Viral Vector Production Market Research, 2032

The global viral vector production market size was valued at $1.1 billion in 2022, and is projected to reach $6.1 billion by 2032, growing at a CAGR of 18.8% from 2023 to 2032. Viral vectors are genetically modified viruses that are used as vehicles to deliver specific genes or genetic material into cells. They are extensively utilized in biotechnology and gene therapy to introduce therapeutic genes, correct genetic defects, or manipulate cellular processes. There are several types of viral vectors commonly used in biotechnology such as adenoviruses (AdV), adeno-associated viruses (AAV), lentiviruses, retroviruses, and others.

Adenoviral vectors are derived from adenoviruses, which naturally infect humans and cause respiratory illnesses whereas AAV vectors are derived from non-pathogenic viruses that depend on co-infection with helper viruses, such as adenoviruses, for replication. These viral vectors have wide applications in the biotechnology and pharmaceutical industries. They have revolutionized the fields of biotechnology and gene therapy, enabling the development of innovative treatments and tools for understanding and manipulating genetic processes.

Market Dynamics

The rise in the prevalence of cancer, infectious diseases, and genetic disorders has had a significant impact on the market. The increase in burden of these diseases has created a growth in demand for innovative therapies, including gene therapy. There is a corresponding increase in the demand for viral vectors to support the development and manufacturing of gene therapies as the prevalence of these diseases continues to rise. This has driven the growth of the viral vector production market size.

In addition, the adoption of strategies in the viral vector production market has contributed to its expansion. Companies implement various approaches to enhance efficiency, increase production capacity, and improve cost-effectiveness. Viral vector production companies can meet the rise in demand for viral vectors, streamline production processes, and reduce manufacturing costs which is expected to support the growth of the market.

Furthermore, the increase in demand for gene therapy and the growth in awareness among healthcare professionals and patients about its potential benefits have also fueled the expansion of the viral vector production market. There is greater recognition of the crucial role played by viral vectors in delivering therapeutic genes. This increased demand and awareness have driven investments in viral vector production and propelled the market growth.

On the other hand, the high cost of production and stringent regulatory requirements pose significant challenges to the growth of the viral vector production market. The complex and intricate manufacturing processes involved in producing viral vectors can be costly, requiring specialized facilities, equipment, and skilled personnel. In addition, stringent regulatory frameworks, including Good Manufacturing Practices (GMP), are in place to ensure the safety, efficacy, and quality of viral vectors. The cost and regulatory hurdles create barriers for market entry, particularly for smaller companies, and can impede the overall growth and scalability of the market.

However, the extensive pipeline of gene therapy and viral vaccines presents a promising outlook for the future growth of the viral vector production market. The demand for viral vectors is set to rise as they play a critical role in facilitating the delivery and efficacy of these therapies with an expanding pipeline in various therapeutic areas. The demand for viral vector production is expected to experience a substantial upsurge as more gene therapies and viral vaccines advance through clinical trials and gain regulatory approval. This favorable market scenario creates an opportunity for viral vector production companies to expand their operations and cater to the increase in requirements of the dynamic biopharmaceutical industry.

The viral vector production market experienced a notable surge in both the short and long term as a result of the COVID-19 pandemic. The urgent requirement for vaccines and therapies to combat the virus led to an increased demand for viral vectors. These vectors played a crucial role in delivering COVID-19 vaccines and stimulating immune responses. This surge in demand prompted manufacturers to rapidly scale up their production capacities, driving market growth.

Furthermore, companies involved in viral vector production implemented various strategies to meet the heightened demand. These collaborations and partnerships between players not only helped in addressing the needs during the pandemic but also contributed significantly to the growth of the viral vector production market. The positive growth of the market was further reinforced by the continued development and production of viral vector-based therapies and vaccines for COVID-19, bolstering the long-term prospects of the market.

Segmental Overview

The global viral vector production market is segmented on the basis of viral vector type, indication, application, end user, and region. On the basis of virus type, the market is categorized into adenoviral vectors, adeno-associated viral vectors, lentiviral vectors, retroviral, and other types. On the basis of indication, it is segregated into cancer, genetic disorders, infectious diseases, and other diseases. On the basis of application, it is bifurcated into gene therapy and vaccinology.

On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

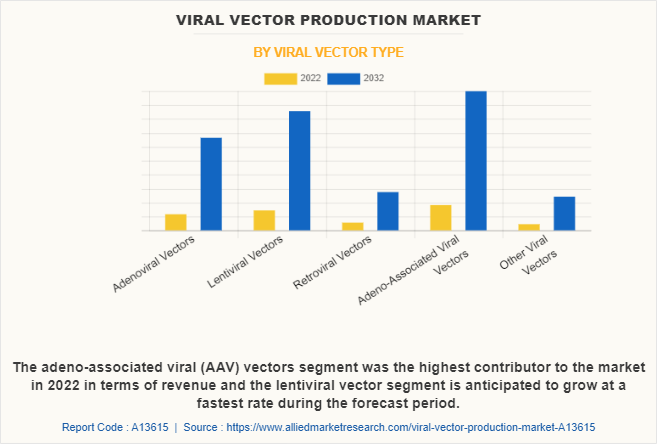

By Viral Vector Type

On the basis of viral vector type, the adeno-associated viruses (AAV) vectors segment accounted for the largest viral vector production market share. The growth of the segment is mainly due to the surge in demand for AVV in the gene therapy sector. According to the Alliance for Regenerative Medicine (ARM), adeno virus associated vector was the primary vector used in the gene therapy clinical trials. Thus, such significant demand in the market fosters the segment growth.

On the other hand, lentiviral vectors segment is anticipated to be the fastest growing segment during the forecast period, owing to the versatility of lentiviral vectors allows them to be used in a wide range of therapeutic applications, including the treatment of genetic disorders, cancer immunotherapy, and regenerative medicine.

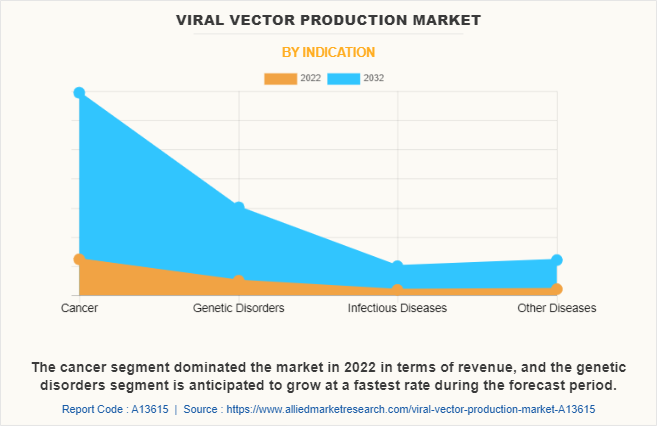

By Indication

On this basis of indication, the cancer segment dominated the market in 2022 in terms of revenue, which is attributed to the high prevalence of cancer all around the globe. According to the National Cancer Institute, in 2020, an estimated 1,806,590 new cases of cancer were diagnosed in the U.S. and 606,520 people died from the disease. Such huge prevalence of cancer surges the demand for advanced therapies such as gene therapy to treat cancer which boosted the demand for viral vector production for development and research related to advance therapies.

On the other hand, the genetic disease segment is anticipated to grow at a fastest rate during the forecast period which is attributed to the significant prevalence of genetic disorders around the globe. In addition, increase in research and development efforts, as well as clinical trials, focused on developing and commercializing vector-based gene therapies for various genetic disorders is anticipated to foster viral vector production market growth.

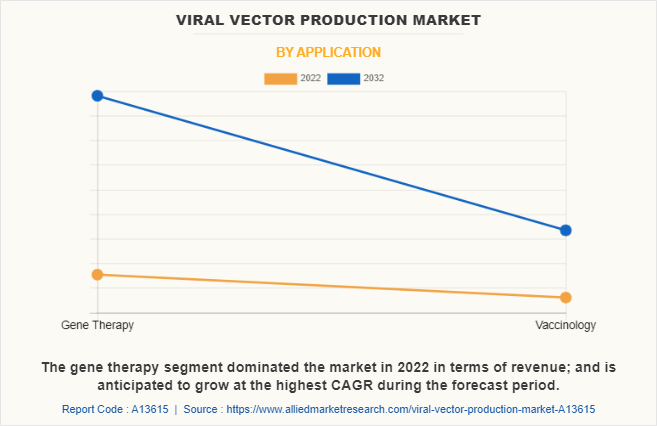

By Application

On the basis of application, the gene therapy segment dominated the market in 2022 and is anticipated to be the fastest growing segment during the viral vector production market forecast period. The dominance of the gene therapy segment in terms of revenue is attributed to the significant demand and investment in the development and commercialization of gene therapies. Furthermore, the potential to provide long-term or permanent solutions for genetic disorders, cancer, and other diseases using viral vectors has fueled the growth of this segment.

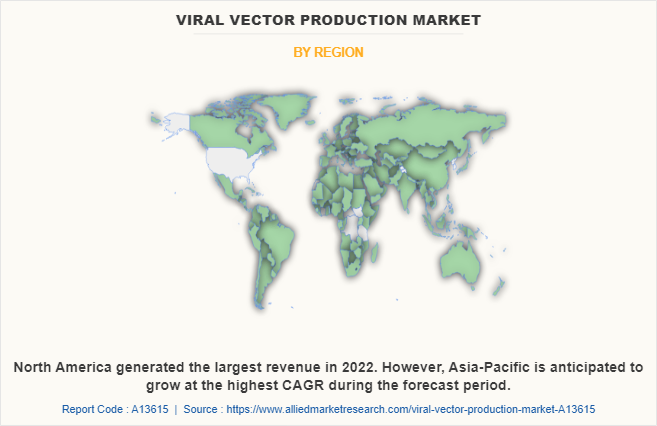

By Region

The viral vector production industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major viral vector production market share in 2022 and is expected to maintain its dominance during the forecast period.

The growth is mainly attributed to the robust and well-established biotechnology and pharmaceutical industry, with advanced infrastructure and expertise in gene therapy and viral vector production. In addition, the presence of leading biotech and pharmaceutical companies, research institutions, and academic centers contribute to the growth of the market.

In addition, North America benefits from strong government support and funding for research and development in the field of gene therapy and advanced therapeutics. This support enables the region to be at the forefront of innovation and accelerates the commercialization of viral vector-based therapies.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The Asia-Pacific region has witnessed significant growth in the biotechnology and pharmaceutical sectors in recent years. This growth is driven by factors such as increasing investment in research and development, expanding healthcare infrastructure, and rise in government support for the biotech industry. As a result, there is a growth in demand for viral vectors in the region to support the development and production of advanced therapies.

In addition, the Asia-Pacific region has a high burden of cancer, genetic disorders, and infectious diseases. As a result, there is an increase in focus on developing gene therapies and viral vector-based vaccines to address these healthcare challenges. The demand for viral vectors as essential tools in development of therapies drives the growth of the viral vector production industry.

COMPETITION ANALYSIS

Competition analysis and profiles of the major players in viral vector productiontion, such as Andelyn Biosciences, Charles River Laboratories, Danaher Corporation, FinVector Oy, Lonza, Novartis AG, Oxford Biomedica, Takara Holdings Inc., Thermo Fisher Scientific Inc. and Avid Bioservices, Inc. are provided in this report. There are some important players in the market such as Merck KGaA, Fred Hutchinson Cancer Center, Corning Incorporated, Avid Bioservices, Inc., and others. Major players have adopted product launch, product expansion and acquisition as key developmental strategies to improve the product portfolio of the viral vector production market.

Recent Product Launches in the Viral Vector Production Market

In July 2022, Takara Bio Inc., launched a new CDMO service using a brain-tropic AAV (adeno-associated virus) vector "CereAAV" for customers in the gene and cell therapy industry.

In October 2022, Charles River Laboratories International, Inc. introduced its nAAVigation Vector Platform (nAAVigation) as a new offering. Drawing on its extensive experience in Adeno-Associated Virus (AAV) vector contract development and manufacturing (CDMO), as well as biologics testing, Charles River has developed a platform that simplifies the process of manufacturing GMP-grade AAV vectors.

Recent Acquisitions in the Viral Vector Production Market

In January 2021, Thermo Fisher Scientific Inc., has completed the acquisition of Henogen S.A., Novasep's viral vector manufacturing business in Belgium for approximately Euro 725 million in cash which owns a manufacturing business and provides contract manufacturing services for vaccines and therapies to biotechnology companies and biopharma customers.

Geographical Expansion

In May 2020, Thermo Fisher Scientific Inc. announced that it expands its capacity for viral vector development and manufacturing services with construction of a new commercial manufacturing site in Plainville, Mass.

Recent Partnerships in the Viral Vector Production Market

In January 2023, Charles River Laboratories International, Inc. and Rznomics Inc., a biopharmaceutical company based in South Korea that focuses on RNA-based gene therapeutics, announced a partnership as a viral vector contract development and manufacturing organization (CDMO).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the viral vector production market analysis from 2022 to 2032 to identify the prevailing viral vector production market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the viral vector production market segmentation assists to determine the prevailing market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global viral vector production market trends, key players, market segments, application areas, and market growth strategies.

Viral Vector Production Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.1 billion |

| Growth Rate | CAGR of 18.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 286 |

| By Indication |

|

| By Application |

|

| By Viral Vector Type |

|

| By Region |

|

| Key Market Players | Oxford Biomedica, Avid Bioservices, Inc., FinVector Oy, Danaher Corporation, Thermo Fisher Scientific Inc. , Lonza, TAKARA HOLDINGS INC., Charles River Laboratories, Andelyn Biosciences, Novartis AG |

Analyst Review

The viral vector production market presents several opportunities and challenges. The viral vector production market plays a pivotal role in the development and commercialization of gene therapies, vaccines, and other advanced therapeutics. Companies that may establish a strong foothold in viral vector production stand to gain a competitive advantage with the increase in demand for advanced therapies, such as gene therapies and viral vector-based vaccines.

Furthermore, investing in robust and scalable viral vector production capabilities is crucial to meet the growing demand for these therapies. Collaboration and partnerships with academic institutions, research organizations, and contract manufacturing organizations (CMOs) may provide access to innovative technologies, expertise, and manufacturing capacity. Leveraging these collaborations may accelerate the development and production of viral vectors, enabling faster time-to-market for gene therapies and vaccines.

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to surge in demand for viral vector production due to rise in number of clinical trials for gene therapies, developed healthcare infrastructure, and presence of prominent key players in this region. Furthermore, Asia-Pacific is anticipated to witness notable growth during the forecast period owing to a rise in investments for clinical trials and R&D in this region through government support and rise in awareness among healthcare professionals about advanced therapies for treatment of rare diseases

Viral vectors are tools used in gene therapy and vaccine development to deliver genetic material into target cells. They are derived from naturally occurring viruses that have been modified to remove their disease-causing ability while retaining their ability to efficiently enter cells and deliver the desired genetic material.

The total market value of viral vector production market is $1.1 billion in 2022.

The forecast period for viral vector production market is 2023 to 2032.

The market value of viral vector production market in 2032 is $6.1 billion.

The base year is 2022 in viral vector production market.

Major players that operate in the viral vector production market are Andelyn Biosciences, Charles River Laboratories, Danaher Corporation., FinVector Oy, Lonza, Novartis AG, Oxford Biomedica plc, Takara Holdings Inc., Thermo Fisher Scientific Inc. and Avid Bioservices, Inc.

The adeno-associated viral (AAV) vectors held a dominant position in terms of revenue in 2022, which is attributed to the significant demand for these vectors in gene therapies.

Key factors driving the growth of the viral vector production market includes rise in prevalence of cancer, infectious diseases, and genetic disorders, increase in demand and awareness for gene therapy and surge in number of strategies adopted by market key players

Asia-Pacific has the highest growth rate in the market with 19.8% CAGR owing to the growth in emphasis on advanced therapies, including viral vector-based gene therapies.

Viral vectors are designed to carry and introduce therapeutic genes, such as missing or mutated genes, into the cells of patients. They act as delivery vehicles, transporting the genetic material to the target cells where it may be expressed and produce the desired therapeutic effect.

Loading Table Of Content...

Loading Research Methodology...