Waterproofing Products Market Research, 2033

The global waterproofing products market was valued at $42.5 billion in 2019 and is projected to reach $66.1 billion by 2033, growing at a CAGR of 3.8% from 2023 to 2033.

Report Key Highlighters:

- The global waterproofing products market has been analyzed in terms of value ($Million). The analysis in the report is provided based on product type, application, 5 major regions, and more than 15 countries.

- The global waterproofing products market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The waterproofing products market is fragmented in nature with few players such as BASF SE, Sika AG, Carlisle Companies Inc., RPM International Inc., GCP Applied Technologies Inc., which hold significant share of the market.

- The report facilitates strategy planning and industry dynamics to enhance decision-making for existing market players and new entrants entering the waterproofing products industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share of the global waterproofing products market.

Waterproofing products are materials or coatings designed to prevent the penetration of water into structures, protecting against moisture-related damage. These products are crucial in various construction applications, such as roofs, basements, foundations, and bathrooms. They serve to create a barrier that repels water, preventing it from seeping through surfaces and causing structural deterioration.

The properties of effective waterproofing products include durability, flexibility, and adherence to diverse surfaces. These products are often formulated with materials such as bitumen, silicone, acrylics, or elastomeric compounds to ensure resilience against weathering and temperature fluctuations. In addition, they offer UV resistance to withstand sunlight exposure. Waterproofing products come in various forms, including liquid membranes, sheet membranes, and sealants, allowing for application versatility. Their ability to form a seamless protective layer enhances the longevity of structures by safeguarding against water ingress, mold growth, and corrosion; thereby preserving the integrity and longevity of buildings and infrastructure.

The growth of the construction industry serves as a key driver for the waterproofing products market.

As the construction sector expands globally, which includes residential, commercial, and industrial developments, the demand for effective waterproofing solutions experiences a simultaneous surge. This heightened demand is rooted in the industry's intrinsic need to fortify structures against water ingress, which can lead to pervasive damage, compromising the longevity and integrity of buildings.

Urbanization trends further increase this demand, as a rise in the development of urban areas intensifies construction activities, necessitating robust waterproofing measures to safeguard structures from the deleterious effects of water exposure. Governments' substantial investments in infrastructure projects, including bridges, tunnels, and highways, contribute significantly to the demand for waterproofing products, as these projects require resilient protection against water-induced deterioration.

An increase in demand for waterproofing membranes from roofing and wall applications is expected to drive the demand for waterproofing products.

Waterproofing membranes are utilized in roofing and constructing walls as they have high tensile strength and are weather resistant. In addition, they help to improve flow resistance at high temperatures and offer fire resistance. In the Middle East and Asia-Pacific, there is a growing need for waterproofing membranes for use in wall and roofing applications, owing to rise in initiatives involving commercial infrastructure in these areas.

The popularity of PVC roofing systems has increased recently due to several unique qualities, such as their long lifespan, resilience to extreme weather and temperature changes, low lifecycle costs, energy efficiency, heat and solar reflectance, flame resistance, chemical and grease resistance, ease of maintenance, installation flexibility, inherent recyclability or repurposing, and other benefits. According to the Ministry of Housing, Communities, and Local Government (UK), the UK’s new housing unit building climbed from 41,600 units in Q4 2021 to 42,350 units in Q1 2022. In addition, a House of Commons report released in 2022 stated that the number of households in England is predicted to rise steadily to 26.9 million units by 2043, representing increase of almost 150,000 households per year.

The Bureau of Economic Analysis estimates that the value added by the construction sector in the U.S. during the first three quarters of 2022 was approximately $2,980 billion, which represents a 5% increase over the same period the previous year. Manchester City Council approved a nine-year development proposal for four skyscrapers in February 2022. Under this project, residential buildings with 39–60 floors will be built on the Trinity Islands, which are the banks of the River Irwell. The project is expected to involve building 1,950 apartments. Thus, a rise in demand for waterproofing membranes is expected to drive the growth of the waterproofing products market during the forecast period.

Fluctuating raw material prices pose a significant challenge to the waterproofing products market, impacting both production costs and overall demand. The industry heavily relies on materials such as polymers, resins, and additives, the prices of which are subject to market dynamics, geopolitical factors, and supply chain disruptions. Sudden and unpredictable increases in raw material costs can lead to elevated production expenses for manufacturers, ultimately affecting the affordability of waterproofing products for consumers and businesses.

This can create a deterrent to construction projects and maintenance activities, as stakeholders may defer or scale back their plans to mitigate rise in expenses. Moreover, the volatility in raw material prices can disrupt long-term planning and budgeting for construction projects, as contractors and developers may struggle to anticipate and absorb unexpected cost hikes. This uncertainty may lead to delays in decision-making and project implementation, further hindering the demand for waterproofing products.

Rise in demand for environmentally friendly solutions in the construction industry is expected to offer lucrative opportunities to the waterproofing products market. With increasing awareness of environmental sustainability, there is a growing preference for construction materials that minimize ecological impact. This shift in consumer and industry preferences is steering the market towards innovative, green waterproofing products.

Manufacturers are responding to this demand by developing eco-friendly materials that not only offer effective waterproofing solutions but also align with sustainable construction practices. Surge in interest in environmentally friendly waterproofing products can be attributed to the construction industry's commitment to reduce its carbon footprint. Consumers and regulatory bodies are placing greater emphasis on adopting construction materials that are not only efficient but also ecologically responsible. This trend is prompting manufacturers to invest in R&D to create waterproofing solutions that meet stringent environmental standards.

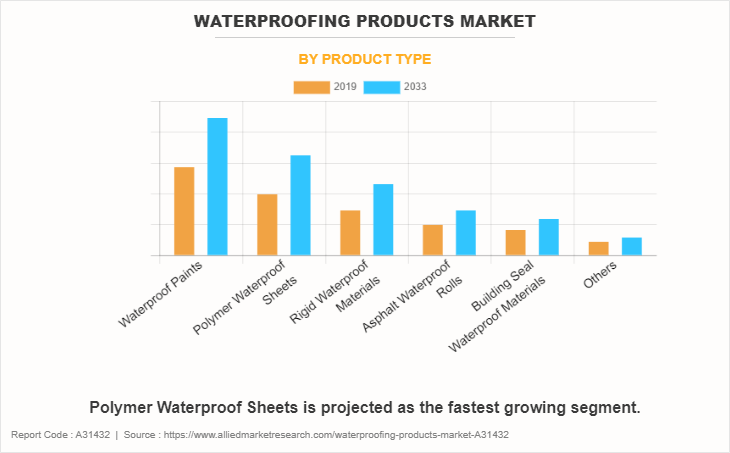

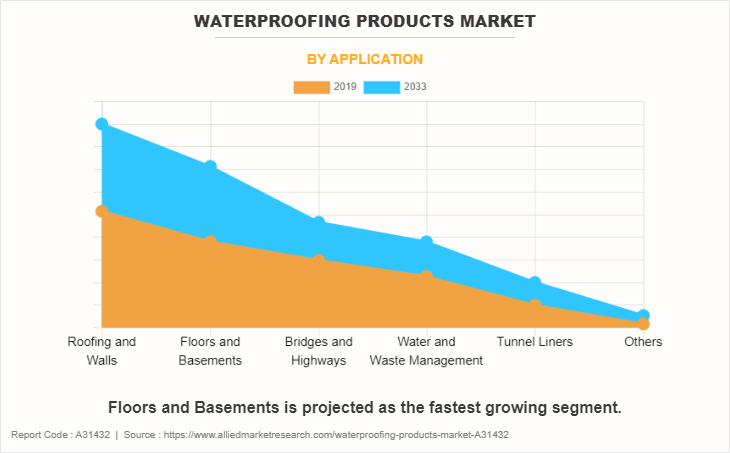

The global waterproofing products market is segmented into product type, application, and region. By product type, the market is divided into waterproof paints, polymer waterproof sheets, rigid waterproof materials, asphalt waterproof rolls, building seal waterproof materials, and others. By application, it is categorized into roofing and walls, floors and basements, water and waste management, tunnel liners, bridges and highways, and others. region-wise, the market is studied across North America, Europe, Asia-Pacific, South America, and Middle East and Africa.

The waterproof paints segment accounted for the largest share in 2019. The increasing demand for waterproof paints in the waterproofing products market can be attributed to a growing awareness of the importance of protecting surfaces from water damage. Additionally, the rise in construction activities, climate variations, and a desire for durable and long-lasting solutions further drive the demand for waterproof paints in the market.

Polymer waterproof sheets is expected to register the highest CAGR of 4.3%. The increasing demand for polymer waterproof sheets in the waterproofing products market can be attributed to their superior durability, flexibility, and cost-effectiveness. These sheets offer excellent water resistance, UV stability, and ease of installation, making them a preferred choice for construction projects seeking long-lasting and efficient waterproofing solutions.

The roofing and walls segment accounted for the largest share in 2019. The growing awareness of climate change and extreme weather conditions has fueled the demand for waterproofing products in roofing and walls applications. Additionally, the construction industry's continuous expansion, coupled with the increasing focus on sustainable and energy-efficient buildings, has driven the adoption of advanced waterproofing solutions, boosting market demand.

Floors and basements is expected to register the highest CAGR of 4.4%. The rising demand for floors and basements waterproofing products is propelled by increasing construction activities, growing awareness of the importance of waterproofing for structural longevity, and a surge in urbanization. Additionally, climate change-induced weather extremes have heightened the need for effective waterproofing solutions, further driving market demand.

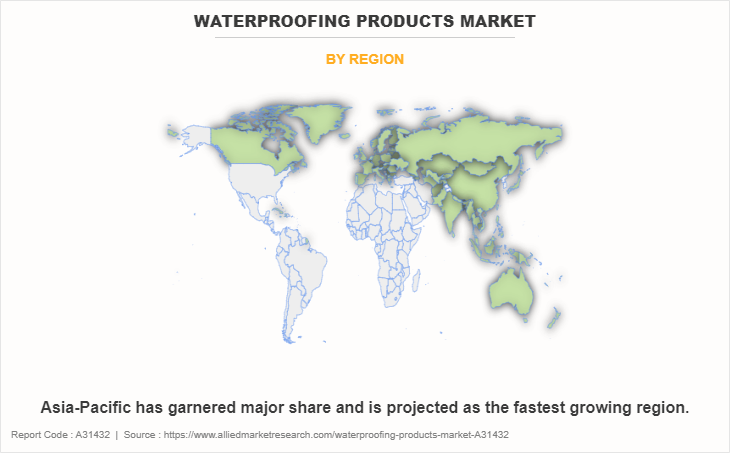

Asia-Pacific garnered the largest share in 2019. The demand for waterproofing products in the Asia-Pacific region is increasing due to rapid urbanization, a surge in construction activities, and heightened awareness of the importance of protecting structures from water damage. Additionally, frequent extreme weather events and the growing emphasis on sustainable construction practices further drive the need for effective waterproofing solutions.

The major players operating in the global waterproofing products market are BASF SE, Sika AG, Carlisle Companies Inc., RPM International Inc., GCP Applied Technologies Inc., HOLCIM, Soprema Group, GAF, Henry Company, and The Dow Chemical Company.

Other players operating in the market are Saint-Gobain Weber GmbH, Fosroc Ltd., Maris Polymers, Pidilite Industries Ltd., and Bayer Material Science AG.

Strategies Undertaken By Key Players:

In March 2023, Holcim acquired Quimexur, a leading producer of liquid membranes for roofing and waterproofing applications in Argentina. This acquisition is expected to expand HOLCIM's position in roofing and waterproofing across Latin America.

In May 2023, Holcim acquired PASA, a leading producer of roofing and waterproofing solutions in Mexico and Central America. With this acquisition, HOLCIM is further expanding its solutions and products business to become a leader in roofing systems in Latin America.

In October 2022, Holcim acquired the Polymers Sealants North America (PSNA), a leader in coating, adhesive and sealant solutions. with this acquisition PSNA is expected to accelerate the growth of Solutions and Products, especially in waterproofing and coatings.

In January 2021, Henry Company, a leader in building envelope systems, announced the launch of the Henry Blueskin PreSeal System – a pre-applied waterproofing system that incorporates a proprietary dual bond technology, providing a mechanical and chemical bond for improved adhesion to concrete. This product launch significantly increased the demand for waterproofing products market.

In August 2021, Sika AG acquired Shenzhen Landun Holding Co., Ltd., a manufacturer of waterproofing systems in China. This acquisition provided a platform for Sika AG to further grow and strengthen its position in the fast-growing China waterproofing products market.

In July 2021, Sika acquired American Hydrotech Inc. in the U.S. and its affiliate Hydrotech Membrane Corporation in Canada. Hydrotech is an experienced and highly regarded liquid membrane manufacturer and provider of full-system roofing and waterproofing solutions. This acquisition strengthens Sika's roofing and waterproofing portfolio.

In June 2020, Sika acquired Modern Waterproofing Group, a leading manufacturer of roofing and waterproofing systems in Egypt. This acquisition extended Sika Egypt's offering of roofing, waterproofing, and building envelope systems and boosted the waterproofing products market growth.

In March 2020, Sika AG, a specialty chemical company that supplies to the building sector and motor vehicle industry introduced a new production facility for the SikaProof structural waterproofing membrane. The SikaProof system is used to waterproof below-ground structures and basements. This expansion boosted the growth of waterproofing products.

In January 2020, BASF introduced MasterSeal 730 UVS waterproofing membrane for integral sealing of below grade structures. MasterSeal 730 UVS is a pre-applied, high-density polyethylene (HDPE) sheet waterproofing membrane treated with unique pressure-sensitive adhesive and protective coating to enable good adhesion with concrete surfaces without requiring additional protective screed. This product launch boosted the growth of waterproofing products.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the waterproofing products market analysis from 2019 to 2033 to identify the prevailing waterproofing products market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the waterproofing products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global waterproofing products market trends, key players, market segments, application areas, and market growth strategies.

Waterproofing Products Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 66.1 billion |

| Growth Rate | CAGR of 3.8% |

| Forecast period | 2019 - 2033 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Carlisle Companies Inc., Dow, GCP Applied Technologies Inc., Soprema, Henry Company, GAF., HOLCIM, BASF SE, Sika AG, RPM International Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, rise in awareness and emphasis on construction durability and longevity are the primary drivers fueling the growth of the market. Rise in urbanization continues to leads to growing demand for robust waterproofing solutions to protect structures from water damage, ensuring their structural integrity over time. In addition, stringent building codes and regulations mandating the use of waterproofing materials in construction projects contribute significantly to the market's expansion.

However, the market faces certain restraints that may impede its growth. One key restraint is high initial cost associated with advanced waterproofing technologies and materials. This can pose a challenge for small-scale construction projects and budget-conscious consumers, limiting the widespread adoption of waterproofing products. In addition, lack of awareness and education about the benefits of waterproofing among some stakeholders in the construction industry may hinder the market growth.,

The CXOs further added that the waterproofing products market presents lucrative opportunities for manufacturers and suppliers. Rise in focus on sustainable and environmentally friendly construction practices has led to the development of eco-friendly waterproofing solutions. This trend aligns with the growing global consciousness towards environmental conservation and presents an opportunity for market players to innovate and cater to rise in demand for sustainable building materials. Moreover, the expansion of infrastructure projects, particularly in emerging economies, offers lucrative opportunities l for the waterproofing products market to thrive.

Roofing and walls is the leading application of Waterproofing Products Market.

Increase in awareness of green roofs is the upcoming trend of Waterproofing Products Market in the world.

BASF SE, Sika AG, Carlisle Companies Inc., RPM International Inc., GCP Applied Technologies Inc., are the top companies to hold the market share in Waterproofing Products.

Asia-Pacific is the largest regional market for Waterproofing Products.

Increase in use of waterproofing membranes in infrastructure applications and surge in residential construction are the drivers of the of Waterproofing Products Market.

The global waterproofing products market was valued at $42.5 billion in 2019 and is projected to reach $66.1 billion by 2033, growing at a CAGR of 3.8% from 2023 to 2033.

Loading Table Of Content...

Loading Research Methodology...