WealthTech Solutions Market Research, 2031

The global Wealthtech Solutions Market was valued at $4.8 billion in 2021, and is projected to reach $18.6 billion by 2031, growing at a CAGR of 14.8% from 2022 to 2031.

WealthTech solutions serve consumers with extremely high net worth and are used for managing wealth planning. The solutions offer various benefits such as improved portfolio management, asset liquidity, cost transparency, and increased customer service. Moreover, WealthTech solutions allow businesses to identify new generation customer needs for small consulting firms and large banks, such as tech-enabled financial solutions, automated rebalancing, and portfolio creation.

The demand for WealthTech solutions market is expected to grow, owing to capabilities such as financial data analytics, machine learning capabilities, and portfolio rebalancing. In addition, growth popularity of AI-based assistance in banks, investment firms, and wealth management firms and the increasing implementation of automation solutions are driving the growth of the WealthTech solutions market. However, privacy and security issues have emerged as key industry problems due to the extensive flow of customer data. On the contrary, rise in demand for predictive analytics technology is driving the WealthTech solutions market growth.

The report focuses on growth prospects, restraints, and trends of the WealthTech solutions market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the WealthTech Solutions market.

Segment Review

The WealthTech solutions market is segmented on the basis of component, deployment mode, enterprise size, and end user. By component, it is segmented into solution ad service. By deployment mode, it is bifurcated into on-premise and cloud. Based on enterprise size, it is segregated into large enterprises and small & medium-sized enterprises. On the basis of end user, it is segmented into banks, wealth management firms and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

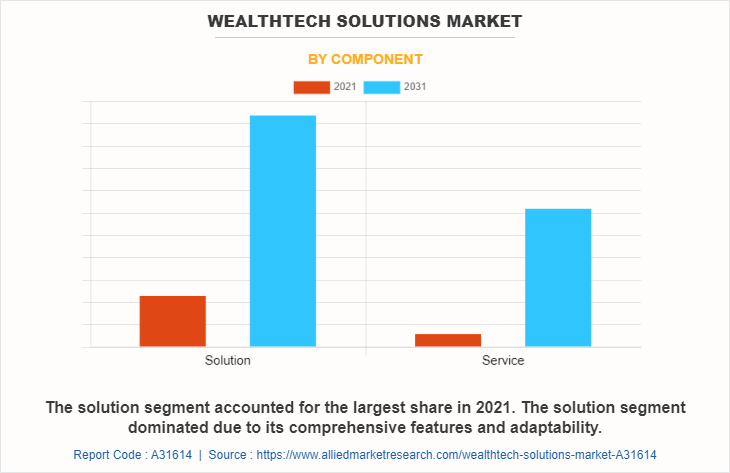

Based on component, the solution segment attained the highest growth in 2021. This is attributed to the fact that individuals and companies have been changing the way they manage their finances through WealthTech or wealth management technology. The worldwide flow of money is being controlled by a digital financial ecosystem made up of tools like SaaS, big data, and AI. Thus, these digital tools are major factors for the growth of the market. In addition, with more dynamic user interface (UI) and user experience (UX) features, the conventional WealthTech solutions interface is getting simpler to use and improving the end-user experience.

Region wise, North America attained the highest growth in 2021. This is attributed to the fact that wealth management business in North America has increased with development of new & innovative business operating models and hostile efforts by new competitors to capture a share of the world's largest market for investment securities. Furthermore, banks and private firms, on the other hand, are increasingly demanding more from their wealth management advisors, resulting in a significant demand for cutting-edge financial advice which is tailored to their particular requirement.

The report analyzes the profiles of key players operating in the WealthTech solution market such as 3rd eyes Anaytics, Aixigo AG, BlackRock, Inc., BME inntech, InvestCloud, Inc., InvestSuite, Synechron, Valuefy, Wealthfront Corporation. And WealthTechs Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the WealthTech solution market.

COVID-19 Impact Analysis

The outbreak of COVID-19 pandemic and the consequent lockdown had resulted in an acute financial crisis for the consumers which led them to postpone their wealth management. The fall in demand for WealthTech solutions was being driven by job insecurity and economic uncertainty amongst the people during pandemic. Moreover, because to the worldwide government lockdown caused by COVID-19, businesses were totally stopped, industries were shut down and people were not able to meet daily needs. Therefore, the market has suffered greatly as a result of financial losses from business disruptions in all industry sectors. Thus, COVID-19 pandemic had a negative impact on WealthTech solutions industry.

Top Impacting Factors

Growth in the Implementation of Automated Solutions

Increase in adoption of automation solutions across industries is fueling the growth of the WealthTech solution market. By using WealthTech solutions, companies and banks can understand new generation client demands, such as tech-enabled financial solutions, automatic rebalancing, and portfolio building. Moreover, WealthTech solution help companies discover the demands of the next generation of customers, including those for tech-enabled financial solutions, automatic rebalancing, and portfolio development. In addition, innovative WealthTech solution providers have developed numerous automation solutions for incumbents to enhance their operations and increase income by harnessing the potential of cutting-edge technologies like AI, machine learning, and blockchain. Therefore, this is a major growth factor for the WealthTech solutions market size.

High Cost of WealthTech Solutions and Regulatory Burdens

WealthTech management institutions have been dealing with greater complexity in areas of compliance and regulation. Increase in regulatory burdens by governments and rise in costs of WealthTech solutions pose new challenges to WealthTech firms and their parent companies. For instance, in past few years, the WealthTech businesses of several global banks have attracted significant regulatory action from the US government. Moreover, the cost of these risks is especially high for high net worth businesses such as private banks and their parent companies because of the huge range of their product offerings and the sensitive nature and high profile of their client base. Therefore, this is a major factor hampers growth of the WealthTech solution market.

Rise in Demand for Predictive Analytics Technology

The term predictive analytics refers to use of statistics and modeling techniques to make predictions about future outcomes and performance. Predictive analytics looks at current and historical data patterns to determine if those patterns are likely to emerge again. Moreover, predictive analytics in WealthTech management derive relevant information that gives advisors insight into their current clients and potential financial needs. In addition, predictive analytics technology is critical to WealthTech company survival because it helps to win insights into client behavior and their needs so they can improve services and product. Furthermore, implementation of predictive analytics technology will the revenue of WealthTech solution providers in the upcoming years. Therefore, these factors will provide major lucrative opportunities in the growth of the WealthTech solutions market share.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the WealthTech solutions market forecast from 2021 to 2031 to identify the prevailing WealthTech solutions market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the WealthTech solutions market outlook segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global WealthTech solutions market trends, key players, market segments, application areas, and market growth strategies.

WealthTech Solutions Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 18.6 billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 215 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | 3rd-eyes analytics, Aixigo AG, BlackRock, Inc., InvestCloud, Inc., BME inntech, Synechron, InvestSuite, Valuefy, WealthTechs Inc., Wealthfront Corporation. |

Analyst Review

WealthTech solution reduce credit risk by completing responsibility of debt collection. In addition, new technologies help WealthTech solution companies to better serve customers by giving them access to web portals and applications to review and answer common questions related to their accounts. Thus, it provides benefits such as cost-effectiveness, powerful insights & reporting, and credit evaluation, which are expected to increase demand for factoring services. Moreover, with further growth in investments across the globe and rise in demand for WealthTech solution service, various companies have expanded their current product portfolio with increased diversification among customers.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on In February 2022, Data analytics and AI technology giant SAS acquired Honolulu-based Kamakura Corp., which will expand its reach within the financial services industry and broaden the SAS portfolio of financial risk management software. It is one of the leading companies in the data analytics and WealthTech solution market. Therefore, this strategy will help for the growth of the SAS’s WealthTech solution business.

Some of the key players profiled in the report include 3rd eyes Anaytics, Aixigo AG, BlackRock, Inc., BME inntech, InvestCloud, Inc., InvestSuite, Synechron, Valuefy, Wealthfront Corporation., and WealthTechs Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the WealthTech solution market.

The demand for WealthTech solutions is expected to grow, owing to capabilities such as financial data analytics, machine learning capabilities, and portfolio rebalancing. In addition, growth popularity of AI-based assistance in banks, investment firms, and wealth management firms and the increasing implementation of automation solutions are driving the growth of the market.

North America is the largest regional market for WealthTech Solutions Market

The estimated industry size of WealthTech Solutions Market is expected to reach $18,548.92 billion by 2031

3rd eyes Anaytics, Aixigo AG, BlackRock, Inc., BME inntech, InvestCloud, Inc., InvestSuite, Synechron, Valuefy, Wealthfront Corporation. And WealthTechs Inc

Loading Table Of Content...

Loading Research Methodology...