Water Pump Market Research: 2031

The Global Water Pump Market Size was valued at $56.1 billion in 2021, and is projected to reach $86.3 billion by 2031, growing at a CAGR of 4.4% from 2022 to 2031.A water pump is a device used to increase water pressure to transfer it from one position to another. Modern water pumps are used worldwide to supply water for agricultural, municipal, industrial, and residential applications. Water pumps are also utilized to transfer wastewater in sewage processing plants. Water pumps most often are operated by electricity, but other energy sources are also used such as gasoline or diesel engines.

Market Dynamics

Rise in growth of oil & gas industries, in turn, increases the demand for pumps, which is projected to boost the water pumps market growth. For instance, according to the report on North America Midstream Infrastructure Association, rise in oil & gas infrastructure is projected to grow from $685 million in 2018 to $895 million by 2035. In addition, standard valves can be easily upgraded using automatic actuator systems or automatic control systems, which drives the growth of the water pumps market.

Moreover, the demand for water pumps has significantly increased from the food & beverages industry mainly from the developing nations in Asia-Pacific and Latin America.A pump body mainly consists of a body, seat, and a stem, which may or may not be manufactured using a single material.

Moreover, industrial pumps are mainly custom designed and manufactured as well as available as pre-designed valves as per the industry requirement. Moreover, there is rise in adoption of pumps in oil & gas, food & beverages, power generation, water & wastewater, chemicals, and other prominent processing industries.

Furthermore, surge in agriculture and rising demand for processed food, the food & beverages processing industry has witnessed high growth in countries such as India, Brazil, and others. This, in turn, has created a high demand for water pumps for processing industries, thereby fueling the growth of the water pumps market. Furthermore, fluctuation in raw material prices is anticipated to restrain the growth of the water pumps market. Contrarily, technological innovation in water pumps in anticipated to provide lucrative opportunities for the water pump market growth.

The demand for water pumps decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic has shut down production of various products for the water pump end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the water pump market significantly during the pandemic.

The major demand for equipment and machinery was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was badly affected by the spread of coronavirus, thereby halting demand for equipment and machinery. Equipment and machinery manufacturers must focus on protecting their workforce, operations, and supply chains to respond to immediate crises and find new ways of working after COVID-19 infection cases start to decrease.

Segmental Overview

The water pump market is segmented into Type, Driving Force, Application, and Region. By type, it is divided into centrifugal pumps and positive displacement pumps. By driving force, the water pump market is classified into electric-driven and engine driven. By application, it is divided into oil & gas, chemicals, power generation, water/wastewater, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type:

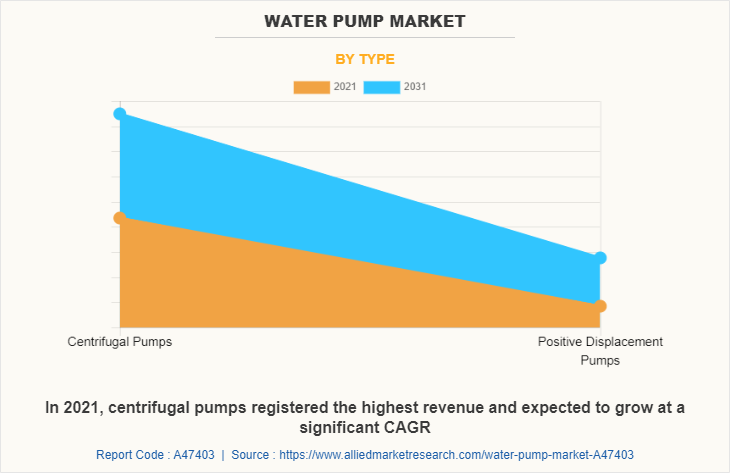

The water pump market is divided into centrifugal pump and positive displacement pumps. In 2021, centrifugal pumps registered the highest revenue and expected to grow at a significant CAGR, owing to centrifugal pumps are the most widely used pump because they are the best technology for water and thin liquids and slurries that are encountered in every industry such as oil & gas, chemical, water and wastewater treatment, agriculture, and construction. A centrifugal pump has many advantages over other materials such as easy maintenance and durability.

It offers a tight seal, which prevents leakage to a great extent. Linear control valves are used for industrial applications and can be utilized for flow of any fluid in the process. Major players, such as Flowserve Corporation and Metso Corporation, offer centrifugal pump for industrial applications. For instance, Flowserve Corporation offered a centrifugal pump named as RCEV-vertical chemical centrifugal pump. It has high-performance and excellent control performance, with low noise or low cavitation control function. It minimizes vibrations and is used for industrial applications. This versatile nature of centrifugal pumps highly contributes to the growth of the water pump market.

By Driving Force:

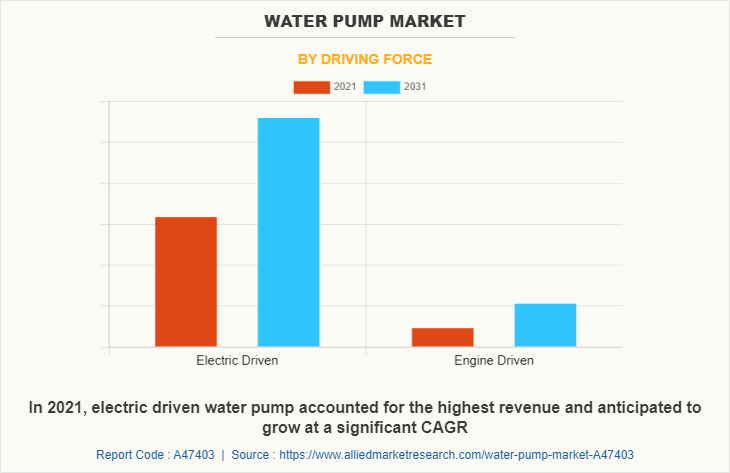

The water pump market is classified into electric-driven and engine driven. In 2021, electric driven water pump accounted for the highest revenue and anticipated to grow at a significant CAGR, because electric pumps are used in industries such as meat industries, food & beverages industry, fish canneries, milk & dairy sectors, and others. Electric pumps are used in applications such as dishwasher and washing machines. Increase in manufacturing and industrial activities around the globe leads to rise in demand for more electric pumps, which is expected to cater to the growth of the market.

By Application:

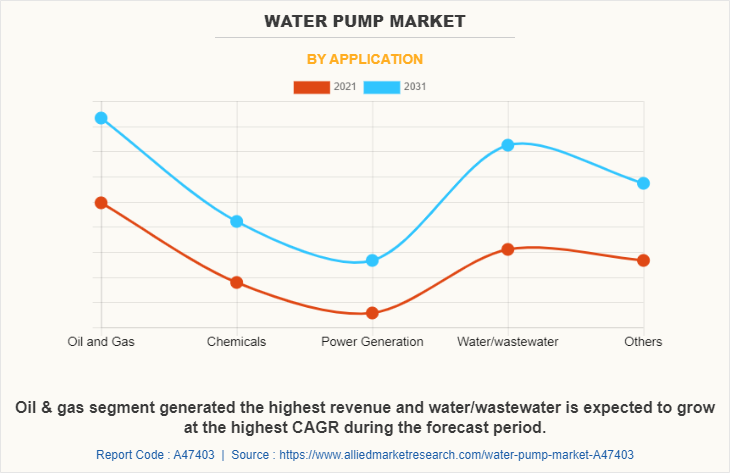

The water pump market is divided into oil & gas, chemicals, power generation, water/wastewater, and others. The oil & gas segment generated the highest revenue and water/wastewater is expected to grow at the highest CAGR during the forecast period. The oil & gas industry is the highest consumer of water pumps, mainly owing to the high demand for water pumps from nearly all its activities. For instance, according to DNV GL AS, a technical advisory company for oil & gas industry based in Norway, in 2020, the demand for oil & gas is mainly anticipated from emerging economies, including countries from South East Asia, Sub-Saharan Africa, India, and China. Moreover, the increase in global energy demand has led to high investments in the oil & power industry infrastructure.

In addition, European countries have focused on the generation of power from renewable resources, including hydraulic energy, geothermal energy, and solar energy. The construction of new infrastructure for power generation through these resources is expected to boost the growth of the water pumps market for oil & gas applications.

By Region:

The water pump market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest water pump market share and is anticipated to secure the leading position during the forecast period. Asia-Pacific includes majority of developing countries, such as India, Vietnam, and Indonesia, which exhibit lucrative opportunities for the water pumps market. Moreover, growth in infrastructure development in emerging countries, such as India and China, is anticipated to cater to the growth of the water pumps market.

For instance, China invested around $20 billion on a mega petrochemical project complex in Yantai, Shandong, China. Further the bio-pharmaceutical sector in Asia is growing rapidly, owing to large spending on life sciences, biotechnology, pharmaceuticals, and healthcare industry by local governments. Such growth perspectives in industrial growth aid in boosting the demand for water pumps, which is expected to drive the water pumps market significantly.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the water pump market include ATLAS COPCO, Baker Hughes, EBARA CORPORATION, Flowserve Corporation, Grundfos, Husqvarna AB, Kirloskar Brothers Limited, KSB Group, Sulzer AG, Xylem Inc. are provided in this report. There are some important players in the market such as Xylem Inc., Flowserve Corporation, and Ebara Corporation. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the water pump market.

Some examples of product launches in the market

In May 2021, KSB SE & Co. KGaA launched a new generation of its time-tested submersible grey water pumps on the market, the AmaDrainer 3 type series. This pump is having compact design, integrated float switch, and a diameter of no more than 155 mm make the type series suitable for narrow spaces such as light wells. As a result, it can be used for emergency drainage as well as other purposes including draining exterior basement stairwells and underground corridors. It can also be used to drain shafts and cellar rooms as well as to extract water from reservoirs and rivers.

In September 2021, Kirloskar Brothers Limited launched a new product, NEO series 4-inch borewell submersible pumps. These pumps provide a 60% reduction in electricity costs because to their energy-saving features. Even, this pump is available in a wide range of 40 models.

In November 2021, Husqvarna AB launched a HUSQVARNA W50P, which is a medium-sized water pump for drainage and irrigation. It is a quick-starting engine and a high-end pump house enabling effective and reliable work even in difficult conditions.

Acquisitions in the market

In December 2020, EBARA CORPORATION acquired Turkish company Vansan A.S. which is a renowned manufacturer of various types of pumps such as centrifugal pumps, submersible pumps & motors and axial flow vertical turbine pumps.

In August 2021, Atlas Copco AB acquired CPC Pumps International Inc., which is based in Ontario, Canada and it specializes in design and manufacturing of custom engineered and mission critical centrifugal pumps. This acquisition will strengthen the presence of Atlas Copco AB in the North America region.

In October 2021, Xylem Inc. acquired Turkish company, Anadolu Flygt which is a market leader in the supply, installation and after-sales service for pump and water treatment systems. This acquisition will strengthen the presence of Xylem's across the Middle East, Africa and Turkey region.

In March 2022, Sulzer Ltd. Ensival Moret (EM) which is a part of Moret Industries and it offers a wide range of industrial pumps with strong positions in a broad range of industrial applications such as fertilizers, sugar, mining, and chemicals.

In August 2022, Grundfos Holding A/S acquired Mechanical Equipment Company, Inc. (MECO) which is a leading manufacturer of industrial water treatment products. This acquisition will strengthen the presence of Grundfos Holding A/S in the North America region.

In October 2022, EBARA CORPORATION acquired Hayward Gordon L.P. which is a leading manufacturer of pumps and mixer in North America region. This acquisition will enhance the sales network of EBARA.

Partnership in the market

In March 2022, Flowserve Corporation partnered with Gradiant which delivers cutting-edge water and wastewater treatment facilities all over the world, with an emphasis on the rapidly developing Asia-Pacific and Americas regions. Through this partnership, customers will get unmatched comprehensive water treatment solutions that combine flowserve's flow control strategies and product expertise with Gradiant's cutting-edge customized water treatment technology.

Business Expansion in the market

In September 2022, Grundfos Holding A/S expanded its presence in Indjija, Serbia. This expansion adds an additional 17,000 sq. meters to its facility in the country. The new facility will primarily manufacture circulator pumps, domestic wastewater pumps, domestic pressure boosters, and integrated water circuits for the global market.

KEY BENEFITS FOR STAKEHOLDERS

The report provides an extensive analysis of the current and emerging global water pump market trends and dynamics.

In-depth market global water pump market analysis is conducted by constructing market estimations for key market segments between 2022 and 2031.

Extensive analysis of water pump market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

Water pump market forecast analysis from 2022 to 2031 is included in the report.

The key players within water pump market outlook are profiled in this report and their strategies are analysed thoroughly, which help understand the competitive outlook of water pump industry.

Water Pump Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 86.3 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 230 |

| By Type |

|

| By Driving Force |

|

| By Application |

|

| By Region |

|

| Key Market Players | EBARA CORPORATION, Grundfos Holding A/S, Husqvarna AB, Sulzer Ltd., Atlas Copco AB, Kirloskar Brothers Limited, Xylem, Baker Hughes Inc., KSB SE & Co. KGaA, Flowserve Corporation |

Analyst Review

The water pumps market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific registered the highest share of the global water pumps market share in 2021, owing to strong economic growth, rapid urbanization, and presence of large population base significantly contribute toward the growth of the water pumps market in Asia-Pacific. centrifugal pumps registered the highest revenue and expected to grow at a significant CAGR, owing to centrifugal pumps are the most widely used pump because they are the best technology for water and thin liquids and slurries that are encountered in every industry such as oil & gas, chemical, water and wastewater treatment, agriculture, and construction.

Various market players have adopted strategies such as product launch, business expansion, partnership, and acquisition to expand their business and strengthen their market position. For instance, in March 2022, Flowserve Corporation partnered with Gradiant which delivers cutting-edge water and wastewater treatment facilities all over the world, with an emphasis on the rapidly developing Asia-Pacific and Americas regions. Through this partnership, customers will get unmatched comprehensive water treatment solutions that combine flowserve's flow control strategies and product expertise with Gradiant's cutting-edge customized water treatment technology. As a result, such strategic moves are expected to provide lucrative growth opportunities in the global water pumps market.

The global water pump market was valued at $56,108.8 million in 2021, and is projected to reach $86,304.4 million by 2031, registering a CAGR of 4.4% from 2022 to 2031.

The base year considered in the global Water Pump market report is 2021.

Oil & gas is the leading application of the Water Pump Market.

The top 10 market players are selected based on two key attributes- competitive strength and market positioning.

Asia-Pacific is the largest regional market for Water Pump.

Rise in adoption of water pumps in oil & gas, chemicals, water/wastewater industry are the upcoming trends of Water Pump Market in the world.

ATLAS COPCO, Baker Hughes, EBARA CORPORATION, Flowserve Corporation, Grundfos, Husqvarna AB, Kirloskar Brothers Limited, KSB Group, Sulzer AG, Xylem Inc. are the top companies to hold the market share in Water Pump.

The report contains an exclusive company profile section, where leading 10 companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...