Wi-Fi Module Market Research, 2032

The global Wi-Fi module market was valued at $54.3 billion in 2023 and is projected to reach $145.6 billion by 2032, growing at a CAGR of 11.4% from 2024 to 2032.

The Wi-Fi module market involves making, designing, and selling small electronic parts used in providing wireless internet access to various appliances. They include a Wi-Fi chipset, an antenna, and associated software that makes it easy to add Wi-Fi capability to a product. The Wi-Fi module market applications range from consumer electronics, including smartphones, laptops, and tablets; smart home products like thermostats, security cameras, and appliances; industrial automation; and medical care devices. The industry is driven by the need for continuous, seamless wireless connectivity, the growth of IoT devices, and developments in Wi-Fi technology, including Wi-Fi 6E and Wi-Fi 6. Major players in this sector include semiconductor firms and system integrators that compete with Wi-Fi module manufacturers to create solutions that meet the needs of diverse end-user sectors. Notable companies in the Wi-Fi module market are listed in the Wi-Fi Module Company List.

Key Takeaways

By type, the embedded Wi-Fi modules segment dominated the Wi-Fi module industry size in terms of revenue in 2023 and is anticipated to grow at a high CAGR during the forecast period.

By application, the smart home devices segment dominated the Wi-Fi module market size in terms of revenue in 2023 and is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

On April 20, 2024, the Indian government announced the launch of its "Digital Village" initiative, aimed at bringing high-speed internet connectivity to rural areas across the country. The initiative includes plans to deploy thousands of Wi-Fi hotspots powered by locally manufactured Wi-Fi modules. These hotspots will provide affordable internet access to villagers, enabling them to access online education, healthcare, government services, and e-commerce platforms. The government aims to bridge the digital divide between urban and rural areas and empower rural communities with digital tools for economic and social development.

On November 10, 2023: China's rapid urbanization and smart city development initiatives are driving significant demand for Wi-Fi modules. The government's focus on building connected infrastructure, including smart grids, intelligent transportation systems, and public safety networks, requires reliable wireless connectivity. Wi-Fi modules are being integrated into various smart city applications, such as smart street lighting, environmental monitoring, and public Wi-Fi hotspots. This growing demand is expected to propel the Wi-Fi module market in China, with local manufacturers poised to benefit from this trend.

On 05 August 2023, the U.S. Federal Communications Commission (FCC) opened the 6 GHz band for unlicensed use, paving the way for the expansion of Wi-Fi 6E technology. This new spectrum allocation provides a significant boost to Wi-Fi performance, enabling faster speeds, lower latency, and increased capacity. The move is expected to drive the adoption of Wi-Fi 6E-enabled devices, including smartphones, laptops, and IoT devices, which will, in turn, increase the demand for Wi-Fi 6E modules.

On 18 May 2023, the European Union (EU) introduced stricter energy efficiency regulations for electronic devices, including Wi-Fi modules. The new regulations aim to reduce energy consumption and promote sustainability in the electronics industry. Wi-Fi module manufacturers are now required to develop more energy-efficient designs and optimize power consumption in their products. This initiative is expected to drive innovation in Wi-Fi module technology and lead to the development of more eco-friendly solutions.

On 01 February 2023, the Japanese government announced a program to accelerate the deployment of Wi-Fi 6 networks for public safety applications. The initiative aims to enhance communication and coordination among emergency responders during natural disasters and other emergencies. The government plans to deploy Wi-Fi 6 access points in public areas and provide mobile Wi-Fi 6 devices to first responders. This will enable them to access critical information, communicate effectively, and coordinate their efforts in real time,

Key Market Dynamics

The Wi-Fi module market forecast is experiencing dynamic growth driven by several key factors. The increasing adaptation of Internet of Things (IoT) devices to different areas, such as smart homes, industrial automation, and healthcare, are the main drivers. These modules are important in facilitating seamless connection and communication among IoT devices, thereby aiding their spread. In addition, there is a growing desire for faster internet connections among consumers and businesses, which is increasing the demand for more advanced Wi-Fi modules that provide higher data rates and better network performance. This demand has been especially pronounced with the advent of video streaming, online gaming, and cloud services.

Furthermore, the spread of smart home devices such as smart thermostats, lighting, security systems, and appliances helps to expand the Wi-Fi module industry. As a result, these smart gadgets rely heavily on wireless-fidelity communication to interact with one another as well as with users' smartphones or tablets, resulting in a growing demand for reliable and effective Wi-Fi modules for PC. Furthermore, the emerging markets, characterized by rapidly increasing internet penetration, provide an important opportunity for the Wi-Fi modules market. This means that as more people and businesses in such places develop their digital infrastructure and begin using the internet, there will be great demand for these devices.

However, the market also has another challenge, which is security issues. Due to this reason, the increase in connected devices has resulted in vulnerability and data protection concerns, thereby presenting significant hurdles. The Wi-Fi modules could be hindered from taking off because of cyber security incidents like hacking and unauthorized access due to perceived risks associated with wireless connectivity both to consumers and enterprises.

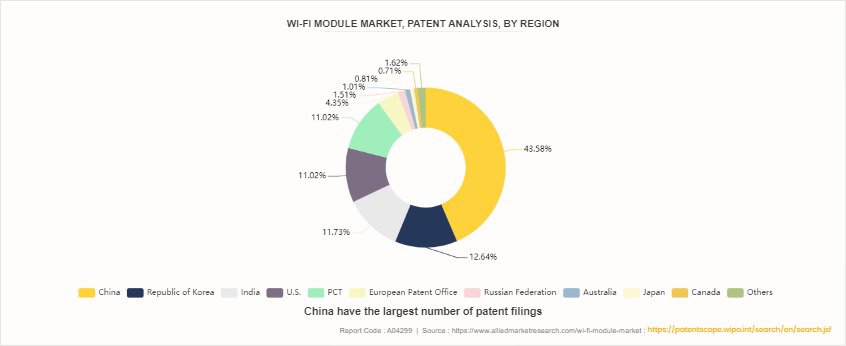

Patent Analysis of Global Wi-fi Module Market

The global Wi-Fi module industry report is segmented according to the patents filed in China, the Republic of Korea, India, the U.S., PCT, the European Patent Office, the Russian Federation, Australia, Japan, and the UK. China and the Republic of Korea have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have the maximum number of patent filings.

Market Segmentation

The Wi-Fi module market data is segmented into type, application, and region. Based on the type, the market is divided into embedded Wi-Fi modules and router scheme Wi-Fi modules. By application, the market is segmented into consumer electronics, enterprise, industrial, smart home, medical, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Market Segment Outlook

The Wi-Fi module market insights in terms of revenue in 2023 were dominated by embedded Wi-Fi modules with a high CAGR expected during the forecast period due to their flexibility and indispensable nature in the rapidly expanding IoT ecosystem. These USB Wi-Fi modules are integral to various applications, enabling seamless wireless connectivity and adding value to diverse devices. With compact sizes, low power consumption levels, and strong performance levels, they are most appropriate for use within different products, from consumer electronics to industrial machines. This segment is driven by an upswing in demand for smart devices like wearables, smart home appliances, and industrial IoT hardware. In addition to this, technological advancements such as the development of Wi-Fi 6E and Wi-Fi 6 standards have continued to increase the capabilities of embedded Wi-Fi modules, making them more attractive to manufacturers.

In 2023, the Wi-Fi module sector analysis was dominated by smart home devices in respect to revenue, and its CAGR is expected to rise at an impressive rate during the forecast period due to customer demand for connected as well as automated homes. For instance, smart thermostats, security systems, lighting controls, and home entertainment systems all depend on Wi-Fi connection so that they can work seamlessly and offer a unified user experience. The incorporation of these technologies has resulted in their usage becoming widespread due to the benefits that these provide when it comes to energy efficiency, convenience, and safety.

Regional/Country Market Outlook

Based on region, the Asia-Pacific region topped the list of moneymakers in the Wi-Fi module segment and is expected to grow at the fastest rate throughout this period due to several reasons that make it insurmountable. It is a global hotspot for electronics manufacturing; countries like China, Japan, South Korea, and Taiwan are central players in producing and innovating consumer electronics and IoT devices. The explosion of cities, rising revenues, and internet penetration increase demand for state-of-the-art wireless communication solutions such as Wi-Fi modules within these nations. Furthermore, government schemes towards digitization along with smart city projects across Asia force the uptake of Wi-Fi modules and Wi-F boards. Key technological firms’ presence plus unceasing R&D investments are some of the key factors behind the latest emerging versions of Wi-Fi equipment. The Wi-Fi module market size by country in the Asia-Pacific region is dominated by China in the year 2023. In addition, the Wi-Fi module for the US market across the North America region dominated the market and is expected to follow the same trend during the forecast period.

Competitive Landscape

The Wi-Fi module market share by companies is analysed across top players, including Murata Manufacturing Co., Ltd., Silicon Labs, Texas Instruments Incorporated, Cypress Semiconductor Corporation, Qualcomm Technologies, Inc., Broadcom Inc., Microchip Technology Inc., MediaTek Inc., u-blox, and Redpine Signals. Further, the other Wi-Fi Module Company List includes Espressif Systems and AzureWave Technologies.

Recent Key Strategies and Developments

In December 2023, Qualcomm Technologies, Inc., a global leader in wireless technology, unveiled its groundbreaking Wi-Fi 7 Networking Pro Series platform. Designed to transform wireless connectivity, this platform delivers multi-gigabit speeds and ultra-low latency, ensuring seamless experiences for high-bandwidth applications such as 8K video streaming, cloud gaming, and augmented reality. Leveraging advanced technologies like 4K QAM modulation and Multi-Link Operation, the Wi-Fi 7 Networking Pro Series platform promises to usher in a new era of high-performance, reliable, and efficient wireless communication for smartphones, Wi-Fi modules for PCs, extended reality (XR) devices, and the wider IoT ecosystem.

In September 2023, Silicon Labs, a renowned provider of silicon, software, and solutions for a smarter, more connected world, introduced a family of ultra-compact Wi-Fi 6 modules designed to address the unique challenges of space-constrained IoT devices. These modules offer exceptional performance with reduced size, making them ideal for applications like wearable devices, smart home sensors, and industrial automation nodes. Despite their small footprint, these modules boast robust security features, low power consumption for extended battery life, and long-range connectivity to ensure seamless operation in various IoT environments.

In May 2023: Infineon Technologies AG, through its acquisition of Cypress Semiconductor Corporation, launched a series of cutting-edge Wi-Fi 6E modules that unlock the full potential of the newly opened 6 GHz band. These modules provide a significant boost in bandwidth and capacity, minimizing interference for demanding applications like video conferencing, virtual reality, and real-time industrial control. With enhanced security features and robust performance, Infineon's Wi-Fi 6E modules are poised to become the go-to solution for next-generation consumer electronics, industrial IoT devices, and automotive connectivity systems.

In March 2023, MediaTek, a leading fabless semiconductor company, expanded its IoT portfolio with the introduction of AI-enabled Wi-Fi 6 modules. These modules combine high-speed Wi-Fi 6 connectivity with integrated artificial intelligence (AI) capabilities, enabling edge devices to process data locally and make intelligent decisions. This innovation is expected to revolutionize applications like smart home automation, industrial monitoring, and predictive maintenance by bringing the power of AI to the edge of the network.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wi-fi module market analysis from 2024 to 2032 to identify the prevailing wi-fi module market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wi-fi module market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Wi-Fi Module Market trends, key players, market segments, application areas, and market growth strategies.

Wi-Fi Module Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 145.6 Billion |

| Growth Rate | CAGR of 11.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 270 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | u-blox, Silicon labs, Texas Instruments Incorporated, Qualcomm Technologies, Inc. , Microchip Technology Inc., MediaTek Inc, Cypress Semiconductor Corporation, Redpine Signals Inc., Broadcom Inc, Murata Manufacturing Co., Ltd. |

Analyst Review

The global Wi-Fi market is driven prominently by the smart grid & smart appliances application. The adoption of cloud computing and increase in use of smart & connected devices mainly in the commercial, residential, and industrial sectors fuel the growth of the Wi-Fi module market. The robust growth in the electronics industry in North America and the increase in demand for smart connected devices has driven the market in the region.

In recent years, numerous industries are shifting their focus towards cloud computing components in order to eliminate investment costs required for hardware storage and physical infrastructure. Moreover, cloud computing provides certain advantages such as viability, scalability, and high-speed. Furthermore, cloud computing also helps in data storage and retrieval. These factors are expected to propel the growth of the Wi-Fi modules.

Among the analyzed geographical regions, North America accounted for the highest revenue in the global market in 2017 followed by Europe, Asia-Pacific, and LAMEA. However, Asia-Pacific is expected to grow at a higher growth rate, predicting a lucrative market growth for the Wi-Fi module market.

Murata Manufacturing Co., Ltd., Taiyo Yuden Co., Ltd., Azure Wave Technologies, Inc., Silicon Laboratories Inc., Laird PLC, Broadlink, Advantech Co., Ltd., Shanghai MXCHIP Information Technology Co., Ltd., Silex Technology, Inc., and Microchip Technology Inc. are the key market players that occupy a significant revenue share in the Wi-Fi module market.

Murata Manufacturing Co., Ltd., Silicon Labs, Texas Instruments Incorporated, Cypress Semiconductor Corporation, Qualcomm Technologies, Inc., Broadcom Inc., Microchip Technology Inc., MediaTek Inc., u-blox, and Redpine Signals.

Asia-Pacific, driven by high demand in countries like China and India

Increased adoption of Wi-Fi 6/6E and emerging Wi-Fi 7 technology, along with integration into IoT devices.

The Wi-Fi module market was valued at around $54.3 billion in 2023, with growth projections continuing upwards.

Consumer electronics, including smartphones, tablets, and smart home devices.

Loading Table Of Content...