X-ray Market Research, 2032

The global X-ray market size was valued at $13.4 billion in 2022 and is projected to reach $24.9 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032. X-ray imaging refers to a diagnostic imaging technique that uses electromagnetic radiation in the form of X-rays to visualize the internal structures of the human body. It involves the emission of X-ray beams through the body, which is then detected on the other side by a specialized detector. The X-ray images produced provide detailed information about the bones, tissues, and organs, helping healthcare professionals in the diagnosis and management of various medical conditions. X-ray imaging is widely used due to its non-invasive nature, relatively low cost, and ability to capture real-time images, making it an essential tool in medical diagnostics.

Market Dynamics

The innovations in the medical device industry for launching advanced X-ray imaging systems owing to a massive pool of target population, are expected to create lucrative opportunities for the expansion of the X-Ray market size. In addition, the rise in the number of individuals suffering from various diseases such as cardiac diseases, dental diseases, and orthopedic disorders and the increase in investments for R&D activities by various key players across the globe are anticipated to positively impact the market growth. Furthermore, the growth of the X-Ray market is expected to be driven by emerging markets, owing to the availability of improved healthcare infrastructure, and an increase in unmet healthcare needs.

In addition, X-ray systems are constantly evolving, with new technologies being developed to improve image quality, reduce radiation exposure, and increase efficiency. This drives the demand for newer and better X-ray imaging systems, thus creating potential opportunities for market growth. In addition, the geriatric population's increasing life expectancy and focus on preventive healthcare are also contributing to the market's growth. Regular X-ray screenings are crucial for the early detection of age-related conditions and for improving patient outcomes.

Furthermore, the surge in demand for point-of-care imaging drives X-ray market growth. Point-of-care imaging involves conducting X-ray examinations at the patient's bedside or in remote locations, providing immediate access to diagnostic imaging in critical situations. This approach is particularly beneficial in areas with limited access to centralized imaging facilities or in emergency scenarios where time is crucial. Portable X-ray systems can be deployed in various settings such as rural areas, disaster zones, and ambulances, enabling prompt diagnosis and timely patient management. This capability has a significant impact on emergency medical services, trauma care, and critical care, where rapid decisions based on imaging findings can be life-saving. The growing demand and adoption of point-of-care imaging by healthcare professionals are driving market growth, as it offers convenience, accessibility, and improved patient outcomes in diverse healthcare settings.

However, the high cost of X-ray systems hinders the growth of the market growth. The cost of X-ray equipment is substantial, making it difficult for healthcare facilities, especially in developing regions, to afford and invest in advanced X-ray technology. This restricts the adoption and availability of X-ray systems, hindering growth during X-ray market forecast.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The COVID-19 pandemic has had a significant impact on the X-Ray industry. The temporary cancellations of non-emergency appointments have led to a decrease in the number of procedures, which has negatively impacted the radiology industry as a whole. As routine care and preventive services were limited to emergency and urgent cases, the demand for digital X-ray systems decreased. Thus, the decrease in the number of general procedures has negatively impacted the market.

However, On the other hand, the pandemic required chest radiological procedures. X-rays, the main imaging technique for identifying and tracking respiratory disorders, were crucial in determining how much lung involvement COVID-19 patients had. Research that appeared in the Journal of Radiology stated that there was a significant increase in the number of chest X-ray exams performed during the pandemic. This increase was caused by the necessity to detect pneumonia and lung infiltrates, two lung disorders linked to COVID-19, which increased demand for X-ray systems and boosted the growth of X-ray industry.

Segmental Overview

The X-ray market is segmented into technology, portability, end user, and region. By technology, the market is categorized into digital imaging and analog imaging. On the basis of portability, it is segregated into stationary and mobile. Depending on the end user, it is fragmented into hospitals, diagnostic imaging centers, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

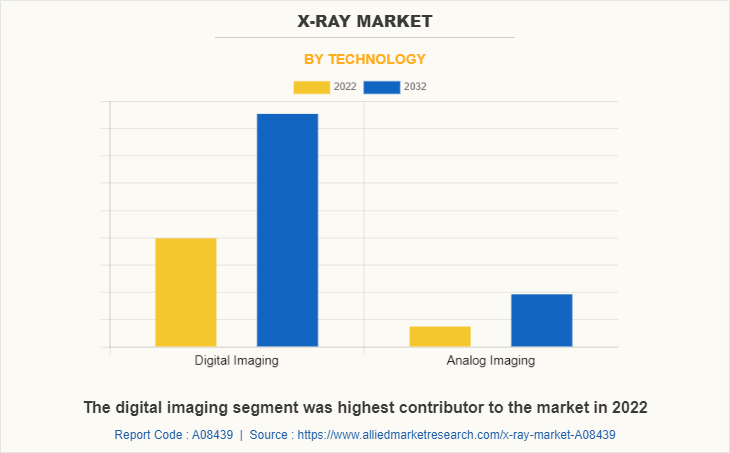

By Technology

The X-Ray market is segmented into digital imaging and analog imaging. The Digital imaging segment accounted for the largest share in 2022 and is projected to register the highest CAGR during the forecast period, owing to its advantages over film-based systems, including immediate image acquisition, improved image quality, reduced radiation exposure, and integration capabilities.

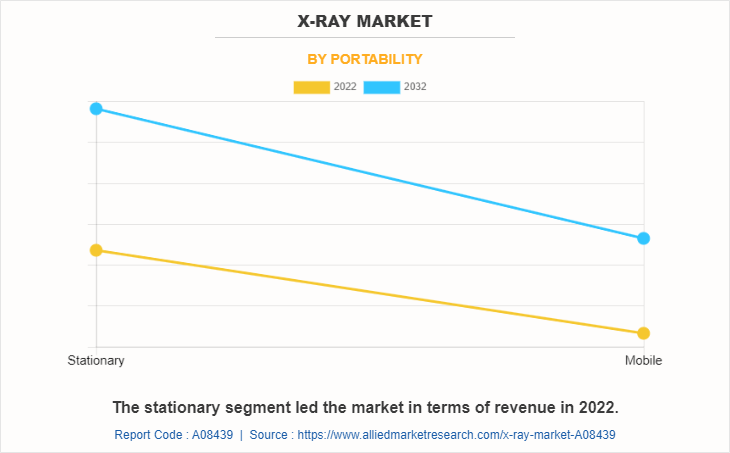

By portability

The X-Ray market is divided into stationary and mobile. The stationary segment occupied the highest share in 2022 and is expected to remain dominant during the forecast period, owing to its wide applications, technological advancements, superior image quality, and cost-effectiveness. In addition, many hospitals and diagnostic centers professionals are skilled to use stationary x-ray systems. However, the mobile segment is projected to register the highest CAGR during the forecast period owing to the demand for advanced imaging capabilities in large healthcare facilities, technological advancements, integration with data management systems, and customization for different medical specialties.

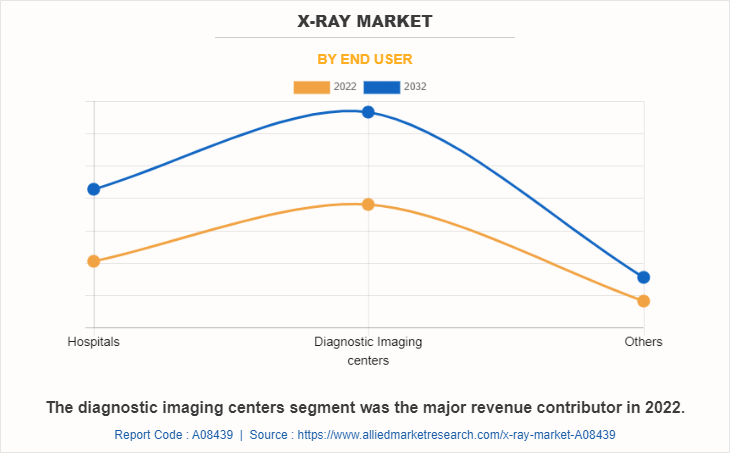

By End User

The X-Ray market is classified into hospitals, diagnostic imaging centers, and others. The diagnostic imaging centers segment occupied the highest X-ray market share in 2022 and is expected to remain dominant during the forecast period, owing to the increasing demand for diagnostic imaging services, coupled with advancements in imaging technologies. However, the hospital segment is projected to register the highest CAGR during the forecast period owing to a rise in the adoption of digital X-ray systems for diagnostic and therapeutic purposes, a rise in the availability of portable digital X-ray systems, and a surge in the prevalence of chronic disorders and increase in a number of hospital visits.

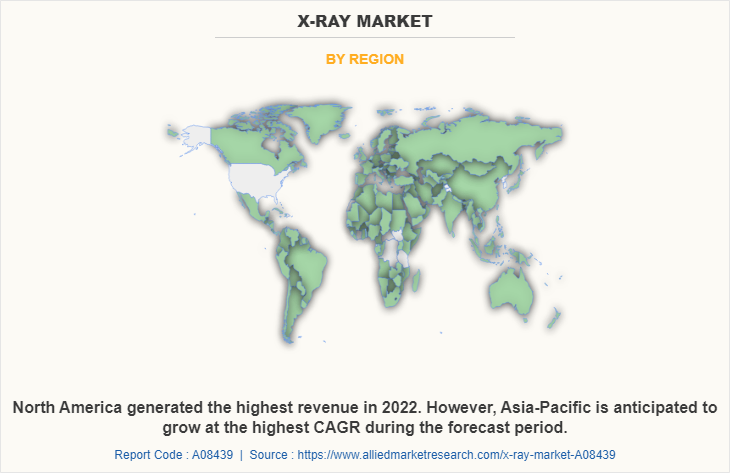

By Region

The X-Ray market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest X-ray market share in terms of revenue in 2022, owing to an increase in the adoption of advanced imaging systems such as digital X-ray systems, a rise in the prevalence of chronic diseases, and an increase in the number of key players offering advanced X-ray imaging systems.

The presence of several major players such as Fujifilm Holdings Corporation, General Electric., Koninklijke Philips N.V., Shimadzu Corporation., and Siemens, and the wide availability of advanced digital X-ray systems in the region drives the growth of the X-Ray market. Furthermore, the presence of well-established healthcare infrastructure and the rise in the adoption rate of digital X-ray systems over traditional X-ray systems are expected to drive market growth.

Asia-Pacific is expected to grow at the highest rate during the forecast period due to technological advancements, an increase in the prevalence of chronic diseases, a surge in investment in healthcare infrastructure, growth in the geriatric population, and favorable government initiatives toward the use of digital technologies in imaging systems. Moreover, the region has become a hub for the digital X-ray market owing to its large population base, diverse patient pool, and relatively lower costs of diagnosis compared to developed countries. Furthermore, the high prevalence of chronic diseases, such as cardiac disorders, respiratory diseases, and orthopedic diseases, is driving the demand for X-ray imaging systems.

Competitive Analysis

Competitive analysis and profiles of the major players in the X-Ray market such as Koninklijke Philips N.V., Shimadzu Corporation., Siemens, Hologic Inc., Mindray Medical International Limited, Onex Corporation, Canon Medical Systems Corporation, General Electric, Fujifilm Holdings Corporation, Allengers Medical System Limited. key players have adopted strategies such as product launch, product approval, agreement, innovation, and partnership to enhance their product portfolio.

Recent Acquisition in the X-Ray Market

In March 2022, Canon Medical Systems Corporation, a medical equipment manufacturing company, entered into an agreement to acquire Nordisk Røntgen Teknik A/S, a Danish company, with advanced technology for the development and manufacture of diagnostic X-ray systems. Through this acquisition, Canon Medical opens up access to European-based technology, development, and manufacturing for advanced multipurpose and motorized digital radiographic imaging solutions.

Recent Product Approval in the X-Ray Market

In May 2022, Carestream Health, a worldwide provider of medical imaging systems and a subsidiary of Onex Corporation, released Smart Noise Cancellation (SNC), a groundbreaking artificial intelligence (AI)-based technology that greatly improves image quality—producing images that significantly clearer than with standard processing. SNC has received FDA 510(k) Clearance and is available as an optional feature with Carestream’s ImageView Software powered by Eclipse.

Recent Partnership in X-Ray Market

In February 2021, Siemens Healthineers and the Kantonsspital Baden (KSB) in Switzerland, a networked, regional center of competence, formed a long-term, strategic, and technological partnership for the next eight years. This “Value Partnership” includes procurement and maintenance of medical imaging systems, holistic technology management with guaranteed uptime, expansion of telemedicine solutions, technology needs and capacity assessment, process optimization, and certified employee training programs.

Recent Product Launch in the X-Ray Market

In April 2023, Shimadzu Corporation, a biotechnology research company, released the EZy-Rad Pro radiography system for clinics. It improved to ensure the system can be easily operated by healthcare personnel. In addition, Shimadzu will also help reduce the burden on patients by shortening examination times.

In August 2022, GE Healthcare, a medical technology company, released its most advanced fixed X-ray system yet, the next-generation Definium 656 HD. Leading GE Healthcare’s portfolio of fixed X-ray products, this latest generation of the overhead tube suspension (OTS) system delivers consistent, highly automated, efficient exams that impart clinical confidence while simplifying workflow, improving consistency, and reducing errors to help keep radiology departments running smoothly.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the x-ray market analysis from 2022 to 2032 to identify the prevailing x-ray market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the X-ray market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global X-ray market trends, key players, market segments, application areas, and market growth strategies.

X-ray Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.9 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Technology |

|

| By Portability |

|

| By End user |

|

| By Region |

|

| Key Market Players | Koninklijke Philips N.V. , Siemens, Allengers Medical System Limited, General Electric, Onex Corporation, Mindray Medical International Limited., Hologic Inc., CANON MEDICAL SYSTEMS CORPORATION, Shimadzu Corporation., Fujifilm Holdings Corporation |

Analyst Review

The increase in demand for advanced X-ray systems and rise in investments for development of portable and cost-effective digital X-ray imaging system, globally are expected to offer profitable opportunities for the expansion of the market. In addition, the increase in awareness about early diagnosis and availability of a wide variety of X-ray systems configuration have piqued the interest of several companies, thus driving the market growth.

The increase in adoption of digital X-ray system over traditional systems by hospitals and private clinics is expected to boost the growth of the market. In addition, the increase in prevalence of chronic diseases such as respiratory disease, orthopedic diseases, and cancer disorders across the globe has resulted in a rise in demand for highly efficient and accurate X-ray system, thus driving the growth of market.

Furthermore, North America accounted for the largest share in terms of revenue in 2022, owing to advancement in technology in radiology industry, increase in number of surgical procedures, and upsurge in number of key players offering advanced X-ray imaging systems. However, Asia-Pacific is anticipated to witness notable growth owing to high prevalence of aging population with increased need of routine checkups procedures, surge in prevalence of chronic diseases, and rise in awareness regarding early diagnosis and treatment.

X-ray imaging refers to a diagnostic imaging technique that uses electromagnetic radiation in the form of X-rays to visualize the internal structures of the human body.

The Digital imaging segment is the most influencing segment in X-ray market owing to its advantages over film-based systems, including immediate image acquisition, improved image quality, reduced radiation exposure, and integration capabilities.

The major factor that fuels the growth of the X-ray market are rise in prevalence of diseases requiring x-ray examinations , Technological advancements in X-ray systems and Rise in demand for point of care imaging.

The base year is 2022 in X-ray market.

Top companies such as Koninklijke Philips N.V. , Shimadzu Corporation., Siemens, Canon Medical Systems Corporation and Fujifilm Holdings Corporation held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The total market value of X-ray market is $13,373.58 million in 2022.

The forecast period for X-ray market is 2022 to 2032

The market value of X-ray market in 2032 is $24,918.23 million

Loading Table Of Content...

Loading Research Methodology...