Virology Market, 2033

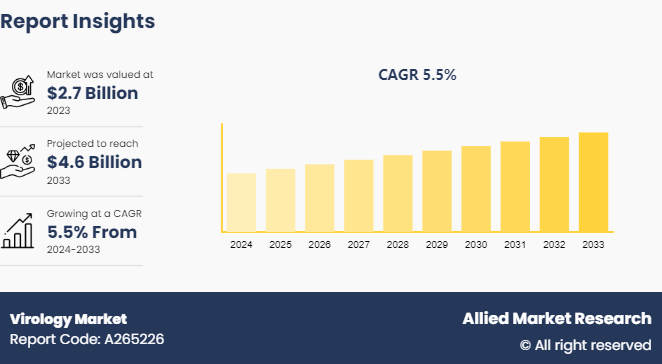

The global virology market was valued at $2.7 billion in 2023, and is projected to reach $4.6 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033. The virology market is being driven by the increasing prevalence of viral infections globally, coupled with advancements in diagnostic technologies. The rise in public health awareness and the growing demand for effective antiviral therapies are further propelling market growth. Additionally, government initiatives and investments in research and development are contributing to the rapid expansion of this market, as the need for improved virus detection and treatment options becomes more critical.

Market Introduction and Definition

Virology is a scientific field that studies viruses and virus-like organisms. This field includes a variety of aspects such as classification, disease development mechanisms, cultivation methods, and genetic traits. Virology, often considered a subset of microbiology or pathology, focuses on the immune response to viruses, their ability to infect or destroy host cells, evolutionary processes, structural and compositional characteristics, diverse infection pathways, culturing techniques, laboratory applications, isolation methods, and physiological properties.

Key Takeaways

- The virology market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intendeds to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The emergence of novel human pathogens and the resurgence of various diseases are significant concerns in the current decade. Emerging infections are defined as diseases whose incidence has increased in recent decades or threatens to rise in the future. These emergences can occur due to the detection or spread of pathogens in new areas, the recognition of previously undetected diseases within a population, or the discovery of infectious causes in established diseases. Several factors contribute to the emergence of these diseases, including population growth, poverty, malnutrition, increased domestic and global connectivity, economic factors driving population migration, social practices, the prevalence of immunosuppressive diseases, unplanned urbanization, deforestation, and changes in agricultural practices such as mixed farming. Additionally, genetic mutations in pathogens have significantly contributed to these outbreaks. These emerging and re-emerging infectious diseases drive the need for advanced research, diagnostics, and treatment solutions. The increasing prevalence of these diseases necessitates the development of innovative antiviral drugs, vaccines, and diagnostic tools.

Due to the high costs associated with generating novel therapies and diagnostic tools, the subject of virology research and development presents significant financial obstacles for businesses. The complex nature of investigating viruses, which frequently necessitates specialized facilities and expertise, adds to the financial burden. Virology research and development often involve major research in laboratories, clinical trials for medication and vaccine candidates, and regulatory compliance requirements, all of which necessitate a large time and resource investment.

The rapid evolution of diagnostic technologies in virology presents promising avenues for future advancements. Emerging techniques such as multiplex RT-PCR followed by microarray analysis are poised to transform clinical virology laboratories. These methods enable comprehensive and swift detection of a wide range of viral pathogens directly from clinical specimens, including the ability to type and subtype viruses efficiently. While some of these assays are already commercially available, their widespread adoption in routine virology practice requires further validation and standardization. The ongoing refinement and integration of these technologies hold great potential to enhance diagnostic accuracy, speed, and efficiency, thereby supporting clinicians in making informed decisions for the management of patients with viral infections.

Global Virology Market Patent Analysis

The patent analysis of the virology market highlights innovative products that enhance the industry. Companies are regularly investing in intellectual property to advance technology, ensure competitive advantage, facilitate unique product development, and drive the growth of virology market products.

In August 2021, Wuhan Ruitai Landing Medical Laboratory Co., Ltd. introduced a kit for molecular virology detection. This utility model pertains to molecular virology, specifically a detection kit comprising a main body. Fixed limiting blocks are attached to the inner left and right walls of the main body. Movable clamping plates are connected to the top surfaces of these limiting blocks, each featuring evenly spaced fixing holes. The main body's rear surface is hinged to a cover plate, where the inner side of the cover plate includes a fixed convex block. The top surface of the main body includes a groove that aligns with the convex block. This design allows test tubes containing reagents to be securely held inside the main body using the clamping plates. The groove and convex block facilitate a tight seal when the cover plate closes, ensuring enhanced internal sealing of the kit body. Additionally, an airbag and air inlet pipe assist in exhausting air from inside the kit body, further improving its sealing effectiveness.

In January 2024, Yan'an University unveiled a culture dish for molecular virology detection. The invention pertains to culture dishes designed specifically for molecular virology detection. It consists of two parts: an inner dish housed within an outer dish, firmly connected together. The outer dish is topped with a cover plate, and a sealing cover is affixed to the upper part of the inner dish. This sealing cover connects securely to the inner wall of the cover plate via multiple connecting blocks. At the bottom of the outer vessel, a central column is fixed, featuring evenly spaced grooves on its outer surface. A concave-shaped support block is situated at the base of this column, where the bottom end of the column is inserted. A mounting block is fixed centrally at the bottom of the support block. This setup allows the central column to rotate the inner vessel, enabling researchers to conveniently study and analyze samples from various positions within the inner dish. Importantly, the inner vessel remains stable without displacement during this process, always positioned beneath the instrument. Furthermore, the height of the inner vessel can be adjusted as needed to accommodate the researcher's specific requirements.

In February 2021, the Institute of Pathogen Biology, Chinese Academy of Medical Sciences, introduced a nanopore three-generation sequencing detection method for plasma virology. The method includes the following steps: preparation of viral nucleic acid in blood samples and incorporation of a standard nucleic acid internal reference, construction of a nanopore sequencing library, real-time sequencing of nanopores and conversion to a real-time fast file, bioinformatics analysis, and more. The method not only detects virus groups in blood samples quickly, but it also improves the coverage rate of a virus's entire genome sequence, achieving the goal of quickly detecting the virus in the blood sample.

Market Segmentation

The virology market is segmented into type, application, end user, and region. On the basis of type, the market is divided into diagnostics test, antiviral therapeutics, viral infection controlling techniques, and interferons. As per application, the market is segregated into skin & soft tissues infections, GI tract infections, sexually transmitted diseases, and others. On the basis of end user, the market is segmented into hospitals, diagnostics laboratories, research & academic institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The virology market in North America is characterized by robust research and development activities, advanced healthcare infrastructure, and significant investments in combating infectious diseases. On 1 April 2024, the IHR NFP of the United States of America notified WHO of a laboratory-confirmed human case of avian influenza A (H5N1) detected in the state of Texas. This incident underscores the region's proactive approach to virological surveillance and response, leveraging state-of-the-art diagnostic technologies and coordinated public health efforts. The market continues to witness innovations in diagnostics, therapeutics, and preventive measures, driven by ongoing challenges such as emerging pathogens and the re-emergence of infectious diseases, highlighting the critical role of virology in safeguarding public health across North America.

- In August 2021, the first COVID-19 vaccine, known as the Pfizer-BioNTech COVID-19 Vaccine, received approval from the U.S. Food and Drug Administration (FDA) . It was branded as ComiRNAty (Koe-mir’-natee) for marketing purposes. This vaccine was approved for the prevention of COVID-19 disease in individuals aged 16 years and older. Additionally, it was available under emergency use authorization (EUA) .

- In May 2020, Bio-Rad obtained FDA approval for emergency use authorization of the COVID-19 total antibody test.

Competitive Landscape

The major players operating in the virology market include GlaxoSmithKline plc, Abbott Laboratories, Boehringer Ingelheim Corporation, Merck and Co. Inc., Novartis International AG, Siemens, Johnson & Johnson, AstraZeneca AB, Roche, and Trinity Biotech.

Recent Key Strategies and Developments

- On June 20, 2024, Gilead Sciences, Inc. announced that an interim analysis of its pivotal Phase 3 PURPOSE 1 trial had revealed topline results indicating that lenacapavir, the company’s twice-yearly injectable HIV-1 capsid inhibitor, had demonstrated 100% efficacy for investigational use in HIV prevention among cisgender women.

- On June 2, 2024, Gilead Sciences, Inc. and Arcus Biosciences, Inc. announced new data from Cohort B of the ARC-9 study, a Phase 1b/2 trial assessing the safety and efficacy of etrumadenant (a dual A2a/b adenosine receptor antagonist) in combination with the anti-PD-1 monoclonal antibody zimberelimab, FOLFOX chemotherapy, and bevacizumab (EZFB) for third-line metastatic colorectal cancer (mCRC) . Zev A. Wainberg, M.D., MSc, Co-Director of the GI Oncology Program at the University of California Los Angeles and a principal investigator of the ARC-9 trial, presented these findings during an oral session at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting (Abstract 3508) .

Industry Trends

- In May 2022, QuantuMDx Group Limited launched its latest respiratory panel test, the Q-POC SARS-CoV-2, Flu A/B & RSV Assay. This innovative test was designed to operate on the Q-POC platform, which features multiplex capabilities. This advancement allows users to perform rapid point-of-care testing in various settings, whether clinical or non-clinical.

- In January 2022, InTec garnered attention with the introduction of its new and highly sensitive SARS-CoV-2 Rapid Antigen Test, known as the AQ+ Covid-19 Ag Rapid Test. Specifically developed for professional use, this test enables healthcare professionals and even non-specialists to quickly and conveniently detect COVID-19 cases.

Key Sources Referred

- European Society of Clinical Infectious Diseases.

- WHO

- National Institute of Health

- Leica Microsystems

- Nature

- Virology Journal

- American Society for Microbiology

- The President and Fellows of Harvard College

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the virology market analysis from 2024 to 2033 to identify the prevailing virology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the virology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global virology market trends, key players, market segments, application areas, and market growth strategies.

Virology Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.6 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 320 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Siemens, Merck and Co. Inc., Roche, AstraZeneca AB, Trinity Biotech, GlaxoSmithKline Plc., Abbott Laboratories, Johnson & Johnson, Novartis International Ag, Boehringer Ingelheim Corporation |

The upcoming trends in the virology market globally include advances in antiviral therapies, vaccine development for emerging viruses, and increasing focus on personalized medicine approaches.

The leading application of the virology market is diagnostics.

Asia-Pacific is the largest regional market for Virology.

The global virology market was valued at $2.7 billion in 2023, and is projected to reach $4.6 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

The major players operating in the virology market include GlaxoSmithKline plc, Abbott Laboratories, Boehringer Ingelheim Corporation, Merck and Co. Inc., Novartis International AG, Siemens, Johnson & Johnson, AstraZeneca AB, Roche, and Trinity Biotech.

Loading Table Of Content...