Water Chillers Market Research - 2032

The Global Water Chillers Market was valued at $6 billion in 2022, and is projected to reach $8.4 billion by 2032, growing at a CAGR of 3.4% from 2023 to 2032.

Water chillers are mechanical devices that are used to lower the temperature of water. Most water chillers employ a closed loop system where a refrigerant is used for the heat exchange process. The heat extracted from the water by the refrigerant is then transferred to the atmosphere. Water chillers use components such as compressors, condensers, and evaporators for the cooling process. Water chillers require small space and are noiseless and vibration-less in their operation as they do not need vents and ducts unlike air chillers.

Market Dynamics

The feature of quiet operation of water chillers is a major advantage for it, as water chillers find increased application in hospitals and schools. They also incur low energy and maintenance costs. The thermal conductivity of water is very high, in comparison to that of air and thus water chillers are more efficient than air conditioners. Water chillers also do not need parts replacement as often as air cooled chillers as they are installed inside buildings unlike air chillers which are exposed to the outdoor elements such as rain, snow, ice, and heat, as they require lots of fresh supply of air to operate.

Water chillers benefit by their advantages over air chillers such as noiseless operation and higher efficiency. Quiet operation of water chillers is an important feature for end users such as hospitals and schools, where any extra noise is unwanted. Since water chillers use water as a refrigerant instead of other toxic chemicals, they are safer for people who come in contact with them. The growing global population and rising disposable income levels are important factors that are expected to contribute to the growth of the market and expansion of water chillers market size.

The rising urbanization and increased construction activity around the world is also a major driver for the water chillers industry. However, the higher cost of water chillers is a major restraining factor. Air chillers are cheaper in comparison to water chillers as they do not need components such as cooling towers and condenser water pumps as part of their design. Also, water chillers are less efficient than air chillers in humid environments. This is because humidity increases the wet-bulb temperature, which indicates how efficiently water absorbs heat.

Water chillers, however, have a longer lifespan and offer more savings on energy costs than air chillers. The opportunity for growth of the global water chillers market comes from the extensive use of water chillers in the global food & beverage, chemical & petrochemical and rubber & plastic industries. Petrochemicals that flow through pipes require cooling to reduce the heating of the product and water chillers are used in the plastic manufacturing industry to cool the hot plastic after extrusion or blowing molding process.

According to data from the United Nations (UN), more than 54% of the global population is living in urban areas. Due to the factors of growing population, urbanization, and increased standard of living of consumers around the world, the global air duct market is expected to expand. These factors are expected to aid the global water chillers market grow as the growth of the global HVAC industry is related to the growth of urbanization. With rising disposable income, consumers are increasingly looking for increased comfort in their living or working conditions.

Rising number of nuclear families is resulting in increasing construction of buildings in urbanized and rural areas. With the increasing number of commercial spaces such as hotels, office spaces, airports, educational institutions, and hospitals, the water chillers market is expected to grow at a rapid pace. A water chiller system can provide the benefit of reducing energy and maintenance costs due to its higher efficiency and longer service life. The rising number of hospitals, individual clinics, schools, and colleges around the world is anticipated to accelerate the market growth for water chillers in the near future, as quiet operation is particularly important in such environments where unwanted noise caused by air conditioner operation can cause disturbance.

Segmental Overview

The Water Chillers Market is segmented into Type, Installation and End User Industry, Capacity, System, Region.

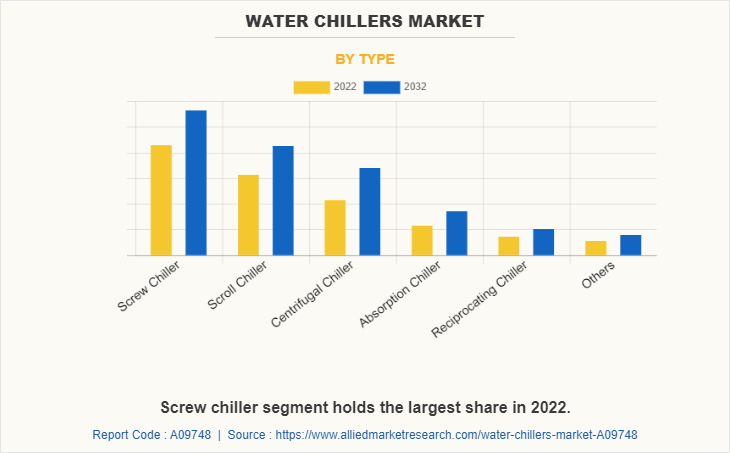

By Type:

On the basis of type, the water chillers market is bifurcated into screw chiller, scroll chiller, centrifugal chiller, absorption chiller, reciprocating chiller and others. In 2022, screw chiller segment registered the highest revenue as screw chillers are used for providing cooling solutions for both industrial operations and cooling systems. The screw chillers are lightweight and compact, and they have cooling capacities ranging from 20 tons to 1,000 tons. Some of the major companies in the market that deal with screw chillers include Trane Technologies Plc., Daikin Industries Ltd., and Johnson Controls.

District cooling is a centralized system of producing chilled water which is supplied through an underground pipeline system to provide cooling energy. District cooling is proven as a more cost-effective cooling solution that generates less carbon footprint. District cooling is better than traditional decentralized air conditioning as it reduces the impact on the environment and climate while being more efficient. District cooling as an alternative to traditional air conditioning can reduce electricity consumption during peak demand period. Centralized district cooling systems are being implemented by the government of Dubai to reduce the current electricity consumption of air conditioning systems. Such environment-friendly and cost-effective initiatives and projects are expected to increase the popularity and adoption of water chillers.

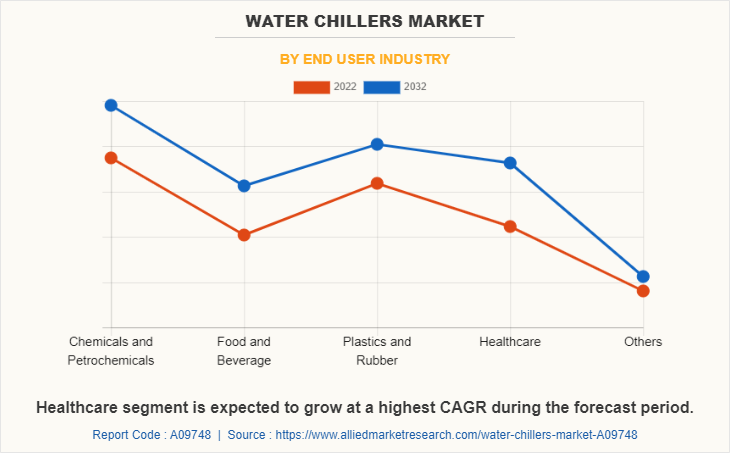

By End User Industry:

On the basis of end user industry, the water chillers market is bifurcated into chemicals & petrochemicals, food & beverage, plastics & rubber, healthcare and Others.. In 2022, chemicals & petrochemicals segment registered the highest revenue as Chemical reactions often generate heat that needs to be dissipated to maintain the desired temperature and prevent unwanted side reactions. Water chillers are used to cool the reactor and maintain the desired reaction temperature. Moreover, the development and manufacture of chillers that benefit the chemical and petrochemical industries is the primary focus of major market players.

However, during the COVID-19 pandemic, various manufacturers in the water chillers market had to stop their business in countries, such as China, the U.S., and India. This break directly impacted the sales of water chiller manufacturing companies. In addition, lack of manpower and raw materials also constricted supply of raw materials for manufacturing the water chillers, which negatively influenced the growth of the market. However, reopening of production facilities and introduction of vaccines for coronavirus disease are gradually leading the water chiller manufacturing companies to resume their regular manufacturing and services. This is expected to lead to re-initiation of companies at their full-scale capacities, that helped the market to recover by the end of 2021.

In addition, high initial investment and setup cost, fluctuation in raw material prices, and rise in demand for variable refrigerant flow (VRF) systems are anticipated to restrain the growth of the global water chiller market. On the contrary, technological innovation in chillers is expected to offer remunerative global water chillers market opportunity.

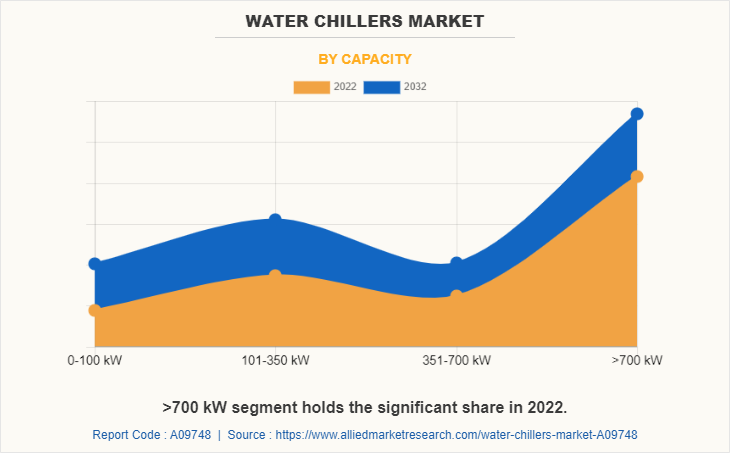

By Capacity:

On the basis of capacity, the water chillers market is bifurcated into 0-100 kW, 101-350 kW, 351-700 kW and >700 kW. In 2022, >700 kW segment registered the highest revenue as prominent players are developing technologically advanced and low-energy-consuming chillers to boost the development of the industry. For instance, in April 2021, Geoclima S.r.l., which is a leading manufacturer of refrigeration and heating equipment launched water cooled chiller with turbocor centrifugal compressors, axial fans and Evaporative System for outdoor installation. The cooling capacity of this newest water-cooled chiller is 2500 kW. Such factors are expected to drive the growth of the market.

The water chillers market is segmented on the basis of type, capacity, end user industry, system, and region. On the basis of type, the market is categorized into screw chiller, scroll chiller, centrifugal chiller, absorption chiller, reciprocating chiller, and others. On the basis of capacity, the market is divided into 0-100 kW, 101-350 kW, 351-700 kW and >700 kW. On the basis of end user industry, it is classified into chemicals and petrochemicals, food & beverage, plastics & rubber, healthcare, and others. On the basis of system, the market is further bifurcated into water accumulation and continuous flow. Region-wise, the market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

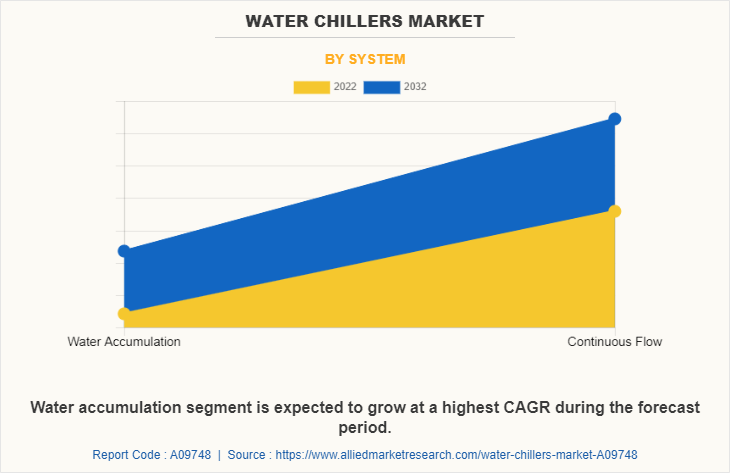

By System:

On the basis of system, the water chillers market is bifurcated into water accumulation and continuous flow. In 2022, continuous flow segment registered the highest revenue as such systems are easy to install and are highly durable. With time such systems are getting more efficient owing to the use of special circulation systems for these systems which makes these systems more efficient.

By Region:

On the basis of end user industry, the water chillers market is bifurcated into North America, Europe, Asia-Pacific and LAMEA.. In 2022, Asia-Pacific registered the highest revenue as strong economic growth, rapid urbanization, and presence of large population base significantly contribute toward the growth of the water chillers market in Asia-Pacific. In addition, increase in remodeling and repairing work in developing countries, such as China, India, Vietnam, and Indonesia fuels the demand for water chillers. China is the one of the most valued construction markets in Asia-Pacific, and its construction expenditure is expected to increase every year until 2030, owing to rise in income levels and rapid urbanization and industrialization.

Competition Analysis

The major players profiled in the report having significant water chillers market share included are Carrier Global Corporation, Mitsubishi Electric Corporation, Daikin Industries Ltd., Dimplex Thermal Solutions, LG Electronics, Johnson Controls International PLC, Gree Electric Appliances, Inc. of Zhuhai, Thermax Limited, Midea Group Co., Ltd., and Trane Technologies plc. Major companies in the market have adopted product launch, partnership, business expansion, and acquisition as their key developmental strategies to offer better products and services to customers in the market that is contributing towards water chillers market growth.

Key Benefits For Stakeholders

- This report provides a quantitative water chillers market forecast along with analysis of the market segments, current trends, estimations, and dynamics of the water chillers market analysis from 2022 to 2032 to identify the prevailing water chillers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the water chillers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global water chillers market trends, key players, market segments, application areas, and market growth strategies.

Water Chillers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.4 billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Type |

|

| By End User Industry |

|

| By Capacity |

|

| By System |

|

| By Region |

|

| Key Market Players | Mitsubishi Electric Corporation, Hitachi, Ltd., Johnson Controls International PLC, Thermax Limited, Dimplex Thermal Solutions, LG Electronics, Daikin Industries Ltd., Midea Group Co., Ltd., Trane Technologies plc, Carrier Global Corporation |

Analyst Review

The water chillers market witnesses huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to register significant growth in the near future, owing to strong economic growth, rapid urbanization, and the presence of a large population base. Furthermore, the majority of countries in the region spend on construction sector for the growth of their economies. The vapor compression chillers segment generated the highest revenue in 2021, due to an increase in demand for district cooling systems in many industries.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand its business and strengthen its market position. For instance, in May 2022, Carrier launched the innovative Aqua Edge 19MV oil-free water-cooled centrifugal chiller designed to deliver reliable performance, incredible efficiency, easy installation and a wide operating range. The launch of new water chillers with advanced specifications helps in offering a better product range useful for various industries such as food & beverage, plastics, medical, and others. As a result, such strategic moves are expected to provide lucrative growth opportunities in the global water chillers market during the forecast period.

In addition, growth of manufacturing industries, especially in countries such as India, China, and Vietnam, has led to rise in demand for water chillers. In addition, growth in the food & beverages sector in countries such as South Korea, Germany, and the U.S. has increased demand for chillers. Furthermore, scroll chillers are ideal for use in small and medium scale industries.

In addition, advancements in technologies are expected to reduce the negative environmental impact of chillers. For instance, the introduction of low-GWP (global warming potential) refrigerant in chillers is anticipated to reduce pollution caused by them. Furthermore, the availability of water chillers in a wide range of configurations and capacities increases its usability and positively influences the market.

The global water chillers market was valued at $6,005.6 million in 2022, and is projected to reach $8,412.7 million by 2032, registering a CAGR of 3.4% from 2023 to 2032.

The forecast period considered for the global water chiller market is 2022 to 2031, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global water chiller market report can be obtained on demand from the website.

The base year considered in the global water chiller market report is 2022.

The top companies holding the market share in the global water chiller market report are Carrier Global Corporation, Mitsubishi Electric Corporation, Daikin Industries Ltd., Dimplex Thermal Solutions, LG Electronics, Johnson Controls International PLC, Gree Electric Appliances, Inc. of Zhuhai, Thermax Limited, Midea Group Co., Ltd., and Trane Technologies plc.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

By type, the screw chillers segment is the highest share holder of water chiller market.

Loading Table Of Content...

Loading Research Methodology...