Zero-Touch Provisioning Market Statistics, 2032

The global zero-touch provisioning market size was valued at $3 billion in 2022, and is projected to reach $9.5 billion by 2032, growing at a CAGR of 12.6% from 2023 to 2032.

Zero-touch provisioning is a method of configuring and deploying devices, such as computers, smartphones, and other network-enabled devices, with minimal or no user intervention. The term "zero-touch" refers to the device that can be set up and configured automatically, without any input from the user. In zero-touch provisioning, the device is pre-configured with all the necessary settings and software before it is shipped to the user. This eliminates the need for manual configuration by the user or IT staff, saving time and reducing the risk of errors.

Increasing adoption of Industrial Internet of Things (IIoT) is a key driver for the growth of zero-touch provisioning market. Industrial IoT involves connecting machines, sensors, and devices to the internet to collect and analyze data, improving operational efficiency and reducing costs. Industrial IoT devices often have specific configurations and requirements, which can be difficult to manage manually. Zero-touch provisioning helps to ensure that all devices are provisioned with the correct configuration and settings, reducing the risk of configuration errors and improving the overall efficiency of the network.

In addition, the rising need for eliminating manual configuration and the growing adoption of cloud services are major driving factors for the zero-touch provisioning market. However, technical and organizational obstacles to a zero-touch implementation is a major factor for hampering the growth of the market as zero-touch provisioning involves automating the configuration process for network devices, which requires a good understanding of the underlying network infrastructure and protocols. One of the technical complexities of zero-touch provisioning is ensuring that the network devices are configured correctly.

Zero-touch provisioning requires the creation of device profiles that include the necessary configuration settings for each device. Contrarily, the emergence of 5G networks presents a significant opportunity for the zero-touch provisioning market. 5G networks are expected to support a massive increase in connected devices and enable a wide range of new use cases, from smart cities to autonomous vehicles to industrial automation, which will provide an opportunity to scale up zero-touch provisioning market during the forecast period.

Segment Review

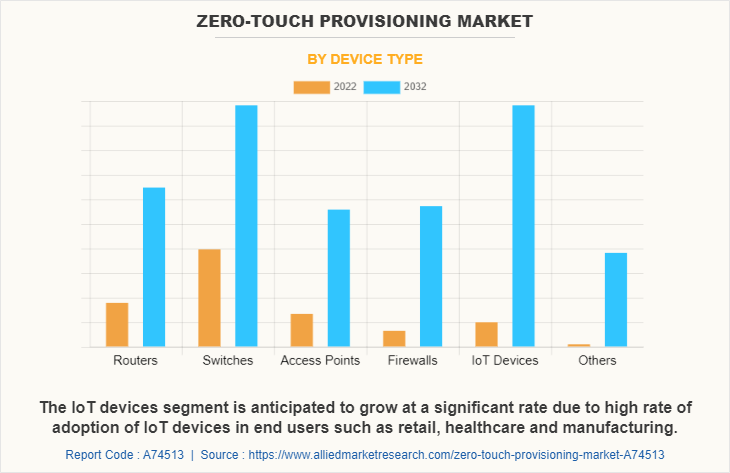

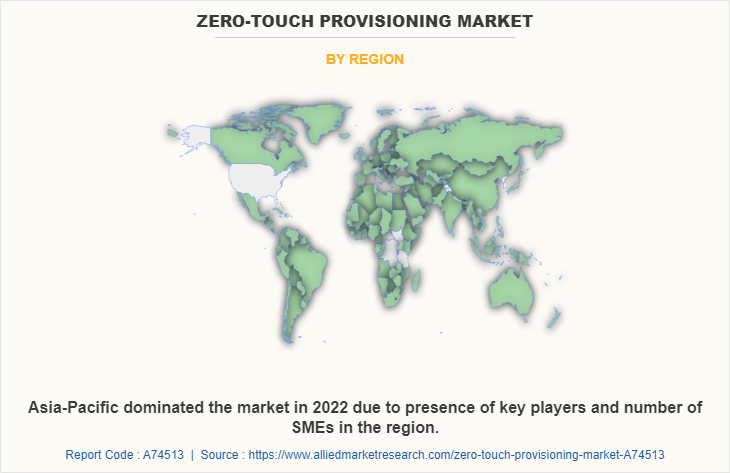

The zero-touch provisioning market is segmented on the basis of component, device type, complexity, enterprise size, deployment model, industry vertical, and region. By component, the market is segmented into platforms and services. By device type, it is categorized into routers, switches, access points, firewalls, IoT devices and others. By complexity, the market is segmented into multi-vendor environment, complex network architecture and dynamic network environment. By enterprise size, it is segmented into large enterprises and small and medium-sized enterprises. By deployment mode, the market is bifurcated into on-premises and cloud. On the basis of industry vertical, it is segmented into IT and telecom, BFSI, manufacturing, healthcare, retail and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By device type, the switches segment attained the highest growth in zero-touch provisioning market share in 2022. This is because the adoption of SDN is driving the demand for zero-touch provisioning switches that can support this emerging technology. SDN relies heavily on automation and zero-touch provisioning to deliver services to end-users. In addition, zero-touch provisioning switches that offer advanced analytics and visibility features are becoming increasingly popular as organizations look to gain deeper insights into their network performance and make informed decisions about network optimization and troubleshooting.

However, the IoT devices segment is considered to be the fastest growing segment in zero-touch provisioning market forecast. This is due to the increasing complexity of IoT deployments, zero-touch provisioning solutions help organizations to streamline the process of deploying and managing their IoT devices, which can result in greater efficiency and cost savings. Moreover, with the increasing number of cyber threats, there is a growing focus on device security. Zero-touch provisioning solutions in the IoT devices segment can help organizations to improve the security of their IoT devices by automating the process of configuring and deploying security policies.

On the basis of region, Asia-Pacific attained the highest growth in 2022. This is primarily because the adoption of cloud-based services is growing rapidly in the Asia-Pacific region. With the increasing number of devices that need to be managed in a cloud environment, the demand for zero-touch provisioning is increasing, as it enables automated deployment and configuration of network devices in the cloud. In addition, with the increasing adoption of 5G technology in the Asia-Pacific region, the demand for zero-touch provisioning is also expected to increase. Zero-touch provisioning can help organizations to automate the deployment and configuration of 5G network infrastructure, enabling faster time-to-market and improved network performance.

However, LAMEA is considered to be the fastest-growing region during the forecast period. This is driven by the growing threat of cyber-attacks and data breaches. Moreover, security and compliance are becoming increasingly important considerations for organizations in LAMEA. As a result, zero-touch provisioning solutions are being designed with built-in security features and compliance controls, to ensure that network devices are deployed in a secure and compliant manner. In addition, with the rapid pace of digital transformation, there is a growing need for automation in the networking industry. Zero-touch provisioning solutions enable organizations to automate the configuration and deployment of network devices, reducing the need for manual intervention and enabling more efficient and scalable network management.

Market Landscape and Trends

The zero-touch provisioning market has witnessed significant growth in recent years, driven by a number of factors. The need for network automation is increasing, as organizations seek to streamline their operations and reduce manual intervention. Zero-touch provisioning solutions are a key part of network automation, enabling organizations to automate the deployment and management of network devices. Moreover, network security is a top concern for organizations, and zero-touch provisioning solutions can help improve security by automating security features, such as secure boot and automated patching.

In addition, network environments are becoming more complex with the presence of multiple vendors and types of devices. Zero-touch provisioning solutions can help simplify network management by automating the configuration and deployment of devices across different vendors and types. Therefore, the zero-touch provisioning market is constantly evolving, with new trends emerging as technology advances.

Top Impacting Factors

Rise in Need for Eliminating Manual Configuration

Manual configuration of network devices, such as routers and switches, is a time-consuming and error-prone process that can lead to network downtime and security vulnerabilities. Zero-touch provisioning automates the configuration process, eliminating the need for manual configuration and reducing the risk of human error. With ZTP, network administrators can deploy new devices quickly and easily, without the need for any manual intervention. In addition, manual configuration is a costly process, as it requires skilled network engineers or technicians to perform the configuration. With ZTP, organizations can reduce their IT costs by automating the provisioning process and freeing up their IT staff to focus on more strategic tasks.

Furthermore, manual configuration is also a security risk, as it can lead to misconfigured devices and security vulnerabilities. Zero-touch provisioning helps to ensure that all devices are provisioned with the latest security patches and configurations, reducing the risk of security breaches. Therefore, the rising need for eliminating manual configuration is a key driver for the zero-touch provisioning market, as organizations look to automate their network provisioning processes to improve efficiency, reduce costs, and enhance security.

Growth in the Adoption of Cloud Services

Cloud services have become increasingly popular in recent years, as they offer many benefits to organizations, including cost savings, scalability, and flexibility. Cloud services require a different approach to network provisioning, as network devices need to be provisioned and managed in a virtual environment. Zero-touch provisioning makes it easy to provision and manage network devices in a cloud environment, which is essential for organizations that are transitioning to the cloud.

Moreover, zero-touch provisioning enables network administrators to automate the provisioning of devices, reducing the time and effort required to configure them. This is particularly important in a cloud environment, where network devices need to be provisioned quickly and efficiently to meet the demands of the business. In addition, cloud services require a high level of automation to manage the infrastructure, and zero-touch provisioning plays a crucial role in this process. Zero-touch provisioning helps organizations to automate the provisioning of network devices in a cloud environment, reducing the need for manual intervention and improving the overall efficiency of the network. Therefore, these trends are contributing to the zero-touch provisioning market growth.

Increase in Adoption of Industrial Internet of Things (IIoT)

The increasing adoption of Industrial Internet of Things (IIoT) is a significant driver for the zero-touch provisioning market. Industrial IoT involves connecting machines, sensors, and devices to the internet to collect and analyze data, improving operational efficiency and reducing costs. Industrial IoT devices often have specific configurations and requirements, which can be difficult to manage manually. Zero-touch provisioning helps to ensure that all devices are provisioned with the correct configuration and settings, reducing the risk of configuration errors and improving the overall efficiency of the network.

In addition, IIoT requires a high degree of automation to manage the infrastructure, and zero-touch provisioning plays a crucial role in this process. Zero-touch provisioning enables network administrators to automate the provisioning of devices, reducing the time and effort required to configure them. Furthermore, the adoption of industrial IoT is increasing across numerous sectors, including manufacturing, healthcare, transportation, and energy. As more organizations adopt IIoT, the demand for zero-touch provisioning is also increasing, as organizations look to automate their network provisioning processes to support their IIoT infrastructure, improve efficiency, and enhance security.

Technical and Organizational Obstacles to a Zero-touch Implementation

The technical complexity of zero-touch provisioning can be a major obstacle for organizations looking to implement this solution. Zero-touch provisioning involves automating the configuration process for network devices, which requires a good understanding of the underlying network infrastructure and protocols. One of the technical complexities of zero-touch provisioning is ensuring that the network devices are configured correctly. Zero-touch provisioning requires the creation of device profiles that include the necessary configuration settings for each device. These device profiles must be accurate and up to date to ensure that devices are correctly provisioned.

In addition, zero-touch provisioning also requires the use of standard protocols and APIs to automate the configuration process. This requires knowledge of the various protocols and APIs used by different network devices, as well as the ability to integrate these protocols and APIs into a zero-touch provisioning solution. Furthermore, organizations with stored organizational structures may face challenges in implementing zero-touch provisioning. Zero-touch provisioning requires close collaboration between IT teams responsible for network operations and those responsible for device management. Therefore, these factors are hampering the growth of the zero-touch provisioning market.

High Implementation Costs

One of the major restraining factors for the adoption of zero-touch provisioning is the high implementation costs associated with it. ZTP requires the deployment of new hardware, software, and network infrastructure to support automated provisioning, configuration, and management of devices. The implementation costs of zero-touch provisioning solutions can be significantly high, particularly for small and medium-sized enterprises (SMEs) with limited budgets. They may not have the resources to invest in new infrastructure, hardware, and software needed for zero-touch provisioning implementation.

In addition, implementing zero-touch provisioning requires expertise in network infrastructure, protocols, and automation. Organizations need to hire new staff or invest in training existing staff to ensure they have the necessary skills to implement and maintain a zero-touch provisioning solution.

Emergence of 5G Networks

The emergence of 5G networks presents a significant opportunity for the zero-touch provisioning market. 5G networks are expected to support a massive increase in connected devices and enable a wide range of new use cases, from smart cities to autonomous vehicles to industrial automation. In addition, zero-touch provisioning can help organizations automate the deployment and management of devices connected to 5G networks, reducing the need for manual intervention and improving operational efficiency. With zero-touch provisioning, devices can be automatically provisioned and configured based on predefined policies, reducing the risk of human error and ensuring consistency across devices. In addition, as 5G networks enable new use cases that require low latency and high bandwidth, such as autonomous vehicles and virtual reality, zero-touch provisioning can help ensure that these devices are provisioned and configured to deliver the required performance and reliability.

Furthermore, 5G networks will enable new applications and use cases, such as autonomous vehicles, smart cities, and Industry 4.0, which will require automated device provisioning and configuration to ensure efficient and reliable operation. Zero-touch provisioning can help organizations deploy and manage these devices at scale, improving operational efficiency and reducing the risk of downtime. Therefore, the emergence of 5G networks presents a significant opportunity for the zero-touch provisioning market, as organizations seek to efficiently and effectively manage the large number of devices connected to these networks.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the zero-touch provisioning market analysis from 2023 to 2032 to identify the prevailing zero-touch provisioning market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the zero-touch provisioning market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global zero-touch provisioning market trends, key players, market segments, application areas, and market growth strategies.

Zero-Touch Provisioning Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.5 billion |

| Growth Rate | CAGR of 12.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 335 |

| By Component |

|

| By Device Type |

|

| By Network Complexity |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Google LLC, Riverbed Technology, Nokia, Red Hat, Inc., Arista Networks, Inc., Cisco Systems, Inc., Juniper Networks, Inc., Huawei Technologies Co., Ltd., Extreme Networks, ZPE Systems, Inc. |

Analyst Review

The zero-touch provisioning market has experienced significant growth in recent years, and the trend is expected to continue. The rising number of connected consumer devices, Internet of Things (IoT), and industrial machines deployed across commercial, consumer, industrial, and infrastructure spaces is accelerating the adoption of zero-touch provisioning market globally. Moreover, the resultant increase in pivotal deployment of 5G networks and the large-scale emergence of network slicing has profoundly changed the orchestration and management of networks and networks related services. In addition, the adoption of cloud-based services such as Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS) is increasing in recent years. Cloud-based ZTP solutions offer several benefits such as ease of deployment, scalability, and cost-effectiveness, which makes them an attractive option for businesses looking to manage their networks more efficiently. Furthermore, the increasing demand for network automation, the growing adoption of SDN, cost savings, improved security, and scalability are all significant growth factors for the zero-touch provisioning market.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, In February 2022, Hewlett Packard Enterprise collaborated with Qualcomm Technologies, Inc., a wireless technology innovator. Under this collaboration, companies offered the next generation of 5G distributed units, supported by the Qualcomm® X100 5G RAN, a Qualcomm Technologies’ inline accelerator card. Additionally, this collaboration aimed to address the requirements of next-generation networks, the lower total cost of ownership, and simplify deployments by offering O-RAN-compliant, high-performance, energy-efficient and cloud native 5G solutions. Moreover, in November 2021, Nokia partnered with Ooredoo Group, a global telecommunications company. Under this partnership, both companies brought various technologies and services to customers in North Africa, Southeast Asia, and the Middle East. Moreover, Nokia offered its cloud-native Core software to deliver Ooredoo zero-touch automation abilities that propelled better reliability and scale.

Some of the key players profiled in the report include Arista Networks, Inc., Cisco Systems, Inc., Extreme Networks, Google LLC, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia, Red Hat, Inc., Riverbed Technology and ZPE Systems, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the zero-touch provisioning market.

The global zero-touch provisioning market was valued at $2,961.64 million in 2022, and is projected to reach $9,445.85 million by 2032, registering a CAGR of 12.6% from 2023 to 2032.

Increasing adoption of Industrial Internet of Things (IIoT) is a key driver for the growth of zero-touch provisioning market.

Asia-Pacific is the largest regional market forZero-Touch Provisioning Market.

The key growth strategies include product portfolio expansion, acquisition, partnership, merger, and collaboration.

The key players operating in the zero-touch provisioning market are Arista Networks, Inc., Cisco Systems, Inc., Extreme Networks, Google LLC, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Nokia, Red Hat, Inc., Riverbed Technology and ZPE Systems, Inc.

Loading Table Of Content...

Loading Research Methodology...