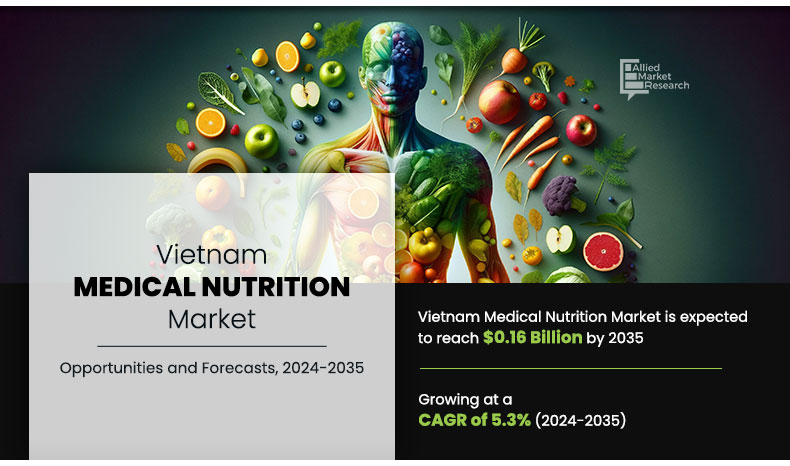

Vietnam Medical Nutrition Market Research, 2035

The Vietnam medical nutrition market size was valued at $0.09 billion in 2023, and is projected to reach $0.16 billion by 2035, registering a CAGR of 5.3% from 2024 to 2035. The growth of the Vietnam medical nutrition market is driven by rise in demand for enteral and oral nutrition. For instance, Abbott, formed strategic partnerships with the Departments of Vietnam Ministry of Health (MOH) and the Asia-Pacific Economic Cooperation (APEC) for long-term improvements to public healthcare. The company’s support on MOH and APEC health initiatives (including food safety, maternal health, and clinical nutrition) led the MOH to grant Abbott an MOH Award recognizing the company’s contributions in Vietnam.

Medical nutrition is a specialized field dedicated to using targeted dietary interventions to manage medical conditions and improve health outcomes. It focuses on developing and administering nutritional products tailored to meet the specific needs of individuals dealing with chronic illnesses, malnutrition, or metabolic disorders. These products provide essential nutrients, vitamins, and minerals to support physiological functions, boost immune response, and aid in recovery. By optimizing metabolic pathways, enhancing nutrient absorption, and preventing disease-related complications, medical nutrition helps manage symptoms and improve patients' quality of life.

Key Takeaways

- On the basis of product type, the enteral & oral nutrition segment dominated the market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

- On the basis of application, the others segment dominated the market share in 2023. However, the cancer segment is anticipated to grow at the highest CAGR during the forecast period.

- On the basis of end user, the home care segment dominated the market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

- On the basis of distribution channel, the drug store and retail pharmacies segment dominated the market share in 2023. However, online providers segment is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The Vietnam medical nutrition market is experiencing robust growth driven by several key factors, including rising healthcare awareness, increasing prevalence of chronic diseases, and strategic partnerships among industry players. One of the primary drivers is the growing incidence of chronic conditions, such as cancer and diabetes. According to the World Health Organization (WHO) report in 2022, Vietnam recorded 180,480 new cancer cases, which underscores the urgent need for specialized nutritional support to maintain the strength of patients during treatment. The increasing prevalence of diabetes, as highlighted by the International Diabetes Federation (IDF), further amplifies the demand for medical nutrition products. In 2021, approximately 3,994.1 thousand individuals in Vietnam were reported to have diabetes, with projections indicating a rise to 6,015.3 thousand by 2045. These statistics indicate a substantial market opportunity for medical nutritional products tailored to these specific health challenges, as patients require dietary interventions to manage their conditions effectively.

However, the Vietnam medical nutrition market pose significant challenges. One of the primary obstacles is the lack of awareness regarding the importance of medical nutrition among both healthcare providers and patients. Many individuals in Vietnam still view nutritional products as supplementary rather than essential components of their health regimen, which can limit market penetration. Additionally, there may be regulatory hurdles that affect the availability and approval of medical nutrition products, potentially leading to delays in product launches and limiting access to essential therapies for patients. The overall healthcare infrastructure in Vietnam, while improving, still faces challenges in terms of capacity and accessibility, particularly in rural areas where healthcare services are less developed. This situation can hinder the effective distribution of medical nutrition products and reduce their reach among the populations that need them most.

Despite these challenges, there are significant opportunities for growth within the Vietnam medical nutrition market. The presence of key players offering medical nutritional products, along with growing initiatives through partnerships and collaborations, is contributing positively to Vietnam medical nutrition market expansion. For instance, Abbott has forged strategic partnerships with the Departments of Vietnam's Ministry of Health (MOH) and the Asia-Pacific Economic Cooperation (APEC) to foster long-term improvements in public healthcare. Abbott's involvement in health initiatives focusing on food safety, maternal health, and clinical nutrition has not only led to the company receiving an MOH Award for its contributions in Vietnam but also elevated healthcare standards in the country. These partnerships enhance the visibility and credibility of medical nutrition products, thereby promoting their adoption among healthcare providers and patients alike.

The growing awareness of the importance of preventive healthcare also presents a lucrative opportunity for the medical nutrition market in Vietnam. As the population becomes more health-conscious, there is a greater willingness to invest in products that enhance overall health and well-being. This trend is particularly evident among the aging population, which is increasingly seeking nutritional solutions to address age-related health concerns. Additionally, as the Vietnamese economy continues to grow, disposable incomes are rising, allowing consumers to invest more in health products, including medical nutrition solutions.

Moreover, innovation in product development presents a significant growth opportunity for the Vietnam medical nutrition market. Companies that prioritize research and development can formulate specialized nutritional products designed to meet the specific needs of diverse patient populations, particularly those with chronic diseases. By focusing on evidence-based nutrition, these companies can build credibility among healthcare professionals, who are more inclined to endorse products supported by clinical research. This emphasis on tailored solutions not only addresses the unique health challenges faced by patients but also aligns with the broader trend towards personalized medicine, enhancing the overall effectiveness and adoption of medical nutrition products within the healthcare system.

Segmental Overview

The Vietnam medical nutrition market is segmented into product type, application, end user, and distribution channel. On the basis of product type, it is segmented into infant nutrition, parenteral nutrition, and enteral & oral nutrition. The parenteral nutrition segment is further categorized into dextrose-based products, fat-based products, and additives-based products. The enteral & oral nutrition segment is further categorized into standardized, semi elemental, and specialized. On the basis of application, the market is classified into diabetes, cancer, gastrointestinal diseases, chronic kidney disease, chronic liver disease, intensive care, chronic obstructive pulmonary disease, and others. The cancer segment is further divided into infants and children, adults and geriatric. The others segment is further segmented into phenylketonuria, tyrosinemia, homocystinuria, isovaleric acidemia, maple syrup urine disease, intractable epilepsy, allergies and rest of all other diseases. As per end user, it is divided into private hospitals, public hospitals and home care. On the basis of distribution channel, the Vietnam medical nutrition market is divided into hospital pharmacies, drug store & retail pharmacies, and online providers.

By Product

The enteral & oral nutrition segment dominated the market share in 2023 and is expected to register the highest CAGR during the forecast period owing to its effectiveness in delivering nutrition orally and directly to the gastrointestinal tract. This approach supports natural digestion processes and is increasingly favored for patients with functional GI tracts. It improves nutrient absorption, lowers infection risks compared to parenteral methods, and aids in overall recovery by promoting a more physiological digestive environment and enhancing patient comfort during nutritional therapy.

By Product

Enteral & Oral Nutrition segment held a dominant position in the market in 2023 and is anticipated to grow at a fastest rate during the forecast period.

By Application

The others segment dominated the market share in 2023. The growth of the medical nutrition market is driven by increasing awareness and diagnosis of rare metabolic disorders that require specialized nutritional products for effective management and symptom relief. Advancements in genetic screening and the greater availability of targeted nutritional solutions specifically designed for these disorders are further propelling demand in this segment, contributing to its significant growth rate and enhancing treatment outcomes for affected patients.

However, the cancer segment is expected to register the highest CAGR during the forecast period. This demand is driven by the need for specialized nutritional support in cancer patients. Nutritional products play a vital role in managing treatment-related side effects, boosting immune function, and preserving body weight and muscle mass during therapy. This support is crucial for helping cancer patients tolerate and recover from treatments like chemotherapy and radiation, fueling significant demand in this segment.

By Application

Others segment held a dominant position in the market in 2023 and cancer segment is anticipated to grow at a fastest rate during the forecast period.

By End User

The homecare segment dominated the market in 2023 and is expected to register the highest CAGR during the forecast period. This growth is fueled by rising demand for at-home treatment options, as patients increasingly prioritize convenience and comfort, especially for long-term care. Homecare solutions ease the strain on healthcare facilities, making them a preferred option for managing chronic conditions, rehabilitation, and elderly care, further driving market expansion.

By End User

Homecare segment held a dominant position in the market in 2023 and is anticipated to grow at a fastest rate during the forecast period.

By Distribution Channel

The drug store & retail pharmacies segment dominated the market in 2023. This is due to the wide availability and accessibility of these outlets, making it convenient for consumers to obtain medical nutrition products. Drug stores and pharmacies also enjoy strong customer trust and offer personalized service, fostering repeat purchases. Additionally, their knowledgeable staff can guide customers effectively, further positioning them as a preferred source for nutritional products.

However, the online providers segment is expected to register the highest CAGR during the forecast period owing to growing shift toward digital healthcare solutions and the convenience they provide. Demand for medical nutrition products through e-commerce platforms is increasing as consumers become more accustomed to online shopping. Online providers offer a broad selection of medical nutrition products, frequently at competitive prices, making them an appealing option for consumers looking for both affordability and convenience.

Competition Analysis

Competitive analysis and profiles of the major players in the Vietnam medical nutrition market include Abbott Laboratories, B.Braun SE, Baxter International Inc., Fresenius SE & Co. KGaA, Nestle S.A, Nutifood, Reckitt Benckiser Group PLC, Danone, Dutch Medical Food, and Otsuka Holdings Co., Ltd. The key players have adopted various strategies, such as agreement, to strengthen their service portfolio.

Analyst Review

This section provides various opinions of top-level CXOs in the Vietnam medical nutrition market. According to the insights of CXOs, the rising prevalence of chronic diseases and metabolic disorders is a major driver of growth in the Vietnam medical nutrition market. CXOs highlighted that awareness is growing among patients and healthcare providers about the role of medical nutrition in managing conditions such as cancer, phenylketonuria, tyrosinemia, and gastrointestinal disorders. These insights emphasize that patients benefit significantly from nutritional interventions that support treatment, recovery, and overall health outcomes.

Additionally, CXOs pointed out that advancements in medical nutrition products, including diverse flavors and convenient formulations, are enhancing patient compliance and satisfaction, which positively impacts adoption rates. The presence of key players and partnerships with health authorities also contributes to market growth by promoting medical nutrition and healthcare standards in the country.

Furthermore, CXOs indicated that Vietnam's aging population, combined with the increased incidence of diet-related conditions, positions the medical nutrition market as essential within the country’s evolving healthcare sector, creating further opportunities for innovation and expansion.

The total market value of Vietnam medical nutrition market is $0.09 billion in 2023.

The market value of Vietnam medical nutrition Market in 2035 is $0.16 billion.

The forecast period for Vietnam medical nutrition Market is 2024 to 2035.

The base year is 2023 in Vietnam medical nutrition Market.

enteral and oral nutrition segmnet accounted for the largest market share in 2023 owing to its effectiveness in delivering nutrition orally, and directly to the gastrointestinal tract, which supports natural digestion processes. This approach is increasingly preferred for patients with functional GI tracts, as it enhances nutrient absorption, reduces infection risks compared to parenteral methods, and promotes overall recovery.

Medical nutrition is a specialized field that focuses on the use of targeted dietary interventions to manage medical conditions and improve health outcomes. It involves the formulation and administration of specific nutritional products designed to address the unique needs of individuals with various health issues, such as chronic diseases, malnutrition, or metabolic disorders.

Loading Table Of Content...