Workout Clothes Market Research, 2035

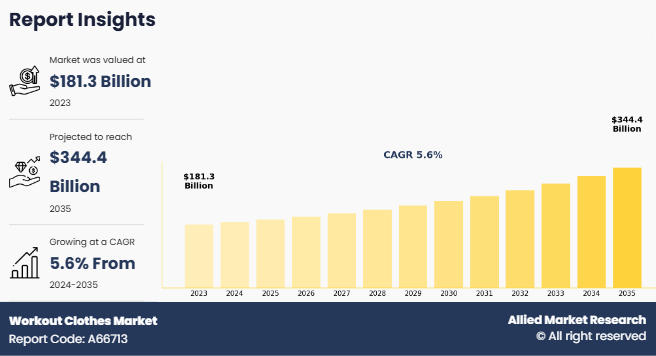

The global workout clothes industry was valued at $181.3 billion in 2023, and is projected to reach $344.4 billion by 2035, growing at a CAGR of 5.6% from 2024 to 2035. Workout clothes are clothing designed for physical activities such as exercise, sports, and training. These clothes provide comfort, ease of movement, and support during workouts. Many workout clothes help keep the body cool and dry by allowing airflow and absorbing sweat. Wearing the right workout clothes can improve performance by reducing discomfort and preventing irritation. Some designs offer extra support for muscles and joints, making activities such as running, weightlifting, and stretching easier. Workout clothes are also worn for casual wear, as they combine function with everyday style.

Market Dynamics

Rise in health consciousness and the adoption of active lifestyles have significantly contributed to global workout clothes market growth. Consumers seek moisture-wicking, breathable, and stretchable fabrics that improve mobility and provide durability during exercise. More individuals are engaging in fitness routines, including gym workouts, yoga, running, and outdoor activities, which has led to an increase in demand for comfortable and performance-driven workout clothes. In addition, the shift toward preventive healthcare has encouraged people to incorporate regular physical activity into daily routines, further boosting demand for high-quality workout clothes. The increasing focus on fitness as part of a healthy lifestyle continues to boost global workout clothes market size in recent years.

Moreover, workout clothes are chosen for both exercise and daily wear, increasing demand for apparel that offers comfort and functionality. Brands are introducing innovative designs with performance features and contemporary aesthetics to meet consumer expectations. The expansion of fitness culture has further contributed to market growth, with more individuals prioritizing clothing that supports an active lifestyle. The demand for high-quality fabrics, ergonomic fits, and durable materials is anticipated to rise as more people integrate physical activity into everyday routines, further driving the global workout clothes market demand.

Even though the market has experienced rapid growth, the market faces certain challenges. For instance, the presence of counterfeit workout clothes has negatively impacted brand reputation, leading to restrained market demand. Fake products, often made from inferior materials, fail to provide the durability, comfort, and performance expected from established brands. Consumers who unknowingly purchase counterfeit items may experience discomfort, poor fit, and rapid wear and tear, leading to dissatisfaction. Negative experiences with these low-quality imitations of workout clothes can degrade trust in authentic brands, as consumers may associate poor performance with the original manufacturer. Brands such as Nike, Adidas, and Lululemon face challenges as counterfeit products dilute exclusivity and weaken perceived value among consumers.

In addition, loss of consumer confidence in product authenticity has further constrained demand for premium workout apparel. Counterfeit items are often sold at lower prices, diverting sales from genuine brands and reducing overall revenue. The widespread availability of fake products through online marketplaces and unauthorized retailers has made it difficult for brands to maintain control over product distribution. As counterfeit workout clothes emerge in the market, consumer hesitation in purchasing high-end workout clothes is anticipated to increase, thus affecting long-term brand loyalty.

Furthermore, the growing demand for sustainable and eco-friendly workout apparel is creating opportunities in the global workout clothes market by encouraging brands to develop innovative products that align with environmental concerns. Consumers are increasingly seeking workout clothes made from recycled materials, organic fabrics, and biodegradable fibers, driving the expansion of sustainable product lines. Brands incorporating eco-friendly manufacturing processes, such as waterless dyeing and reduced chemical treatments, have gained a competitive edge. Transparency in sourcing and ethical labor practices have also influenced purchasing decisions, as consumers prioritize brands that demonstrate a commitment to sustainability.

Moreover, the growth has been further supported by advancements in fabric technology, enabling the production of durable and high-performance workout clothes using sustainable materials. The rising preference for long-lasting apparel reduces frequent replacements, increasing consumer interest in quality-driven purchases. Companies launching collections featuring plant-based dyes, regenerated fibers, and recyclable packaging have attracted environmentally conscious buyers. Expanding availability of sustainable workout clothes across online and offline retail channels has contributed to wider market penetration, allowing brands to reach a growing segment of consumers who prioritize sustainability without compromising performance or style.

Segmental Overview

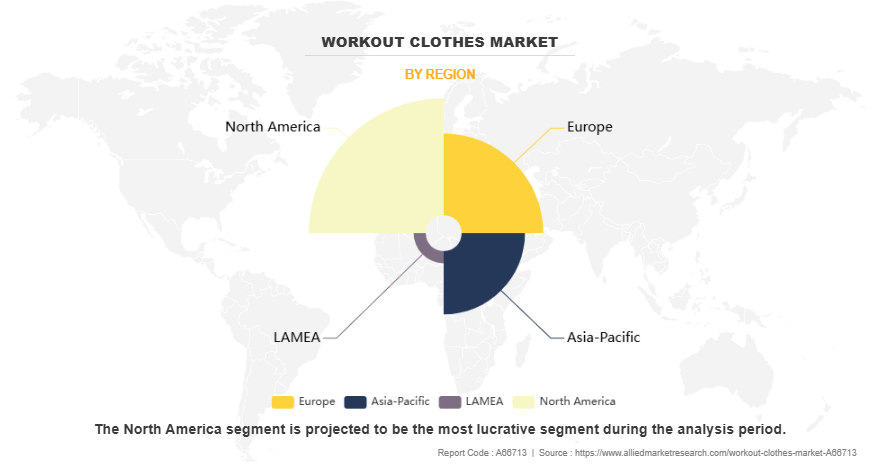

The workout clothes market is segmented into product type, end user, material type, distribution channel, and region. Based on product type, the market is divided into tops, bottoms, and others. Based on end user, the market is categorized into men, women, and others. Based on material type, the market is fragmented into polyester, nylon, spandex, cotton, and others. Based on distribution channel, the market is classified into sporting goods retailers, departmental stores, online sales channel, and others. By region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Singapore, and rest of Asia Pacific), and LAMEA (Brazil, Argentina, South Africa, UAE, and rest of LAMEA).

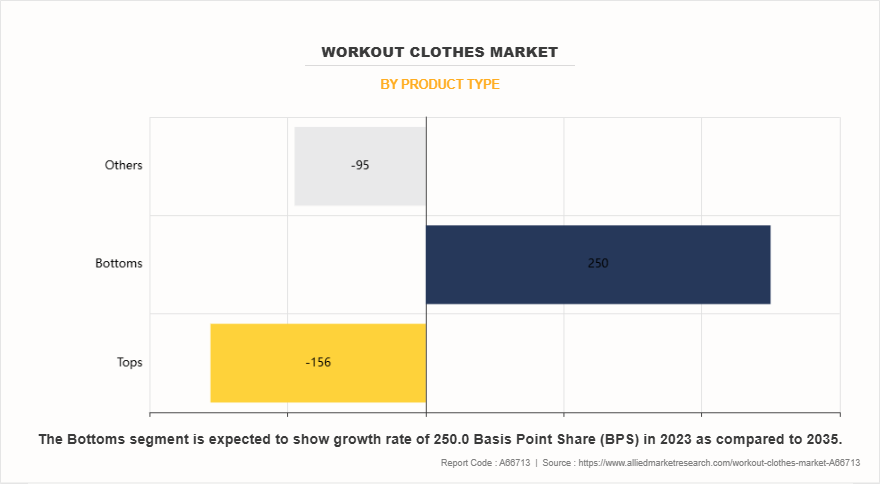

By Product Type

By product type, tops segment dominated the global workout clothes market in 2023 and is anticipated to maintain its dominance during the forecast period. High demand for T-shirts, tank tops, and sweatshirts designed for various fitness activities has contributed to strong sales of tops. Consumers prefer moisture-wicking, breathable, and lightweight fabrics that provide comfort during workouts. The increasing popularity of athleisure has further driven market growth, as many consumers opt for stylish and functional tops for both exercise and casual wear. Moreover, rising participation in sports, gym workouts, and outdoor activities have fueled the need for performance-enhancing tops. Advancements in fabric technology, including odor control and sweat-resistant materials, have further attracted consumers. Moreover, the growth of online shopping and brand collaborations with athletes and influencers have increased product visibility, ensuring continued dominance of the tops segment in the global workout clothes market share.

By End User

By end user, men segment dominated the global workout clothes market in 2023 and is anticipated to maintain its dominance during the forecast period. Strong preference for gym workouts, weight training, and high-intensity sports has driven demand for durable and functional workout clothes, including moisture-wicking t-shirts, compression wear, and performance shorts. Higher engagement in professional and recreational sports further supports the need for specialized workout clothes designed for flexibility and endurance. Growing interest in muscle recovery has led to increased adoption of compression gear, which improves circulation and reduces fatigue. Athleisure trends have further influenced purchasing decisions, as many men prefer gym clothing for both fitness and casual wear. In addition, expanding product lines featuring sweat-resistant, odor-control, and stretchable fabrics is anticipated to attract male consumers in the coming years.

By Material Type

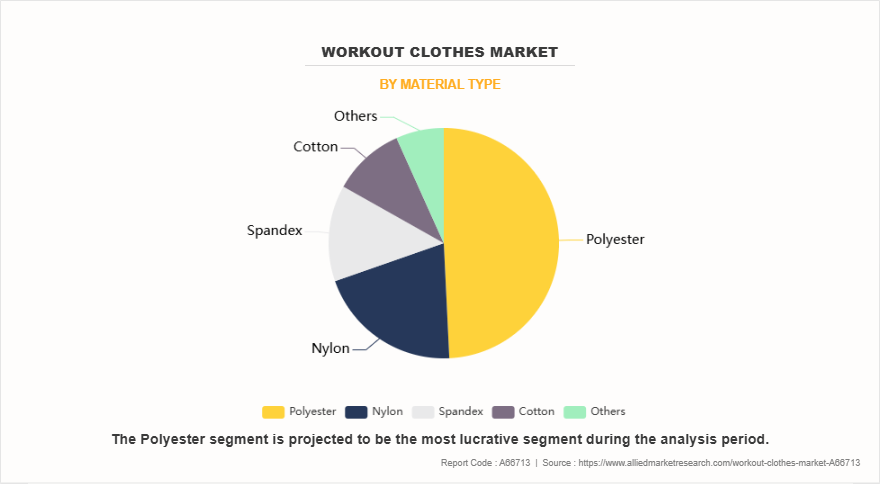

By material type, polyester segment dominated the global workout clothes market in 2023 and is anticipated to maintain its dominance during the forecast period. High durability, moisture-wicking properties, and quick-drying features have made polyester a preferred choice for workout clothes. The ability to retain shape and withstand frequent washing without losing strength further increases demand for polyester-based t-shirts, leggings, shorts, and compression wear. Polyester blends offer stretchability and breathability, making them suitable for high-intensity workouts and outdoor activities. Advancements in fabric technology, including odor resistance and UV protection, have improved the performance of polyester workout clothes. The affordability of polyester compared to natural fibers has also contributed to its widespread use across different consumer segments. Moreover, many brands have incorporated recycled polyester to meet growing sustainability concerns, further strengthening demand for eco-friendly workout clothes made from polyester.

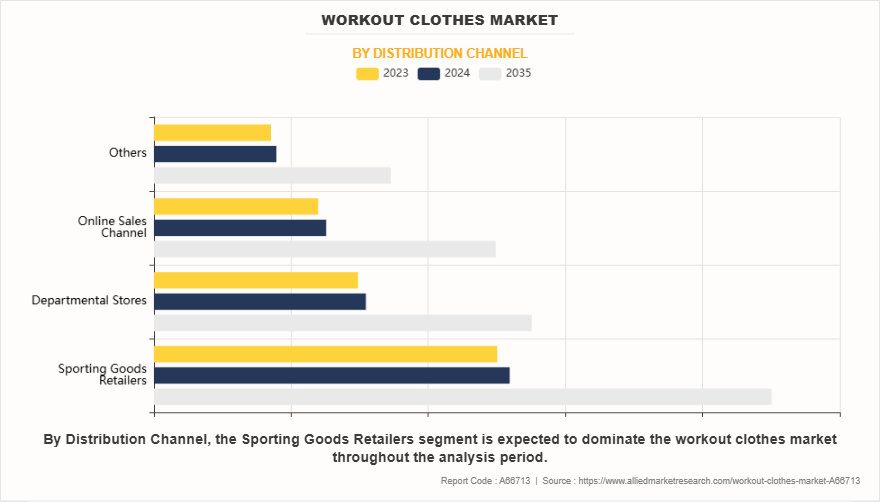

By Distribution Channel

By distribution channel, sporting goods retailers segment dominated the global workout clothes market in 2023 and is anticipated to maintain its dominance during the forecast period. Wide product availability, expert recommendations, and access to premium and performance-driven workout clothes contribute to the strong presence of sporting goods retailers. Consumers prefer in-store purchases to evaluate fabric quality, fit, and comfort before buying, especially for specialized workout clothes such as compression wear and high-performance gear. Exclusive brand collaborations, loyalty programs, and seasonal discounts attract a steady customer base. Many retailers offer personalized fittings and advanced product displays, improving the shopping experience. Sporting goods retailers also stock a variety of price ranges, catering to both professional athletes and individuals focused on regular fitness routines. Expanding retail chains and investments in omnichannel strategies, including online ordering with in-store pickup, further drives growth of this segment.

By Region

Region-wise, North America is anticipated to dominate the market with the largest share during the global workout clothes market forecast period. High participation in fitness activities across cities like New York, Los Angeles, and Toronto drives strong demand for workout clothes. Gym culture, marathon events, and outdoor sports, such as hiking and cycling, have led to increased sales of performance-oriented workout clothes. Established brands such as Nike, Under Armour, and Lululemon, have played a key role in shaping the market by introduction of innovative fabric technologies, including moisture-wicking and compression wear. Strong retail infrastructure, with major sporting goods chains such as Dick‐™s Sporting Goods and Foot Locker, ensures wide accessibility thus driving market expansion. Furthermore, growing interest in sustainable fashion has driven brands to launch eco-friendly collections, fueling market growth in North America.

Competiton Analysis

The key players operating in the global workout clothes industry include Nike, Inc., Adidas AG, Lululemon Athletica Inc., Under Armour, Inc., Puma SE, VF Corporation, ASICS Corporation, New Balance Athletics, Inc., Gymshark Ltd., and Gap Inc. Several well-known and upcoming brands are vying for market dominance in the expanding workout clothes market in the region. Smaller niche firms are more well-known for catering to consumer demands and preferences in the global market. Large conglomerates, however, control most of the market and often buy innovative start-ups to broaden their product lines.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the workout clothes market analysis from 2023 to 2035 to identify the prevailing workout clothes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the workout clothes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global workout clothes market trends, key players, market segments, application areas, and market growth strategies.

Workout Clothes Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 344.4 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2023 - 2035 |

| Report Pages | 480 |

| By End User |

|

| By Product Type |

|

| By Material Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Under Armour, Inc., Nike, Inc., Adidas AG, Puma SE, New Balance Athletics, Inc., Lululemon Athletica Inc., Gap Inc., VF Corporation, ASICS Corporation, Gymshark Limited |

Analyst Review

This section consists of the opinion of the top CXO in the workout clothes market. Executives emphasize the need for advanced fabric technologies, including moisture-wicking, odor-resistant, and temperature-regulating materials, to meet evolving consumer preferences. Sustainable and recycled materials have gained traction as brands respond to increasing environmental concerns. Companies investing in research and development for performance-enhancing features, such as muscle support and adaptive fit designs, are expected to capture greater market share in the coming years.

Moreover, customization and personalization, including tailored fits and AI-driven size recommendations, present new opportunities to enhance customer satisfaction. Market leaders recognize shifting consumer behaviors, particularly the rise of athleisure and multifunctional workout clothes. In addition, the increasing popularity of home workouts and digital fitness platforms has led to higher demand for comfortable and stylish workout clothes, expanding the market beyond traditional gym-goers.

CXOs also highlight the importance of digital strategies and direct-to-consumer (DTC) channels in driving growth. E-commerce expansion, AI-powered shopping experiences, and seamless omnichannel integration create significant competitive advantages for market players in the global workout clothes market. Strategic partnerships with influencers, athletes, and fitness communities further strengthen brand visibility and engagement. Emerging markets, particularly in Asia-Pacific and Latin America, present strong growth potential owing to rising disposable incomes and increased fitness awareness. Companies that incorporate technology, sustainability, and evolving consumer trends are positioned to maximize long-term growth in the workout clothes market.

Sustainable materials, smart fitness wear, gender-neutral designs, personalized fits, seamless construction, eco-friendly dyes, biodegradable fabrics, AI-driven customization, direct-to-consumer sales, and multifunctional athleisure are key upcoming trends in the global workout clothes market.

The workout clothes market was valued at $181.3 billion in 2023.

By end user, men segment has leading application of Workout Clothes Market.

North America is the largest regional market for Workout Clothes.

The key players operating in the global workout clothes industry include Nike, Inc., Adidas AG, Lululemon Athletica Inc., Under Armour, Inc., Puma SE, VF Corporation, ASICS Corporation, New Balance Athletics, Inc., Gymshark Ltd., and Gap Inc.

Loading Table Of Content...

Loading Research Methodology...