Wearable Sensors Market Research, 2034

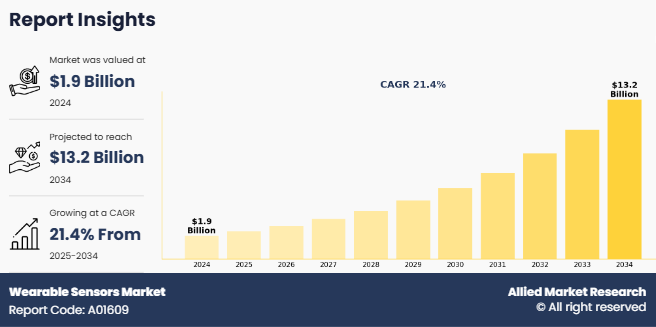

The global wearable sensors market size was valued at $1.9 billion in 2024, and is projected to reach $13.2 billion by 2034, growing at a CAGR of 21.4% from 2025 to 2034. Wearable sensors are compact, lightweight devices integrated into wearable technology, designed to monitor and collect data from the user's body and environment. These sensors capture physiological parameters such as heart rate, body temperature, and movement, providing real-time insights into health, fitness, and daily activity. They are embedded in smartwatches, fitness trackers, and medical devices, making them essential for personal health monitoring, sports, and healthcare applications. Advanced wearable sensors utilize wireless sensor technology such as accelerometers, gyroscopes, and optical sensors to ensure accurate and continuous data collection. As they evolve, wearable sensors are playing a critical role in preventive healthcare, personalized medicine, and remote patient monitoring, driving innovation in the healthcare and consumer electronics sectors.

The wearable sensors market is segmented into Type, Application, and End User.

Key Takeaways:

- By Type, the wearable sensors market share in the accelerometers segment held the largest share in the wearable sensors market for 2024.

- By Application, the wristwear segment held the largest share in the wearable sensors market for 2024.

- By End-User, the consumer segment held the largest share in the wearable sensors market for 2024.

- Region-wise, Asia-Pacific held the largest market share in 2024. However, Europe is expected to witness the highest CAGR during the forecast period.

Surge in popularity of smart wearable devices drives the growth of the wearable sensors market. Devices such as smartwatches, fitness trackers, and health wearables are increasingly favored for their ability to provide real-time data on vital health metrics, including heart rate, activity levels, and overall wellness. These devices incorporate advanced sensors, such as accelerometers, gyroscopes, and biosensors, delivering precise health insights. The growing consumer demand for convenient, continuous health monitoring is fueling the adoption of wearable devices in fitness, healthcare, and lifestyle sectors. In addition, advancements in IoT and AI technologies are enhancing the functionality of these devices, enabling personalized health recommendations and remote monitoring. As awareness of preventive healthcare grows, the demand for smart wearable devices, and consequently wearable sensors, has accelerated, contributing significantly to market expansion.

Segment Review

The wearable sensors market is segmented on the basis of type, application, end user, and region. On the basis of type, the market is divided into accelerometers, gyroscopes, inertial sensors, motion sensors, pressure and force sensors, touch sensors, and others. By application, the market is segregated into wristwear, eyewear, footwear, neckwear, bodywear, and others. As per the end user, the market is classified into consumer,

healthcare, industrial, and others. Depending on region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Region-wise, Asia-Pacific held the largest share in 2024 in the wearable sensors industry, exceeding 40%, fueled by high production capabilities, tech-savvy populations, and strong investments in smart manufacturing and healthcare. North America and Europe follow, supported by innovation hubs and rising chronic disease management needs. The market is expected to diversify further by 2034, with significant growth in medical-grade applications, AR/VR-enabled eyewear, and AI-integrated industrial wearables indicating a maturing ecosystem that is transitioning from fitness-focused consumer devices to advanced, multifunctional, cross-sectoral solutions.

Competition Analysis

The key players in the wearable sensors market are STMicroelectronics, Panasonic Corporation, Infineon Technologies, Knowles Electronics, NXP Semiconductors, ROHM Semiconductor, TE Connectivity, MEMSIC, Analog Devices, and Murata. Product launch and acquisition business strategies were adopted by the major market players in 2024

Recent Developments in the Wearable Sensors Market

- In June 2025, Planar partnered with Megapixel to launch a premium LED display platform that combines Planar̢۪s cutting-edge display technology with Megapixel̢۪s advanced processing expertise 1. The collaboration introduces a new line of ultra-fine pixel pitch, Chip-on-Board (COB) MicroLED video wall displays, powered by Megapixel̢۪s HELIOS LED Processing Platform. Designed for high-end commercial applications, this next-generation solution delivers exceptional image quality, reliability, and precise control, targeting sectors that demand top-tier visual performance.

- In January 2025, LG launched LG Schools, an ambassador program aimed at K-12 educational institutions, offering them access to commercial display technologies like LG CreateBoard digital whiteboards, LED displays, and UltraGear monitors. The initiative allows schools to test and deploy these technologies while providing feedback to LG for product improvement. This collaborative approach is designed to enhance classroom engagement and ensure LG̢۪s education solutions remain innovative and effective.

Top Impacting Factors

Driver

Growing integration with smartphones and IoT devices

Rapid proliferation of smartphones and Internet of Things (IoT) devices has significantly propelled the demand for wearable sensors. These sensors, embedded in devices such as smartwatches, fitness bands, and smart clothing, rely heavily on seamless connectivity with smartphones and other smart devices to collect, transmit, and analyze physiological and environmental data. Smartphones act as central hubs, processing information such as heart rate, activity level, and sleep patterns, and presenting it through user-friendly apps. For instance, as of 2022- 23, 85% of individuals aged 15 and above in India were using an active mobile phone connection, up from 70.2% two years prior. Notably, 94% of urban residents had access to mobile services.

Additionally, IoT-enabled wearables ecosystems enable real-time data sharing across healthcare systems, cloud platforms, and other connected devices, thus enhancing the functionality of wearables for both consumers and professionals. Integration with voice assistants, GPS, AI-driven analytics, and remote monitoring platforms further increases the utility of wearable sensors, not just for fitness tracking but also for chronic disease management and emergency alerts. As 5G connectivity becomes more prevalent, data transmission becomes faster and more reliable, enabling wearables to deliver more real-time insights with higher accuracy. Moreover, tech companies are continuously innovating to create more compact, power-efficient sensors that can seamlessly interact with smart devices, driving the adoption of these technologies across sectors like healthcare, sports, military, and elderly care. This interconnectedness has expanded the role of wearables from niche fitness gadgets to essential health management tools, contributing significantly to the wearable sensors market growth.

Restraints

High cost and affordability issues

High cost of wearable sensors remains a major barrier to widespread adoption, especially in low- and middle-income regions. Affordability challenges limit access to these advanced devices, creating health technology inequality between populations. This pricing gap affects consumer adoption, as not everyone is able or willing to pay premium pricing for fitness or health monitoring. Lack of comprehensive insurance coverage for basic or consumer-grade wearables discourages more people from adopting these devices. Limited accessibility further arises from the need for compatible smartphones and digital literacy. High out-of-pocket expenditure deters many potential users, especially the elderly or those with chronic diseases in resource-limited settings. As a result, more people are benefiting from wearable technology, which leads vulnerable populations to fall behind in digital health.

Opportunity

Remote patient monitoring

Remote patient monitoring (RPM) presents a major opportunity in the wearable sensors market, especially as global healthcare systems shift toward more proactive, patient-centered care. Wearable sensors equipped with health monitoring features such as heart rate, blood pressure, oxygen saturation, glucose levels, and temperature allow for continuous data collection outside clinical settings. This is particularly valuable for managing chronic diseases such as diabetes, cardiovascular conditions, and respiratory illnesses, which require regular monitoring and timely interventions. Integration of wearable technology into telehealth platforms enables healthcare providers to remotely

track patients' vital signs, detect anomalies in real time, and intervene before complications arise. This reduces hospital remissions, lowers healthcare costs, and improves patient outcomes.

Moreover, RPM through wearables enhances care accessibility for rural or mobility-challenged populations who may have difficulty attending frequent in-person appointments. Following the COVID-19 pandemic, the demand for contactless and home-based health monitoring increased, accelerating the adoption of RPM solutions. Insurance providers and health systems are increasingly recognizing the value of such devices, with some offering reimbursement models or subsidies for patients using approved wearables. The opportunity extends further individual care, as aggregated, anonymized health data from wearables can support public health research and population health management. As technology continues to improve with longer battery life, more accurate sensors, and seamless integration with electronic health records, wearable sensors are poised to become an integral part of mainstream healthcare delivery through RPM, transforming the way medical services are accessed and delivered.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wearable sensors market from 2024 to 2034 to identify the prevailing wearable sensors market opportunities.

- The wearable sensors market overview is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wearable sensors market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global wearable sensors market report.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wearable sensors market trends, key players, market segments, application areas, and market growth strategies.

Wearable Sensors Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 13.2 billion |

| Growth Rate | CAGR of 21.4% |

| Forecast period | 2024 - 2034 |

| Report Pages | 260 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | NXP Semiconductors, STMicroelectronics N.V., Panasonic Corporation, Infineon Technologies AG, ROHM Semiconductor, Knowles Electronics, LLC, Analog Devices, Inc., TE Connectivity, MEMSIC Semiconductor Co., Ltd., Murata Manufacturing Co., Ltd. |

Analyst Review

The wearable sensor market has witnessed huge traction in the recent years, owing to the recent advances in telecommunications, microelectronics, sensor manufacturing, and data analysis techniques, especially in the healthcare sector. Medical grade wearable sensors are used in various accessories such as hats, wrist bands, socks, shoes, eyeglasses, wristwatches, headphones, and garments.

Sensor size plays a vital role in the adoption of wearable sensors in critical applications of the healthcare industry. However, the use of wearable sensors is expected to increase in the healthcare sector, owing to evolution in miniature circuits, microcontroller functions, front-end amplification, and wireless data transmission. In digital health monitoring systems, wearable sensors facilitate continuous physiological access and reduce manual intervention.

The global wearable sensor market is expected to witness tremendous growth, owing to the increasing scope of applications of these sensors. The adoption of sensors has increased among individuals, owing to the growing incidence of health hazards caused by pollution and rising concerns about health and well-being. Moreover, the need for easy and convenient patient monitoring techniques from a distant location has supplemented the market growth.

The wearable sensors market was valued at $1,926.6 million in 2024 and is estimated to reach $13,190.1 million by 2034, exhibiting a CAGR of 21.4% from 2025 to 2034.

Asia-Pacific was the highest revenue contributor, accounting for $824.6 million in 2024, and is estimated to reach $6,265.3 million by 2034, with a CAGR of 22.7%.

Surge in popularity of smart wearable devices drives the growth of the wearable sensors market. Devices such as smartwatches, fitness trackers, and health wearables are increasingly favored for their ability to provide real-time data on vital health metrics, including heart rate, activity levels, and overall wellness.

The wristwear segment was the highest revenue contributor to the market, with $1,257.4 million in 2024, and is estimated to reach $10,233.8 million by 2034, with a CAGR of 23.5%

The key players in the wearable sensors market are STMicroelectronics, Panasonic Corporation, Infineon Technologies, Knowles Electronics, NXP Semiconductors, ROHM Semiconductor, TE Connectivity, MEMSIC, Analog Devices, and Murata. Product launch and acquisition business strategies were adopted by the major market players in 2024

Loading Table Of Content...

Loading Research Methodology...