Water Treatment Technology Market Research, 2030

The global water treatment technology market was valued at $168.0 billion in 2020, and is projected to reach $265.9 billion by 2030, growing at a CAGR of 4.8% from 2021 to 2030.

Water treatment technology is an essential line of defense to eliminate bacteria and contaminants before the supply of potable and clean water for consumption. It includes several stages such as collection, screening & straining, chemical addition, coagulation & flocculation, sedimentation & clarification, filtration, disinfection, storage, and distribution.

The demand for chemically treated water increased, owing to rise in population and industrialization in many end-use segments where water treatment technology is used to provide clean and drinkable water. For instance, according to a report published by the Ministry of Jal Shakti of India, expenditure by the department of water resources increased at an annual growth rate of 5% from 2016to 2021. This may act as one of the key drivers responsible for the growth of the water treatment technology market. In addition, both developed and developing countries face water scarcity problems, owing to lack of freshwater resources, which, in turn, led the governments to focus more on water treatment technologies for producing clean and potable water. This fuel the growth of the water treatment technology market during the forecast period.

However, the cost of water treatment technology increased over the past few years, owing to the high cost of water & wastewater treatment equipment. Moreover, water treatment technology includes various stages that require highly efficient machines that can only be operated by experienced professionals. Thus, high equipment cost and less availability of trained professionals hamper the growth of the water treatment technology market.

On the contrary, technological advancements and increasing R&D activities led to development of energy efficient water technology systems. For instance, Pure Aqua Inc. developed an energy efficient reverse osmosis system that can effectively filter-off unwanted dissolved solids in the water by consuming around 30% less energy compared to conventional reverse osmosis systems. Furthermore, introduction of automation, remote control, and communication technologies in water treatment system have made the manufacturers of water treatment systems to lower operating cost by maximizing operational flexibility. This can increase the demand for automated water treatment technologies in various end-use sectors, thus is expected to provide lucrative growth opportunities for the market.

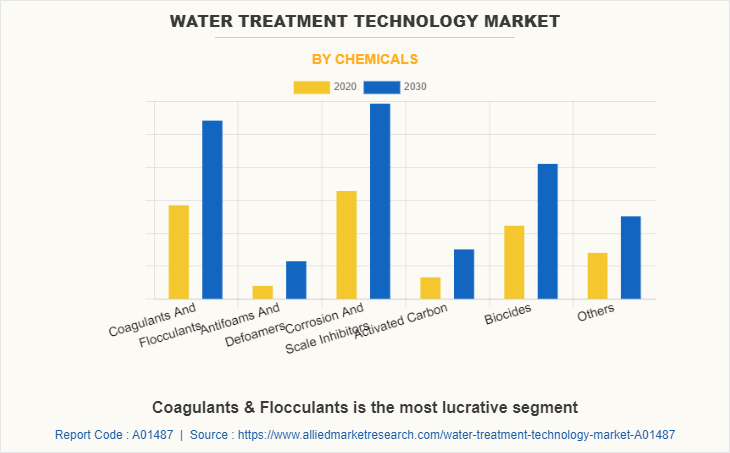

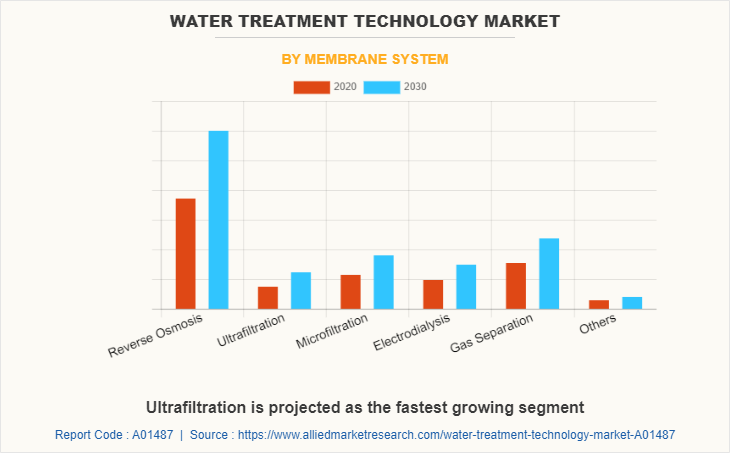

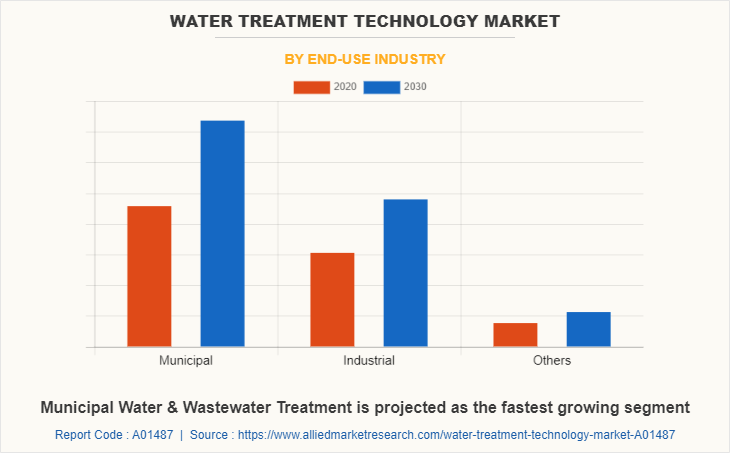

The water treatment technology market is segmented on the basis of chemicals, membrane system, end-user industry, and region. Depending on chemicals, it is fragmented into coagulants & flocculants, antifoam & defoamers, corrosion & scale inhibitors, activated carbon, biocides, and others. According to membrane system, it is classified into reverse osmosis, ultrafiltration, microfiltration, electrodialysis, gas separation, and others. As per the end-user industry, it is classified into municipal water & wastewater treatment, industrial, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include AECOM, Aquatech International LLC, Ashland Global Holdings Inc., BASF SE, BioMicrobics, Inc., DOW, DuPont, PepsiCo, the 3 M company, and The Coco-Cola Company.

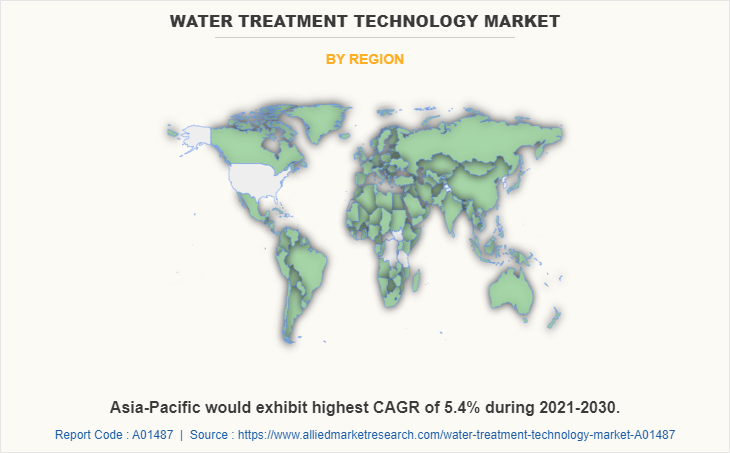

Asia-Pacific water treatment technology market size is projected to grow at the highest CAGR of 5.4% during the forecast period and accounted for 29.2% of water treatment technology market share in 2020. This is attributed to the increase in scarcity of freshwater sources in the region, which, in turn, surged the demand for water treatment technologies to provide clean and potable water. Furthermore, countries such as China, India, and Australia emphasize on development of water treatment plants to mitigate the scarcity of fresh water. For instance, according to a report published by the National Institution for Transforming India (NITI Aayog), in February 2021, India's wastewater treatment plants market stood at $2.4 billion in 2019 and is projected to reach $4.3 billion by 2025, owing to increase in demand for municipal and sewage water treatment plants across the country This is projected to aggressively penetrate the demand for water treatment technology in Asia-Pacific. Moreover, increase in demand for water treatment technology in countries, including China, India, Japan, and Korea, attracted the key players to expand or enter the region.

According to chemicals, coagulants & flocculants segment is anticipated to grow at the highest CAGR of 5.3% during the forecast period. This is attributed to the fact that coagulants & flocculants are cost-effective chemicals with high efficiency over wide range of pH and water temperatures. Furthermore, it can lower dosage requirements to achieve the required water treatment. This has made customers more linear toward purchasing coagulants & flocculants for various water treatment applications, hence fueling the growth of coagulants & flocculants segment in the global water treatment technology market.

As per the membrane system, the reverse osmosis segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 5.0% during the forecast period. This is attributed to the fact that reverse osmosis is the best method for water softening. Furthermore, factors such as less maintenance, high system efficiency, less space requirement, and easy installation make reverse osmosis one of the widely used membrane system in various end-use industries. These factors drive the growth of the reverse osmosis segment in the global water treatment technology market.

Depending on end-user industry, the municipal water & wastewater treatment segment dominated the global market in 2020, and is anticipated to grow at CAGR of 4.9% during the forecast period. This is attributed to industrialization and urbanization in both developed and developing countries, including the U.S., China, and India which, in turn, increase the requirement for water and wastewater treatment plants. For instance, according to an article published by The Times of India, in September 2021, Delhi Jal Board (DJB) established India’s largest wastewater treatment plant in 2022 that is capable to treat around 564 billion liters of wastewater per day. This propel the growth of municipal water and wastewater treatment segment in the global water treatment technology market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the water treatment technology market analysis from 2020 to 2030 to identify the prevailing water treatment technology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the water treatment technology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global water treatment technology market trends, key players, market segments, application areas, and market growth strategies.

IMPACT OF COVID-19 ON THE GLOBAL WATER TREATMENT TECHNOLOGY MARKET

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe.

- COVID-19 negatively impacted the water treatment technology market, owing to its dependence on chemical, petrochemical, pulp & paper, municipal water & wastewater facilities, and other sectors. According to a report published by the National Bureau of Statistics of China, the chemical industry witnessed a 20% decline in production in March 2020 compared to March 2019, while profits declined by 66%.

- Furthermore, several chemical manufacturing companies either shut down or halted their operations, due to the risk of infections among workforce where water treatment technology-based equipment are used for transporting & filtering large liquid masses. This temporarily hampered the water treatment technology market amid the COVID-19 period.

- In addition, the falling income of customers and international travel restrictions led to a contraction of the demand for water treatment technology among refining sectors. For instance, according to a report published by the U.S Bureau of Labor Statistics, in March 2020, the global oil demand decreased by 3 billion barrels per day during March 2020, owing to the lockdowns and transport restrictions.

- In addition, around 100 countries temporarily halted the trade of unnecessary products which, in turn, hampered the demand-supply chain of water treatment technology equipment.

- However, the demand for water treatment technology among sectors such as agriculture and food processing maintained the position of the water treatment technology market in both developed and developing economies during the COVID-19 situation. For instance, according to an article published by DownToEarth, the gross value added (GVA) by agriculture sectors in India grown by 3.4% during April-June 2020.

Water Treatment Technology Market Report Highlights

| Aspects | Details |

| By Chemicals |

|

| By Membrane System |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | AECOM, BASF SE, The 3M Company, PepsiCo, BioMicrobics, Inc., Ashland Global Holdings Inc., DOW, DuPont, Aquatech International LLC, The Coca-Cola Company |

Analyst Review

According to the CXOs of leading companies, the global water treatment technology market is expected to exhibit high growth potential during forecast period. The increase in use of water treatment technology in various end-user industries, including oil & gas, pulp & paper, chemical, food & beverage, healthcare, and municipal supplemented the market growth. In addition, the Asia-Pacific wastewater and sewage treatment market offers promising opportunities for the water treatment technology manufacturers, owing to increase in demand for chemically treated water in countries, including India, China, and Australia. Furthermore, increase in demand for efficient and cost-effective automated water treatment equipment and emergence of automation program, such as industry 4.0 in water treatment sector propel the growth of the water treatment technology market.

In addition, reverse osmosis membrane system for water treatment is often regarded as a cost effective alternative in oil refining and chemical manufacturing activities. In addition, factors including easy installation, less maintenance, and novel inventions for application of water treatment technology in several end-use industries drive the growth of water treatment technology market.

The CXOs further added that sustained economic growth and development of municipal water & wastewater treatment facilities increase the demand for water treatment technology.

Factors such as increasing demand for chemically treated water, lack of freshwater resources, and rapid industrialization in both developed and developing are the key factors boosting the water treatment technology market growth.

The global water treatment technology market was valued at $168 billion in 2020, and is projected to reach $265.9 billion by 2030, growing at a CAGR of 4.8% from 2021 to 2030.

AECOM, Aquatech International LLC, Ashland Global Holdings Inc., BASF SE, BioMicrobics, Inc., DOW, DuPont, PepsiCo, The 3M company, and The Coco-Cola Companyare the key players in the global water treatment technology market.

Industries such as municipal water & waste water treatment, pulp & paper, chemical manufacturing, food & beverage, healthcare, and others may increase the demand for water treatment technology.

The water treatment technology market is segmented on the basis of chemicals, membrane system, end user industry, and region. Depending on chemicals, it is fragmented into coagulants & flocculants, antifoam & defoamers, corrosion & scale inhibitors, activated carbon, biocides, and others. According to membrane system, it is classified into reverse osmosis, ultrafiltration, microfiltration, electrodialysis, gas separation, and others. As per the end-user industry, it is classified into municipal water & wastewater, industrial, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Increasing government initiatives for wastewater treatment, technological advancements in water treatment technology, urgent requirement to minimize the scarcity of water, and rising awareness about the benefits of water treatment are the drivers of water treatment technology market.

Applications such as municipal water & wastewater treatment, industrial, and others are expected to drive the adoption of water treatment technology market during the forecast period.

Loading Table Of Content...