Warehouse Automation Market Research - 2031

The Global Warehouse Automation Market size was valued at $13.6 billion in 2021, and is projected to reach $57.6 billion by 2031, growing at a CAGR of 15.3% from 2022 to 2031.

Market Introduction and Definition

Warehouse automation is the use of machines, robots, and software to automate the movement and storage of inventory and other goods in a warehouse.the process of implementing computer-based systems and autonomous machinery to help employees handle inventory from the time it enters the warehouse until it exits is known as warehouse automation. Automating warehouse operations involve modernized material handling equipment and highly automated machinery. It helps to streamline the warehouse processes, making them more efficient and error free while lowering costs.

Warehouse Automation Market Dynamics

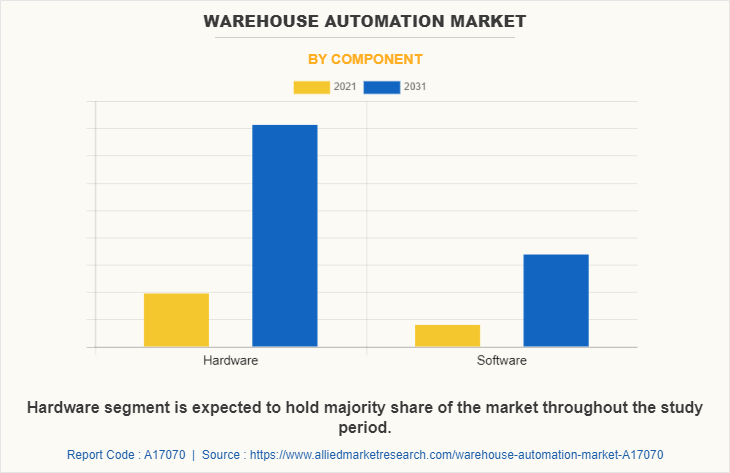

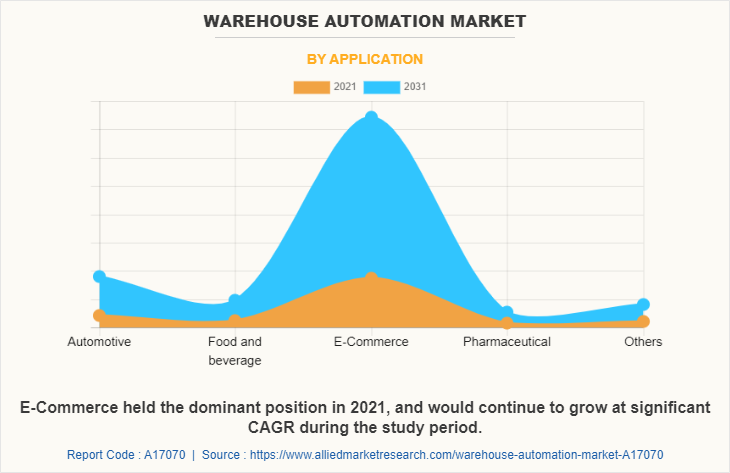

The market for warehouse automation is divided on component, application, end-user industry segment, regional basis. With regard to component, there are two: hardware or software. Automotive, food & beverage, e-commerce, pharmaceuticals and others make up application sectors of this market. Retailers plus manufacturers & distributors constitute its end-user industry segments. Geographical analysis includes North America, Europe Asia-Pacific and LAMEA.

Over the past few years, the online shopping convenience and a wide range of choices have been driving factors in boosting e-commerce industry particularly in the developed countries such as United States where in 2022 over 14% of entire retail sales were done online compared to about 6% in 2013.The same scenario applies in Philippines that experiences rapid growth of e-commerce due to increased number of smartphones users respectively. Government initiatives, like India's $1.24 billion investment in 5G broadband, boost e-commerce in developing nations like China and Brazil. Concurrently, global population growth, projected to exceed 9.5 billion by 2050, spurs industrial activity and trade, with Q1 2022 seeing a $1 trillion increase in global trade compared to the previous year.

This surge demands larger inventories, pushing traditional warehouses to adopt automation, particularly SMEs, which make up over 60% of market players. Yet, high initial costs for automation systems pose challenges, with prices ranging from hundreds of thousands to millions of dollars. Concerns over job displacement due to automation also loom large, especially for middle-skilled workers, with reports suggesting significant threats to jobs in countries like India and China. However, opportunities emerge with technological advancements, such as automated robots and intelligent software, offering promising growth avenues. Companies like Hormann and Honeywell pioneer innovative solutions, hinting at further industry advancements.

Recent Developments In Warehouse Automation Market

In March 2024 LG Business Solutions USA is introducing the LG CLOi CarryBot family of autonomous mobile robots (AMRs), aiming to redefine warehouse efficiency and flexibility. These robots are engineered to intelligently navigate intricate floor plans, facilitating the movement and delivery of payloads in customizable configurations. Loading and unloading tasks are handled by workers, enhancing operational efficiency and adaptability in warehouse environments.

In October 2023, Amazon announced new robotic solutions named Sequoia and Digit to enhance workplace safety and expedite deliveries to customers. These additions complement existing robotic arms like Sparrow and Cardinal, as well as the autonomous mobile robot Proteus

The global population is increasing at a significant pace. It is estimated that the global population can cross 9.5 billion by the year 2050, from around 7.5 billion in 2020. The rise in population is playing significant role in increasing the demand for various products. Industries hold, and organize their raw material, intermediate, and final inventories, in a warehouse for better management. This rise in demand for goods has stressed the traditional form of warehouse operation and management. Which is slow, subject to human errors, and has high operational cost. On the other hand, warehouse automation has enabled the warehouses to be more productive and quicker, with minimal human errors. In addition to that, reduction in human workforce leads to lesser operational cost. Along with the machineries, software is widely used in warehouses for better management, and execution of the orders.

E-commerce sector is growing at an exponential rate, owing to the convenience and large variety of products available on the online channels. During the COVID-19 pandemic induced lockdowns the sales in e-commerce sector were sky-rocketed. This has positively impacted the warehouse automation market. In addition, increasing number of geriatric populations, and increase in number of diseases have led to the rise in demand for pharmaceuticals. Since, pharmaceutical industry make extensive use of cold storage and warehouses, the demand for warehouse automation is expected to increase. Rising disposable income has also boosted the demand in industries such as automotive, textile, food & beverages, and manufacturing. These industries make extensive use of warehouses for storing their large inventories. Thus, rise in these industries is expected to boost the warehouse automation industry.

In addition, major businesses in the warehouse automation market offer a wide range of products and services, to meet the customers’ needs. They constantly innovate their offerings to stay competitive in the market. For instance, in September 2021, Honeywell International Inc., introduced its latest innovation in warehousing industry’s robotic technology. It launched a smart depalletizing robot for the warehouse automation market. This will enable the warehouses and distribution centers automate the manual process. Moreover, Other businesses in this market are partnering with other businesses in the similar market, to offer better and innovative products and services.

The novel coronavirus had rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic had halted the production of many components in warehouse automation market due to lockdown. The economic slowdown initially resulted in reduced spending on various warehouse automation components. However, COVID-19 has positively affected the e-commerce industry.

This prevented the warehouse automation market from a steep downward trend. In addition, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022 the number of COVID-19 cases have diminished significantly. This has led to the full-fledged reopening of warehouse automation providers at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, the advancements in technology that have improved the material handling devices and robots, are anticipated to provide lucrative opportunities for the warehouse automation market growth.

Warehouse Automation Market Segmentation

The warehouse automation market is segmented into Component, Application and End User Industry.

By component, the market is bifurcated into hardware, and software.

On the basis of application, the market is categorized into automotive, food & beverage, e-commerce, pharmaceuticals, and others.

On the basis of end-user industry, it is bifurcated into retailers, and manufacturers & distributors.

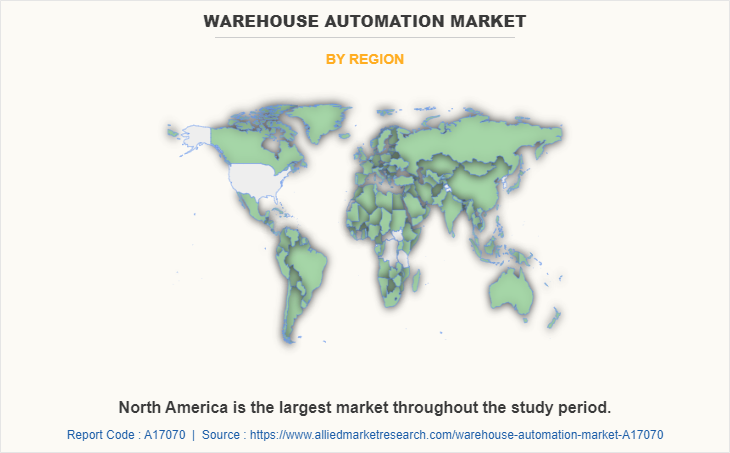

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America held the largest warehouse automation market share in 2021, accounting for the highest share. Whereas, Asia-Pacific is anticipated to grow at a higher CAGR throughout the forecast period. This is attributed to rapid economic growth of the region.

Competition Analysis

Key companies profiled in the warehouse automation market forecast report include ABB Ltd., Amazon.com Inc. (Amazon Robotics), ATMOS, Bastian Solutions LLC, Daifuku Co Ltd., Dorabot, Fanuc Corporation, Honeywell International Inc., Jungheinrich AG, KION GROUP (DEMATIC), Kuka AG, Omron Corporation, Schneider Electric, Siemens AG, SSI-Schaefer, Yaskawa Electric Corp, and Zebra Technologies Corporation (Fetch Robotics, Inc.)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the warehouse automation market analysis from 2021 to 2031 to identify the prevailing warehouse automation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the warehouse automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global warehouse automation market trends, key players, market segments, application areas, and market growth strategies.

Warehouse Automation Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 57.6 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 310 |

| By Component |

|

| By Application |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | Daifuku Co Ltd., Jungheinrich AG, KION GROUP (DEMATIC), SSI-Schaefer, Kuka AG, Bastian Solutions LLC, Fetch Robotics, Inc., Dorabot, Schneider Electric, ATMOS, ABB Ltd., Siemens AG, Fanuc Corporation, Omron Corporation, Yaskawa Electric Corp., Honeywell International Inc., Amazon Robotics |

Analyst Review

The warehouse automation market has witnessed significant growth in past few years, owing to surge in purchase from online-channels. The market is experiencing growth owing to rise in global trade, and increased disposable income.

Inventory management in a non-automated is labor intensive and prone to human errors. Thus, to address such issues, various levels of automation is being introduced in warehouses. An automated warehouse is largely managed by robots and other automated systems, which reduces the possibility of human error, and makes the warehouse work efficiently at a fast pace. This increases the profitability of warehouses. In addition, rise in labor costs is also a major factor driving the growth of the warehouse automation. Developed countries such as U.S., and Canada, which already had a highly developed e-commerce, and industrial sectors are leading the warehouse automation market. In addition, governments in developing countries have implemented various policies for development of industrial sector. Since, industries make significant use of warehouses for storage of raw materials and finished products, growth of industries is expected to drive the growth of the warehouse automation market.

Moreover, the advancements in artificial intelligence, and communication protocols are anticipated to make automation efficient; this is anticipated to provide lucrative opportunities for the market growth.

The development of warehouse automation systems that reduce the necessity of human intervention and enhance fast deliveries in E-Commerce industry is a major trend in the market.

Warehouse automation systems are extensively used by retailers as well as manufacturers and distributors.

North America is the largest regional market for Warehouse Automation.

$13,634.2 Million is the estimated industry size of Warehouse Automation.

ABB Ltd., Amazon.com Inc. (Amazon Robotics), ATMOS, Bastian Solutions LLC, Daifuku Co Ltd., Dorabot and Fanuc Corporation are some of the top companies to hold the market share in Warehouse Automation.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

The Warehouse Automation market is projected to reach $57,578.3 million by 2031.

Latest version of global Warehouse Automation market report can be obtained on demand from the website.

Loading Table Of Content...