in prevalence of zoonotic diseases and government initiatives to improve animal healthcare infrastructure are accelerating market expansion.

Competition Analysis

Major key players that operate in the global veterinary PoC hematology diagnostics market are Volition, Virbac, Fujifilm Holdings Corporation, Siemens AG, Zhejiang Pushkang Biotechnology Co., LtD., Chengdu Seamaty Technology Co., Ltd, Antech Diagnostics, Inc, IDEXX Laboratories, Inc, Zoetis Services LLC, and Bionote USA Inc. Key players operating in the market have adopted product launch and agreement as their key strategies to expand their product portfolio.

Recent Developments in the Veterinary PoC Hematology Diagnostics Industry

- In April 2024, Volition announced that its Nu.Q Vet Cancer Test is now available in clinics to veterinarians across the U.S and Europe through Antech, a leading veterinary diagnostics company.

- In March 2024, Volition announced supply agreement with Fujifilm Vet Systems Co. Ltd., a leading veterinary diagnostic laboratory service, to launch the Nu. Vet Cancer Test to veterinarians in Japan.

- In December 2024, Zoetis Services LLC announced the launch of its new screenless point-of-care hematology analyzer, Vetscan OptiCell. It isthe first cartridge-based, artificial intelligence (AI) powered diagnostic tool for veterinary hematology, providing complete blood count (CBC) analysis for accurate insights in minutes.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the veterinary poc hematology diagnostics market analysis from 2024 to 2030 to identify the prevailing veterinary poc hematology diagnostics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the veterinary poc hematology diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global veterinary poc hematology diagnostics market trends, key players, market segments, application areas, and market growth strategies.

Veterinary Poc Hematology Diagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 2.3 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2024 - 2030 |

| Report Pages | 473 |

| By Product Type |

|

| By Application |

|

| By Animal Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Siemens Healthineers AG, Volition, Fujifilm Holdings Corporation, Chengdu Seamaty Technology Co., Ltd., Bionote USA Inc., IDEXX Laboratories, Inc., Zoetis Services LLC, Virbac SA, Zhejiang Pushkang Biotechnology Co., Ltd., Antech Diagnostics, Inc. |

The total market value of Veterinary PoC Hematology Diagnostics Market was $1.3 billion in 2024.

The market value of Veterinary PoC Hematology Diagnostics Market is projected to reach $2.2 billion by 2030.

The forecast period for Veterinary PoC Hematology Diagnostics Market is 2025 to 2030.

The growth of the Veterinary PoC Hematology Diagnostics Market is driven by advancements in PoC diagnostic technology, growing pet adoption and rise in live stock population. Furthermore, the growing adoption of pet insurance also contribute significantly in the market growth.

The base year is 2024 in Veterinary PoC Hematology Diagnostics Market.

Top companies such as Volition, Antech Diagnostics, Inc, IDEXX Laboratories, Inc, and Zoetis Services LLC held a high market position in 2024.

Loading Table Of Content...

Loading Research Methodology...