Wireless Electric Vehicle Charging Market Insights, 2033

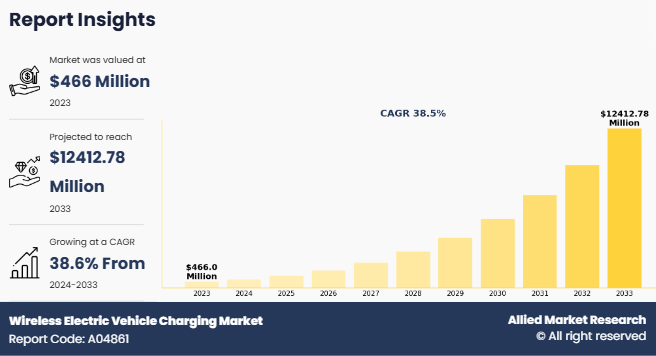

The global wireless electric vehicle charging market size was valued at $466 million in 2023, and is projected to reach $12.4 billion by 2033, growing at a CAGR of 38.6% from 2024 to 2033.

Wireless EV Charging refers to the process of recharging an electric vehicle (EV) without the need for a physical cable or plug connection. This technology uses electromagnetic fields to transfer energy between a transmitting pad typically embedded in the ground or floor and a receiving pad installed on the vehicle.

One of the important factors such as rise in population with surge in need of the consumers drives market growth. Further, increased development and rapid acceptance of newly developed technologies are fueling the market demand. Government support through increased investment in developing wireless charging electric vehicles and expanding charging station infrastructure significantly drive the growth of the wireless EV charging market. However, expensive integration of technology and slower charging are restraining the market growth. In January 2022, Continental AG collaborated with Volterio, a startup for developing fully automatic charging robots for electric vehicles. This development aligns closely with the wireless EV charging market as it represents an innovative step toward convenience and automation in EV charging.

Report Key Highlighters

• The wireless EV charging market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value available from 2022 to 2032.

• The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The wireless EV charging market share is marginally fragmented, with players such as Wipowerone, Witricity, Evatran, Dashdynamic, HEVO, Induct EV Inc., Continental AG, Toyota Motor Corporation, Robert Bosch GmbH, and Electreon. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

Increased sales of electric vehicles

Moreover, there is an increased demand for wireless connected devices and low maintenance vehicles among the consumers. This in turn increases awareness about electric vehicles. Rise in awareness and surge in demand for electric cars leads to an increase in the production of electric vehicles. For instance, according to a report by the IEA organization, electric car sales valued for 14 million in 2023, 95% of which were in China, Europe, and the U.S. Therefore, rise in production of electric vehicles supports the growth of the wireless electric vehicle charging market during the forecast period.

Expensive integration of technology and slower charging

Slower charging rates and costlier integration of technology as compared to traditional cable chargers act as the key restraints to the growth of the wireless electric vehicle charging market. For instance, Robert Bosch GmbH wireless charging for electric vehicle technology costs $3000-$4000, which gives 3.6 KW power. In addition, wireless charging devices have a distance limitation.

RF energy technology fails when energy is to be transferred over a long distance. In electric vehicles, the charging time required is more and it varies in accordance with the vehicle battery capacity. Devices take longer to charge when the power supplied is of the same amount. Furthermore, technology is more expensive, as inductive charging requires electronics and coils in both devices and chargers, thus, it increases the complexity and cost of manufacturing. However, newer approaches and advancements in technology are anticipated to reduce transfer losses and improve speed.

Excessive research in far-field wireless technologies

Many technologies fail to provide transmission over a long distance. This is expected to be overcome by using the latest laser and microwave energy transmission mediums. Such methods are categorized into far-field of wireless charging. The laser beam is a coherent light beam, which is capable of efficiently transporting extremely high energy by using a line of sight.

Currently, companies such as Continental AG, Plugless Power Inc., and others, are conducting research to develop wireless charging systems that use microwave or laser beam technology for charging devices that are based on inductive charging technology. Such technological advancements in the field of wireless electric vehicle charging are expected to boost market growth. Thus, excessive research in far-field wireless charging technologies is projected to provide lucrative opportunities for market expansion.

Segment Review

The wireless EV charging market is segmented into installation, vehicle type, power source, distribution channel and region. By installation, the market is segregated into home and commercial. On the basis of vehicle type, the market is classified into passenger cars and commercial vehicles. On the basis of power source, the market is divided into below 11 KW, 11-50 KW and above 50 KW. On the basis of distribution channel, the market is bifurcated into aftermarket and OEMs. Region-wise, the wireless EV charging market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

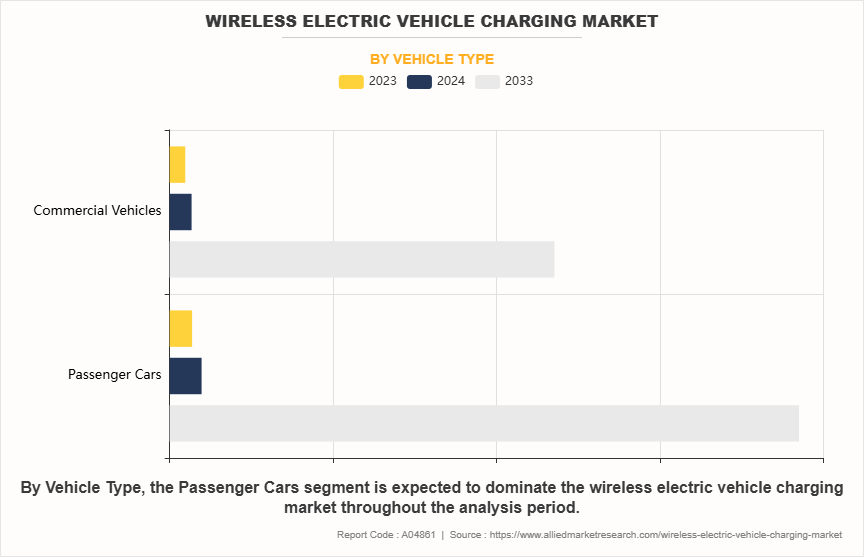

By Vehicle Type

On the basis of vehicle type, the market is classified into passenger cars and commercial vehicles. Passenger cars accounted for the largest share in 2023. This growht is driven by the growing adoption of advanced technologies in personal vehicles and the increasing demand for connectivity and convenience features among individual consumers. The integration of satellite services in passenger cars, such as satellite navigation systems, in-car entertainment, and real-time traffic monitoring, has significantly enhanced the driving experience, contributing to the segment's wireless EV charging market growth.

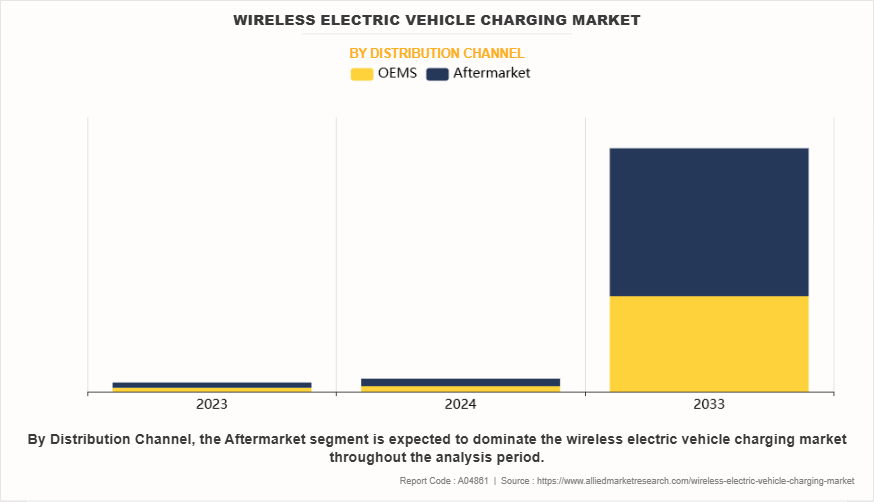

By Distribution Channel

On the basis of distribution channel, the market is bifurcated into aftermarket and OEMs. Aftermarket generated the largest revenue in 2023, driven by the growing demand for maintenance, upgrades, and replacement of satellite-enabled systems across various industries. The aftermarket segment encompasses a wide range of services, including hardware component replacements, software updates, and system integration, which are essential for maintaining the performance and reliability of satellite systems over their operational lifespan.

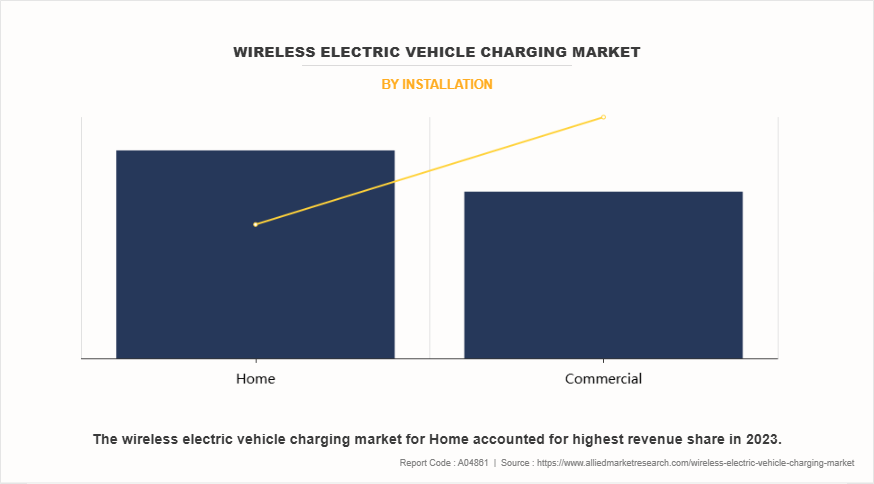

By Installation

By installation, the market is segregated into home and commercial. Home segment accounted for the largest share in 2023.The home segment accounted for the largest share in 2023, primarily driven by the widespread adoption of satellite-based services for direct-to-home (DTH) television, high-speed internet, and home automation systems. Increasing consumer demand for uninterrupted entertainment and connectivity, especially in remote and rural areas, has significantly contributed to the growth of this segment. Advancements in satellite technology, such as high-throughput satellites (HTS) and low Earth orbit (LEO) constellations, have improved service quality and accessibility for home users. Additionally, the growing popularity of smart home devices and streaming platforms has further boosted the demand for reliable satellite services in residential settings.

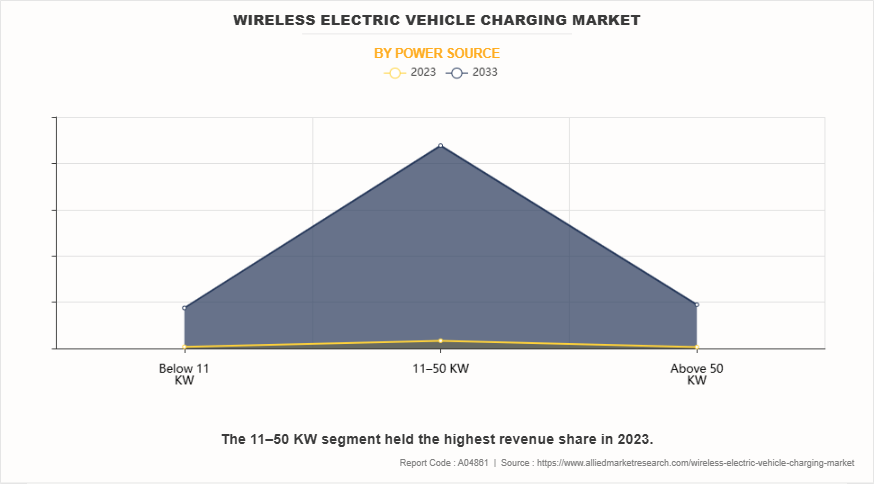

By Power Source

On the basis of power source, the market is divided into below 11 KW, 11-50 KW and above 50 KW. The 11-50 KW dominated the market in 2023.The 11-50 kW segment dominated the market in 2023, driven by its widespread use across various applications, including commercial and industrial sectors, as well as residential setups requiring moderate power output. This power range is highly versatile, catering to a broad spectrum of satellite ground stations, remote monitoring systems, and communication hubs. The demand for 11-50 kW systems has surged due to their ability to provide reliable performance while maintaining energy efficiency, making them a preferred choice for medium-scale operations.

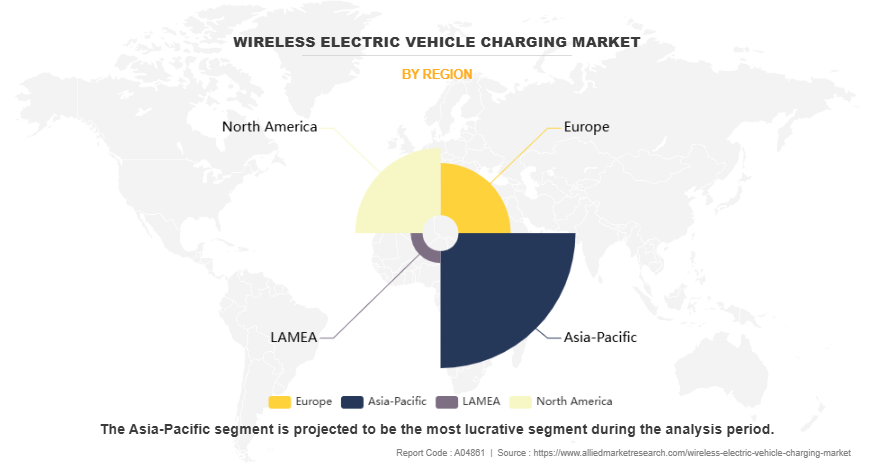

Region-wise, the wireless EV charging market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific generated the largest share in 2023. Asia-Pacific generated the largest share in 2023, driven by the region's rapid technological advancements, expanding satellite infrastructure, and growing demand for satellite-based services across various industries. The region's diverse market, including countries such as China, India, Japan, and South Korea, has seen significant investments in satellite communication, Earth observation, and broadband connectivity, particularly in rural and underserved areas.

Competitive Analysis

Competitive analysis and profiles of the major global wireless EV charging market players that have been provided in the report include Wipowerone, Witricity, Evatran, Dashdynamic, HEVO, Induct EV Inc., Continental AG, Toyota Motor Corporation, Robert Bosch GmbH, and Electreon. The key strategies adopted by the major players of the global wireless EV charging market size are product launch and mergers & acquisitions.

Top Impacting Factors

The global wireless EV charging industry is expected to witness notable growth registering a CAGR of 38.55% from 2024 to 2033. The wireless EV charging market forecast is expected to witness significant growth due to increase in adoption of electric vehicles, advancements in charging technologies, rise in investments in smart infrastructure, and surge in emphasis on reducing carbon emissions through sustainable mobility solutions will create wireless EV charging market opportunity.

Historical Data & Information

The global wireless EV charging industry is competitive, owing to the strong presence of existing vendors. Vendors in the global wireless EV charging market size with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Wireless EV Charging Market

In 2022, WiTricity purchased Qualcomm Halo™, adding certain Wireless Electric Vehicle Charging (WEVC) patents owned by Qualcomm and the exclusive license from Auckland UniServices.

In December 2022, Electreon Germany GmbH, a subsidiary of Electreon Wireless LTD, a provider of wireless charging solutions for electric vehicles, started its project of public wireless charging infrastructure for electric cars in Germany. The company will also install two static charging stations along a 1 km stretch of road, and the two locations will be chosen based on the bus route and the stops the bus makes while operating.

In March 2023, Witricity partnered with ABT SE to upgrade VW ID.4 for wireless charging using Witricity technology, with a target availability in early 2024. The company also plans to expand this development to additional EV models in the future.

Key Benefits For Stakeholders

- This report provides a quantitative wireless EV charging market analysis segments, current trends, estimations, and dynamics of the wireless electric vehicle charging market analysis from 2023 to 2033 to identify the prevailing wireless electric vehicle charging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wireless electric vehicle charging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global wireless EV charging market demand.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wireless electric vehicle charging market trends, key players, market segments, application areas, and market growth strategies.

Wireless Electric Vehicle Charging Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 12.4 billion |

| Growth Rate | CAGR of 38.6% |

| Forecast period | 2023 - 2033 |

| Report Pages | 224 |

| By Vehicle Type |

|

| By Distribution Channel |

|

| By Installation |

|

| By Power Source |

|

| By Region |

|

| Key Market Players | Induct EV Inc., WITRICITY CORPORATION, CONTINENTAL AG, EVATRAN GROUP (PLUGLESS), Electreon, Dashdynamic, ROBERT BOSCH GMBH, HEVO Inc., Wipowerone, TOYOTA MOTOR CORPORATION, INC, Wave Charging |

Analyst Review

Wireless charging is an emerging technology that provides enhanced durability of electric vehicles (EVs) and ease of charging. The miles covered per charge by the electric vehicles and the availability of the charging stations and time required for charging are some of the restraining factors for the adoption of the electric vehicles. The electric vehicles are premium vehicles, hence they are equipped with the high-end features such as premium lighting, infotainment, touch screen panels, and others. These features are powered by the soul battery box available for traction and auxiliary functions. The regular use of these devices causes excessive draining of battery. These issues can be resolved with the help of wireless charging technology.

Increase in sales of electric vehicles (EVs) and frequent need of harvesting ambient RF energy are expected to drive the wireless charging market during the forecast period. However, expensive technology for its integration and slower charging as compared to other charging technologies are anticipated to hamper the growth of the market. Moreover, excessive research in far-field wireless charging technologies, and increase in Internet of Things (IoT) are expected to offer lucrative opportunities in future.

Market players focus on product launch and merger to expand their presence in the market and improve their offerings. For instance, Nichicon Corporation and Qualcomm entered into a strategic agreement. Based on the agreement, Nichicon Corporation is expected to include Qualcomm Halo Wireless Electric Vehicle Charging (WEVC) technology in its product portfolio and focus on commercializing Qualcomm Halo Wireless Electric Vehicle Charging, that is, WEVC technology for hybrid and electric vehicles.

Opportunities such as usage of IoT technologies, digital applications, and autonomous ride sharing are expected to boost the demand for the wireless electric vehicle charging.

The home segment is the leading installation of wireless electric vehicle charging market.

The upcoming trends of wireless electric vehicle charging market increase in adoption of electric vehicles, advancements in charging technologies.

Asia-Pacific is the largest regional market for wireless electric vehicle charging.

The global wireless electric vehicle charging market was valued at $466.0 million in 2023.

Wipowerone, Witricity, Evatran, Dashdynamic, HEVO are some of the top companies to hold the market share in Wireless Electric Vehicle Charging.

Loading Table Of Content...

Loading Research Methodology...