Viral Vectors And Plasmid DNA Manufacturing Market Research, 2033

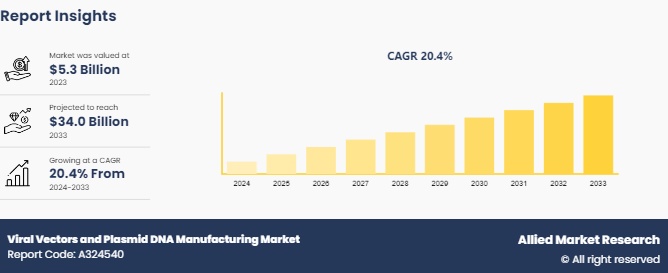

The global viral vectors and plasmid DNA manufacturing market size was valued at $5.3 billion in 2023, and is projected to reach $34.0 billion by 2033, growing at a CAGR of 20.4% from 2024 to 2033. The major factors driving the growth of the viral vectors and plasmid DNA manufacturing market are increasing demand for gene therapies, advancements in gene editing technologies, and growing interest in vaccines.

Market Introduction and Definition

Viral vectors and plasmid DNA are crucial components in the fields of gene therapy, vaccine development, and molecular biology. Viral vectors, derived from viruses, are engineered to deliver genetic material into cells. Common types include lentiviruses, adenoviruses, and adeno-associated viruses (AAVs) . These vectors are advantageous due to their efficiency in transducing cells and delivering genes, but their manufacturing process is complex and requires stringent safety and quality controls to ensure they are free from replication-competent viruses and other contaminants. Production typically involves cell culture systems, purification processes, and extensive testing to meet regulatory standards.

Plasmid DNA is a simpler circular DNA molecule that is not integrated into the host genome. It is often used as a vector for gene cloning, gene therapy, and as a DNA vaccine component. The manufacturing process for plasmid DNA involves bacterial fermentation, where the plasmid is replicated within a host bacterial cell, usually E. coli. Following fermentation, the plasmid DNA is extracted, purified, and subjected to rigorous quality control tests to ensure it meets the required purity and concentration standards. The simplicity of plasmid DNA production, compared to viral vectors, makes it a cost-effective and scalable option for many applications. Both viral vectors and plasmid DNA manufacturing are pivotal in advancing modern biotechnology and therapeutic developments, offering distinct advantages and posing unique challenges in their production and application.

Key Takeaways

- The viral vectors and plasmid DNA manufacturing market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Viral vectors and plasmid DNA industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives

Key Market Dynamics

According to the viral vectors and plasmid DNA manufacturing market forecast analysis key factors driving the growth of the viral vectors and plasmid DNA market are growing interest in vaccines, advancements in gene editing technologies, increase in demand for gene therapies, and high adoption of contract manufacturing organizations. In an article published by the National Library of Medicine, between 2010 and 2022, the total number of cell and gene therapy clinical trials has steadily increased worldwide at a compound annual growth rate of 20–25%. Gene therapies, which involve the insertion, alteration, or removal of genes within an individual’s cells to treat disease, rely heavily on viral vectors and plasmid DNA as critical delivery mechanisms. The expanding pipeline of gene therapy candidates in clinical trials underscores the increasing reliance on these vectors for effective gene transfer. In addition, the advancements in genetic engineering and biotechnology have enhanced the safety, efficiency, and specificity of viral vectors and plasmid DNA, making them more attractive for therapeutic applications. Thus, the rise in demand for gene therapies is expected to drive the viral vectors and plasmid DNA manufacturing market growth.

In addition, according to the viral vectors and plasmid DNA manufacturing market trends analysis the increase in global focus on vaccines as a critical tool for public health significantly is expected to drives the growth of the market. Vaccines require sophisticated delivery mechanisms to ensure efficacy and safety, and viral vectors and plasmid DNA have emerged as essential components in this domain. These vectors serve as vehicles to deliver genetic material into cells, prompting the production of antigens that elicit an immune response. Advancements in biotechnology have improved the efficiency and scalability of these vectors, making them more accessible for large-scale vaccine production. Moreover, the rise of personalized medicine and the development of novel gene therapies have expanded the application of viral vectors and plasmid DNA beyond traditional vaccines, further accelerating market growth. Regulatory support and significant investments from both public and private sectors contribute significantly to the growth viral vectors and plasmid DNA manufacturing market size.

Application Of Cell and Gene Therapy

According to the viral vectors and plasmid DNA manufacturing market analysis, the rise in the research and development in the cell and gene therapy is expected to cintribute significantly in the growth of the mrket. Cell and gene therapy represent innovative approaches in medical science, targeting a wide array of health conditions. Cancer leads the way with a significant 59.8% of all cell and gene therapy clinical trials. This is attributed to a rise in prevalence of cancer and the surge in demand of effective cancer treatment options. Cardiovascular diseases accounts for 6.2% of clinical trials, owing to ongoing efforts to address heart-related conditions, which remain a leading cause of death globally. By leveraging the regenerative capabilities of cell and gene therapies, researchers aim to develop treatments that can repair damaged heart tissue and improve cardiovascular health.

Immunology accounts for 5.7% of clinical trials. These trials often focus on modulating the immune system to treat autoimmune diseases and other immune-related disorders, potentially offering new treatment for patients with conditions that are difficult to manage with conventional therapies. Dermatology accounts for 4.7% of the clinical trials. This includes innovative approaches to treating chronic skin diseases, wounds, and other dermatological issues through regenerative medicine. Neurological conditions account for over 4.3% of the clinical trials. Researchers are actively exploring the applications of cell and gene therapies to treat disorders such as Parkinson's disease, Alzheimer's disease, and spinal cord injuries, aiming to restore function and improve quality of life for patients. Furthermore, Infections, account for 4.0% of the clinical trials, focusing on developing therapies that can enhance the body's ability to fight off various pathogens. These trials often explore ways to bolster the immune system or directly target infectious agents using genetically engineered cells. In addition, musculoskeletal disorders and other diseases account for 3.7% and 11.5% of clinical trials respectively.

Market Segmentation

The viral vectors and plasmid DNA manufacturing industry is segmented into vector type, workflow, application, end user, disease, and region. By vector type, the market is divided into adenovirus, retrovirus, adeno-associated virus (AAV) , lentivirus, plasmids, and others. By workflow, it is categorized into upstream manufacturing and downstream manufacturing. By application, the market is divided into antisense & RNAi therapy, gene therapy, cell therapy, vaccinology, and research applications. By end user, the market is classified into pharmaceutical & biopharmaceutical companies and research institutes. By disease, the market is segregated into cancer, genetic disorders, infectious diseases, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the viral vectors and plasmid DNA manufacturing market share in 2023 advanced healthcare infrastructure, significant investments in research and development, and the presence of major biotech companies. However, according to the viral vectors and plasmid DNA manufacturing market opportunity analysis the Asia-Pacific region, is expected to witness rapid expansion owing to to rising healthcare expenditure, growing biotechnology industry, and increasing awareness of gene therapy applications. Additionally, countries like China and India are making substantial investments in biotechnology, which further propels market growth.

- In an article published by the American Cancer Society, in 2024, 2, 001, 140 new cancer cases and 611, 720 cancer deaths are projected to occur in the U.S.

- In an article published by the National Bureau of Economic Research, the number of patients receiving gene therapies annually will peak at 94, 696 patients in 2025.

- According to the Department of Biotechnology (Government of India) , the Indian biotechnology industry is expected to grow to $150 billion by financial year 2025.

Industry Trends

- In June 2023, researchers at the University at Buffalo developed a gene therapy using adeno-associated virus 9 (AAV9) to deliver the FOXG1 gene, which is critical for early brain development. The researchers concluded that these promising results in mice provide a foundation for advancing gene therapy toward human clinical trials to potentially benefit children with FOXG1 syndrome. Plasmid DNA is crucial in the construction and production of viral vectors such as AAV. The advancement in AAV-based gene therapy is expected to lead to higher demand for plasmid DNA, driving the growth of the market.

- According to a 2024 article by National Library of Medicine viral vectors are now widely used and the number of approved therapies is expected to increase.

- In February 2024, the New South Wales Government announced the establishment of a new company to operate the world-leading viral vector manufacturing facility based at Westmead, which is projected to produce groundbreaking and life-saving therapies. The New South Wales Government has committed funding of $134.5 million to establish the facility and to manufacture viral vector products for research and clinical trials

Competitive Landscape

The major players operating in the viral vectors and plasmid DNA manufacturing industry include Merck KGaA, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Cobra Biologics, Catalent Inc., Wuxi Biologics, TakarBio Inc., Waisman Biomanufacturing, Genezen laboratories, and Batavia Biosciences. Other players in the viral vectors and plasmid DNA market are Miltenyi Biotec GmbH, SIRION Biotech GmbH, Virovek Incorporation, BioNTech IMFS GmbH, Audentes Therapeutics, BioMarin Pharmaceutical, and RegenxBio, Inc.

Recent Key Strategies and Developments

- In October 2023, AGC Biologics announced the expansion of its pDNA manufacturing facility in Germany. This is expected to help the company to reduce the time required for manufacturing.

- In February 2023, BioNTech SE announced that it completed the setup of its first plasmid DNA manufacturing plant in Germany. This has enabled the company to manufacture pDNA independently for clinical and commercial applications.

- In April 2022, FUJIFILM Holdings Corporation acquired a cell therapy manufacturing unit from Atara Biotherapeutics, Inc. The company is expected to help the manufacturing of Atara's commercial-and clinical stage allogeneic cell therapies at the unit as part of the manufacturing and services agreement

- In July 2022, Charles River Laboratories announced the launch of the Plasmid DNA Centre of Excellence in the UK. The expansion comes after Charles River acquired Cognate BioServices and Cobra Biologics, two innovative contract development and production companies for plasmid DNA, viral vectors, and cell therapy (CDMOs)

- In January 2022, WuXi Biologics entered a long-term collaboration with Shanghai BravoBio Co., Ltd to accelerate the development of innovative vaccines, to address the growing challenge of infectious diseases

Key Sources Referred

- Department of Biotechnology (Government of India)

- National Library of Medicine

- Center of Disease Control and Prevention

- American Cancer Society

- Clinical Trials

- National Bureau of Economic Research

- World Health Organization

- New South Wales Government

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the viral vectors and plasmid DNA manufacturing market analysis from 2024 to 2033 to identify the prevailing viral vectors and plasmid DNA manufacturing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the viral vectors and plasmid DNA manufacturing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global viral vectors and plasmid DNA manufacturing market trends, key players, market segments, application areas, and market growth strategies.

Viral Vectors and Plasmid DNA Manufacturing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 34.0 Billion |

| Growth Rate | CAGR of 20.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Vector Type |

|

| By Workflow |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | TakarBio Inc, Genezen laboratories, Waisman Biomanufacturing, LLC, Lonza Group AG, Catalent Inc., WuXi Biologics., Merck KGaA, Thermo Fisher Scientific Inc., Cobra Biologics, FUJIFILM Corporation |

The market value of Viral Vectors and Plasmid DNA Manufacturing Market is projected to reach $34.0 Billion by 2033.

The global viral vectors and plasmid DNA manufacturing market was valued at $5.3 billion in 2023

The forecast period for Viral Vectors and Plasmid DNA Manufacturing Market is 2024-2033.

The base year is 2023 in Viral Vectors and Plasmid DNA Manufacturing Market

Major key players that operate in the Viral Vectors and Plasmid DNA Manufacturing Market are Merck KGaA, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, and Cobra Biologics

Loading Table Of Content...