Wireless Connectivity Market Research, 2032

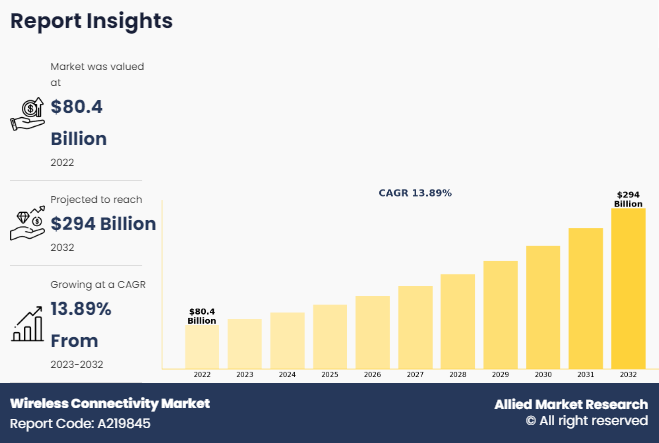

The global Wireless Connectivity Market was valued at $80.4 billion in 2022 and is projected to reach $294 billion by 2032, growing at a CAGR of 13.89% from 2023 to 2032.

Wireless connectivity refers to the capability of devices to establish communication and exchange data without the need for physical wired connections. It enables the seamless transmission of information over short or long distances using electromagnetic signals, radio waves, or other wireless technologies.

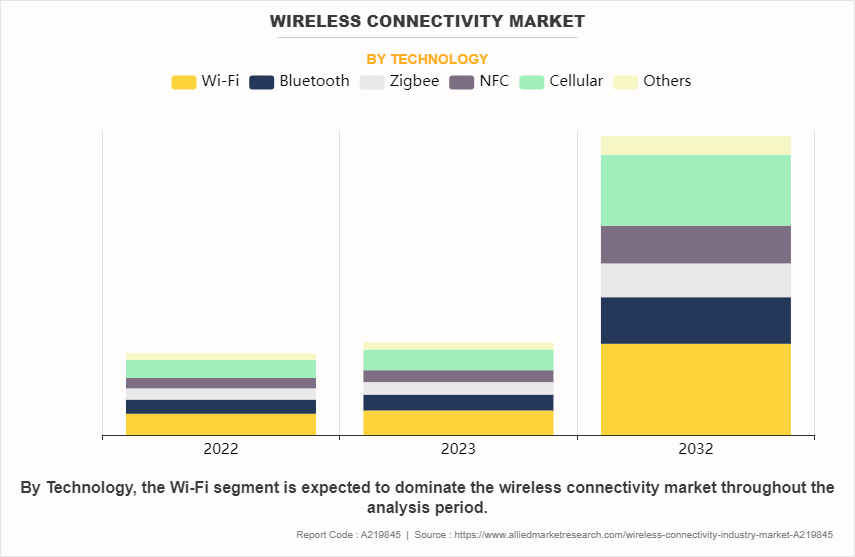

Common wireless connectivity technologies include Wi-Fi, Bluetooth, Zigbee, NFC, RFID, cellular (3G, 4G, 5G), and others. Wireless connectivity plays a crucial role in enabling mobility, flexibility, and convenience in various applications such as internet access, device pairing, IoT deployments, location tracking, and mobile communication.

Key Takeaways of the Wireless Connectivity Market Report

- On the basis of technology, the wifi segment dominated the wireless connectivity industry size in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

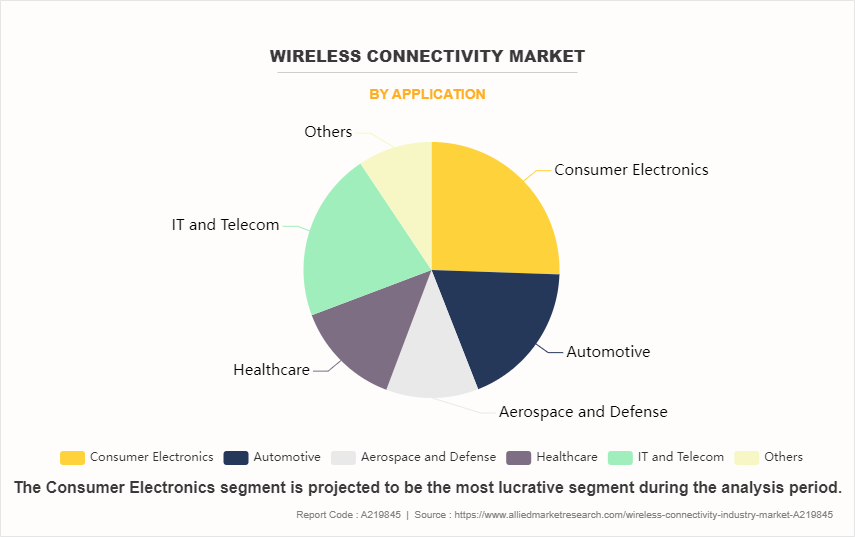

- Based on application, the consumer electronics segment dominated the wireless connectivity market statistics share in terms of revenue in 2022. However, the IT & Telecom segment is anticipated to grow at a faster rate in the forecast period, owing to increasing demand for high-speed internet, cloud services, and mobile communication solutions. As businesses prioritize digital transformation and remote work, there's a surge in demand for robust wireless infrastructure and solutions to support connectivity needs, driving significant growth opportunities within the IT & Telecom segment.

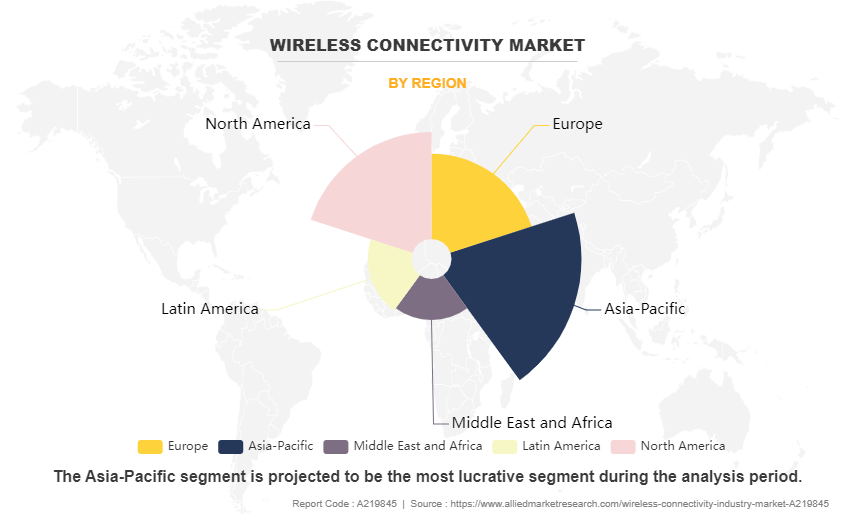

- Region-wise, the Asia-Pacific region dominated the wireless connectivity market in terms of revenue in 2022. China dominated the wireless connectivity market size by country in the Asia-Pacific region. The market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Segment Overview

The wireless connectivity market is segmented into Technology, Application, and Region.

Based on technology, the wireless connectivity industry is divided into Wifi, Bluetooth, Zigbee, NFC, Cellular, and Others. In 2022, wifi dominated the market in terms of revenue and is projected to manifest the highest CAGR during the forecast period, owing to its ubiquitous presence, high data transfer speeds, and compatibility with various devices. Its widespread adoption across consumer electronics, smart homes, and businesses solidifies its market position. Additionally, the growing demand for seamless internet connectivity further cements Wi-Fi's status as the primary revenue generator in the wireless system connectivity sector.

Based on application, the wireless connectivity market segmentation is done into consumer electronics, automotive, aerospace & defense, healthcare, IT & telecom, and others. In 2022, the consumer electronics segment dominated the market in terms of revenue. However, the IT & telecom segment is expected to grow at the highest CAGR during the forecast period, owing to the rising demand for data-intensive applications, such as video streaming, cloud computing, and remote collaboration tools; there's a heightened need for high-speed and reliable wireless connectivity solutions. In addition, the ongoing deployment of 5G networks, coupled with the increasing adoption of IoT devices and smart city initiatives, further propels growth within the IT & Telecom segment as businesses and telecommunications providers invest in expanding and upgrading their wireless infrastructure to meet evolving connectivity demands.

Based on region, it is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, South-East Asia and rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, and Rest of Middle East and Africa). Asia-Pacific, specifically China, remains a significant participant in the wireless connectivity market analysis with a CAGR of 15.22% due to its strong manufacturing capabilities, technological expertise, large consumer base, and ongoing investments in infrastructure development and technological innovation.

Competitive Analysis

Wireless connectivity market share by company and profiles including Qualcomm Incorporated, Broadcom Inc., Intel Corporation, MediaTek Inc., Texas Instruments Incorporated, Infineon Technologies AG, NXP Semiconductors N.V., Murata Manufacturing Co., Ltd., Microchip Technology Inc., and STMicroelectronics N.V. are provided in this report. The major wireless connectivity companies adopted product launch, collaboration, and acquisition business strategies in 2022. For instance, in February 2022, Hewlett Packard Enterprise and Qualcomm Technologies announced a collaboration to deliver the next generation 5G virtualized distributed unit solutions. The companies will collaborate to deliver the industry’s first fully optimized VDU solution with up to 60% lower total cost of ownership for operators.

Market Dynamics

The rising demand for interconnected devices

The rising demand for interconnected devices is a major catalyst propelling wireless connectivity growth projections. As smartphones, tablets, wearables, IoT gadgets, and smart home appliances become more prevalent, there is an increasing need for smooth communication among them. Wireless system connectivity solutions like Wi-Fi, Bluetooth, Zigbee, and NFC facilitate this connectivity, enabling devices to communicate, exchange information, and access online services. This demand is further amplified by the proliferation of the Internet of Things (IoT), where interconnected devices play a pivotal role across various domains, including smart homes, industrial automation, healthcare, and transportation. As individuals and businesses embrace this connected lifestyle, the demand for reliable wireless connectivity solutions continues to escalate.

For instance, in January 2022, Telstra announced the deployment of Ericsson Private 5G, an on-premises dedicated 5G network for enterprises that utilizes a single-server 5G dual-mode core. Telstra's advanced network capabilities offer an industrial wireless network connectivity platform for the enterprise that can deliver low latency and enhanced resiliency.

High cost of deployment and maintenance

The restricted bandwidth capacity within wireless networks poses a significant hurdle to the advancement of the wireless connectivity market insights. As the demand for rapid data transmission grows alongside the prevalence of data-intensive activities like video streaming, gaming, and IoT applications, existing bandwidth structures struggle to keep up. This limitation results in network congestion, slower speeds, and compromised performance, particularly in densely populated urban areas or during peak usage times. Furthermore, as new technologies emerge and contribute to greater bandwidth consumption, the strain on current wireless networks intensifies. Addressing this challenge entails investing in infrastructure upgrades, managing spectrum resources effectively, and innovating technologies to enhance spectral efficiency, all aimed at facilitating the seamless expansion of wireless connectivity companies' capabilities.

The widespread adoption of 5G technology

The widespread adoption of 5G technology signals a transformative trajectory for the wireless connectivity market opportunity. With its commitment to ultra-fast data speeds, minimal latency, and extensive device connectivity, 5G opens doors to numerous opportunities across various sectors. Industries spanning healthcare, manufacturing, transportation, and entertainment stand to benefit from heightened connectivity, fostering innovative applications like remote surgery, autonomous vehicles, smart factories, and immersive media experiences. Moreover, 5G's capacity to accommodate a vast array of IoT devices will revolutionize smart city endeavors, enabling real-time oversight and management of urban infrastructure, energy grids, and transportation systems. Additionally, 5G's potential to enable edge computing at the network periphery promises faster decision-making, heightened reliability, and fortified security for critical applications. In essence, 5G technology propels unprecedented levels of innovation, efficiency, and connectivity, shaping the forthcoming landscape of wireless network connectivity.

Recent Developments in the Wireless Connectivity Industry

- In November 2022, A provider of cellular vehicle-to-everything (C-V2X) and automotive solutions, Quectel Wireless Solutions, announced the release of its new AG18 module. The module's PC5 direct communications feature allows for efficient communication between cars and their surroundings, enhancing traffic efficiency and safety.

- In January 2022, Telstra announced the deployment of Ericsson Private 5G, an on-premise dedicated 5G network for enterprises that utilizes a single-server 5G dual-mode core. Telstra's advanced network capabilities offer an industrial wireless connectivity platform for the enterprise that can deliver low latency and enhanced resiliency.

- In June 2022, Texas Instruments expanded its wireless connectivity product portfolio with the launch of MCUs, which offer BLE at half the price of competing devices.

Key Benefits For Stakeholders

- This study comprises an analytical depiction of the market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global wireless connectivity market forecast is quantitatively analyzed from 2022 to 2032 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in wireless connectivity.

- The report includes the market share of key vendors and wireless connectivity market trends.

Wireless Connectivity Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 294 billion |

| Growth Rate | CAGR of 13.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | MediaTek Inc., Qualcomm Incorporated., Intel Corporation, Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., Infineon Technologies AG, STMicroelectronics N.V., NXP Semiconductors N.V., Broadcom Inc., Microchip Technology Inc. |

Analyst Review

The wireless connectivity market is experiencing swift growth due to advancements in technology, rising demand for connected devices, and the widespread use of IoT applications in various sectors. Market analysts are closely observing these trends and assessing the factors influencing market dynamics.

One primary growth driver is the ongoing innovation in wireless communication technologies, including Wi-Fi, Bluetooth, and 5G cellular networks. These technologies are continuously evolving to meet the increasing need for faster speeds, lower latency, and enhanced reliability. The deployment of 5G networks, particularly, is expected to have a significant impact, enabling new applications such as autonomous vehicles and remote healthcare. Another factor propelling market expansion is the growing adoption of connected devices like smartphones, wearables, and IoT sensors. This surge in device usage is fueling demand for wireless connectivity solutions capable of seamless connection and communication with these devices, driving market growth. In addition, the COVID-19 pandemic has accelerated the adoption of remote work and virtual collaboration tools, further boosting the demand for robust wireless connectivity solutions. Businesses are investing in upgrading their wireless infrastructure to support remote work setups effectively.

However, the wireless connectivity market also faces challenges. Security concerns are significant, given the growing number of connected devices and associated vulnerabilities. Ensuring data security and privacy over wireless networks is crucial to maintaining consumer trust.

Moreover, spectrum limitations and infrastructure constraints pose challenges to the scalability and reliability of wireless networks. Addressing these constraints and investing in infrastructure will be essential to meeting the increasing demand for high-speed, dependable wireless connectivity.

The widespread deployment of 5G networks and the internet of things (IoT) ecosystem are the upcoming trends of Wireless Connectivity Market in the world.

Consumer electronics is the leading application of Wireless Connectivity Market

Asia-Pacific is the largest regional market for Wireless Connectivity.

The wireless connectivity market was valued for $80.4 billion in 2022.

Qualcomm Incorporated, Broadcom Inc., Intel Corporation, MediaTek Inc., Texas Instruments Incorporated, Infineon Technologies AG, NXP Semiconductors N.V., Murata Manufacturing Co., Ltd., Microchip Technology Inc., and STMicroelectronics N.V. are the top companies to hold the market share in wireless connectivity.

Loading Table Of Content...

Loading Research Methodology...