Wall Covering Market Research, 2031

The Global Wall Covering Market size was valued at $152 billion in 2021, and is projected to reach $239.7 billion by 2031, growing at a CAGR of 4.7% from 2022 to 2031.

Wall covering is used to enhance the aesthetic appearance and protect the vertical surfaces of houses and offices. Depending on individual needs, it is a covering that may be used on both internal areas and external facades. Wall coverings are widely implemented in residential and non-residential sectors. Wallpaper, wall-panel, and tiles such as marble and ceramics are some of the popular materials used as wall coverings. Wallpaper and tiles are used at offices, business premises, and homes to make them look elegant and stylish.

Market Dynamics

Wall covering market has grown due to expansion of residential and non-residential construction in emerging countries. Furthermore, these coverings have various advantages, such as being moisture & stain resistant, they enhance texture, and protect wall surface. All of these benefits are expected to propel the wall covering market forward.

Moreover, increase in government and private investments in infrastructure in developed countries have fueled the market growth. In addition, technological advancement in digital and traditional printing has created growth opportunities for market during the forecast period.

The wall covering market has experienced growth as a result of an increase in construction and infrastructure activities. A change toward visually pleasing interior and exterior wall designs has occurred as a result of rise in personal disposable income, which is anticipated to support market development. Furthermore, rise in construction spending in developing countries is expected to have a positive impact on total market demand.

For instance, in March 2022, the U.S. President invested $3.1 billion in funding for new energy-efficient residential buildings. Hence, these investments are expected to provide lucrative growth in the wall covering market.

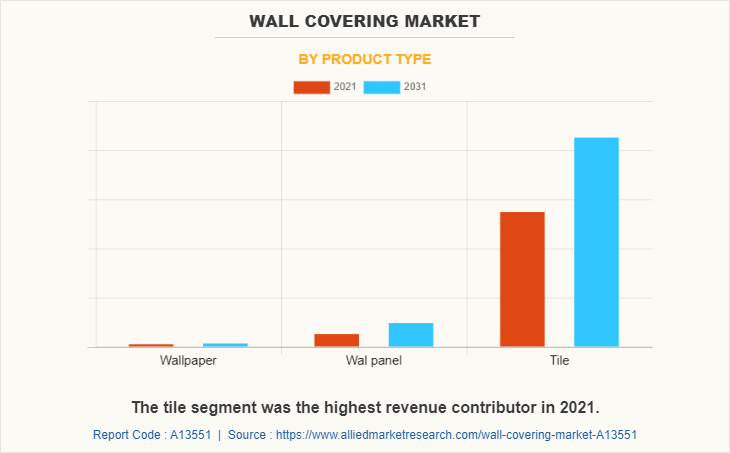

On the basis of type, the tile segment generated the largest revenue in 2021 due to an increase in demand from residential and commercial buildings for wall protection and to enhance the interior and exterior wall appearance. These merits are projected to boost the demand for the product, which is estimated to drive the overall market growth in the coming years. On the basis of application, the new construction segment accounted for the highest revenue in the global market in 2021, owing to the expanding market for wall covering in commercial structures including malls, universities, and large complexes.

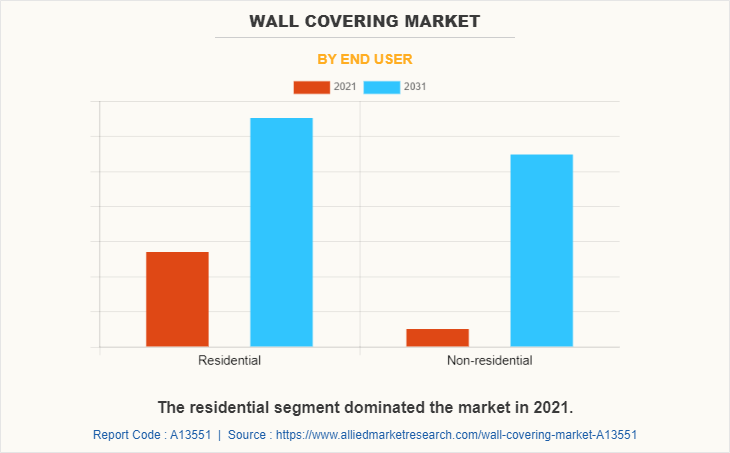

On the basis of end-user, the residential segment registered the highest revenue in 2021. This is due to an increase in residential homes due to the rise in population in countries such as the U.S., India, and China. Moreover, government investments in residential construction are fueling the wall covering market growth.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the wall covering market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 on the market. This has led to reopening of wall covering companies to their full-scale capacities.

This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

On the basis of region, Asia-Pacific registered the wall covering market share in 2021, owing to a rise in infrastructure activity in the region. Moreover, surge in construction activities owing to rapid urbanization & industrialization is estimated to boost the demand for wall covering. According to an article released by Global Construction and Oxford Economics, the volume of construction output is expected to witness growth by 85% to $15.5 trillion globally by 2030, with three countries, China, the U.S., and India, leading the way and accounting for 57% of all global growth. Hence, utilization of wall covering market in new construction and renovation for a sustainable environment is expected to provide lucrative growth opportunities in the wall covering market forecast period.

The wall covering market is segmented into Product Type, Printing type, Application and End User. On the basis of product, the market is divided into wallpaper, wall-panel and tiles. On the basis of application, the market is divided into new construction and renovation. On the basis of printing type, the market is divided into digital and traditional. On the basis of end-user, the market is divided into residential and non-residential. Region-wise, the market analysis is conducted across North America, Europe Asia-Pacific, and LAMEA.

Competition Analysis

The key players operating in the wall covering industry are A.S. Creation Tapeten AG, Ahlstrom Munksjo, Architonic, Asian Paints Ltd., Brewster, Daltile, F. Schumacher & Co., Grandeco, J. Josephson Inc., Maya Romanoff Corporation, Nippon Paint Holdings Co. Ltd., Onmi W.C. Inc., Osborne & Little, Saint Gobain Adfors, Sanderson Design Group, Waldan Paper Services, LLC, and York Wall Coverings.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wall covering market analysis from 2021 to 2031 to identify the prevailing wall covering market opportunities.

- The market research is offered along the wall covering market overview with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wall covering market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global wall covering market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the wall covering market players.

- The report includes the analysis of the regional as well as global wall covering market trends, key players, market segments, application areas, and market growth strategies.

Wall Covering Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 239.7 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 271 |

| By Product Type |

|

| By Printing type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ahlstrom Munksjo, A.S. Creation Tapeten AG, Daltile, York WallCoverings, Sanderson Design Group, Saint Gobain, Waldan Paper Services, LLC, Onmi W.C. Inc., J. Josephson Inc., Brewster, Asian Paints Ltd., Maya Romanoff Corporation, Nippon Paint Holdings Co. Ltd, Osborne & Little, Grandeco, F. Schumacher & Co., Architonic |

Analyst Review

The wall covering market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to remain the major revenue-generating region of the market in the near future. The implications of renovation and remodeling of existing buildings to abolish substandard architecture are expected to provide new opportunities mainly in the Asia-Pacific market over the coming years. Significant upgrades to educational, mall, hotel, and resort buildings are expected to provide strong growth opportunities during the forecast period in China, Germany, Spain, the UAE, and the U.S. Moreover, various technological advancements, digital printing, and wallpapers are expected to provide lucrative growth in the market.

Various market players have adopted strategies such as product launches, business expansions, acquisitions, and agreements to expand their businesses and strengthen their market position. For instance, in September 2021, Ahlstrom-Munksjö successfully completed the acquisition of Chinese decor paper producer, Minglian New Materials Technology Co., Ltd. By combining Minglian with its existing Decor business, Ahlstrom-Munksjö created a global leader in decor papers with improved cost competitiveness and strong presence in Europe, Americas, and Asia. The business combination allows Ahlstrom-Munksjö to leverage its brand and capabilities in the large and growing high-end decor paper market in China. ?As a result, such strategic moves are expected to provide lucrative growth opportunities in the global wall covering market.

The global wall coverings market size was valued at $152,035.1 million in 2021.

Asia-Pacific is the largest regional market for Wall Covering.

The wall coverings market size is projected to reach $239,732.8 million by 2031.

New construction is the leading application of Wall Covering Market.

Rapid urbanization in emerging economies and growth in construction sector are the upcoming trends of Wall Covering Market in the world

The product launch is key growth strategy of smart bathroom industry players.

Residential and non-residential are the end-user of the wall covering market.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...