Wireless Motor Control Systems Market Research, 2032

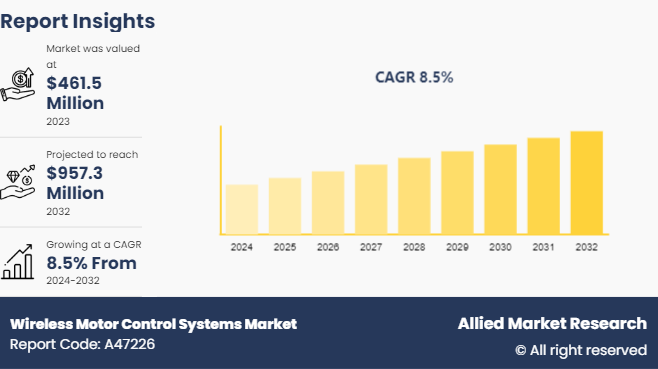

The global wireless motor control systems market was valued at $461.5 million in 2023, and is projected to reach $957.3 million by 2032, growing at a CAGR of 8.5% from 2024 to 2032.

Market Introduction and Definition

Wireless motor control systems enable the remote management and monitoring of motor operations using wireless communication technologies, improving efficiency and flexibility in industrial settings. Key components include wireless communication modules for data transmission, motor controllers to manage motor functions, sensors to monitor parameters like speed and temperature, software for programming and control, and actuators to execute commands on the motors.

Wireless motor control systems offer flexibility, efficiency, and safety by eliminating cumbersome wiring, enabling remote operation, and facilitating real-time monitoring. These systems help streamline industrial processes, reduce maintenance costs, and enhance productivity in various applications, from manufacturing to robotics.

Key Takeaways

The wireless motor control systems market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major wireless motor control systems industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global wireless motor control systems Market and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global wireless motor control systems market is experiencing growth due to several factors such as renewable energy integration, regulatory support and incentives, trends toward decentralization, and the development of microgrids. However, lack of standardization and perception of risk restrains the development of the wireless motor control systems market. In addition, the surge in electric vehicle charging infrastructure and ongoing rural electrification initiatives in developing countries are projected to provide ample opportunities for wireless motor control systems market growth and development during the forecast period.

Renewable energy integration has become increasingly important due to environmental concerns and technological advancements. However, the intermittent of renewable energy sources like wind and solar makes it challenging to integrate them into the grid. However, wireless motor control systems help by storing excess energy during peak production times and releasing it when demand is high or renewable generation is low. This ensures a reliable and stable energy supply while maximizing the utilization of clean and sustainable energy sources.

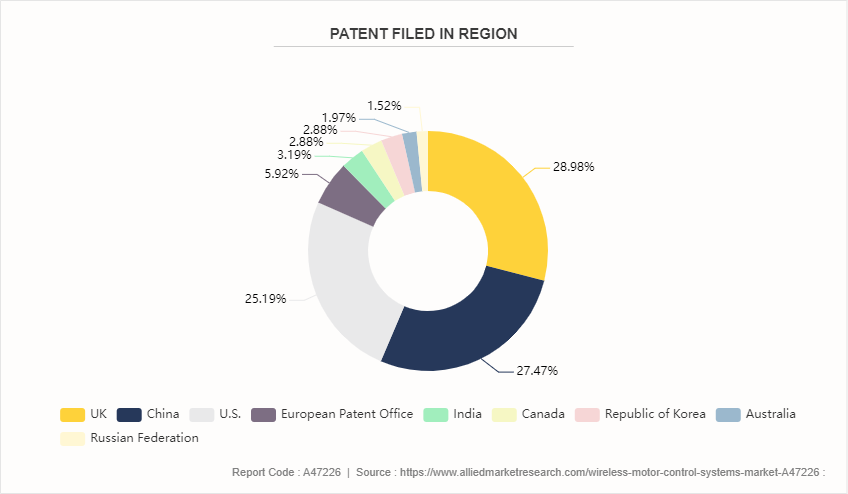

Patent Analysis of Global Wireless Motor Control Systems Market

The wireless motor control systems market is segmented according to the patents filed by UK, China, U.S., European Patent Office, India, Canada, Republic of Korea, Australia, Russian Federation. UK has the largest number of patent filings, owing to suitable research infrastructure. Approvals from these patent holders are followed by high adoption of wireless motor control system and initiatives associated with enhancing safety by reducing the hazards associated with wired connections at regional and global level. Therefore, these countries have the maximum number of patent filings.

Market Segmentation

The wireless motor control systems market is segmented into product type, communication technology, end user, and region. On the basis of product type, the market is divided into motor drivers, controllers, actuators, and others (sensors) . On the basis of communication technology, the market is segmented into bluetooth, wi-fi, Zigbee, RFID, Others. As per end-user industry, the market is segregated industrial and non industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

Market Segment Outlook

Based on product type, the controllers segment held the highest market share in 2023, accounting for more than two-thirds of wireless motor control systems market size. Controllers enable precise control, monitoring, and automation of motor functions, driving their widespread adoption across various industries such as manufacturing, automotive, and utilities. Their versatility and functionality contribute significantly to their dominant position in the market.

Based on communication technology, the wi-fi held the highest market share in 2023, accounting for more than two-fifths of wireless motor control systems market size. Wi-Fi is prevalent in industrial applications due to its high bandwidth, long-range communication capabilities, and interoperability with a wide range of devices. It is especially suited for applications requiring real-time data transfer, such as video surveillance and industrial control systems.

Based on end user, the industrail segment held the highest market share in 2023, accounting for nearly threex-fourth of the wireless motor control systems market share, due to its robust demand for automation and remote monitoring capabilities. Industries leverage wireless systems to enhance operational efficiency, reduce downtime, and enable real-time control, thereby driving significant adoption and market share within this sector.

Regional/Country Market Outlook

In North America, the wireless motor control systems market exhibits robust growth driven by factors such as advanced industrial infrastructure, stringent regulatory standards, and widespread adoption of automation technologies. The U.S. leads the market, propelled by its flourishing manufacturing, oil & gas, and automotive sectors. Canada also contributes significantly, with a focus on energy efficiency and sustainability driving demand for wireless motor control solutions. Moreover, Mexico's expanding industrial base and increasing investments in automation further bolster market growth. Key players in the region, along with technological innovation hubs and strategic partnerships, ensure North America remains a dominant force in the global Wireless Motor Control Systems market.

In November 2023, NXP launched a purpose-built system in package version of its S32 microcontroller range for automotive motor control designs. The NXP S32M takes a 42V input for the motor control gate driver and in-package microcontroller die.

In October 2023, A Chinese clinical team has implanted a wireless processor into the skull of a paralyzed man, significantly recovering his motor skills. The team announced the outcome on Tuesday, calling it a breakthrough in the country's brain-computer interface (BCI) device, a frontier technology that may assist the rehabilitation of patients with brain diseases and injuries, and even expand the human brain's processing capability in the future.

Competitive Landscape

The major players operating in the wireless motor control systems market overview include Siemens AG, ABB Ltd., Schneider Electric SE, Rockwell Automation, Inc., Mitsubishi Electric Corporation, Eaton Corporation plc., General Electric Company, Emerson Electric Co., Honeywell International Inc., and Danfoss Group.

Recent Key Strategies and Developments

In June 2023, Renesas unveiled over 35 motor control MCUs that have the ability to precisely manipulate motors, including achieving a desired speed, position, and torque, which is essential for optimal performance and efficiency.

In June 2023, Nidec Corporation announced development of a proof of concept (PoC) to realize an “Intelligent Motor solution” a system that the Company defined to adapt Intelligent Motors, which are equipped with microcomputers and data coupling and time synchronization functions, and products with an Intelligent Motor, to digital twin.

Industry Trends:

In April 2024, Toshiba Electronics Europe GmbH introduced a motor control driver IC, the TB9M003FG, which is part of their Smart Motor Control Driver (SmartMCD) family. This highly integrated device is designed to drive three-phase brushless DC (BLDC) motors and permanent magnet synchronous motors (PMSM) more efficiently. It combines an Arm Cortex-M0 CPU with a vector engine co-processor and pre-drivers to control external B6 N-channel MOSFETs. The device is aimed at automotive applications such as electric pumps, fans, body control, and thermal management systems

In April 2024, The European Union (EU) announced four pilot lines for semiconductors under the Chips Joint Undertaking (Chips JU). The latter focused on developing wide bandgap semiconductors for motor control systems, among other applications.

In September 2023, Artery Technology developed high-performance microcontroller units (MCUs) to enable efficient motor control solutions. The AT32 MCU series, particularly the AT32F413 and AT32F421, are designed for high-speed and real-time control, improving motor vector control accuracy. These MCUs are suitable for various applications, including electric scooters, hair dryers, and HVAC systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wireless motor control systems market analysis from 2024 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wireless motor control systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wireless motor control systems market trends, key players, market segments, application areas, and market growth strategies.

Wireless Motor Control Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 957.3 Million |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By Communication Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., Schneider Electric SE, ABB Ltd., General Electric Company, Emerson Electric Co., Eaton Corporation plc, Siemens AG, Danfoss Group, Rockwell Automation, Inc., Mitsubishi Electric Corporation |

Loading Table Of Content...