Video Banking Service Market Research, 2031

The global video banking service market was valued at $71.4 billion in 2021, and is projected to reach $247.9 billion by 2031, growing at a CAGR of 13.6% from 2022 to 2031.

Video banking is a term used for performing banking transactions or professional banking consultations via a remote video connection. Service of virtual banking can be performed via purpose-built banking transaction machines or via a video conference enabled bank branch. Moreover, video banking enables personalized and expert service at a distance and is a powerful component of a comprehensive digital customer service strategy. Major benefit is that video banking allows banks to interact with customers digitally in a secure and efficient yet still human way.

The demand for video banking service is increasing, owing to rapid development in automation of the banking industry. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation. In addition, personalized banking services to customers and rapid growth in digital banking services are driving the growth of the market. However, video banking requires strong internet connectivity as well as video conferencing and security and privacy concerns have emerged as key industry problems. On the contrary, technological advancements in the field of banking further give major opportunities for the video banking service market growth.

Segment Review

The report focuses on growth prospects, restraints, and trends of the video banking service market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the video banking service market size.

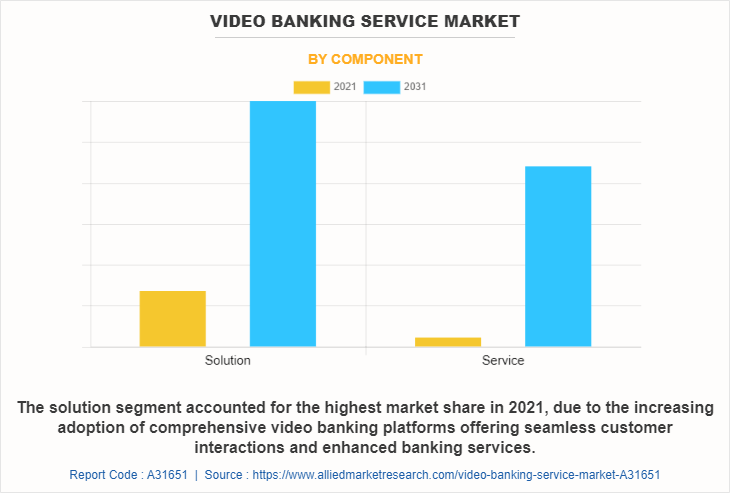

By component, the solution segment attained highest growth in 2021. This is attributed to the fact that with the help of video banking solutions, commercial bankers can schedule video meetings to maintain a personal and meaningful relationship even during remote interactions, ultimately deepening relationships, building trust, and improving investment outcomes.

Region wise, North America attained the highest growth in 2021. This is attributed to growing need of video for financial services, virtual workforce management, and cloud-based collaboration platform are some of the major factors impacting the market growth. In addition, banks and corporations are adopting video collaboration solutions with the aim to make faster decisions and avoid high costs associated with traveling.

The report analyzes the profiles of key players operating in the video banking service market such as AU Small Finance Bank Limited, Barclays, Glia Technologies, Inc., Guaranty Trust Bank Limited, NatWest International, Royal Bank of Scotland plc, Star Financial, StonehamBank, U.S. Bank and Ulster Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the video banking service market share.

The video banking service market is segmented on the basis of component, deployment mode, and application. By component, it is segmented into solution and services. By deployment mode, it is bifurcated into on-premise and cloud. On the basis of application, it is segmented into banks, credit union and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

COVID-19 Impact Analysis

COVID-19 pandemic has accelerated digital technology adoption in the financial sector and the role of financial technology (fintech) firms in supporting households and businesses during the crisis. Moreover, the outbreak of COVID-19 has led to more usage of banking components because remote working and social distancing have helped video banking service to gain a huge customer base. In addition, many banks and fintech industries have introduced various attractive banking strategies for supporting the SME’s and consumers to adopt video banking service, which created numerous opportunities for the market. Thus, COVID-19 pandemic had a positive impact on video banking service market.

Top Impacting Factors

Growth in Digital Banking Services

Growth in digital banking trends leads to the growing use of mobile phones and internet penetration all over the globe, banks are moving toward digital channels to provide their services. Moreover, banks are working in partnership with fintech corporations and other third-party interfaces to create additional customer-centric products & services, and thereby deliver an enhanced customer experience. In addition, government is also initiating and driving the use of digital banking services by various initiatives globally. Furthermore, many banks are implementing machine learning to predict fraud even before it occurs to enhance the security measures in the banking platform. The growth of digital banking is anticipated to benefit significantly from the increased incorporation of innovative technologies in video banking service in the next years. Therefore, this is one of the major driving factors for the video banking service market.

Security Concerns Regarding Privacy of Customers

Privacy and security concerns have emerged as key industry problems due to the extensive flow of customer data. Service providers of video for financial services place a high priority on enhancing client data security against theft, data breaches, and other cyber risks as well as on assuring the secure administration and privacy of customer data. Moreover, with no all-encompassing federal law in place, banks and other financial institutions, including companies that offer digital financial services, face increasing pressure to be proactive in managing consumer privacy. For instance, 80% of bank executives polled in the World Retail Banking Report cited cyber security and privacy as major concerns as the shift to digital banking continues. Therefore, this is a major factor hampers growth of the video banking service market.

Technological Advancement in the Field of Banking

An increasing demand for a digital banking experience from millennials and Gen Z is transforming how the entire banking industry operates. Moreover, consumers’ growing desire to access financial services from digital channels has led to a surge in new banking technologies that are conceptualizing the banking industry. In addition, digitalization is changing how people interact and do business on a day-to-day basis, and advancements in banking technology are continuing to influence the future of financial services around the world. Furthermore, banking industry is undergoing a technological churn right now due to rising competition from fintech startups and increasing concern for cyber-security. Surge in adoption of blockchain and artificial intelligence in the banking industry propels growth of the market. Therefore, these factors provide major lucrative opportunities for growth of the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the video banking service market forecast from 2021 to 2031 to identify the prevailing video banking service market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video banking service market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global video banking service market trends, key players, market segments, application areas, and market growth strategies.

Video Banking Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 247.9 billion |

| Growth Rate | CAGR of 13.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 182 |

| By Component |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | Royal Bank of Scotland plc, Glia Technologies, Inc., ulster bank, NatWest International, stonehambank, U.S. Bank, Star Financial, AU Small Finance Bank Limited, Barclays, Guaranty Trust Bank Limited. |

Analyst Review

Video banking is a term used for performing banking transactions or professional banking consultations via a remote video connection. Moreover, video meetings save time and reduce or eliminate the need for bank employees to commute to work, which can result in shorter wait times for customers. In addition, video communication also enables a more consistent customer journey. By leveraging “face-to-face” long-distance calls, customers can retain their preferred advisor, regardless of where they live or work.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on In July 2021, Popio Mobile Video Cloud, a video banking and collaboration solutions provider, partnered with Jaguar Software, a banking software solutions provider, to integrate Jaguar's digital processing and deposit services into Popio's video platform. With the integration, financial institutions can combine mobile video chat into other banking services such as check and payment processing, according to a press release. Therefore, this strategy will help for the growth of the SAS’s video banking service business.

Some of the key players profiled in the report include AU Small Finance Bank Limited, Barclays, Glia Technologies, Inc., Guaranty Trust Bank Limited, NatWest International, Royal Bank of Scotland plc, Star Financial, StonehamBank, U.S. Bank, and Ulster Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the video banking service market.

The demand for video banking service is increasing, owing to rapid development in automation of the banking industry. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation.

The leading application of Video Banking Service Market are banks, credit unions and others.

North America is the largest regional market for Video Banking Service market.

The estimated industry size of Video Banking Service is projected to reach $ 247,848.91 million by 2031.

AU Small Finance Bank Limited, Barclays, Glia Technologies, Inc., Guaranty Trust Bank Limited, NatWest International, Royal Bank of Scotland plc, Star Financial, StonehamBank, U.S. Bank and Ulster Bank.

Loading Table Of Content...

Loading Research Methodology...