Video Game Software Market Research, 2031

The global video game software market size was valued at $198.5 billion in 2021, and is projected to reach $751.4 billion by 2031, growing at a CAGR of 14.4% from 2022 to 2031.

The rise in demand for work-from-home and remote education policies during the period of the COVID-19 pandemic aided in propelling the growth of the global video gaming market, hence empowering the demand for video game software solutions. Moreover, the increase in demand for easily accessible forms of entertainment and media positively impacts the growth of the video game market. However, hardware and infrastructure requirements of modern video games can hamper the video game software market forecast. On the contrary, the emergence of advanced technologies such as virtual reality and mixed reality with video game software solutions suites are expected to offer remunerative opportunities for expansion of the video game software industry during the forecast period.

A video game software is a program that allows users to interact with the game through the use of a user interface or input devices such as joysticks, controllers, keyboards, or motion sensor devices. Video game software programs use a platform that is a combination of electronic components and computer hardware along with associated software. These platforms are required for video games to function. The video game software market is segmented into Device Type, End User and Genre.

The video game software market is segmented on the basis of device type, end user, genre, and region. On the basis of device type, the industry is divided into smartphones, consoles, PC, and others. On the basis of end-user, the market is classified into personal and commercial. On the basis of genre, the market is classified into action, adventure, role-playing, simulation, strategy, sports, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the video game software market analysis are Activision Blizzard, Apple, Inc, Beijing Babeltime Technology Co., Ltd., Electronics Art, Inc, Konami Holdings Corporation, Lucid Games, Microsoft Corporation, Nintendo, Nova Gaming Ventures Private Limited, Rovio Entertainment Corporation, Sony Interactive Entertainment., Square Enix Holdings Co. Ltd, Tencent Holdings Limited, TA Games Studio, Ubisoft Entertainment SA, Virtous Holdings Pte. Ltd, Zeus Interactive Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

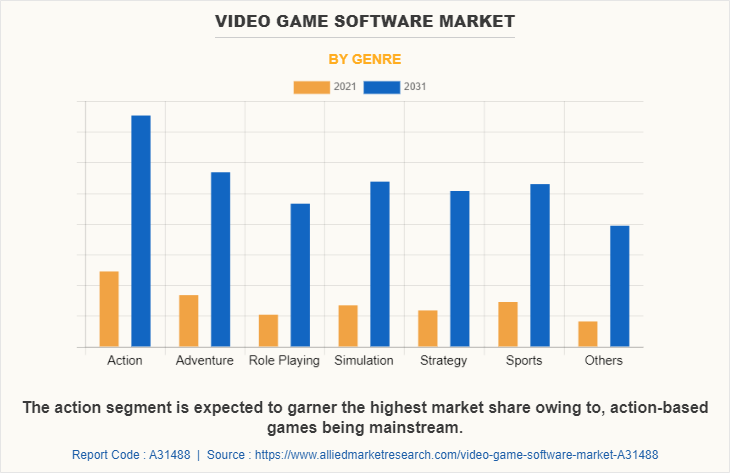

On the basis of genre, the action segment dominated the video game software market share in 2021, and is expected to continue this trend during the forecast period owing to the action genre gaining high attention from the mainstream media with popular games like Call of Duty and battlefield franchises. However, the role playing segment is expected to witness the highest growth in the upcoming years, owing to the rise in popularity of games like Elden Ring and Witcher.

On the basis of region, the video game software market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of video game developers and vendors such as Activision Blizzard, Apple, Inc, and Rovio Entertainment Corporation. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid economic and technological developments in the region, which is further expected to fuel the video game software market growth in the region.

The report focuses on growth prospects, restraints, and analysis of the global video game software market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global video game software market share.

Top Impacting Factors

Rise in popularity of video games

In the recent few years, video games have gained immense popularity and have become more mainstream than ever before. According to an article published by FinancesOnline, more than 2.69 billion people were playing video games in 2020. With an audience of more than 34.5% of the world’s population consuming media in the format of video games, the video games market is expected to reach $169.7 billion by the end of 2025 with a CAGR of 12% (as per a report published by FinancesOnline). This is enabling video game developers to be able to even cater to a specific audience’s niche such as VR and AR games. According to an article published by GamesIndustry.biz, the virtual reality gaming market was valued at $3.2 billion in the year 2020. Such instances are promising great opportunities for the future of the video game software industry.

Developments in video game library

There has been an increase in the number of video game vendors actively developing AAA titles in the past few years. Furthermore, the increase in adoption of cloud gaming aids the future growth of video games and other gaming-related services. Moreover, the COVID-19 pandemic helped fuel the number of investments coming into the video gaming ecosystem, as people were in search of newer avenues for entertainment during the period of COVID-19 lockdowns.

For instance, in March 2021, Meta Platforms, Inc. (formerly known as Facebook, Inc.) announced the launch of more than 60 games for their Oculus Quest platform. Such instances are showcasing the growth potential for the video game market in the coming years. This was proven by the rise in number of active players in online games during the period. According to an article published by The Washington Post, in May 2020, Microsoft reported a 130% increase in multiplayer engagement across March and April with more than 10 million active Xbox game pass subscribers. Such factors supported the growth of the market during the period.

COVID-19 Impact Analysis

The video game software market has witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increased screen time and digital presence of people during the period of COVID-19-induced lockdowns and social distancing policies. This increase in the video gaming industry was driven by the fact that the majority of the people were quarantined within their houses and relied on video games for their entertainment needs, which caused the video gaming market to flourish during the period.

For instance, according to Nielsen Games Video Game Tracking (VGT), the number of gamers who say they are playing video games more now due to the COVID-19 pandemic has increased since March 23, 2020. The increase was reportedly highest in the U.S. (46%), followed by France (41%), the UK (28%), and Germany (23%). Similar trends were being noticed all across the world, which supported the growth of the global video game software market during the period. Moreover, the lack of social interaction and activities during the social distancing phase of the pandemic further fueled the dependence on video game software solutions during the period.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the video game software market analysis from 2021 to 2031 to identify the prevailing video game software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the video game software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global video game software market trends, key players, market segments, application areas, and market growth strategies.

Video Game Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 751.4 billion |

| Growth Rate | CAGR of 14.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Device Type |

|

| By End User |

|

| By Genre |

|

| By Region |

|

| Key Market Players | Zeus Interactive Co., Ltd., Virtous Holdings Pte. Ltd, Tencent Holdings Limited, Activision Blizzard, Rovio Entertainment Corporation, TA Games Studio, Beijing Babbletime Technology, Co. Ltd, Electronics Art, Inc, Square Enix Holdings Co. Ltd, Lucid Games, Nova Gaming Ventures Private Limited, Nintendo, Ubisoft Entertainment SA, Apple, Inc., Microsoft Corporation, Konami Holdings Corporation, Sony Interactive Entertainment |

Analyst Review

Demand for video games has been on a rise for the past few years and is expected to continue to grow further in the coming years, owing to the growth in popularity of digital entertainment tools that can help provide an immersive and engaging user experience, without having the user to leave the confines of their home. In addition, growth in digital and internet penetration in many regions of the world promises new opportunities for the growth of the social media and video game software market.

Key providers of the video game software market such as Nintendo, Electronics Art, Inc, and Microsoft Corporation account for a significant share of the market. Various companies establish partnerships to increase their video game development capabilities with larger requirements for video game software and services. For instance, in March 2022, Square Enix Holdings Co., Ltd. announced a collaboration with Qualcomm Inc. Under this collaboration, both companies are anticipated to develop new innovations for Qualcomm’s snapdragon spaces project to create immersive, head-worn augmented and mixed reality (AR/MR) gaming experiences.

In addition, with the increase in demand for video game software, various companies expand their current product portfolio with increase in diversification among customers. For instance, in May 2022, Rovio Entertainment Corporation announced the launch of a custom Angry Birds-themed DLC for Minecraft. The DLC gives Minecraft: Bedrock Edition players an opportunity to experience the classic Angry Birds slingshot game in an all-new way, as well as some extra adventures and cosmetic goodies to use in the game.

Moreover, market players are expanding their business operations and customers by increasing their acquisitions. For instance, in January 2022, Sony Interactive Entertainment announced the acquisition of a premier independent videogame developer and creator of Halo and Destiny, Bungie, Inc. This acquisition gave Sony Interactive Entertainment access to Bungie’s world-class approach to live game services and technology expertise, furthering SIE’s vision to reach billions of players.

The rise in demand for work-from-home and remote education policies during the period of the COVID-19 pandemic aided in propelling the growth of the global video gaming market, hence empowering the demand for video game software solutions.

On the basis of region, the video game software market was dominated by North America in 2021, and is expected to retain its position during the forecast period, owing to its high concentration of video game developers and vendors such as Activision Blizzard, Apple, Inc, and Rovio Entertainment Corporation.

The global video game software market size was valued at $198.52 billion in 2021, and is projected to reach $751.39 billion by 2031, growing at a CAGR of 14.4% from 2022 to 2031.

The key players profiled in the video game software market analysis are Activision Blizzard, Apple, Inc, Beijing Babeltime Technology Co., Ltd., Electronics Art, Inc, Konami Holdings Corporation, Lucid Games, Microsoft Corporation, Nintendo, Nova Gaming Ventures Private Limited, Rovio Entertainment Corporation, Sony Interactive Entertainment., Square Enix Holdings Co. Ltd, Tencent Holdings Limited, TA Games Studio, Ubisoft Entertainment SA, Virtous Holdings Pte. Ltd, Zeus Interactive Co., Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...