Virtual Desktop Infrastructure Market Research, 2031

The global virtual desktop infrastructure market size was valued at $9 billion in 2021, and is projected to reach $19.8 billion by 2031, growing at a CAGR of 8.3% from 2022 to 2031.

Surge in the need to increase employee efficiency and enhanced data security offered by virtual desktop infrastructure (VDI) boost the growth of the global virtual desktop infrastructure (VDI) market. In addition, cost saving associated with VDI solutions positively impacts the growth of the virtual desktop infrastructure (VDI) industry. However, performance, compatibility issues, and expensive deployment & sign-up costs of virtual desktop infrastructure (VDI) platforms hamper the market growth. On the contrary, an increased market for workspace as a service is expected to offer remunerative opportunities for the expansion of the virtual desktop infrastructure (VDI) industry during the forecast period.

Virtual desktop infrastructure (VDI) solutions are typically based on a client/server model, where the organization’s chosen operating system and applications run on a server located either in the cloud or in a data center. In this model, all interactions with users occur on a local device of the user’s choosing, reminiscent of the so-called ‘dumb’ terminals popular on mainframes and early Unix systems. VDI is also a key component of digital workspaces as many modern virtual desktop workloads run on virtual desktop infrastructure (VDI) technology which typically executes on virtual machines (VMs) either at on-premises data centers or in the public cloud.

The global virtual desktop infrastructure (VDI) market is segmented on the basis of offering, deployment mode, enterprise size, industry vertical, and region. By offering, the market is bifurcated into solution and service. By deployment mode, the market is segmented into on-premise and cloud. By enterprise size, it is categorized into large enterprises and SMBs. By industry vertical, the market is divided into IT & telecom, construction and manufacturing, BFSI, healthcare, government and public sector, retail, education, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in the Virtual desktop infrastructure market analysis are IBM, HP Enterprise, Vmware, Inc, Ericom Software, Inc, Intel Corporation, Microsoft Corporation, Huawei Technologies, Parallels International Gmbh, AWS, Cisco Systems, Citrix, IGEL Technologies, Evolve IP, LLC, Redhat, Inc, N Computing Limited, Vagrant, Inc, Neverfail, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the virtual desktop infrastructure industry.

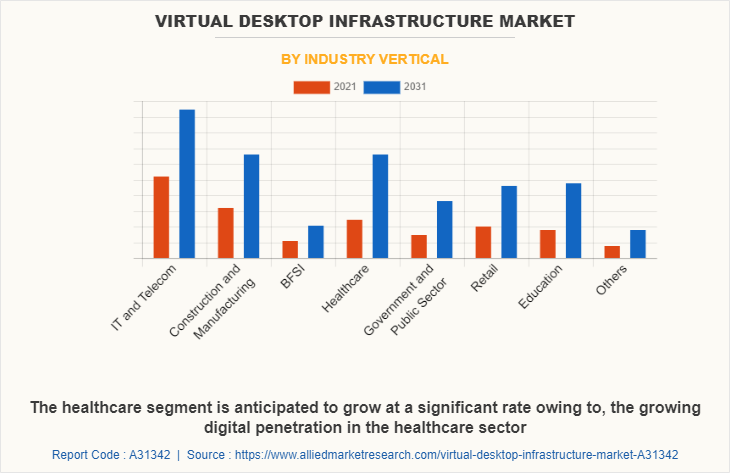

In terms of industry vertical, the IT and telecom segment holds the largest share of the virtual desktop infrastructure market, owing to the rapid adoption of virtualization and VDI solutions since the outbreak of the COVID-19 pandemic. However, the healthcare segment is expected to grow at the highest rate during the forecast period, owing to the adoption of virtualized solutions for better management and enhanced security within the healthcare sector, which is anticipated to drive the virtual desktop infrastructure market growth.

Region wise, the virtual desktop infrastructure industry was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to its expanding investments in new technologies such as cloud and digital technologies are anticipated to bring prominent growth in the market. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the increase in demand from the European countries and surge in technology investments, which are expected to drive the growth of the virtual desktop infrastructure (VDI) market in Asia-Pacific region.

The report focuses on growth prospects, restraints, and trends of the global virtual desktop infrastructure (VDI) market analysis. The study provides Porter’s five forces analysis to understand impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the global virtual desktop infrastructure market share.

Top Impacting Factors

Surge in need to increase employee efficiency

With the sudden increase in the remote working employees of in a majority of business sectors, post the outbreak of the COVID-19 pandemic, organizations are in dire need to ensure that employees have seamless access to operations data round the clock to remain productive. Thus, organizations need to ensure that employees experience the same computing experience anywhere and anytime across the globe, and with the implementation of virtual desktop infrastructure VDI and desktop virtualization technology organizations can manage their entire IT infrastructure from a single dashboard. As the essential structure of a virtual desktop infrastructure (VDI) is centrally generated, administrated, and delivered over a network to each of its users, which reduces the computing load on local clients and improves overall efficiency.

Moreover, in this era of immense market competition, companies are focusing on boosting productivity at workplaces using various software and tools, especially virtual desktop infrastructure solutions. Employees who have access to such tools can securely access their corporate virtual desktops and data from a remote location. Moreover, VDI clients are capable of providing a richer desktop experience as compared to a typical mobile device and enable its employees to access specialized enterprise applications that they typically do not have access to from their homes. Such factors boost the development of virtual desktop infrastructure solutions during the period.

Enhanced Data Security offered by virtual desktop infrastructure solutions

Information security is one of the critical concerns among corporates and organizations, as cyber-threats and data breaches have become more critical than ever. For instance, in June 2020 the U.S. Department of homeland security reported a 250% increase in the number of data breaches and cyber-related attacks on federal systems over the past two years. Moreover, corporations are vulnerable to numerous attacks ranging from the infection of corporate networks by custom malware to targeted hacking along with sophisticated phishing attacks and outright tampering with intellectual property.

However, virtual desktop infrastructure solutions have evolved as one of the ideal ways to defend organizations in a better way for securing their information and managing risk, as with virtual desktop infrastructure solutions organizations can have enterprise level of security for their employees working from home. Moreover, virtual desktop infrastructure solutions play an integral role in Bring your own device (BYOD) programs, as it provides secure access to an employee’s desktop environment. Such high security offered by these solutions fuels the rapid adoption of virtual desktop infrastructure solutions and drives the virtual desktop infrastructure market growth.

COVID-19 Impact Analysis

The global virtual desktop infrastructure market has witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increased digital penetration during the period of COVID-19-induced lockdowns and stringent social distancing policies, which further fueled the demand for remote operational tools such as virtual desktop infrastructure (VDI) tools. According to an article published by Anunta Tech, in September 2021, the COVID-19 pandemic influenced the VDI market, causing the demand for remote desktop tools to grow by over 70% during the period.

Furthermore, the increasing number of COVID-19 cases, caused many organizations to adopt remote working tools. According to an article published by TechTarget, in December 2020, more than 67% of organizations that adopted work-from-home policies post the outbreak of COVID-19, plan to keep their remote working options available for their employees even after the period of the pandemic. Such factors propelled the growth of the global VDI market during the period.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global virtual desktop infrastructure market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global virtual desktop infrastructure market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the market potential.

Virtual Desktop Infrastructure Market Report Highlights

| Aspects | Details |

| By Offering |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Citrix Systems Inc. |

Analyst Review

The adoption of virtual desktop infrastructure (VDI) technology has increased significantly in the IT sector owing to high market competition and rise in prices of IT infrastructure and equipment. Moreover, VDI offers a number of advantages, such as advanced user mobility, ease of access, flexibility, and greater security. This is influencing IT organizations to deploy centrally controlled and less expensive client devices for their organization saving critical operational costs.

Key providers of the virtual desktop infrastructure (VDI) market such as IBM Corporation, HP Enterprise, and Vmware, Inc. account for a significant share of the market. Various brands are introducing virtualization technology to optimize their operational workloads with the larger requirement from large corporations. For instance, in July 2022, Amazon Web Services, Inc. has launched AWS Cloud WAN. AWS Cloud WAN makes it easier to operate a global network by connecting on-premises data centers, colocation facilities, branch offices, and the cloud. Customers can virtually select their network configuration, review their network around the globe and also make their routine configuration and security automated with the help of AWS Cloud WAN.

In addition, with the increase in demand for getting instant solutions to the problem with all the resourceful insights companies such as Cisco Systems, Inc. has performed strategic product development and launch to help the end users. For instance, in April 2021, Cisco Systems, Inc. launched Unified Computing System. This new server solution is equipped with 3rd Gen Intel Xeon Scalable processors. This new launch focuses on improving the performance, improving the security capabilities, and enhancing the workload management of the customers’ complex hybrid cloud and virtual infrastructure. Since the new solution is supported by 3rd Gen Intel Xeon Scalable processors, the customers can also use these processors such as Intel SGX, Intel TME, and a few more.

Furthermore, in March, 2021, Cisco Systems, Inc. partnered with Advanced Micro Devices. Cisco and AMD plan to enhance businesses'?operations on hybrid cloud platforms by providing them with better digital experiences. Cisco has launched a new platform, Unified Computing Systems which works with AMD EPYC 7003 Processors to enable businesses to manage their workloads on cloud and virtual desktop infrastructure.

Surge in the need to increase employee efficiency and enhanced data security offered by virtual desktop infrastructure (VDI) boost the growth of the global virtual desktop infrastructure (VDI) market. In addition, cost saving associated with VDI solutions positively impacts the growth of the virtual desktop infrastructure (VDI) industry.

Region wise, the virtual desktop infrastructure (VDI) market was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to its expanding investments in new technologies such as cloud and digital technologies are anticipated to bring prominent growth in the market.

The global virtual desktop infrastructure (VDI) market size was valued at $8.97 billion in 2021, and is projected to reach $19.77 billion by 2031, growing at a CAGR of 8.3% from 2022 to 2031.

The key players profiled in the Virtual desktop infrastructure (VDI) market analysis are IBM, HP Enterprise, Vmware, Inc, Ericom Software, Inc, Intel Corporation, Microsoft Corporation, Huawei Technologies, Parallels International Gmbh, AWS, Cisco Systems, Citrix, IGEL Technologies, Evolve IP, LLC, Redhat, Inc, N Computing Limited, Vagrant, Inc, Neverfail, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...