WiGig Market Overview

The global Wigig market was valued at USD 22.8 million in 2022, and is projected to reach USD 278.1 million by 2032, growing at a CAGR of 28.7% from 2023 to 2032.

Surge in increasing adoption of data intensive apps and growing advancement in wireless technologies primarily drive the growth of the WiGig market. However, rising costs for chipset manufacture and spectrum congestion hamper market growth to some extent. Moreover, advancement of 5G expected to provide lucrative opportunities for market growth during the forecast period.

The industrial segment emphasized on the development, production, and application of wireless communication technologies that provide multi-gigabit increases is known as the wireless gigabit (WiGig) market. It includes a variety of goods and services that make high-speed wireless connectivity possible for a range of uses, such as virtual reality, data transfer, and streaming multimedia. WiGig, which operates in the unlicensed 60 GHz frequency range, offers a seamless communication and data transmission option between devices without requiring physical wires, making it an effective replacement for conventional wired connections.

Moreover, the development of WiGig-enabled gadgets, including smartphones, laptops, tablets, and smart home appliances, is mostly the responsibility of device manufacturers in this industry. WiGig technology is included in these products, giving consumers improved connectivity and quicker wireless rates. Providers of network equipment are also important stakeholders since they create and implement the infrastructure needed to enable WiGig communication. It comprises networking equipment such as routers, access points, and other devices that allow for fast wireless connections in public areas, offices, and households.

Segment Overview

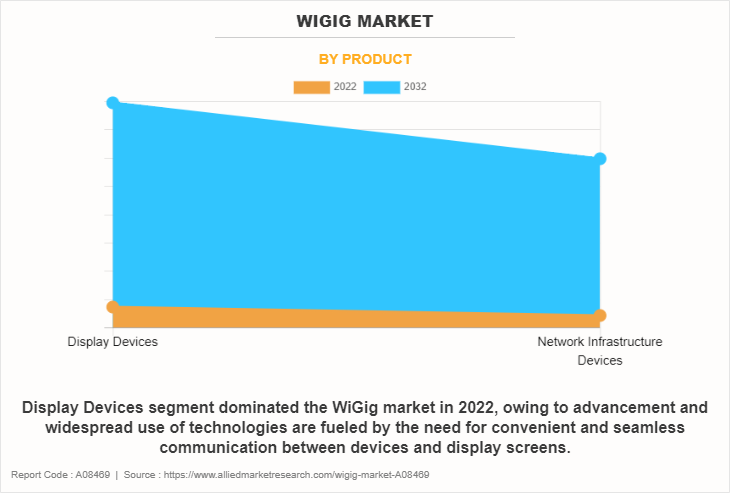

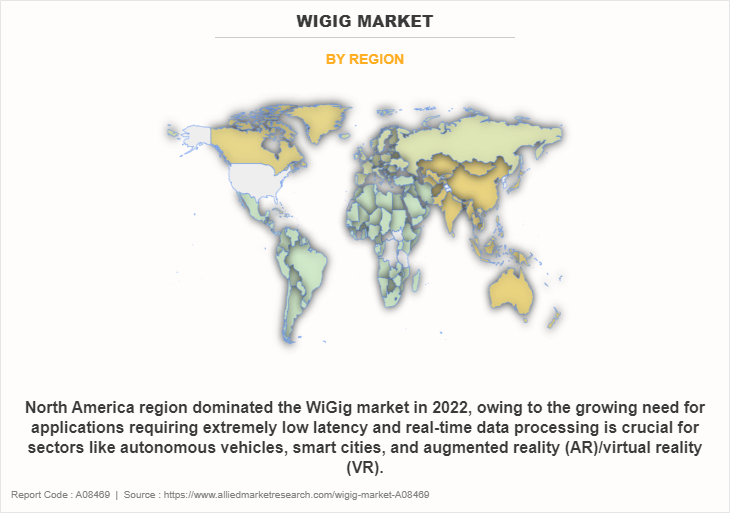

The WiGig market is segmented on the basis of product, type, technology, end user, and region. On the basis of product, it is categorized into network infrastructure devices and display devices. On the basis of type, it is bifurcated into 802.11ad and 802.11ay. On the basis of technology, it is divided into system-on-Chip (SoC) and integrated circuit chip (IC). On the basis of end user, it is fragmented into networking, consumer electronics and commercial. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the WiGig trends. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as the bargaining power of suppliers, the competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and the bargaining power of buyers on the WiGig market share.

On the basis of product, display devices segment dominated the WiGig market in 2022 and is expected to maintain its dominance in the upcoming years owing to the effective use of edge computing resources, improves application performance, and helps in providing end users with high-bandwidth, low-latency services propels the market growth significantly. However, the network infrastructure device segment is expected to witness the highest growth, owing to improve operational efficiency, develop all new applications, and provide end consumers with quicker, more customized services in a variety of industries, such as manufacturing, transportation, telecommunications, and healthcare.

Region-wise, the WiGig market size was dominated by North America in 2022 and is expected to retain its position during the market forecast period, owing to the growing need for applications requiring extremely low latency and real-time data processing is crucial for sectors like autonomous vehicles, smart cities, and augmented reality (AR)/virtual reality (VR) aiding the growth of the market. However, Asia Pacific is expected to witness significant growth during the forecast period, owing to the growing use of 5G technology as well as the rapid growth of IoT devices and applications which is expected to fuel the market growth in this region.

Top Impacting Factors

Increasing Adoption of Data Intensive Apps

The growing popularity of data-intensive apps is driving up demand for high-speed wireless access. Users need faster wireless networks to offer seamless and uninterrupted experiences with the development of streaming services, online gaming, and virtual reality apps. For instance, in the media and entertainment sectors gigabit-speed wireless connections are critical to the fast and effective transfer of big files by content creators and distributors, underscoring the need for high-speed wireless access.

In addition, many companies are deploying cloud-based services and apps extensively, which necessitates fast and dependable wireless connectivity in order to access and work together on data remotely. Increasing numbers of individuals are working remotely, and they need to collaborate and communicate in real time, which drives up the need for high-speed wireless connectivity in commercial settings. The increasing demand for wireless data transfer is attributed to the spread of wearable technologies, smartphones, tablets, Internet of Things (IoT) devices, and smart homes. High-speed wireless connectivity is essential to handle the ever-increasing data traffic as more devices rely on wireless connections for data exchange and access.

Furthermore, wireless technologies are adopted by various industries, including healthcare, manufacturing, transportation, and agriculture, to enhance operational efficiency and automation. These industries also utilize wireless gadgets. For instance, in the healthcare industry, wearables and wireless medical devices gather and send patient data, allowing for real-time and distant healthcare services. In order to facilitate flawless and continuous data transmission, there is an increasing need for wireless gigabit solutions due to the broad adoption of connected devices across numerous industries.

Advancement in Wireless Technologies

The development of Wi-Fi standards and other advancements in wireless technology are major factors propelling the wireless gigabit industry. The rate of data transfer and network capacity rise dramatically with each new generation of Wi-Fi, including Wi-Fi 6 (802.11ax). Multi-gigabit speeds, reduced latency, and increased effectiveness in congested network settings are made possible by Wi-Fi 6. By enabling more dependable and swifter wireless connections, these developments open the door to gigabit-level wireless data transmission rates. The need for wireless gigabit solutions will further increase as Wi-Fi 6 is incorporated into more devices and networks.

In addition, the market for wireless gigabits is also driven by improvements in performance and dependability, which are also a result of advancements in wireless technology. The quality, reliability, and strength of wireless communications are all significantly improved with the deployment of cutting-edge wireless technology. Even in densely populated network situations, this guarantees a more dependable and consistent user experience.

Furthermore, improvements in wireless technology contribute to a decrease in latency, allowing for seamless engagement with data-intensive apps and real-time communication. The increasing popularity of wireless gigabit solutions be attributed to the enhanced performance and dependability of wireless networks, which enable users to take advantages of dependable and fast wireless connectivity.

Key Market Players

WiGig key players such as Intel Corporation, Advanced Micro Devices, Inc., Broadcom, Qualcomm Technologies, Inc., Panasonic Corporation, NEC CORPORATION, NVIDIA Corporation, MediaTek Inc., SAMSUNG and NXP semiconductors. Furthermore, it highlights the strategies of the key players to improve the market share and sustain competition in the WiGig industry.

Key Industry Development

Recent Collaboration in the Market

On June 2021, Samsung Electronics company demonstrated the 6G Terahertz (THz) wireless communication prototype in collaboration with the University of California, Santa Barbara (UCSB). Santa Barbara (UCSB) introduced the potential impact that THz could have on next-generation 6G technology, demonstrating an end-to-end 140GHz wireless link using a fully digital beamforming solution.

On November 2021, MediaTek collaborated with AMD to co-engineer industry leading Wi-Fi® solutions, starting with the AMD RZ600 Series Wi-Fi 6E modules containing MediaTek’s new Filogic 330P chipset. The Filogic 330P chipset will power next-generation AMD Ryzen-series laptop and desktop PCs in 2022 and beyond, delivering fast Wi-Fi speeds with low latency and less interference from other signals.

On May 2021, AMD collaborated with Qualcomm Technologies, Inc., a subsidiary of Qualcomm to optimize the Qualcomm® FastConnect™ connectivity system for AMD Ryzen™ processor-based computing platforms, starting with AMD Ryzen™ PRO 6000 Series processors and the Qualcomm® FastConnect™ 6900 system. With the FastConnect 6900, the latest AMD Ryzen processor-powered business laptops feature Wi-Fi® 6 and 6E connectivity, including advanced wireless capabilities enabled with Windows 11.

Recent Product Launch in the Market

On June 2021, MediaTek launched Dimensity 5G Open Resource Architecture that provides brands with more flexibility to customize key 5G mobile device features to address different market segments. The open resource architecture gives smartphone brands closer-to-metal access to customize features for cameras, displays, graphics, artificial intelligence (AI) processing units (APUs), sensors and connectivity sub-systems within the Dimensity 1200 chipset.

On June 2023, Broadcom Inc. launched availability of its second generation of wireless connectivity chipset solutions for the Wi-Fi 7 ecosystem, spanning Wi-Fi routers, residential gateways, enterprise access points, and client devices. The new chips build on the ecosystem of products with Broadcom’s first-generation Wi-Fi 7 chips while delivering additional functionality to a wider market.

On June 2022, Intel launched a raft of new 'Wi-Fi 6/6E (Gig+)' products & features including 'Double Connect' technology. Also CES 2022 Intel announced a raft of new 12th Gen Intel® Core™ mobile processors (for notebooks) this time with Wi-Fi 6/6E capabilities integrated.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the WiGig market size, segments, key trend, estimations, and dynamics of the market analysis from 2022 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the wigig market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global wigig market trends, key players, market segments, application areas, and market growth strategies.

WiGig Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 278.1 million |

| Growth Rate | CAGR of 28.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 360 |

| By Product |

|

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Broadcom, Intel Corporation, NVIDIA Corporation, NXP semiconductors, NEC CORPORATION, MediaTek Inc., Advanced Micro Devices, Inc., Qualcomm Technologies, Inc. , SAMSUNG, Panasonic Corporation |

Analyst Review

The Wireless Gigabit Market offers both opportunities and challenges in guiding the businesses through shifting digital landscape. In the larger context of digital change, this market is crucial, and maintaining competitiveness in it calls for a sophisticated strategy. The Wireless Gigabit Market presents opportunities for revenue growth and improved customer experiences in the modern business environment, where data is frequently referred to as the new money. 4G and 5G technologies are developing quickly, which emphasizes how crucial it is to remain at the forefront of connection. To guarantee access to cutting-edge technologies and to profit from new trends, enterprises must form strategic alliances with technology suppliers and telecommunications providers. Furthermore, another important factor to consider is the way this market affects the Internet of Things (IoT). Businesses need to plan to utilize IoT extensively as more devices become connected in order to maximize productivity, boost efficiency, and generate new income streams. This could entail making investments in infrastructure and IoT-enabled devices while attending to security issues brought on by the increased attack surface. However, managing costs and innovation simultaneously is a major problem. While using the newest technologies is necessary to remain competitive, enterprises must carefully consider the scalability and return on investment of these solutions. Furthermore, it is critical to navigate legal environments pertaining to data security and privacy, necessitating a proactive approach to compliance.

For instance, in May 2021, Qualcomm Technologies, Inc. released the Qualcomm® SnapdragonTM X65 and X62 5G M.2 Reference Designs. These technologies assist in 5G adoption across a variety of industries, including Always-Connected PCs (ACPCs), Customer Premises Equipment (CPEs), gaming, PCs, laptops, XR, and other mobile broadband (MBB) devices.

The WiGig Market was valued for USD 22.83 million in 2022 and is estimated to reach USD 278.11 million by 2032

The WiGig Market is projected to grow at a compound annual growth rate of 28.7% from 2023 to 2032.

Intel Corporation, Advanced Micro Devices, Inc., Broadcom, Qualcomm Technologies, Inc., Panasonic Corporation, NEC CORPORATION, NVIDIA Corporation, MediaTek Inc., SAMSUNG and NXP semiconductors are the top companies to hold the market share in WiGig.

North America is the largest regional market for WiGig.

Increasing adoption of data intensive apps and advancement in wireless technologies are the upcoming trends of WiGig Market in the world.

Loading Table Of Content...

Loading Research Methodology...