Table Of Contents

- Peering into the Historical Landscape of Accounting

- AI, the Game-changer in Accounting

- AI Assisting in Automation

- Evaluating the Penetration of Existing Technologies

- Delving into Trend-setting Developments

- Unlocking the Power of Financing in Financial Services

- Unveiling Future Capabilities

- Deploying Robust Measures to Navigate Challenges

- Foreseeing a Function-filled Financial Future

Onkar Sumant

Akshata Tiwarkhede

Accounting Services: Fortifying the Financial Foundation of Businesses

Accounting service is a cloud-based platform designed to streamline financial management processes for individuals and businesses. The service enables users to track income and expenses, manage invoices, reconcile accounts, and generate financial reports. Moreover, users can input financial data manually or integrate bank accounts and other financial platforms for automated data entry with the help of accounting services. The service primarily addresses efficient financial record-keeping, accurate reporting, and compliance with accounting standards and tax regulations, as per the requirements of the user.

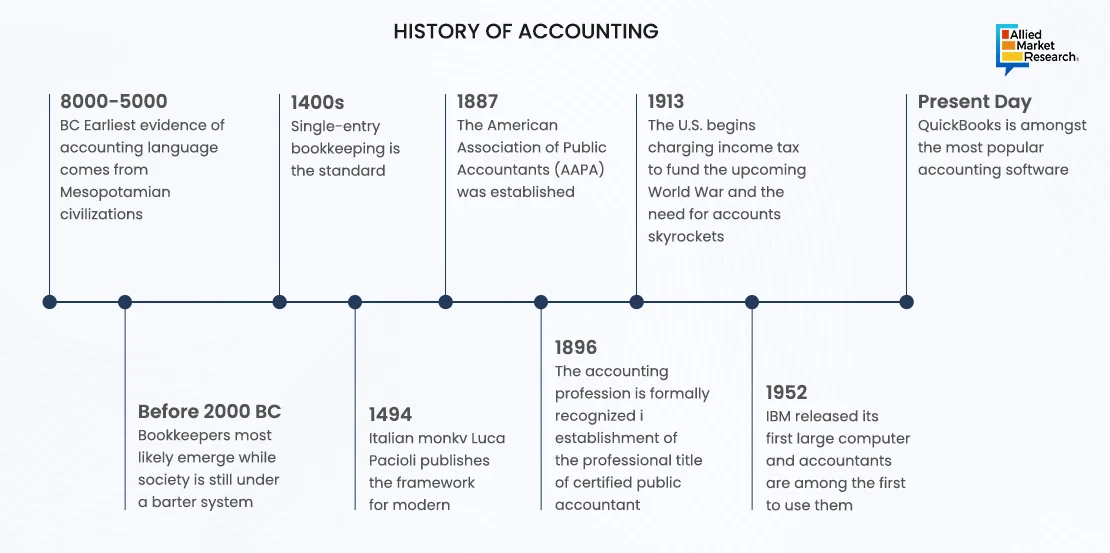

Peering into the Historical Landscape of Accounting

Historically, accounting processes were manual, relying on paper-based ledgers and manual calculations. This method was time-consuming, prone to errors, and lacked real-time visibility into financial data. Accounting processes became more automated with the advent of desktop accounting software in the 1980s and 1990s, such as Intuit's QuickBooks and Sage's Peachtree (now Sage 50), respectively. These software offered features like double-entry accounting, invoicing, and financial reporting, to help improve the efficiency compared to manual methods. In the early 2000s, the advent of cloud-based accounting software facilitated greater scalability and collaboration. The companies such as Intuit with QuickBooks Online and Xero led this transition, enabling users to access financial data from anywhere with an internet connection. As technology advanced, accounting software was being integrated in banking APIs and financial institutions. This enabled seamless data synchronization, reducing the need for manual data entry and improving the accuracy of financial records.

AI, the Game-changer in Accounting

The penetration of artificial intelligence in the accounting services industry has been witnessed to experience rapid increase. From Big 4 to local, accounting firms are realizing the potential that AI exhibits to revolutionize the way financial data is processed and analyzed. This shift is predominantly driven by the facts that AI helps in reducing errors and automating mundane tasks, thereby allowing accountants to prioritize high-value tasks. The Big 4, Deloitte, PwC, Ernst & Young, and KPMG serve as the precursors of AI-driven tools and solutions. In addition, they are heavily investing in auditing, predictive analytics, client insights, and tax compliance to offer their clients with more insightful and advanced services.

AI Assisting in Automation

Massive volume of financial data is rapidly and accurately analyzed with the help of AI-powered audit tools. These tools are used by Big 4 to enhance the efficiency and accuracy of audit processes and to figure out anomalies and issues. Furthermore, AI-guided predictive analytics is being majorly adopted by these firms to assist clients in making data-driven decisions such as identifying potential risks, anticipating financial trends, and devising growth strategies. In addition, these firms customize their services more effectively and strengthen their client relationships by adopting AI-driven solutions, thus offering deeper insights into client behavior and requirements. Automation of complex tax compliance tasks can be easily accomplished by AI that further helps Big 4 to keep track of the current updates of tax codes and regulations while reducing errors.

Thus, recent breakthroughs in accounting technology have largely revolved around automation and AI, significantly reducing manual intervention and improving accuracy. Integration with banking APIs and financial institutions will further streamline data synchronization, offering real-time insights and reporting.

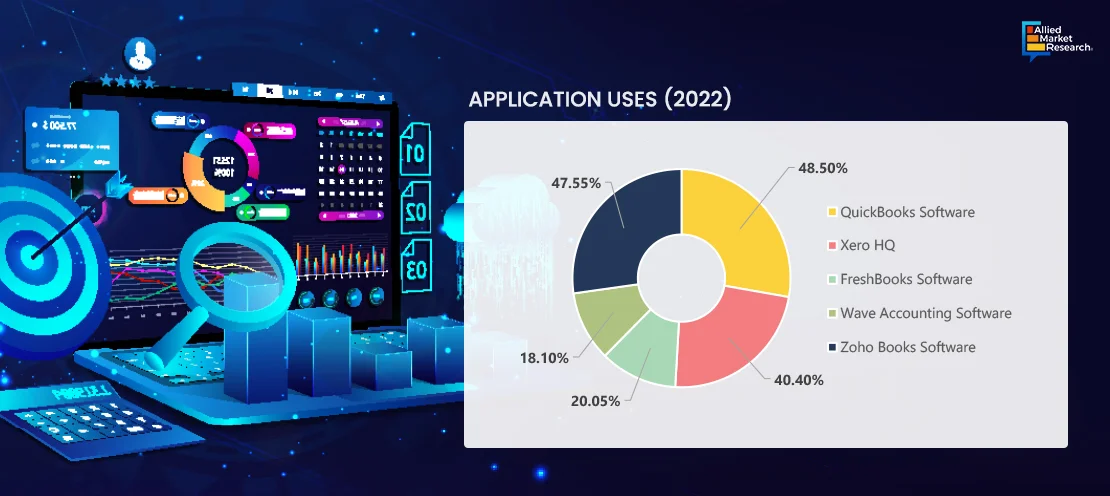

Evaluating the Penetration of Existing Technologies

The accounting software such as QuickBooks, Xero HQ, FreshBooks, Zoho Books, and Wave offer cloud-based solutions, which facilitate automated invoicing, expense tracking, and financial management, helping businesses to stay efficient and streamline operations. QuickBooks witnessed the highest penetration of 48.50% in 2022, showing its widespread adoption among businesses, especially SMEs. Its user-friendly interface and comprehensive features, including invoicing and expense tracking, streamline financial processes, saving time and reducing costs. In addition, it provides accurate financial data, facilitates remote work, and integrates with third-party apps for scalability. Following closely behind is Xero HQ, which witnessed penetration of 40.4%. It offers document management solutions, which streamline various document-related tasks such as printing, scanning, and workflow automation. Its services are designed to improve efficiency and reduce costs for businesses by providing effective solutions for managing documents. With Xero HQ, businesses can optimize their document processes, leading to increased productivity and better resource utilization.

Thus, by using these software services, companies can save time, reduce errors, and gain better insights into their finances. Whether it is managing invoices, tracking expenses, or generating financial reports, these software offer solutions that help businesses run smoothly and effectively.

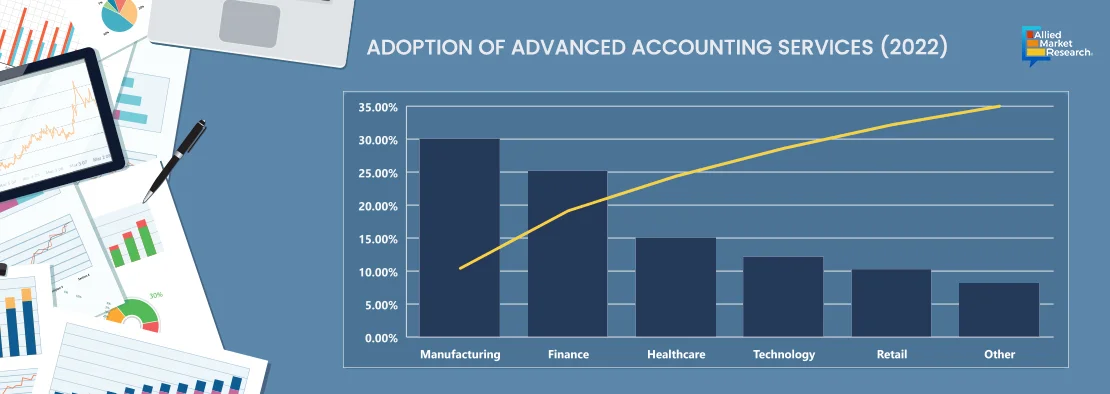

Early adopters of advanced accounting services span a diverse range of industries, including technology, financial services, professional services, retail, healthcare, and manufacturing. These forward-thinking organizations recognize the value of leveraging cloud-based platforms with automation and AI capabilities to streamline processes, improve accuracy, and gain actionable insights into their financial performance. By embracing automation, they can reduce manual intervention, minimize errors, and allocate resources more efficiently.

The manufacturing sector witnessed the highest adoption of accounting services with penetration rate of 30% in 2022, followed by the finance sector. This is primarily attributed to the fact that manufacturing firms heavily rely on accounting systems to manage inventory, monitor production costs, and analyze profitability. They use cost accounting methods to track expenses related to raw materials, labor, and overhead, ensuring efficient production processes and optimal resource allocation. Accurate financial reporting is essential for manufacturing companies to evaluate product profitability, control costs, and make informed decisions about pricing, production volumes, and inventory management.

Finance organizations, including banks, investment firms, and insurance companies, are the second largest adopters of accounting services. As finance companies deal extensively with monetary transactions, complex financial instruments, and regulatory compliance, they require sophisticated accounting systems to manage diverse financial portfolios, track investments, analyze risk, and ensure compliance with stringent regulatory standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Accurate financial reporting is crucial for finance companies to maintain investor confidence, assess financial performance, and make strategic decisions regarding investments and lending.

Whether managing complex financial transactions, optimizing supply chain operations, or enhancing customer experiences, early adopters of advanced accounting technology gain a competitive edge by harnessing the power of innovation to drive growth, improve operational efficiency, and deliver value to their stakeholders. As these sectors often prioritize agility and scalability, cloud-based accounting solutions serve as an ideal option for managing finances in real time and adapting to changing business environments. Real-time data synchronization enables faster decision-making and better strategic planning, empowering businesses to stay agile and responsive to market changes. Thus, the trajectory suggests a continued shift toward digitalization in accounting practices across industries and geographies.

Delving into Trend-setting Developments

Key innovators in this field include industry giants like Intuit QuickBooks, Xero, and Sage, alongside emerging players such as FreshBooks and Wave Accounting. These companies continuously invest in R&D to enhance their platforms' functionality, usability, and security. For instance, in May 2023, Intuit QuickBooks launched global free access to QuickBooks Online Accountant (QBOA), enabling accounting professionals in 170+ countries to move to the cloud faster, scale their practices, and bring more value to their clients and the wider economy.

Moreover, in May 2021, IRIS Software Group (IRIS), a leading software supplier in accountancy practices, launched RIS Elements, the next-generation cloud accountancy platform, which offers an evolving suite of applications designed to support all areas of accountancy, from data capture, compliance, and bookkeeping to customer servicing and advisory services. It automates workflows across multiple applications while maintaining a unified view of data, thereby assisting accountants to collaborate easily with customers to generate improved business outcomes.

Unlocking the Power of Financing in Financial Services

One of the Big 4 firms, KPMG is planning to invest around $2 million by entering into an expanded partnership with Microsoft. The firm is focusing on integrating AI in its tax, audit, and advisory services. Bill Thomas—global chairman and CEO of KPMG International—says “KPMG is embracing the future, and we believe that AI is key to unlocking sustainable growth in a way that will build a better future for our people, our clients and society.”

Furthermore, smaller Indian cities are serving as lucrative markets for major accounting firms that are planning to invest, as the demand for low-cost back office operations is increasing. According to a report by Ernst & Young, multinationals will set up global capability centers for all industries in tier 2 cities of India, including Vadodara, Jaipur, Chandigarh, and Kochi. Estimates suggest that the number of centers will reach up to 2,400 by 2030, thereby creating 2.6 million job opportunities and adding over $100 billion to the economy. In addition, KPMG’s hiring is estimated to reach approximately 20,000 in the next three years, whereas Deloitte asserts that it will hire around 50,000 in the next three years.

Unveiling Future Capabilities

The future of accounting services holds promising potential for further innovation and expansion of capabilities. One anticipated development is the integration of advanced analytics and AI into accounting platforms, enabling predictive financial modeling, trend analysis, and risk assessment. Moreover, blockchain technology may revolutionize aspects of financial auditing and transaction verification, enhancing transparency and security in accounting processes.

Experts foresee continued development roadmaps focused on enhancing user experience, interoperability, and customization options within accounting software. The mainstream adoption potential of these technologies is high, driven by the increasing digitization of businesses and the growing demand for real-time financial insights and compliance solutions.

To realize the full potential of advanced accounting services, several innovations and conditions must align. Technically, seamless integration with other business software and platforms as well as advancements in data security and privacy measures are essential. From a business perspective, fostering a culture of digital transformation and investing in employee training to leverage new accounting technologies effectively are crucial. Socially, there must be a shift toward greater acceptance and trust in digital financial solutions, alongside ongoing regulatory frameworks that support innovation while ensuring accountability and consumer protection.

Future accounting services may utilize advanced predictive analytics to forecast financial trends, identify risks, and optimize decision-making. For instance, AI-powered accounting software like Xero is already incorporating predictive analytics to help businesses anticipate cash flow fluctuations, manage inventory levels, and optimize pricing strategies. By analyzing historical financial data and external market factors, this platform can provide actionable insights to businesses, enabling them to make proactive and informed financial decisions.

Moreover, with the increasing complexity of regulatory requirements, future accounting services may leverage automation technologies to streamline compliance and regulatory reporting processes. For example, Sage Intacct offers automated compliance features that help businesses stay up to date with changing regulations, such as tax compliance, revenue recognition standards, and data privacy laws. By automating routine compliance tasks and providing real-time updates on regulatory changes, these platforms enable businesses to reduce compliance risks and ensure adherence to legal requirements.

Deploying Robust Measures to Navigate Challenges

Despite the benefits, technology adoption in accounting services poses certain risks and concerns. These include data security breaches, job displacement due to automation, and ethical considerations surrounding AI algorithms. Data security breaches pose a significant threat as accounting firms increasingly store sensitive financial information digitally. Cybercriminals target this data for various malicious purposes, including identity theft and financial fraud. To mitigate this risk, accounting firms must implement robust cybersecurity measures such as encryption, firewalls, and secure authentication methods. Regular security audits should be conducted to identify vulnerabilities, and employees should receive comprehensive training on recognizing and avoiding cyber threats. Moreover, maintaining regular data backups ensures that critical information remains secure even in the event of a breach.

Another challenge is job displacement due to automation. With the advent of AI and machine learning technologies, routine accounting tasks can be automated, raising concerns about the future of jobs in the industry. However, accounting firms can overcome this challenge by investing in reskilling and upskilling programs for their employees. By acquiring new skills in areas such as data analysis, strategic planning, and advisory services, accountants can transition to roles that require human insight and expertise. Focusing on value-added services like financial advisory and business consulting also ensures that accountants remain relevant in an increasingly automated world. Furthermore, embracing automation as a tool to enhance productivity and efficiency rather than viewing it as a threat enables accountants to work alongside technology, delivering better outcomes for clients.

Ethical considerations surrounding AI algorithms present another challenge. AI algorithms used in accounting software may reflect systemic bias, lack transparency, and raise concerns about privacy and accountability. To address these concerns, accounting firms must prioritize ethical AI development. This involves designing and deploying algorithms with a focus on fairness, transparency, and accountability. Transparency and explainability are crucial, allowing users to understand how decisions are made and identify any biases present. Adherence to regulatory frameworks and standards governing the use of AI in accounting services ensures compliance with data protection and privacy regulations. Regular auditing of AI algorithms is also essential to identify and address any biases or ethical concerns that may arise.

By addressing these risks proactively, accounting firms can navigate the digital landscape with confidence and reap the rewards of technological advancement. Although technology adoption in accounting services presents challenges, they can be effectively addressed with the right strategies.

Foreseeing a Function-filled Financial Future

In the realm of accounting services, experts foresee a profound transformation fueled by ongoing technological advancements and innovations. The integration of advanced data analytics and business intelligence tools will empower accountants to derive actionable insights from financial data, facilitating informed decision-making. The development roadmaps within the industry prioritize the integration of cutting-edge technologies to streamline processes, enhance efficiency, and drive mainstream adoption. By embracing technological advancements and aligning development roadmaps with industry trends, accounting services are poised to undergo significant transformation, unlocking new opportunities for efficiency, innovation, and value creation.

For further insights, get in touch with AMR analysts.