Wearable Payments Market Research, 2033

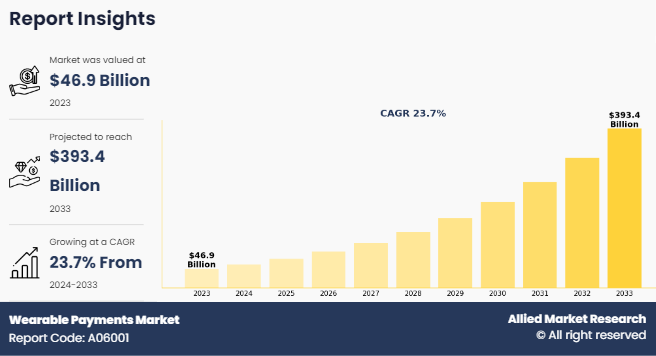

The global wearable payments market size was valued at $46.9 billion in 2023, and is projected to reach $393.4 billion by 2033, growing at a CAGR of 23.7% from 2024 to 2033. Wearable payments refer to the use of wearable devices, such as payment trackers, smart rings, or wristbands, to make contactless payments. These devices typically integrate near field communication (NFC), radio-frequency identification (RFID), or Bluetooth technology, allowing users to make secure, contactless payments by simply tapping or bringing their device close to a point-of-sale (POS) terminal. The wearable payments method is increasingly popular due to its speed, convenience, and enhanced security, eliminating the need for cash or traditional payment methods.

Key Takeaways

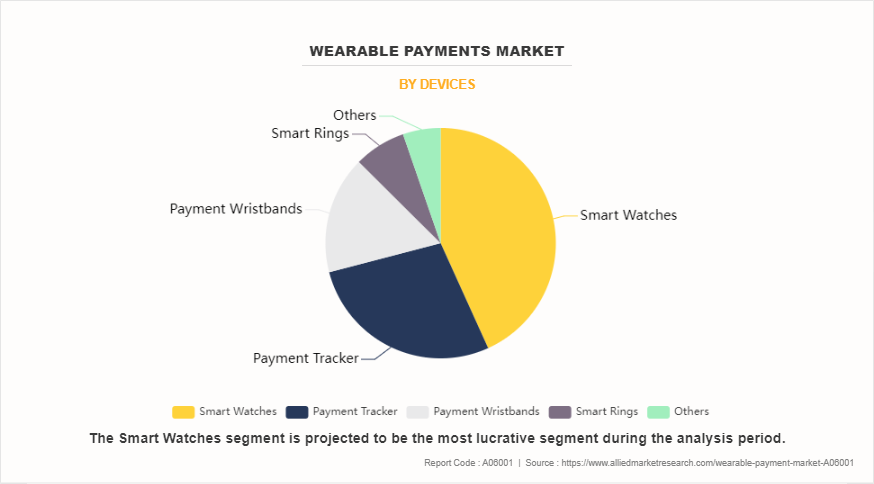

By devices, the smart watches segment held the largest share in the wearable payments market in 2023.

By technology, the near field communication technology (NFC) segment held the largest share in the wearable payments market in 2023.

By application, the grocery stores segment held the largest share in the wearable payments market in 2023.

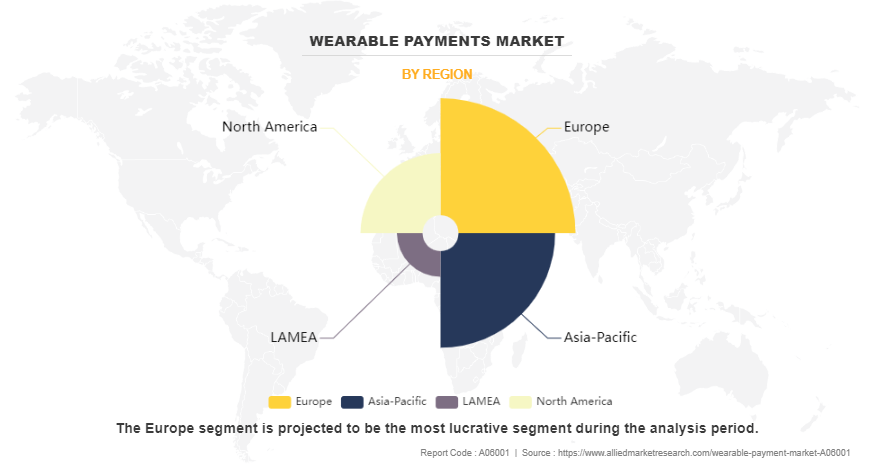

Region-wise, Europe held the largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the wearable payments market forecast period.

In addition, adoption of wearable payments and contactless payment methods has significantly increased in recent years due to surge in adoption of smartphones and ease of transactions as compared to traditional banking, which is expected to drive the market growth. Moreover, increase in adoption of cashless payment across the globe and rise in need for secure and safe contactless payment drive the growth of the market. Wearable payments provide enhanced customer experience to users, which fuels the growth of the market. However, increase in security issues in wearable devices and high cost of wearable devices hamper the growth of the market. On the contrary, surge in adoption of advanced technology in wearable devices such as near field communication (NFC) and radio frequency identification (RFID) is anticipated to offer remunerative opportunities for the expansion of the market.

Segment Review

The wearable payments market share is segmented into devices, technology, application, and region. By devices, it is fragmented into smart watches, payment tracker, payment wristbands, smart rings, and others. By technology, it is segregated into near-field communication technology (NFC), radio frequency identification (RFID), QR & bar code, and others. On the basis of application, the market is divided into grocery stores, bar & restaurants, drug stores, entertainment centers and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of devices, the smart watches segment dominated the wearable payments market in 2023 and is expected to maintain its dominance during the forecast period, owing to enhanced functionalities, convenience, and increased consumer adoption of contactless payment technologies. However, the smart rings segment is expected to witness the highest growth during the forecast period, owing to its compact design, increasing consumer interest in discreet wearable technology, and advancements in payment security features, which make it a convenient alternative for contactless transactions.

Region-wise, Europe dominated the wearable payments market outlook in 2023 and is expected to maintain its position during the forecast period, owing to consumer demand for convenient and secure payment options, coupled with growing partnerships between financial institutions and wearable technology providers. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to rise in smartphone penetration, growing middle class, rise in disposable incomes, and rise in investments in digital payment solutions.

Competition Analysis

The report analyzes the profiles of key players operating in the wearable payments market such as Apple Inc., Barclays Plc, Google, Inc, Mastercard, PayPal, Inc., Samsung Electronics Co. Ltd., Visa Inc., Aevi International, Giesecke+Devrient GmbH, Thales Group, Tappy Technologies Limited, Garmin Ltd, Infineon Technologies AG, Fidesmo AB, and Digiseq Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the wearable payments market.

Recent developments in the Wearable Payments Industry

In August 2024, Mastercard announced a new partnership with boAt, to introduce tap-and-pay functionality on boAt’s smartwatches. This collaboration enables Mastercard cardholders to make seamless payments directly from their boAt wearable devices through Crest Pay, boAt’s official payment application. The new feature aims to enhance convenience and accessibility for users, marking a significant step forward in wearable payment technology in India.

In July 2024, Samsung Electronics announced the new Galaxy Ring, Galaxy Watch7, and Galaxy Watch Ultra, expanding the power of Galaxy AI2 to more people through wearables designed to provide end-to-end wellness experiences3 for everyone.

Top Impacting Factors

Driver

Increase in Adoption of Contactless Payment Solutions

Rise in adoption of contactless payment solutions drives the wearable payments market growth, owing to the growing consumer demand for convenience, technological advancement, and changing payment behaviors, especially accelerated by global events that emphasized the need for touchless transactions. In addition, consumers are more comfortable using contactless payment methods with cards and smartphones, thus naturally extending the preference to wearable devices such as smartwatches, fitness trackers, and payment-enabled rings, which is expected to drive market growth.

Furthermore, the seamless integration of payment capabilities into everyday wearable devices offers unprecedented convenience, eliminating the need to carry physical wallets or even smartphones. The unprecedented convenience factor, combined with enhanced security features such as tokenization and biometric authentication, helped to overcome initial consumer hesitation about adopting wearable payment technology, thereby driving the market growth.

Supportive Government Policies and Regulatory Frameworks

Government policies and regulatory frameworks are important drivers of the wearable payments market by creating a secure, standardized, and consumer-friendly ecosystem. These frameworks establish clear guidelines for data protection, transaction security, and authentication protocols, which builds consumer confidence in wearable payment technologies. For instance, regulations such as PSD2 in Europe and similar frameworks worldwide mandate strong customer authentication (SCA) while simultaneously promoting innovation through open banking initiatives. This regulatory environment encourages financial institutions and technology companies to invest in developing secure wearable payment solutions that comply with established standards, thereby driving the market growth.

In addition, government initiatives promoting cashless transactions and digital payments, particularly accelerated by global health concerns, create a favorable environment for wearable payment adoption. Many governments also implemented policies supporting fintech innovation through regulatory sandboxes and incentive programs, allowing companies to test new wearable payment technologies in controlled environments. Furthermore, the standardization of payment protocols and interoperability requirements by regulatory bodies has made it easier for wearable payment solutions to integrate with existing payment infrastructure, reducing implementation barriers and encouraging wider merchant acceptance. These supportive policies collectively foster an environment where wearable payments can thrive while ensuring consumer protection and market stability.

Restraints

Limited Battery Life and Device Reliability

Limited battery life and device reliability present significant challenges that constrain the growth of the wearable payments industry. Smart watches, fitness trackers, and other wearable payment devices rely heavily on battery power to function, and frequent charging requirements discourage user adoption. When these devices run out of power, consumers cannot access payment functions, creating inconvenient situations at points of sale, which can limit the market growth. In addition, device reliability issues restrain the market growth, as wearable payment devices must maintain consistent connectivity with payment terminals and smartphones while ensuring secure data transmission, restraining the market growth.

Opportunity

Increase in use of NFC, RFID, and host card emulation technology in wearable payments

The growing adoption of NFC (Near Field Communication Technology), RFID (Radio Frequency Identification), and host card emulation technology is significantly transforming the wearable payments landscape. Leading device manufacturers such as Apple, Samsung, and Huawei actively integrate these technologies into their wearable devices and contactless payment solutions, enhancing user convenience and transaction security. The integration of digital wallets such as Apple Pay, Google Wallet, and Samsung Pay with wearable devices further amplifies the convenience and functionality of wearable payments. These digital wallets work seamlessly with NFC-enabled wearables, allowing users to store and access multiple payment cards and accounts on their devices, eliminating the need for physical cards or cash. For instance, businesses leveraging NFC technology for innovative customer engagement, as demonstrated by KFC's NFC-based ordering system in the UK, is enhancing convenience and streamlining the ordering process to provide a seamless customer experience. In addition, host card emulation technology is improving the performance and functionality of wearable devices, making payment processes more efficient and user-friendly. This technological integration is creating new opportunities and driving the expansion of the global wearable payments market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wearable payments market analysis from 2023 to 2033 to identify the prevailing wearable payments market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the wearable payments market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global wearable payments market trends, key players, market segments, application areas, and market growth strategies.

Wearable Payments Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 340 |

| By Devices |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | PayPal, Inc., Digiseq Ltd, Visa Inc., Tappy Technologies Limited, Mastercard Inc, Apple Inc., Aevi International, Giesecke+Devrient GmbH, Fidesmo AB, Google, Inc, Barclays Plc, Garmin Ltd, Infineon Technologies AG |

Wearable payment refers to the use of wearable devices, such as smartwatches, fitness trackers, or smart rings, to make financial transactions. These devices are equipped with Near Field Communication (NFC) technology, allowing users to make payments by simply tapping or holding their wearable near a contactless payment terminal. This technology eliminates the need for physical credit cards or cash and provides a convenient, secure, and fast method of payment.

The forecast period for the wearable payments market is 2024 to 2033.

The base year is 2023 in the wearable payments market.

The total market value of the wearable payments market was $46.9 billion in 2023.

The market value of the wearable payments market is projected to reach $393.4 billion by 2033.

Loading Table Of Content...

Loading Research Methodology...