Wi-Fi 6 Market Insights:

The global wi-fi 6 market size was valued at USD 10.9 billion in 2021 and is projected to reach USD 64.1 billion by 2031, growing at a CAGR of 19.6% from 2022 to 2031.

The Wi-Fi 6 market has been influenced by several market drivers, restraints, and opportunities. Undoubtedly, the COVID-19-induced global lockdowns and stay-at-home directives have enhanced wireless broadband, which have accelerated the need for Wi-Fi 6 globally. In addition, rise in the number of internet users has further boosted the Wi-Fi 6 market growth. However, the range of Wi-Fi 6 is less than that of the 5 Ghz network, which has restricted the market growth for Wi-Fi 6. On the other hand, public places including malls, stadiums, airports, and hotels are increasingly offering Wi-Fi access. With the rising demand for Wi-Fi devices, Wi-Fi 6 is expected to create greater opportunities in the coming years.

Wi-Fi 6 is the next evolution of wireless local area network (WLAN) technology. Wi-Fi 6 is the latest version of the 802.11 wireless networking standard: 802.11ax. This new Wi-Fi standard is reportedly up to 30% faster than Wi-Fi 5.

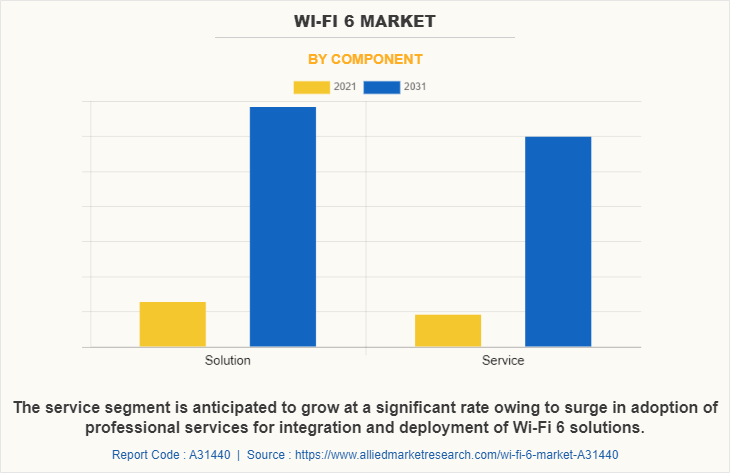

The Wi-Fi 6 market is segmented on the basis of offering, enterprise size, location type, industry vertical, and region. On the basis of offering, the market is segmented into solution and services. On the basis of solutions, the market is segmented into hardware and software. By service, the market is segmented into professional services and managed services.

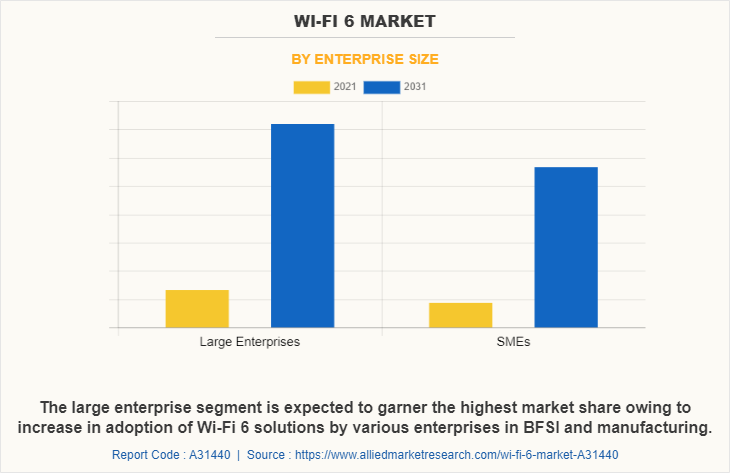

Further, professional services is fragmented into training and education, integration and deployment and support and maintenance. By location type, the market is fragmented into outdoor and indoor. On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. Depending on industry vertical, it is segregated into IT & telecom, healthcare, retail & e-commerce, IT & telecom, travel & hospitality, manufacturing, government, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some of the major players in the market are Apple Inc., Aruba Networks, Asustek Computer Inc., AT&T, Broadcom, Cisco Systems, Fortinet Inc., Hewlett-Packard Company, Huawei Technologies, Intel Corporation, Juniper Networks, Linksys Holdings, Inc., Microsoft Corporation, NXP Semiconductors, Qualcomm Inc., Samsung Electronics Co. Ltd, and Sterlite Technologies Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the Wi-Fi 6 industry.

By offering, the solution segment dominated the growth of the Wi-Fi 6 market share in 2021, and is expected to maintain its dominance in the upcoming years. The need of Wi-Fi 6 solutions in various verticals, such as healthcare and others is driving the growth of the solution segment. However, the services segment is expected to witness highest growth rate during the forecast period due to adoption of Wi-Fi 6 services among end users over time, as they ensure effective functioning of solutions and platforms throughout the process.

By enterprise size, the large enterprises segment dominated the global market in 2021, and is expected to continue this trend during the forecast period, owing to increase in adoption of Wi-Fi 6 software to integrate this into their existing system. Conversely, the small- & medium-sized enterprises segment is expected to grow at the highest CAGR during the forecast period, owing to surge in adoption of Wi-Fi 6 solutions, as it provides cost-effective and efficient solution for SMEs.

Top Impacting Factors:

Growing number of internet users and devices

The growing influence on individual consumers and large economies such as, the internet has become an increasingly vital part of the day-to-day lives. For instance, in 2021, the number of internet users globally stood at 4.9 billion, which means that almost two thirds of the global population is currently connected to the world wide web (www), which provide lucrative growth opportunities for Wi-Fi 6 market.

Furthermore, increasing demand for modern devices with the supporting ability of new wireless frequency bands such as 2.4GHz, 5GHz, and 6GHz is further expected to accelerate the adoption of Wi-Fi 6 technology among users. In addition, These Wi-Fi 6 frames assist in minimizing network interference from other networks and boost network speed. Thus drive the demand of WIFI 6 technology across residential, commercial, and industrial area.

Expanding digital transformation initiatives among industries

The increase adoption of Wi-Fi 6 technology among industries to help businesses to reduce the cost of installation of connections, which includes physically laying out wired connections. In addition to cost savings, Wi-Fi 6 provides businesses with the flexibility to mobilize or change their location whenever required.

Furthermore, industries are evolving significantly to improve their operational efficiency with the adoption of modern devices such as augmented reality/ virtual reality (AR/VR), wireless cameras, and collaborative robots is gaining momentum across the industries. The operation of these devices seamlessly requires enhanced wireless network connectivity. Thus, it is expected to boost the adoption of Wi-Fi 6 technology and their components in the upcoming years. Moreover, rising trends of e-learning across universities and schools required unified network connectivity to deliver uninterrupted services. Thus, it is estimated to provide lucrative growth opportunities for the Wi-Fi 6 industry during the forecast period.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the Wi-Fi 6 Market Forecast, current trends, estimations, and dynamics of the wi-fi 6 market analysis from 2021 to 2031 to identify the prevailing wi-fi 6 market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wi-fi 6 market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wi-fi 6 market trends, key players, market segments, application areas, and market growth strategies.

Wi-Fi 6 Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 64.1 billion |

| Growth Rate | CAGR of 19.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 320 |

| By Component |

|

| By Enterprise Size |

|

| By Location |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Fortinet Inc., Juniper Networks, Aruba Networks, Samsung Electronics Co. Ltd, Sterlite Technologies Limited, Microsoft Corporation, Apple Inc., Intel Corporation, Linksys Holdings, Inc., Hewlett-Packard Company, Qualcomm Inc., Cisco Systems, Huawei Technologies, Broadcom, AT&T, Asustek Computer Inc., NXP Semiconductors |

Analyst Review

The global Wi-Fi 6 market is projected to witness prominent growth, especially in Asia-Pacific and North America. This growth is attributed to increased investments by organizations and governments for digital infrastructure and need of reliable and speed internet Wi-Fi solutions. In addition, the adoption of IoT (Internet of Things)-based devices globally provides ample growth opportunities for the Wi-Fi 6 market. Moreover, the healthcare and life sciences vertical is expected to aggressively adopt Wi-Fi 6 during the forecast period. Ease of handling patient query and enhanced productivity drives the demand for Wi-Fi 6 across the healthcare and life sciences vertical globally.

Prominent market players are exploring new technologies and platforms to meet the rise in customer demands. Product launches, partnerships, and acquisitions are expected to enable them to expand their product portfolios and penetrate different regions. For instance, in June 2022, Cisco launched enterprise Wi-Fi 6 and 6E innovations and is working closely with customers, partners, and device manufacturers to ensure that Cisco wireless gear provides unparalleled and flawless performance on the greatly expanded 6 MHz bands.

The Wi-Fi 6 market has been influenced by several market drivers, restraints, and opportunities. Undoubtedly, the COVID-19-induced global lockdowns and stay-at-home directives have enhanced wireless broadband, which have accelerated the need for Wi-Fi 6 globally. In addition, rise in the number of internet users has further boosted the Wi-Fi 6 market growth.

North America is the largest regional market for Wi-Fi 6

The global Wi-Fi 6 market was valued at $10,856.96 million in 2021, and is projected to reach $64,129.68 million by 2031, registering a CAGR of 19.6% from 2022 to 2031.

Some of the major players in the market are Apple Inc., Aruba Networks, Asustek Computer Inc., AT&T, Broadcom, Cisco Systems, Fortinet Inc., Hewlett-Packard Company, Huawei Technologies, Intel Corporation, Juniper Networks, Linksys Holdings, Inc., Microsoft Corporation, NXP Semiconductors, Qualcomm Inc., Samsung Electronics Co. Ltd, and Sterlite Technologies Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...