Virtual Teller Machine (VTM) Market Research, 2032

The global virtual teller machine (vtm) market was valued at $1.6 billion in 2022, and is projected to reach $5 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

Virtual teller machines are an efficient tool for financial and non-financial institutions to provide convenient and customized services to their customers in real-time. In addition, customers can perform banking transactions through virtual teller machines, while interacting with tellers located at call centers or other branches through video conferencing. Moreover, Interactive teller machines are a great example of modernization in personal financing. These machines are essentially evolved ATMs, and while somewhat limited in utility, VTM’s are providing an interesting option for financial institutions to serve customers in extremely rural or urban areas.

Increase in demand for cost-effective and secure solutions and surge in adoption of automation solutions in the banking sector is boosting the growth of the global virtual teller machine (VTM) market. In addition, increase in adoption of multifunctionality features in VTMs is positively impacts growth of the virtual teller machine (VTM) market. However, security issues and privacy concerns and high implementation cost is hampering the virtual teller machine (VTM) market growth. On the contrary, increase in adoption of video banking technology is expected to offer remunerative opportunities for expansion of the virtual teller machine (VTM) market during the forecast period.

Segment Review

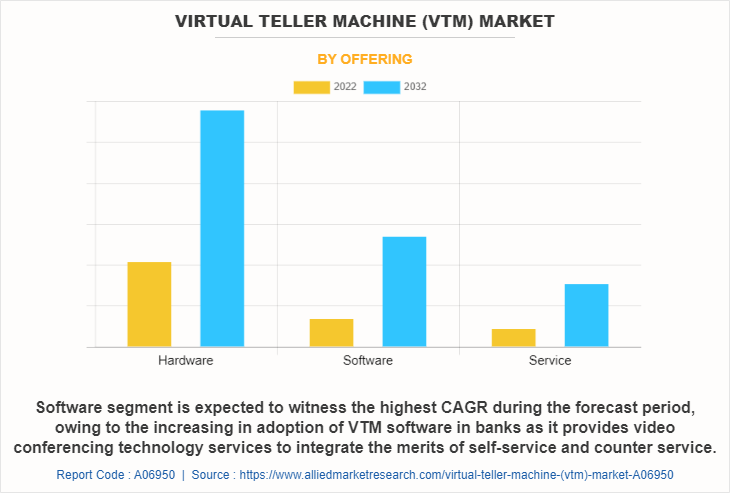

The virtual teller machine (VTM) market is segmented on the basis of by offering, deployment, provider, and region. On the basis of offering, the market is categorized into hardware, software and service. On the basis of deployment, the market is fragmented into on-site, off-site, and others. By provider, it is classified into bank and financial institutions and managed service provider. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of offering, the hardware segment holds the highest virtual teller machine (VTM) market share as it provides personalized services, accelerates throughput, and reduces operational costs. However, the software segment is expected to grow at the highest rate during the forecast period, owing to, rise in technological advancements such as digital convergence, integration of IoT data analysis, and biometrics & cybersecurity.

Region wise, the virtual teller machine (VTM) market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to growing demand for interactive machines and managed services in the financial sector. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rise in virtual teller machine (VTM) technology investment.

Major players operating in the virtual teller machine (VTM) market include Huawei Technologies Co., Ltd., Kontron AG, Aurionpro Solutions Ltd, Arman Design, KIOSK Information Systems, REDYREF, Slabb Kiosks, Phoenix Microsystems, NCR Corporation, and Hitachi-Omron Terminal Solutions. These players have adopted various strategies to increase their market penetration and strengthen their position in the virtual teller machine (VTM) industry.

Digital Capabilities

Video teller machine (VTM) is an electronic banking outlet that allows customers to complete basic transactions, request banking services or receive immediate assistance with the help of live video conferencing consultation with a remote bank teller. The virtual teller machine (VTM) has proven to be an innovative solution to integrate branch counter, ATM, internet banking, mobile banking, and call banking. Moreover, different modules are built into one machine to achieve cash deposit and withdrawal, check deposit, card issuing, investment product purchase, financial consulting, and payment services.

Furthermore, VTM is essentially a "branch in a box" system that uses a combination of touch screens and video technology to offer a virtual version of the in-person banking experience. AI-powered VTMs constantly learn to decode cash withdrawal patterns. Predictive models are highly precise and make it possible to minimize the overall level of cash. This helps eliminate the problem of excess cash idling in the drawers of VTMs. In addition, virtual teller provides banking customers with assistance via internet portals and other electronic systems, most commonly through an Interactive Teller Machine (ITM). These machines are a low-cost alternative to building a branch that offers self-service convenience while being able to maintain a personal touch with clients. Customers can use a virtual teller machine to do sophisticated financial operations while conversing with bankers via Video Conferencing.

Top Impacting Factors

Key Benefits for Stakeholders Increase in Demand for Cost-effective and Secure Solutions

With the growing adoption of cost-effective and secure solutions, customers are expecting more efficient and convenient banking services. Virtual teller machine (VTM) market providers offer solutions that allow banks and financial institutions to offer cost-effective and secure solutions such as online banking, cash withdraws, payment of bills, setting up deposits, making transfers from the account, as well as setting up new accounts fueling market growth in this space. Moreover, banks and financial institutions are prioritizing improving their customer experience to stay ahead of the competition in the market. virtual teller machine (VTM) solutions offer personalized, seamless experiences to customers, propelling demand for these solutions.

Moreover, BPOs are adopted by various banks and financial institutions for the better management of their business operations while offering improved collaboration, simplified compliance, productivity, and risk management. In addition, BPOs are being adopted increasingly, as they offer effective planning and streamlining of data under one platform, which help in regulating operational costs, enhancing decision-making, and increasing sales. With increase in focus of banks toward improving their operational and business process efficiency, the adoption of BPO in BFSI is expected to grow in the upcoming years. This subsequently fuels the growth of the virtual teller machine (VTM) market.

Surge in Adoption of Automation Solutions in the Banking Sector

During the COVID-19 pandemic, an upsurge in demand for automation services supported banks to sustain disruptions. In addition, major firms are also concentrating on introducing new items to obtain an advantage over rivals in the market. Customers of new items would receive complete banking capability. Its goal is to hasten business use of the automation. For instance, in April 2022, UiPath, a leading enterprise automation software company launched new automation as a service, offered on the Finastra cloud, designed to provide a managed service model for automation to Finastra’s thousands of banks, credit union, and financial institution customers.

Moreover, the cloud-native, software-as-a-service (SaaS) suite will give corporate and retail banks the ability to modernize their banking applications to meet customer demands. Furthermore, it is anticipated that increasing adoption of Payment-as-a-Service (PaaS), Big Data, remote banking solutions, video technology and cybersecurity will spur market expansion during the projected period. This factor has led to a surge in demand for automation-based banking systems, thereby fueling the growth of the virtual teller machine (VTM).

Restraint

High Implementation Cost

Implementing VTM software solutions requires substantial investments in terms of hardware, software, and personnel. This can be a major deterrent for small and medium-sized banks and financial institutions, thus hindering their adoption of banking software solutions. VTM is complex in nature, as it requires high level functions and integrations, thus leading to high cost standing between $35,000 and $70,000 and sometimes even higher than $150,000, in case of complex applications with high level features. Hence, this factor is expected to hamper the market growth. The major factors that are leading to higher costs are the implementation, migration, teams and bank's size, and tech-debt associated with digital service technology.

There are other infrastructure costs to consider in addition to the equipment purchase. These include network upgrades to offer the bandwidth required for high-resolution video integration, as well as the establishment of a call center to give remote teller help. The high installation cost is the main factor hindering the development of the virtual teller machine (VTM) market during the projected timeframe. Moreover, to modernize software changes, tech-stack is required, as a result ensuring compatibility of legacy components, while mitigating application to the cloud for data storage leads to compatibility issues and fixing compatibility issues leads to higher cost, thus hindering the virtual teller machine (VTM) market growth.

Opportunities

Increase in Adoption of Video Banking Technology

Increase in adoption of technologies such as the cloud, big data and video technology is changing the landscape of banking industry. In addition, the integration of such technologies with the banking process assists in advancing their visualization capabilities, resolving customer queries, and making complicated data usable. Moreover, video banking is an emerging technology in the banking industry where financial institutions such as banks and credit unions can engage their members or customers in face-to-face transactions with the help of remote video collaboration sessions. Moreover, various banks around the world are involved in implementing video technology for ATM, where customers can use high-definition video chat technology to connect with full-service bankers.

Furthermore, video banking provides personal assistance without manual interaction with the help of video technology. The live teller will appear on the screen to assist customers regarding cash or cheque deposit, account withdrawals, loan payments and transfers. The machine enabled with the video banking technologies do not require debit card or personal identification number (PIN) one can securely withdraw money from a video teller machine (VTM) as it connects face-to-face with banking representative it can implement the method of security questions and photo identification for personal verification. These technical developments in improved video technology standards will significantly pave numerous opportunities for global virtual teller machine (VTM) market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the virtual teller machine (VTM) market segmentation, current trends, estimations, and dynamics of the virtual teller machine market analysis from 2023 to 2032 to identify the prevailing virtual teller machine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the virtual teller machine market segmentation assists to determine the prevailing virtual teller machine (VTM) market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global virtual teller machine (VTM) market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the virtual teller machine (VTM) market players.

- The report includes the virtual teller machine (VTM) market analysis of the regional as well as global virtual teller machine (VTM) market trends, key players, virtual teller machine (VTM) market segments, application areas, and market growth strategies.

Virtual Teller Machine (VTM) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5 billion |

| Growth Rate | CAGR of 12.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 261 |

| By Offering |

|

| By Deployment |

|

| By Provider |

|

| By Region |

|

| Key Market Players | NCR Corporation, KIOSK Information Systems, Hitachi-Omron Terminal Solutions, Diebold Nixdorf, Arman Design, Huawei Technologies Co., Ltd., Kontron AG, Slabb Kiosks, REDYREF, Aurionpro Solutions Ltd |

Analyst Review

Virtual teller machine, or VTM, is a "branch in a box" system that utilizes touch screens and video technology to provide a virtual version of the in-person banking experience. It's an ATM with a live video chat feature. Customers can approach the VTM, press the begin button, and begin a video conversation with a live operator located anywhere in the world. This operator acts similarly to a bank teller in a traditional bank and can perform a variety of services for the consumer. VTMs can either completely replace traditional banks or be positioned alongside a bigger physical facility with live staff to handle more complex requests. Some banks prefer to keep a VTM available outside of usual banking hours to provide customers with greater flexibility.

The global virtual teller machine (VTM) market is expected to register high growth, owing to increasing demand for automation and digitalization across various industries, rise in need for cost-effective and secure banking and financial services, and the growing adoption of VTM solutions among public utilities sector organization are driving the growth of the market. Thus, the increase in the adoption of VTMs, owing to their high reliability and low latency networks is one of the most significant factors driving the growth of the market.

With the surge in demand for virtual teller machines (VTM), various companies have established alliances to increase their capabilities. In January 2021, UST announced a collaboration with KIOSK Information Systems (KIOSK) to develop an innovative self-service Retail AI Vision Checkout platform. The edge computing infrastructure gives consumers self-service access to functioning stores 24/7. Touchless checkout features both speech and gesture-based UI checkout interaction options, as well as flexible payment methods.

In addition, with further growth in investment across the world and the rise in demand for virtual teller machines (VTM), various companies have expanded their current product portfolio with increased diversification among customers. For instance, in January 2022, Burgan Bank launched fully Interactive Automated Teller Machines (ITM). The new advanced electronic banking outlets reflect the Bank's plan to adopt cutting-edge digital technologies that offer customers choice, access, and convenience by allowing them to complete a variety of financial operations seamlessly 24/7 from a variety of locations.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, in January 2023, Euronet Worldwide Inc acquired Bank of the Philippine Islands (BPI) to provide the highest standards of service to the customers of Bank of the Philippine Islands and other customers using these VTMs

The virtual teller machine market is estimated to grow at a CAGR of 12.5% from 2023 to 2032.

The virtual teller machine market is projected to reach $4,986.28 million by 2032.

Increase in demand for cost-effective and secure solutions and surge in adoption of automation solutions in the banking sector is boosting the growth of the global virtual teller machine (VTM) market. In addition, increase in adoption of multifunctionality features in VTMs is positively impacts growth of the virtual teller machine (VTM) market. However, security issues and privacy concerns and high implementation cost is hampering the virtual teller machine (VTM) market growth. On the contrary, increase in adoption of video banking technology is expected to offer remunerative opportunities for expansion of the virtual teller machine (VTM) market during the forecast period.

The key players profiled in the report include Huawei Technologies Co., Ltd., Kontron AG, Aurionpro Solutions Ltd, Arman Design, KIOSK Information Systems, REDYREF, Slabb Kiosks, Phoenix Microsystems, NCR Corporation, and Hitachi-Omron Terminal Solutions.

The key growth strategies of virtual teller machine market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...