Wire And Cable Jacket Material Market Research, 2031

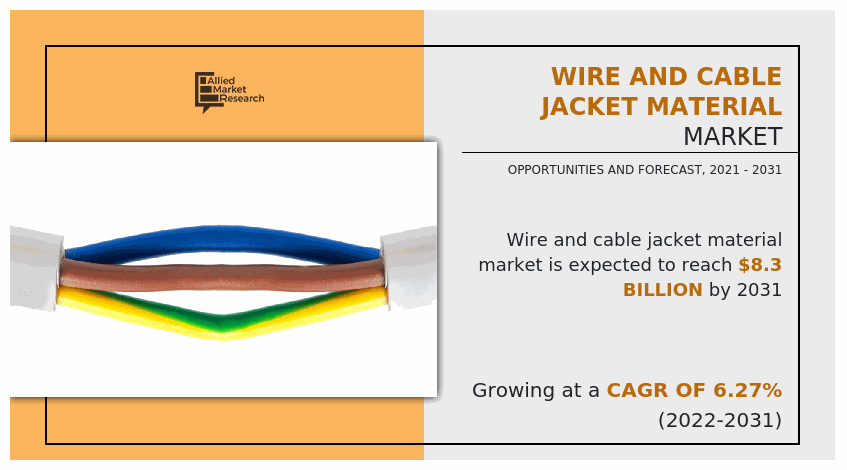

The global wire and cable jacket material market was valued at $4.6 billion in 2021, and is projected to reach $8.3 billion by 2031, growing at a CAGR of 6.27% from 2022 to 2031.

The wire & cable jacket material market is classified on the basis of material type, temperature rating, end-use, and region.

A wire is a single electrical conductor, whereas a group of wires bundled in an assembly is called a cable. The cable jacket is the outside of the cabling that protects the wires from elements, abrasion, and other workplace hazards. But not all jackets are created equal and they all have attributes that make them suitable for different areas or tasks. Different materials are used for cable jacketing, such as thermoplastic and thermosetting materials. In the report, different thermoplastic materials with high temperatures, such as above 200°C are considered. Increase in investment in transmission and distribution of electric power and growth in demand from data centers and the telecom industry are expected to drive the wire & cable jacket material market growth during the forecast period.

Wire and cable jacket material has applications in the aerospace industry. Applications in the aerospace industry include engine, fuselage, wing, landing gear, avionics, and a host of other functions. Aircraft wire harness also includes composite, Ethernet, data bus, RF coaxial, and specialty cable assemblies, such as MS3154. The most prevalent wire & cable insulation materials approved and generally acceptable for aircraft are from the Teflon family, which include fluoropolymers, such as PTFE, ETFE, TFE, and FEP. The need for wire and cable jacket material is expected to rise as a result of technological advancements and the electrification of aircraft systems, thus, driving the market growth during the forecast period.

Pilots are gaining access to a networked ecosystem of apps, services, and documents that define the future flight deck. Every aircraft segment requires data and power lines to connect these digital systems. Alternative energy is required because of higher fuel costs and carbon emissions. Thus, electrifying aircraft provides more efficient, silent, and sustainable flight. It also reduces fuel consumption and operating costs for aircraft operators. Electric aircraft systems need wire and cables for faster, more flexible, and efficient transmission. Thus, both digitalization and electrification of aircraft are projected to increase the demand for aircraft wires and cables. The rising demand for aircraft wires & cables is expected to boost the demand for the wire & cable jacket materials market over the forecast period. However, disruption in the raw material supply and high cost of wire and cable jacket material are expected to hinder the market growth during the forecast period. However, the growing use of renewable energy has resulted in a significant expansion of renewable energy infrastructure globally, boosting demand for wires and cable jacket material as these materials are used in industrial and power generation industries.

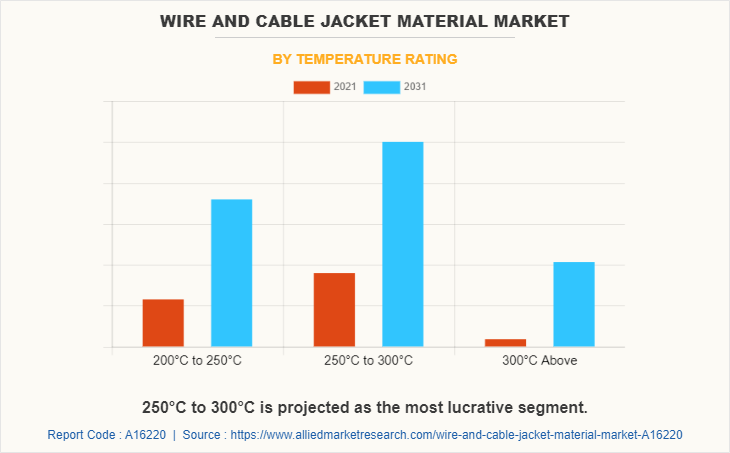

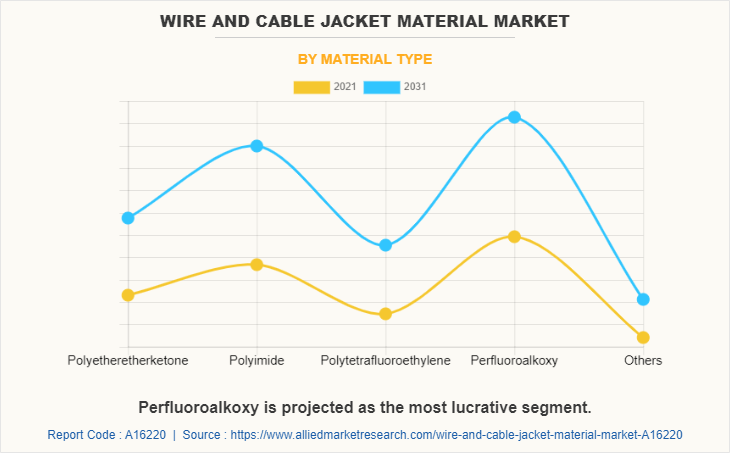

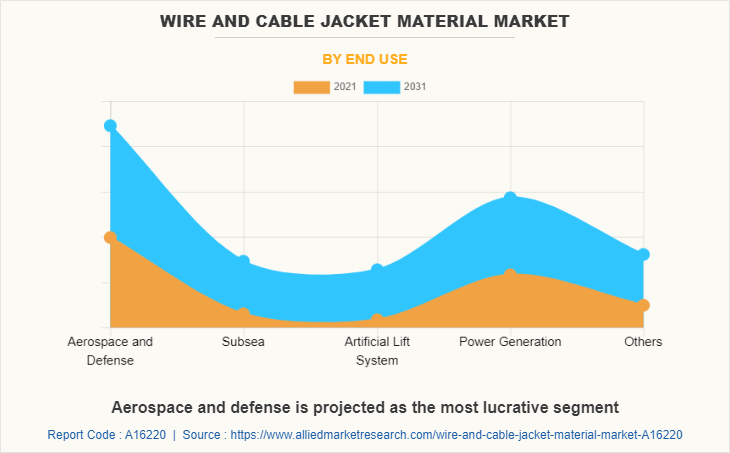

On the basis of material type, the market is segmented into polyetheretherketone, polyimide, polytetrafluoroethylene, perfluoroalkoxy, and others. On the basis of temperature rating, the market is classified into 200°c to 250°c, 250°c to 300°c, and 300°c above. On the basis of end-use, the market is segmented into aerospace and defense, subsea, artificial lift system, power generation, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The wire & cable jacket material market share is analyzed across all significant regions and countries.

The key players operating in the global wire & cable jacket material market include Arkema S.A., Calmont Wire & Cable Inc., DuPont, Evonik Industries AG, Fluorocarbon Group, Galaxy Wire & Cable, Inc., Habia Cable, Groupe PolyAlto, OFS Fitel, LLC, and 3M.

By material type, perfluoroalkoxy emerged as the biggest product segment in the global market for wire & cable jacket material in 2021. PFA can withstand a temperature up to 260°C, making it an ideal material for high-temperature applications. PFA provides strong chemical resistance, in addition to excellent temperature ratings. PFA insulated wire is commonly used as a thermocouple wire, but can also be found in military and aerospace applications.

By temperature rating, the 250°C to 300°C segment accounted for the largest share of revenue in 2021. Wire and cable jacket materials that withstand 250°C to 300°C temperature range include perfluoroalkoxy (PFA) and tetrafluoroethylene (TFE). These high-temperature wire and cable jacket materials withstand very high and low temperatures, are extremely durable and exhibit excellent electrical properties. They are commonly used in military, aerospace, coaxial, and appliance wiring applications.

By end-use, the aerospace & defense segment garnered the largest share of revenue in 2021. Aircraft to military applications require ruggedized cable assemblies to form a highly reliable network backbone. These jacket materials can be specially designed to protect all signal transmissions from external thermal, chemical, mechanical, and environmental stressors. Indoor and outdoor environments can cause the protective jacketing material to crack and crumble over time, exposing the insulation and conductor, and eventually rendering a cable installation nonfunctional.

By region, Asia-Pacific dominated the wire & cable jacket material market in 2021. The growing demand for power, communication, and light in various Asia-Pacific countries is anticipated to drive the wire & cable jacket material market over the forecast period, as these materials are used in power generation. The aerospace and defense industry is growing rapidly in Asia-Pacific countries, which is expected to increase the demand for wire & cable jacket materials as these are used in various aerospace & defense applications.

COVID-19 Impact on Market

- COVID-19 pandemic caused a ban on imports and export, thereby disrupting the supply chain and hampering the wire & cable jacket material market growth.

- There was a huge supply and demand gap created, due to the COVID-19 pandemic.

- Fluctuation in prices of wire & cable jacket material during COVID-19 was a major hindrance to the market.

- During COVID-19, the demand for wire & cable jacket material decreased from the aerospace, and power generation industries, as the operations of these industries were shut due to lockdown.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wire and cable jacket material market analysis from 2021 to 2031 to identify the prevailing wire and cable jacket material market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wire and cable jacket material market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wire and cable jacket material market trends, key players, market segments, application areas, and market growth strategies.

Wire And Cable Jacket Material Market Report Highlights

| Aspects | Details |

| By Temperature Rating |

|

| By Material |

|

| By End Use |

|

| By Region |

|

| Key Market Players | IGUS, OFS Fitel, LLC, Evonik Industries AG, Galaxy Wire & Cable, Inc., ARKEMA S.A., E. I. DU PONT DE NEMOURS AND COMPANY, Calmont Wire & Cable Inc., Fluorocarbon Group, Habia Cable, 3M Company |

Analyst Review

According to the opinions of various CXOs of leading companies, the wire and cable jacket material market is driven by high demand for wires and cables from aerospace, defense, and information technology sectors to drive the market during forecast period. Wire & cable jacket materials are high temperature, chemical, melt resistant, and very high insulation resistant, In addition, they also have properties, such as ruggedness, low-temperature flexibility, UV stability, and heat resistance. Due to these properties, the adoption of wire & cable jacket materials is increasing in various end use industries such as aerospace, power generation, automotive, artificial lift system, subsea, and others. The most prominent cables that are currently available globally include, non-metallic sheathed cables, armored cables, instrumentation cables, low-voltage cables, and communication cables.

The wire and cable jacket material market is expected to be $ 8.3 billion in 2031.

The wire and cable jacket material market is driven by high demand for wires and cables from aerospace, defense, and information technology sectors to drive the market during forecast period.

Asia-Pacific dominated the wire & cable jacket material market in 2021. The growing demand for power, communication, and light in various Asia-Pacific countries is anticipated to drive the wire & cable jacket material market over the forecast period

The key players operating in the global wire & cable jacket material market include Arkema S.A., Calmont Wire & Cable Inc., DuPont, Evonik Industries AG, Fluorocarbon Group, Galaxy Wire & Cable, Inc., Habia Cable, Groupe PolyAlto, OFS Fitel, LLC, and 3M.

COVID-19 pandemic caused a ban on imports and export, thereby disrupting the supply chain and hampering the wire & cable jacket material market growth. • During COVID-19, the demand for wire & cable jacket material decreased from the aerospace, and power generation industries, as the operations of these industries were shut due to lockdown.

Loading Table Of Content...