Wellness Tourism Market Overview, 2030

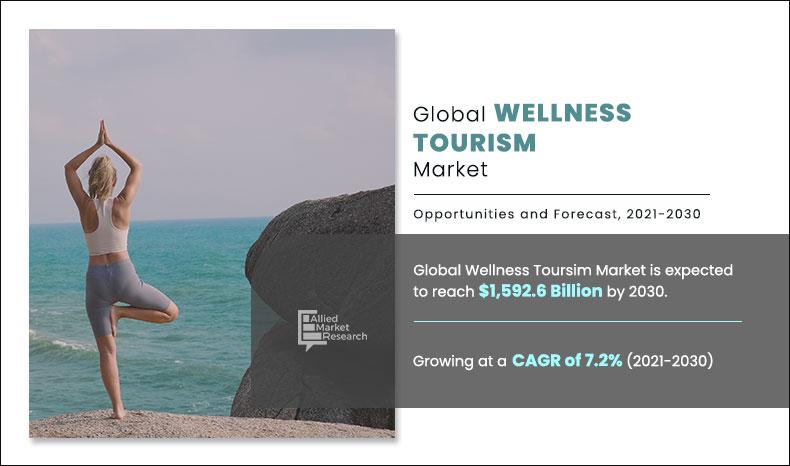

The global wellness tourism market size was valued at $801.6 billion in 2020, and is projected to reach $1,592.6 billion by 2030, registering a CAGR of 7.2% from 2021 to 2030. In 2020, the lodging segment accounted for the highest share in the market. Wellness tourism is traveling associated with the pursuit of maintaining or enhancing one’s personal wellbeing. It is motivated by the desire for healthy living, disease prevention, stress reduction, management of poor lifestyle habits, and/or authentic experiences. The wellness industry is well-positioned to help consumers reclaim travel as an opportunity for rest and relaxation, rejuvenation, discovery, joy, and self-actualization.

Traveling to places and facilities, such as hospitals, clinics, wellness SPAs, fitness centers, and wellness resorts, to enrich the mental as well as physical health is a part of the lifestyle of people now-a-days. This shift in choice makes way for wellness tourism, which involves the promotion of health and personal well-being through various physical, psychological, and spiritual activities. It also includes various services such as transport, lodging, food & beverage, shopping, and others.

Inclination of tourists to socialize with local people and learn about their nature and culture to maintain healthy lifestyle, reduce stress, prevent disease, and enhance their wellbeing resulted in increase of number of such travelers, which, in turn, is expected to drive the wellness tourism market growth.

With the increase in e-literacy, the adoption of mobiles, computers, and other networking devices is rising notably. Online travel service providers aim to ease travel planning and bookings for travelers, as consumers are gradually shifting from traditional reservation to online reservation. Moreover, quick & convenient flight and hotel bookings, activity booking, rise in customer trust in online payment, and ability to compare various available adventure travel options drive the online travel industry growth, which, in turn, fuels the growth of the market.

Growing terrorist attacks, political unrest, and civil riots acts as a threat for the future growth of the travel industry. Attributed to the risk associated and warnings issued by government authorities to avoid such travel, the tourism industry has witnessed decrease in travel booking. Traveler’s safety concerns act as a major setback for travel destinations with higher safety risk. For instance, growing terrorist attacks across the globe has spread fear among people; hence, they have started to opt for destinations, which are less exposed to terrorism and political unrest. Change in travel destination due to safety issue acts as a threat to the growth of the overall wellness tourism market.

The COVID-19 pandemic has disrupted nearly every consumer category, influencing new consumer behaviors, stifling entire industries, and inspiring growth in others, including pockets of the health sector. Rise of telemedicine, at-home fitness, and digital therapy has driven the growth of the wellness tourism market during the pandemic. The key players in sectors, such as telehealth and home fitness, have made significant gains throughout the pandemic, shaping the future of consumer behavior and the wellness sector.

According to the wellness tourism market analysis, the market is segmented on the basis of service type, location, travelers type, and region. By service type, the market is divided into transport, lodging, food & beverage, shopping, activities & excursion, and others. On the basis of travelers type, it is fragmented into primary and secondary. By location, it is bifurcated into domestic and international. Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Italy, Germany, Spain, Italy, Switzerland, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, and the rest of Asia-Pacific), and LAMEA (Brazil, Argentina, the UAE, Chile, Morocco, Dominican Republic, and the rest of LAMEA).

On the basis of service type, the lodging segment accounted for the maximum wellness tourism market share in 2020, and is expected to remain dominant during the forecast period. Hotels are definitely one of the fastest-growing segments of the wellness tourism, which is truly justified as lodging is a critical component of any country's or region's tourism growth.

By Service Type

Shopping segment would witness the fastest growth, registering a CAGR of 7.8% during the forecast period.

On the basis of location, the domestic segment held the major share in the market. Domestic visitors may find it simpler to travel and see sites since they are more familiar with the country's traditions, customs, regulations, etiquettes, and others. Domestic wellness tourism is growing day by day. Furthermore, domestic locations do not need visa or passport nor do they need to convert their money into a different currency; it makes it easier to travel in domestic locations than international. Thus, the popularity of domestic location is growing rapidly.

By Location

International Segment witnssed a major growth rate of 7.8%

On the basis of travelers type, the secondary segment held the major share of 87% of the wellness tourism market. Secondary wellness tourism refers to tourists who include healthful destination activities, treatments, and mind-body experiences, such as spa treatments, exercise, or cuisine, and wines, into their total leisure and business travel as a part of their journey. Its travelers represent a much broader cross-section of visitors who have varied degrees of interest in wellness and are likely to show it in a variety of ways when traveling.

By Travelers Type

Men Segment held the major share of 44.9% in 2020

On the basis of region, North America dominated the wellness tourisms market in 2020, and accounted for maximum share in the wellness tourism market and is likely to remain dominant throughout the wellness tourism market forecast period. Attributed to the extreme growing demand for health wellbeing, North America is one of the leading markets of wellness tourism industry. The U.S. accounts for more than one-third of all global wellness tourism revenues, and it is by far the largest national market. Individuals' high knowledge of holistic health therapies and their high disposable incomes, which encourage health-related travel, are important elements driving the North America wellness tourism market demand.

By Region

North America held the major share of 37.8% in 2020

The players operating in the global wellness tourisms market have adopted various developmental strategies to expand their market share and increase profitability in the market. The key players profiled in this report include Accor S.A, Canyon Ranch, Four Seasons Hotels Ltd., Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation, Marriott International, Inc., Omni Hotels & Resorts, PRAVASSA, Radisson Hospitality, Inc., and Rancho La Puerta Inc.

Key benefits for stakeholders

The report provides quantitative analysis of the current wellness tourism market trends, estimations, and dynamics of the market size from 2020 to 2030 to identify the prevailing wellness tourism market opportunity.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size & segmentation assist to determine the market potential.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the wellness tourism market.

Key market segments

By Service Type

Transport

- Lodging

- Food & Beverage

- Shopping

- Activities & Excursion

- Others

Location

- Domestic

- International

By Travelers Type

Primary

- Secondary

By Region

North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Chile

- Morocco

- Dominican Republic

- Rest of LAMEA

Wellness Tourism Market Report Highlights

| Aspects | Details |

| By SERVICE TYPE |

|

| By LOCATION |

|

| By TRAVELERS TYPE |

|

| By Region |

|

| Key Market Players | Hilton Worldwide Holdings Inc., Four Seasons Hotels Ltd., PRAVASSA, Marriott International, Inc., Radisson Hospitality, Inc., Omni Hotels & Resorts, Accor S.A., Canyon Ranch, Hyatt Hotels Corporation, Rancho La Puerta Inc. |

Analyst Review

According to the insights of the CXOs of leading companies, the wellness tourism market is driven by an expanding global middle class, growing consumer desire to adopt a wellness lifestyle, rising interest in experiential travel, and increasing affordability of flights and travel options. Across regions, Europe remains the destination for the largest number of wellness trips while North America leads in wellness tourism expenditure. Asia-Pacific has made the most gains in the number of wellness trips and wellness tourism expenditure, with demand stimulated by strong economies and an expanding middle class.

Both tourism and overall wellness economy are expected to grow at a faster rate than the global economy. Wellness tourism is clearly positioned at an important intersection between these two giants, and many stakeholders, including the hospitality industry, wellness businesses, and residents & governments of destination countries and regions stand to benefit from this opportunity.

Moreover, rise in adoption of mobile devices and increase in accessibility of the internet have enhanced the communication among travelers, resulting in exchange of experiences and thoughts personally as well as on social media. Moreover, social media and a variety of apps are enabling savvy air travelers to find the health and wellness services they need. For instance, the Sanctifly App provides an efficient way to search airports for healthy choices, including gyms, spas, and pools.

According to the insights of the CXOs of leading companies, the wellness tourism market is driven by an expanding global middle class, growing consumer desire to adopt a wellness lifestyle, rising interest in experiential travel, and increasing affordability of flights and travel options. Across regions, Europe remains the destination for the largest number of wellness trips while North America leads in wellness tourism expenditure. Asia-Pacific has made the most gains in the number of wellness trips and wellness tourism expenditure, with demand stimulated by strong economies and an expanding middle class.

Both tourism and overall wellness economy are expected to grow at a faster rate than the global economy. Wellness tourism is clearly positioned at an important intersection between these two giants, and many stakeholders, including the hospitality industry, wellness businesses, and residents & governments of destination countries and regions stand to benefit from this opportunity.

Moreover, rise in adoption of mobile devices and increase in accessibility of the internet have enhanced the communication among travelers, resulting in exchange of experiences and thoughts personally as well as on social media. Moreover, social media and a variety of apps are enabling savvy air travelers to find the health and wellness services they need. For instance, the Sanctifly App provides an efficient way to search airports for healthy choices, including gyms, spas, and pools.

The global wellness tourism market size was valued at $801.6 billion in 2020, and is projected to reach $1,592.6 billion by 2030, registering a CAGR of 7.2% from 2021 to 2030.

The CAGR of Wellness Tourism market is 7.2%.

Kindly contact with the sales team for better options.

Accor S.A, Canyon Ranch, Four Seasons Hotels Ltd., Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation, Marriott International, Inc., Omni Hotels & Resorts, PRAVASSA, Radisson Hospitality, Inc., and Rancho La Puerta Inc.

The Wellness Tourism market is segmented on the basis of service type, location, travelers type, and region

2020 is the base year calculated in the Wellness Tourism market report

Inclination of tourists to socialize with local people and learn about their nature and culture to maintain healthy lifestyle, reduce stress, prevent disease, and enhance their wellbeing resulted in increase of number of such travelers are the current trends in the future.

North America region holds the major share in the wellness tourism market.

Growing terrorist attacks, political unrest, and civil riots acts as a threat for the future growth of the travel industry.

The COVID-19 pandemic positively impact the wellness tourism market in 2020 and 2021.

Loading Table Of Content...