Vetronics Market Overview, 2030

The global vetronics market was valued at $4.2 billion in 2020, and is projected to reach $6.5 billion by 2030, growing at a CAGR of 4.67% from 2021 to 2030.The vetronics system can be coined as the combination of two words vehicle and electronics. The market refers to all electronics and communications systems that are used in vehicles for effective operations. This terminology is used for military and homeland security vehicles. Vetronics systems can be considered as the digital hub of military vehicles. The system is responsible to control several critical operations such as mobility system, inter-vehicle communication, and self-protection. Completely redundant vetronics system encompasses robust hardware and software interface to perform required operations. Military vetronics systems can be either line fit or retro-fit. In line fit, vehicle manufacturers integrate their pre-designated vetronics system within a set of military vehicles, whereas in retro-fit, the vetronics system are integrated in the aftermarket. Rise in demand to access open military vetronics with an open architecture to cater to single system multiple types of vehicles is expected to expand business opportunities.

Factors such as year-on-year rise in global defense budget expenditure, fueled by nations such as the U.S., Russia, China, and India, along with budget allocation toward acquisition and modernization of existing military vehicles is expected to drive the market in coming years. The total global military expenditure in 2020 was $1981 billion, which was 2.6% more as compared 2019. U.S., China, Russia, the UK, Germany, and India remains the highest market contributors. Rise in cross border conflicts at global level such as war situation between Russia and Ukraine and possible interference of NATO is anticipated to drive the business opportunities for the vetronics industry.

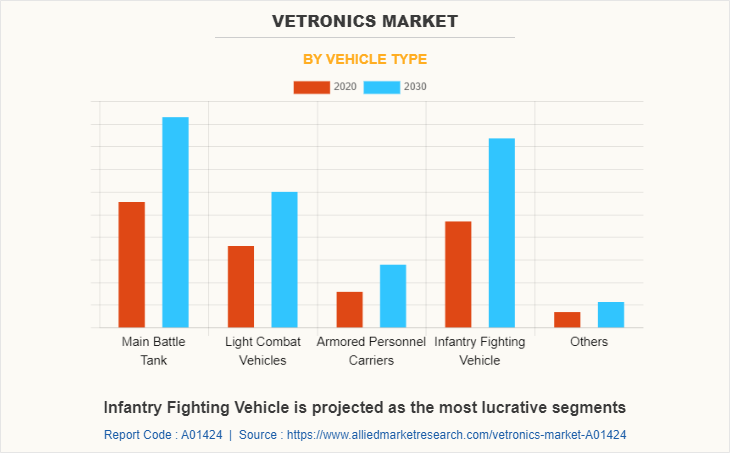

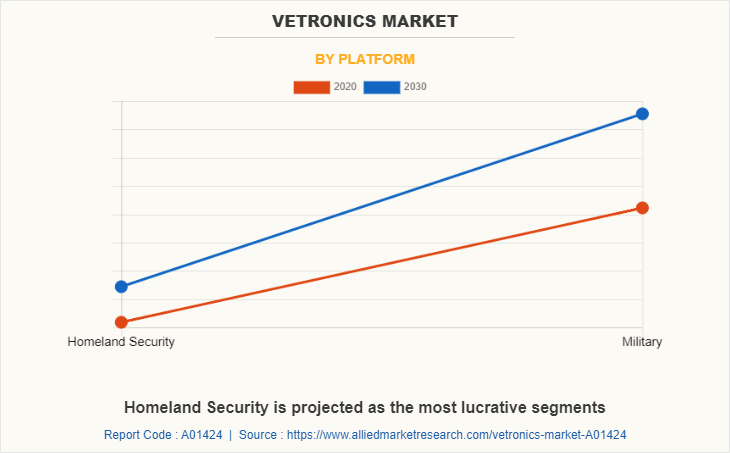

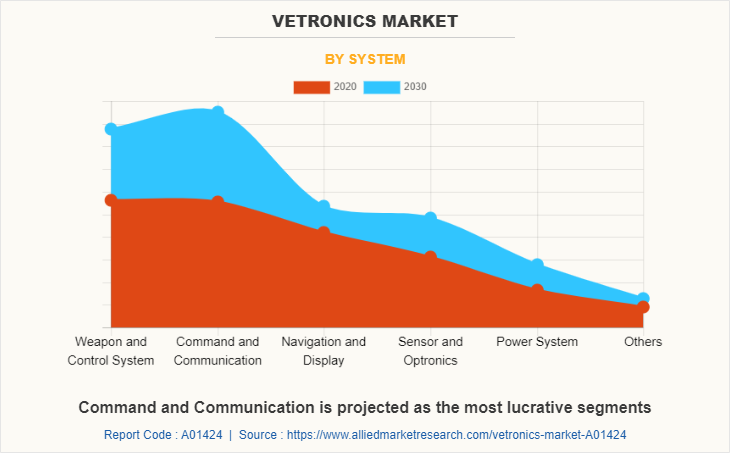

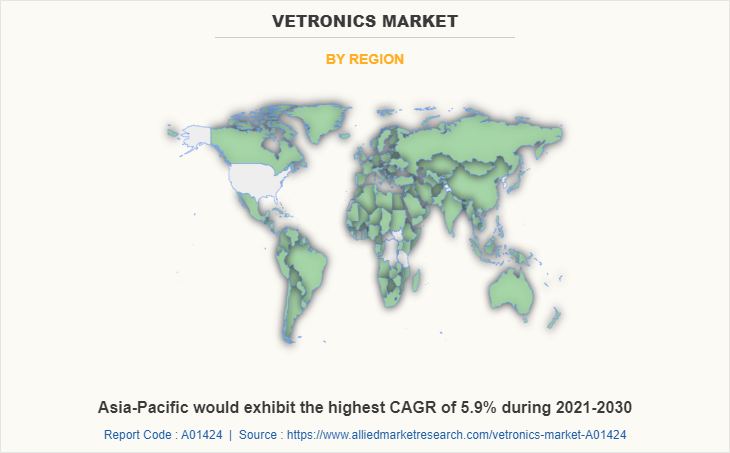

The global vetronics market is segmented on the basis of platform, vehicle type, system, and region. By platform, it is divided into homeland security and military. By vehicle type, it is classified into main battle tank, light combat vehicles, armored personnel carriers, infantry fighting vehicles, and others. By system, it is divided into weapons & control system, command & communication, navigation & display, sensor & optronics, power systems, and Others. By region, the market is analyzed across North, Europe, Asia-Pacific, and LAMEA.

Companies have adopted product development and product launch as their key development strategies in the market. Moreover, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different regions. Key players operating in the vetronics market include Thales Group, Curtiss-Wright Corporation, Saab Ab, General Dynamics Corporation, BAE Systems, Leonardo S.p.A., Rheinmetall AG, Raytheon Technologies Corporation, L3harris Technologies, Inc, and Lockheed Martin Corporation.

Standardization of Vetronics System

There have been notable efforts by several government organizations such as military vetronics association (MILVA), ministry of defense of several nations, and NATO to ensure system standardization. These organizations are releasing mandates to standardize vetronics system on different platforms, suporting open architecture. Panel discussion and exhibitions are conducted by major industry players to boost standardization among vetronics systems and promote open architecture, enabling flexibility in operations and reducing the overall system cost. Integration of open architecture enables users to upgrade their system with new technologies without changing complete system, therefore reducing the overall cost of system upgrade. Manufacturing benefits such as economies of scale can also be achieved as the same system can be integrated on multiple platforms. Logistics optimization due to simplification of components, reduction in training and maintenance cost along with increase life-span of vehicle electronics can be leveraged through standardization and integration of open architecture.

Expanding scope of application

Continuous efforts in research and development done by major industry players such as Lockheed Martin Corporation, Thales Group, and L3Harris in military vetrionics and related subsystems has allowed them to widen their scope of application through releasing innovative and proprietary product range. With rise in hybrid vehicles and unmanned vehicles being integrated in military fleet, the vetroncis market is expected to witness an unprecedented growth rate in the coming years. Electronic motors are capable of generating much higher torque as compared to internal combustion (IC) engine. Electric motors with improved capacities will support hybrid electric drive architecture where IC engine is used to charge batteries within in turn will power the electric motors. A notable amount of vetroncis systems are required to ensure integration of these systems.

Increase in threat of cyber attacks

Redundant vetronics systems are no longer capable to manage rising data management and work bandwidth needed to engage in successful military operations. In addition, technologically advanced vetronics systems that are highly efficient and leverage the benefits of cloud computing are vulnerable to cyber-attacks. New vehicle electronics system regularly exchanges data and information with the central hub through cloud platforms to ensure effective operations. Continuous exchange of data poses a great opportunity for hackers to intercept or corrupt the information. Such factors pose a notable challenge to the military vetronics market.

Integration with Web 4.0

Integration of military vetronics system with web 4.0 state notable business opportunities for the market growth. Symbiotic web systems that are autonomous, collaborative, pro-active, analytical, and data driven along with reasoning and learning capabilities through artificial intelligence (AI) and connected with central processing hub via cloud provide several opportunities for business expansion. The market is emerging toward fully networked and integrated vetronics system, aiming to integrate vehicles, command and control system, aerial vehicles as well as other support vehicles on a single network. Such platforms ensure smooth data transfer across platforms, reduce lead time, and improve efficiency of operations.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the vetronics market analysis from 2020 to 2030 to identify the prevailing vetronics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the vetronics industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global vetronics market trends, key players, market segments, application areas, and market growth strategies.

Vetronics Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Platform |

|

| By System |

|

| By Region |

|

| Key Market Players | Saab Ab, L3Harris Technologies, Inc., BAE Systems plc, Raytheon Technologies Corporation, Curtiss-Wright Corporation, Rheinmetall AG, Leonardo S.p.A, Thales Group, Lockheed Martin Corporation, General Dynamics Corporation |

Analyst Review

The vetronics market is expected to witness a major upsurge in the coming years. Majority of redundant vehicle electronics system are expected to be either discarded or replaced with new and advanced electronics systems. Increase in requirement to transfer more data on a secure platform and perform multiple operations at the same time has generated demand for integrated technologically advanced vetroncis systems in military vehicles. Introduction of unmanned ground vehicles (UGV) and unmanned aerial vehicles (UAV) create a greater demand for comprehensive vehicle electronics networks, positively impacting growth of the market. The market in developed countries such as the U.S., UK, and Russia is expected to capture highest share, whereas the market in developing regions such as India and China is expected to witness highest growth during the forecast period.

Reducing manufacturing cost of vetronics system through adoption of size, weight, and power (SWaP) concept is expected to remain as the primary business strategy of companies operating within the market. The SWaP concept focuses on reducing dimension, weight, and overall power consumption of an electronic component, resulting in reducing manufacturing as well as operation cost. Players are also focusing on integration of open architecture in their vetroncis system to ensure market presence. For instance, in November 2021, Curtiss-Wright launched XMC-528 module with an open-source architecture, allowing system designers to integrate security technology in OPENVPX mosa-based systems.

Internal strategic communication and data security has been an integral part of the military industry and with increasing reliance on machines and unmanned vehicles for several operations, the dependency on command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) systems has increased. In such market scenario, having a vehicle electronic system, which is power efficient, easy to operate, safe, secure, and scalable becomes the primary demand for customers.

Among the analyzed regions, North America is the highest revenue contributor followed by Europe, Asia-Pacific, and LAMEA. Asia-Pacific is expected to maintain the lead during the forecast period, owing to increased CAGR as compared to other regions.

The global Vetronics market was valued at $4.2 billion in 2020, and is projected to reach $6.5 billion by 2030, growing at a CAGR of 4.66% from 2021 to 2030

Key players operating in the vetronics market include Thales Group, Curtiss-Wright Corporation, Saab Ab, General Dynamics Corporation, BAE Systems, Leonardo S.p.A., Rheinmetall AG, Raytheon Technologies Corporation, L3harris Technologies, Inc, and Lockheed Martin Corporation.

The sample for vetronics market report can be obtained on demand from the website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

The key segments covered within the vetronics market are by platform, vehicle type, and system

The types of vetronics can be categorized based on their system. Various systems of vetronics encompass weapons & control system, command & communication, navigation & display, sensor & optronics, and power Systems among others

Loading Table Of Content...