Vietnam Hard Document Storage Market Overview:

The Vietnam hard document storage market size was valued at $19,042.0 thousand in 2017, and is projected to reach $30,679.4 thousand by 2025, growing at a CAGR of 6.2% from 2018 to 2025. The Vietnam hard document storage market is analyzed based on its prospect and future growth rate. The report highlights numerous factors influencing the market, which include market forecast, trends, drivers, restraints, opportunities, and role of different key players operating in the market. It emphasizes on various sectors that use hard document storage services, such as BFSI, healthcare, telecommunications, real estate, energy & utilities, and legal & education. Moreover, it focuses on Vietnam hard document storage market in various cities such as Ho Chi Minh City, Hanoi City, and rest of Vietnam. The report also provides analysis on the opportunities for new entrants in the market and various methods of entry in the market.

Hard document storage services are the best and convenient option for all BFSI, real estate, legal, healthcare, and other industries. Hard document storage services meet all requirements perfectly for storing hard documents securely. These services include vault storage specially designed with climate-controlled environment, to negate degradation of papers they provide services such as document indexing, off-site media storage, tape & microfilm storage, document archiving, and others. These services save space and time and are cost-effective. These services are more efficient choice for small-scale industries as they help reduce the cost involved in data management. Large industries can also use these services to store clients and employee records thus leading to growth of hard document storage in the country. Vietnam is among one of the developing economies across the world. Since 2010, the growth of Vietnams GDP has been at least 5% per year, and in 2017 it peaked at 6.8%. With such rapid economic growth, the country grew from one of the poorest countries in the world to a comfortably middle-income one. The country is investing heavily in the development of manufacturing, agriculture, and service industries. Leading industrial sectors include food processing, garments, shoes, machine building, mining, cement, chemical fertilizers, and others. All these industries need effective and proper hard document storage market.

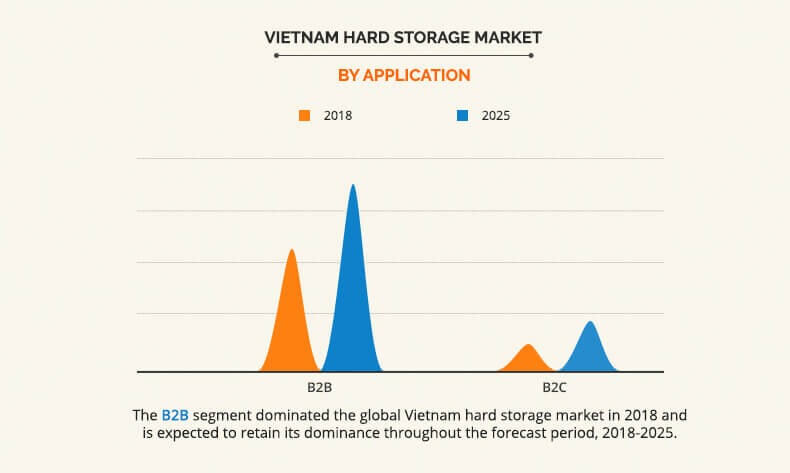

The Vietnam hard document storage market is segmented based on application and city. Based on application, it is bifurcated into B2B and B2C. Based on city, the market is classified into Ho Chi Minh City, Hanoi City, and rest of Vietnam.

Based on application, the market is categorized into B2B and B2C. In 2017, B2B segment held the major share in the Vietnam hard document storage services market in 2017, and is expected to retain its dominance during the forecast period. The business-to-business segment consists of large customer base. With their important personal documents, it can be difficult to find space to hold all documents that are related to each individual. This is anticipated to fuel the demand for hard document storage services during the forecast period.

Based on city, the market is categorized into Ho Chi Minh City, Hanoi City, and rest of Vietnam. In 2017, Ho Chi Minh City occupied the largest share, growing at a CAGR of around 6.8% during the forecast period. Ho Chi Minh City, also known as Saigon, is Vietnams economic and financial center accounting for more than 33% of Vietnams GDP. With a population of over 3.4 million, this dynamic city is widely seen as one of the largest markets for technology and manufacturing in the region and the top emerging property market in Asia-Pacific.

The leading players in the Vietnam hard document storage market have focused on product launch and development of warehouse as their key strategies to gain a significant share in the Vietnam hard document storage market. The key players profiled in the report include Crown Record Management, KINGKHO, Royal Cargo Vietnam Co. Ltd., AGS Four Winds Vietnam, Santa FE, Vietnam Moving Limited Liability Company, Asia Tigers Mobility, Interlink Co., Ltd, Saigon Storage, and Logical Moves.net.

Key Benefits forVietnam Hard Document Storage Market:

This report presents a quantitative analysis of the current trends, estimations, and dynamics of the Vietnam hard document storage market size from 2018 to 2025 to identify the prevailing market opportunities.

The key city in the country is mapped based on their market share.

Porters five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplierbuyer network.

An in-depth analysis of the Vietnam hard document storage market segmentation assists in determining the prevailing market opportunities.

Major cities in the country are mapped according to their revenue contribution to the industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional key players, market segments, application areas, and growth strategies.

Vietnam Hard Document Storage Market Report Highlights

| Aspects | Details |

| By Application |

|

| By COUNTRY |

|

| Key Market Players | SANTA FE, ALLIED PICKFORDS, INTERSKY MOVING AND STORAGE, ROYAL TRANS CO., LTD, CROWN RECORDS MANAGEMENT, UNIGROUP WORLDWIDE UST VIETNAM, ASIAN TIGERS MOBILITY, SAIGON STORAGE, KINGKHO, VIETNAM MOVING CO., LTD |

Analyst Review

The development of end-use industries such as Construction, BFSI, real estate, legal, healthcare, and others is a significant factor that drives the growth of the hard document storage services market.

Currently, Vietnam is at the peak of its economic development led by free trade agreements (FTAs) such as the EU-Vietnam FTA and an increasingly deregulated business environment. However, the country still experience challenges in respect of planning, traffic congestion, security, health, education, energy, housing development, and environmental pollution. Development of numerous businesses related to construction, BFSI, real estate, legal, healthcare, and other sectors in Vietnam are still in transition stage. All these industries will need an effective data storage management system including hard document storage to keep a track of their businesses. Storing hard document is also essential for a wide variety of important processes of business such as auditing, documentation, litigation, and strategic planning. Development of these end-user industries in Vietnam drives the growth of the hard document storage services market.

The hard document storage services market in Vietnam is stable and highly capital-intensive. Major players of Vietnam hard document storage service market such as Crown record management, Royal Cargo Vietnam Co. Ltd, AGS Four winds Vietnam, Asia Tigers Mobility, and others are proactively investing in their businesses regarding infrastructure, transportation, building architecture, and others, which contributes to the growth of hard document storage service industry. For instance, the development and introduction of digital scans and construction of large size warehouse for document storage market by Crown record management was adopted to cater to the growth in market demand and introduce new technology product to the market.

Loading Table Of Content...